Summary:

- Electric vehicles, data centers, and LLMs require large amounts of electricity, increasing demand for energy.

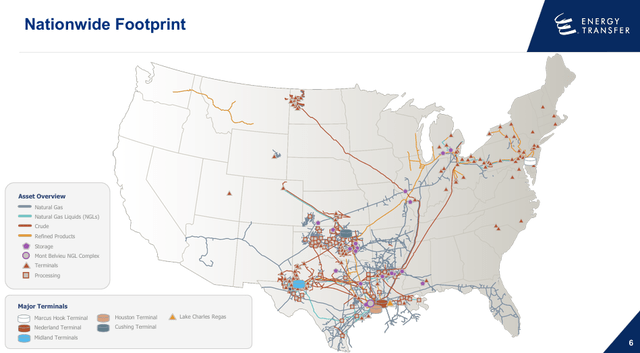

- Energy Transfer has a unique footprint with extensive energy infrastructure across the country.

- ET is undervalued, positioned to benefit from increased energy demand, and offers an 8.23% yield, making it an attractive investment.

PM Images

Electric vehicles, data centers, and training large language models (LLMs) all have one thing in common. They require large amounts of electricity. As electric vehicles become more common in the automotive mix and more data centers are brought online to advance AI capabilities, the demand for electricity will increase. Renewable sources of energy won’t be abundant enough to facilitate the growing amount of energy needed to generate the electricity required for the advancements throughout society.

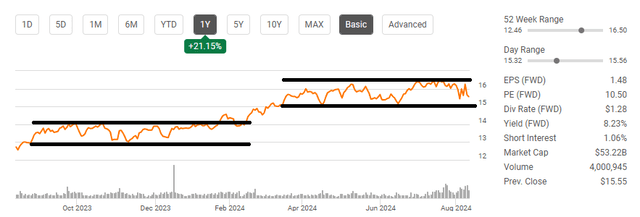

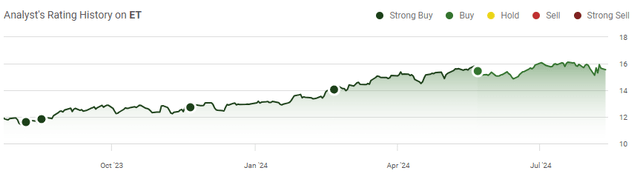

Energy Transfer (NYSE:ET) has a unique footprint that consists of more than 125,000 miles of pipelines across the country. ET is operating an energy infrastructure conglomerate that would be next to impossible to reconstruct from the ground up. ET spent from August of 2023 through February of 2024 before finally breaking out above $14. ET has spent some time above $16 in 2024 but has been stuck range bound between $15 – $16.50 since March. I believe the latest retracement is a buying opportunity, and while units may not be as cheap as they once were, I believe they’re still undervalued.

ET has been expanding its natural gas footprint, which will be critical to the growing demand for electricity across the United States. I believe that ET has been consolidating for too long, and this will ultimately act as a coiled spring and form the next leg for units of ET. As the Fed cuts rates investors will be on the hunt for income-producing assets, and ET has an 8.23% yield with a growing distribution that is supported by strong cash flows. When compared to its peers, ET looks undervalued, and I believe it will trade closer to $20 per unit by the end of 2024.

Following up on my previous article about Energy Transfer

Back in May, I wrote an article about ET (can be read here), and since then, units have declined by -3.08% compared to the S&P 500, appreciating by 1.56%. I have been a unitholder and long on ET prior to the pandemic when pipeline companies were less popular than they are today. While units of ET and other pipeline companies have appreciated over the past year, many are still trading well under their 2015 levels before the oil trade imploded. I believe there is still more value to be unlocked as further consolidation occurs in the industry. I am following up with a new article on Energy Transfer as there is more economic data and technological developments that are making me upgrade my rating to very bullish for units of ET. I think that ET is undervalued, and as the demand for energy continues to increase, more people will realize that pipeline companies help establish the backbone of our economy and cannot be replaced anytime soon.

