Summary:

- Megapack and Powerwall storage products are experiencing high demand and growing as fast as Tesla can increase production.

- Energy storage is a significant revenue driver for Tesla, with the potential market size being almost infinite compared to the auto industry.

- Tesla’s energy storage division is showing strong growth and profitability, while auto revenues are declining.

Sky_Blue

Since I last detailed the energy storage division of Tesla (NASDAQ:TSLA) in my article in April, the pace of development has continued ever more rapidly.

Demand for the company’s commercial and residential energy products continues to surge. Tesla’s manufacturing capacity continues to be increased rapidly but may never be able to keep up with the demand picture.

Those who continue to value Tesla as a simple auto company are failing to see the wood for the trees. As my article in January detailed, Tesla’s auto business is flourishing worldwide. It is energy storage, however, which makes TSLA stock a Buy over and above its current stock trading range.

The company has a number of other potential big revenue hitters in the non-auto sector. These include “Optimus,” “Dojo” (which alone is receiving $1 billion investment in the coming year) and Insurance. These are still only potential game-changers. Even so, Morgan Stanley recently predicted that Dojo would be the one to raise Tesla’s stock price to $400 (it is currently at $250).

That is very speculative. In comparison, energy storage is here and now. The revenue and the growth path are apparent. The company has always stated that its energy revenues could match their auto revenues. This is becoming increasingly clear and measurable. The stock is undervalued because most observers have not recognized this fact.

Figures

Tesla’s growth in energy storage comes at a time of secular market growth everywhere in the world. According to Wood Mackenzie, installations in Q3 in for instance the USA rose to 1.680MW/5.597 MWh. That was a 116% increase on the previous quarter. The figure would have been higher if it had not been for supply chain constraints and delays in interconnecting the grid.

The Inflation Reduction Act in the USA provides for substantial funding and encouragement for the nation’s transformation to renewable energy. This is small fry compared to subsidies enjoyed by the fossil fuel industry, but it is a start. By comparison an IMF report in August estimated that fossil fuels are subsidized to the tune of $7 trillion per annum, or $13 million per minute.

According to some estimates, Tesla currently has about 30% of the global BESS (Battery Energy Storage System) market. Bearing in mind the size of the market a few years hence, it is not surprising that Tesla is ramping up huge production. It is also not surprising that those who understand the market emphasize the influence this could have on company revenues and the company stock price.

CEO Elon Musk has stated that he thinks they can in the long run capture 15% of the total energy market with Megapacks. These are pictured below:

That might be typical Musk over-exuberance. However as this article detailed, if they were to capture 5% of the total energy market, that would produce an astonishing $4.2 trillion in revenue in the long term.

In the whole of 2022, Tesla’s auto revenues rose 40% and energy storage revenues rose 64%. The differential between the two has increased markedly in 2023 and this gap is expected to continue to increase.

At the Q2 2023 earnings call, the rise in energy generation and storage revenues reached 74% year-on-year. These revenues comprised only 6% of total company revenues. That percentage is changing rapidly. Megapack business over the past 3 quarters has grown by 62%, by 152% and by 360%. Deployments actually increased 222%.

At the earnings call Musk got it about right concerning the company’s achievements, and what makes it still a good Buy:

I think it’s ridiculous that we have positive free cash flow in a capital intensive business, while investing massive amounts of money in new technology. That is super hard.

Energy storage growth will only add to the already very impressive free cash flow figures from the company.

Energy storage profitability is improving while auto revenues profit margins are in fact declining somewhat. Its revenue is growing much more rapidly than the admittedly healthy auto business, but that does have a measurable glass ceiling.

Megapack

My article in February detailed how the planned 40GWh capacity of the new Megapack plant to 10,000 units in Lathrop California could contribute about $20 billion of revenue annually (by comparison, the company’s auto revenues in 2022 were $81.462 billion). That $20 billion would equate to the sale of approximately 570,000 Model autos. For comparison, in Q2 this year the company sold 466,140 cars.

The company is building a similarly sized Megapack factory in Shanghai. This will be fully up and running sometime in 2024. The resultant 80 GWh of capacity would provide Tesla with revenue value of $40 billion of profits of $10 billion.

This forward-thinking capital expenditure is based on solid grounds. A Bloomberg study expects capacity of 1.143GWh by 2020 by which time the market size will have increased 15-fold. Tesla intends to remain one of the market leaders in this transition and is perfectly placed to do so.

When Lathrop and the new China factory are both fully up and running, this should produce an immediate $40 billion in sales and $10 billion in profits. Already current lead-times for Megapack are about 18 months to 2 years ahead.