Risks to investing in Energy Transfer

While I am bullish on ET and other pipeline companies, many of the same reasons I am bullish are risk factors to consider in the investment thesis. I can’t raise capital and start competing in the energy infrastructure space tomorrow. Unlike opening a store to sell physical goods, starting an online business, creating a software company, or trying my hand in real estate, it’s not as simple to start an energy infrastructure company. The requirements, including a massive amount of capital, include permits, zoning approvals, land, regulatory approvals on a federal and local level, environmental surveys, and agreements between upstream producers and end-users. At any moment, ET could find itself in a situation where legislation changes, and they need to make upgrades to their infrastructure or find themselves where permits are pulled or denied. If there is an oil spill from its pipelines, there could be a massive lawsuit, and there are always environmental ramifications to deal with, from protests to lawsuits. These are all risk factors to consider in addition to competitive risks from alternative energy sources. As technology improves, more capital is being deployed to find alternative ways of producing energy that are more environmentally friendly and more cost-effective. If there are breakthroughs in the alternative energy space, if could put significant pressure on the amount of fossil fuels that are needed, and that could impact ET’s top and bottom line. There are many risk factors to consider, and while I am bullish, there are many people looking to eradicate the use of fossil fuels in society.

What has changed that has made me very bullish

I am listening to all the big tech earnings calls and connecting the dots. The big one will be NVIDIA Corporation (NVDA) at the end of the month, so I can see where demand for hardware is. On Meta Platforms (META) Q2 earnings call, Mark Zuckerberg provided clear insights as to how their CapEx will be allocated. In addition to Susan Li raising the low-end of 2024 CapEx spending from $35 to $37 billion, Mr. Zuckerberg was clear that the amount of compute needed to train their next Llama 4 model would require almost 10x the amount of compute it took to train Llama 3. He discussed how they are planning the compute clusters they will need over the next several years and would rather risk building capacity upfront rather than too late, given the long lead times for hardware.

On Microsoft’s (MSFT) earnings call Amy Hood discussed how MSFT spent $13.9 billion on property, plant, and equipment and that cloud and AI-related expenses represent almost all of their CapEx allocation. She also discussed how the remaining cloud and AI spend will be dedicated to CPUs and GPUs.

On Amazon’s (AMZN) conference call, Brian Olsavsky discussed how they spent $30.5 billion in the first half of the year on CapEx, and they expect CapEx spending to increase in the 2nd half of 2024. AMZN’s spend will be focused on supporting the growing need for AWS infrastructure as the demand in generative and non-generative AI workloads increases.

Outside of big tech, I am also looking at utilities, and Southern Company (SO) is one of the ones I pay close attention to. On SO’s Q2 conference call, Dan Tucker indicated that sales to existing data centers in Q2 increased by 17% YoY. He also stated that SO has nearly 200 projects and over 30 gigawatts of potential load in their pipeline over the next decade. The most interesting part was that roughly 40% of the projects and 80% of the projected electric load are from data centers.

There has been a debate about whether we’re in an AI bubble. I don’t believe that anyone can accurately predict how AI will shape the future of technology or business over the next 5-10 years, but it’s clear that the largest companies in the world are allocating a tremendous amount of capital and internal resources toward AI capabilities. While there is a lot of opinions on what will happen, AI doesn’t seem like it’s a hype cycle or a bubble, as tens of billions are being poured into infrastructure each quarter to harness the future of AI.

Regardless of what AI eventually becomes, the dollars being spent on hardware and data centers won’t stop anytime soon. The most telling sign is what SO’s management said on their conference call. No matter what the impacts are, the amount of electricity required for the new data centers coming online is quite extensive. Existing data centers are spending an additional 17% YoY with SO, and they are projecting that 80% of the future electric load they will place in production over the next decade will be utilized by data centers.

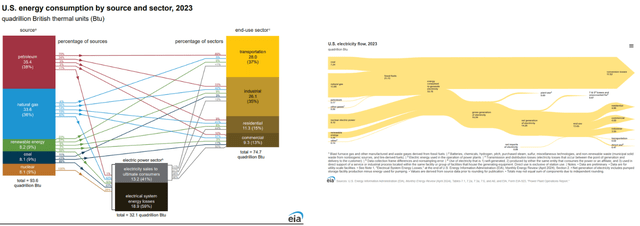

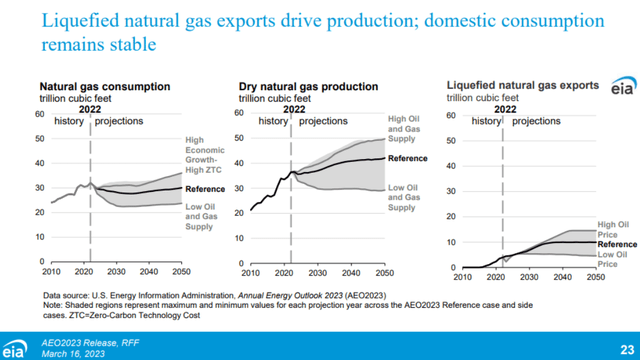

In 2023, natural gas accounted for 13.66 quadrillion Btu’s, which was 41.71% of the electricity utilized. Renewables only accounted for less than 12% of the fuel sources used to create electricity. The EIA also expects natural gas production to increase through 2050, and I am expecting these projections to increase in their next report, considering the updated data regarding how much electricity will be needed to power all of the additional data centers brought online in 2024 and the future ones being built. I think ET is going to be an indirect beneficiary from the AI boom because it has almost 90,000 miles of pipeline and 235 Bcf of storage capacity for natural gas in addition to 65 natural gas processing and treating facilities. As the utilization of natural gas increases, ET will benefit as its infrastructure will play a critical role in supporting the future demand for American energy.

Energy Transfer is positioned to benefit from increased demand in energy and looks undervalued compared to their peers

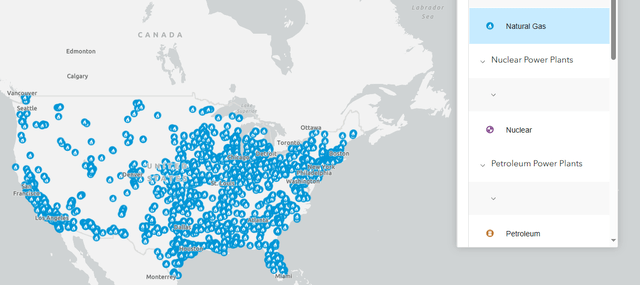

There are more than 2,500 data centers in the United States, and more than half of them are located across 10 markets. Within those largest markets are Northern Virginia, New York / New Jersey, Chicago, Atlanta, and Dallas. Next I am looking at the EIA’s interactive map for where all of the natural gas power plants are, with the majority in the North and Southeast, Midwest, and part of the Southwest. ET provides critical takeaway capacity from the largest natural gas basins across the country and provides natural gas to some of the country’s largest markets, including some of the largest data center markets.

ET currently services 185 natural gas power plants via direct or indirect connections and is constructing 8 natural gas-fired electric generation facilities that will be 10 megawatts each. ET also disclosed that they are in discussions to connect additional natural gas power plants with new connections that could consume an additional 5 Bcf/d of gas. The latest acquisition of WTG, which was announced in May, is critical to the future of ET’s natural gas as it provided an additional 6,000 miles of gas-gathering assets in the Permian and 8 gas processing plants.