The 50/50 split between autos and energy is no longer a pipe-dream. At the Q1 2023 earnings call Management had stated that stationary storage growth would “significantly” exceed auto growth. This aim continues to be the case and one can see a clear road map towards it. The company expect energy storage margins to reach mid 20% range, about the same as autos. The aspiration is to reach this margin in 2023, but perhaps the more likely expectation should be to reach this in 2024.

The projects keep rolling in. Sceptics say these are one-off low-profit projects, but they are mistaken and they leave out software from their calculations. The company expects 20 years of ongoing revenue from the “Powerhub” monitoring and control software for each project. This package comprises “Autobidder,” “Opticaster,” and “Microgridder” programs. Although such matters are confidential between supplier and customer, this detailed analysis reckons the software revenue for Tesla will amount to approximately 5% of the project value.

Credits that will come from the U.S Government’s program under the Inflation Reduction Act will add to the profitability.

One might summarize the following advantages that Megapack has over the competition:

* High efficiency.

* Fast and easy installation.

* Optimization of land use.

* State of the art software integration and management.

* Easy integration with solar.

Some recent projects include:

* Eveco 53 MW project in Belgium using 53 Megapacks (value about $84 million).

* CS Energy 100 MW project in Victoria, Australia using 80 Megapacks (value about $128 million).

* Sierra Estrella project in Arizona, which will be the largest in that State. It is thought that the Megapack value could be as much as $300 million though exact numbers have not been confirmed in public.

* NGEN Smart Grid System at Arnoldstein, the largest such project in Austria so far, at 10MW. It is worth about $16 million to Tesla.

* Cranberry Point Energy Storage & Medway Grid projects in Massachusetts. These are thought to involve approximately 300 Megapacks (value about US$480 million).

*Neoen projects in Australia. The latest to be awarded is the 197 MW Collie Battery in Western Australia for AEMO. The country’s largest project manager in this field, Neoen, has worked on 6 projects together with Tesla. Currently they are installing on the 200 MW and Blyth Battery and the 200 MW Western Downs Battery. Tesla and Neoen originally worked together on the famous “world’s largest battery” project at Hornsdale. Tesla’s software integration abilities are a central driver of the co-operation of the two companies.

In an indication of faith in their own products, the company is installing 68 Megapacks at their own Gigafactory Texas plant. This is thought to have a power of about 131 MW.

This list is by no means intended to be comprehensive but to give an idea of the types and global reach. An interesting site, “Tesla Megapack Tracker,” gives a more comprehensive picture of this. They identify projects amounting to 5,204 MW/12725 MWh.

Powerwall

Earlier this year it was confirmed that the company had installed over half a million residential Powerwalls. VPP’s around the world are gaining pace. Even in fossil fuel-based Texas, customers are reducing bills by about one-third by participating in VPP’s. These provide much needed grid support to ERCOT (Electric Reliability Council of Texas) with the ability for bidirectional charging. As extreme weather becomes more frequent due to climate change, VPP back-up to often-creaking utilities becomes crucial.

The regulatory framework from State to State is about the only impediment to more rapid business which in actuality financially benefits both the utility and consumer. This seems to suddenly be changing.

In Colorado recently, utility Xcel Energy (XEL) set up a VPP scheme, open to households using products from Tesla or SolarEdge (NASDAQ:SEDG). Xcel is active in 8 different States, and this move shows how U.S. utilities are finally actioning large-scale VPP’s after some years of trials.

One forward-thinking utility that has already accrued clear benefits is Green Mountain Development Corp. (OTC:GMND) of Vermont. They have had a pilot program since 2015 of gradually bringing Powerwall users into a VPP. It has been so successful that it is now being opened up fully statewide. Just with 4,800 residences, it has built up 27 MWh capacity and enabled the utility not to have to invest large capex in new generating capacity. The utility and the residence owners have both saved substantial amounts. It is a win-win game. Vermont now expects to have 100% renewable power by 2030 at the latest.

Australia is where Tesla got the VPP project business off the ground, and they continue to grow the South Australia VPP. This is shown here. The long-term aim is to have 50,000 homes in the VPP there. That alone would provide 250 MW of solar energy and 650 MWh of battery storage capacity and have a value of perhaps $5 billion on the basis of $10,000 per Powerwall.

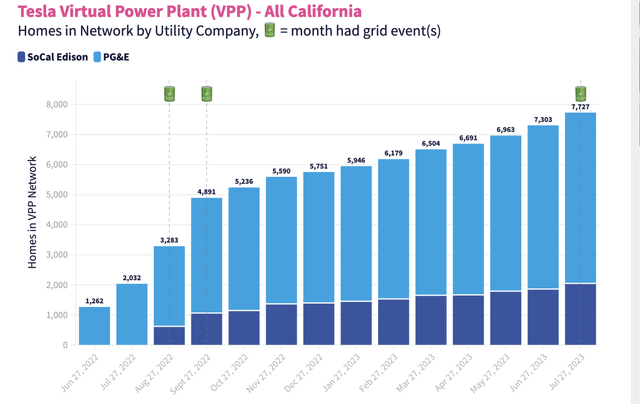

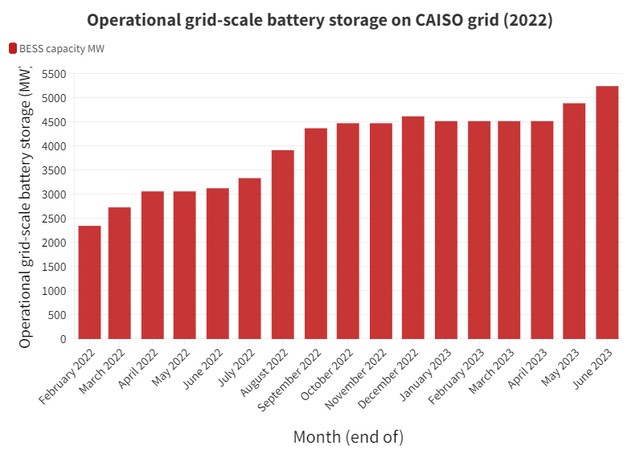

In California, VPP’s are established and have grown strongly in the past year, as the graphic below shows:

This shows even faster growth than California’s grid energy growth, as illustrated below:

Tesla-based VPP’s are expanding worldwide. They are only constrained by the company’s ability to supply product. As with Megapacks, waiting times are up to 2 years for product. As Tesla’s capacity has built up, and as they no longer need to prioritize autos over storage, revenue figures will rise very rapidly.

It was recently announced that Tesla are setting up a VPP in Puerto Rico. There are already about 50,000 units there, much of it from Elon Musk’s charitable assistance to the country following the weather catastrophe of recent years.

There have been reports of a major drive for the use (and potential manufacture) of Tesla Powerwalls in India. This has not been either confirmed or denied by the parties involved. It would be highly beneficial in a country where blackouts are frequent and where there is huge production of polluting coal-based plants.

In the UK, Tesla received a license in 2020 to be an electricity generator to complete with established players like Octopus. They have recently been on a recruitment drive to go full out as a retail electricity provider.

This comes at a time when what would be the complementary auto division has been seeing soaring sales in the country. It may well be that Tesla will do this in country after country as and when their autos have sold well (which is virtually every country in Europe in 2023).

In fact, world leader after world leader seems to want to meet Musk to discuss investments. For example Musk has met with President Erdogan to discuss facilities for both autos and energy storage.

As with the Megapack, there is a substantial order backlog for the Powerwall. Tesla’s plans to ramp up production have not been itemized as clearly as for the Megapack, but the ramp-up has begun. There will be a more powerful Powerwall 3 coming online in the coming months.

Possible Negatives to the Thesis

* Tesla’s ability to supply, and the whole pace of the inevitable transition to renewables, could be slowed down by insufficient supply of minerals such as lithium and nickel.

* The dominance of Asia, especially China, in the market as explained here could be a problem. However Tesla’s increased investments in Asia could stand them in good stead against the competition and are no doubt a reason for Musk’s recent push in the continent and meetings with political leaders in India and Indonesia.

*Lithium battery power might get superseded by other battery technologies.

* Unknown possible world economic or political crises that can hamper an international giant like Tesla.

Conclusion

The future of energy is a picture of renewables replacing fossil fuels. Storage is the natural concomitant of renewable sources such as wind and solar. EVs are the critical way in which greenhouse gases can be reduced and air quality improved. The two complementary technologies are growing together hand-in-hand and Tesla are leading players in both.

Storage, though, will in my opinion come close to matching autos in revenue in the medium term. By next year, the Megapack production should provide revenue potential of $40 billion. This compares to total revenue for the company in 2022 of $81.5 billion. The 50/50 divide between autos and energy is now foreseeable long term, as the growth picture for renewables is far greater than that for autos.

Tesla’s capital investment in storage and their strong share of the market should enable the company to remain at the forefront. It makes their stock very attractively priced, as the current price is based mainly on auto revenues. The long-term future for substantial growth may lie with storage. Other new areas outlined above may of course also contribute substantially long term, but they are by no means certainties in my opinion.

Energy storage is without doubt a rapidly growing worldwide market. It seems to be unstoppable due to worldwide secular trends. The benefits to Tesla, Inc.’s revenue and are cash flow may come sooner than expected. As outlined in this article, for Megapack alone this should amount to $40 billion in sales and $10 billion in profits within a couple years. That is very likely to have a strongly bullish effect on Tesla’s stock price.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.