When I look at what SO is saying, I believe we’re going to experience a large uptick in the amount of natural gas utilized throughout the country. I want to be invested in the companies that are positioned to benefit from these trends. ET has 125,000 miles of pipeline, they have gathering lines that can support 19.9 million MMBtu/d, and they can transport 31.8 million MMBtu/d of natural gas. ET just delivered $3.76 billion in Adjusted EBITDA during Q2, which was a 20.51% YoY increase, adding $640 million to Adjusted EBITDA. This correlated to $2.04 billion in distributable cash flow (DCF) which was up 31.61% YoY from $1.55 billion in Q2 2023. This was aided by increases in crude exports, crude transports, NGL transports, and terminal volumes increasing. ET just raised guidance for its Adjusted EBITDA to $15.3 – $15.5 billion from $15 – $15.3 billion. The WTG Midstream acquisition will be accreditive in 2024 to earnings and ET continues to put itself in a position to thrive in the future as the demand for energy grows.

ET just raised its 2024 growth capital target by $200 million to $3 – $3.2 billion. The midstream business is expected to see 30% of the growth capital to increase processing plant capacity and expand its gathering projects. Looking out to the future, ET has an extensive roadmap to boost their NGL, refined products, midstream, and crude segments. Next year several projects should be completed, including the Sabrina 2 Pipeline conversion, where ET will increase the natural gas service between Mont Belvieu and Nederland from 25,000 Bbls/d to 70,000 Bbls/d. They are also expected to finish their expansion with the Nederland Flexport Expansion Project, which will add 250,000 Bbls/d of NGL export capacity at the Nederland terminal. Energy infrastructure isn’t grabbing headlines, but there is a lot going on behind the scenes to support the growth in technology, and ET is at the center of it. As ET brings more projects online, their Adjusted EBITDA and DCF should continue to increase, which will create a value proposition for shareholders.

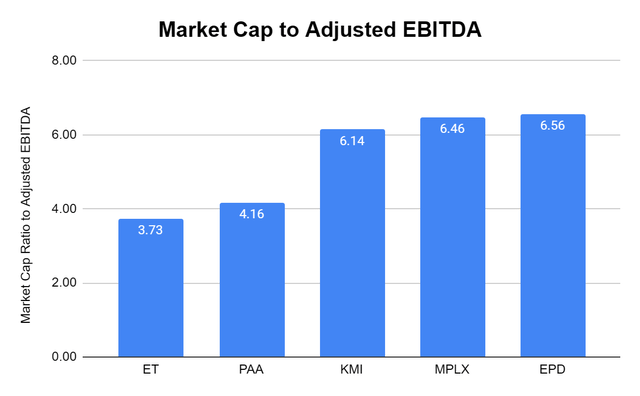

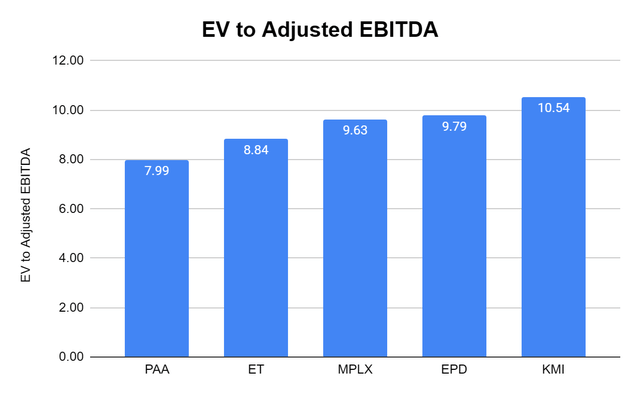

When I compare ET to Enterprise Products Partners (EPD), MPLX LP (MPLX), Plains All American (PAA), and Kinder Morgan (KMI), I still believe ET looks inexpensive. Over the TTM, ET has generated $14.3 billion in Adjusted EBITDA, and they have projected more than $15 billion in 2024. Based on the Adjusted EBITDA from all 5 companies, ET is trading at 3.73 times its Adjusted EBITDA, which is the lowest of its peers. When I look at ET on an enterprise value basis to Adjusted EBITDA, they are trading at 8.84 times, which is the 2nd lowest in the peer group. Compared to the peer group averages of 5.41 times market cap and 9.36 times enterprise value on Adjusted EBITDA, ET looks as if it is trading at a discount to its peers.

Steven Fiorillo, Seeking Alpha Steven Fiorillo, Seeking Alpha

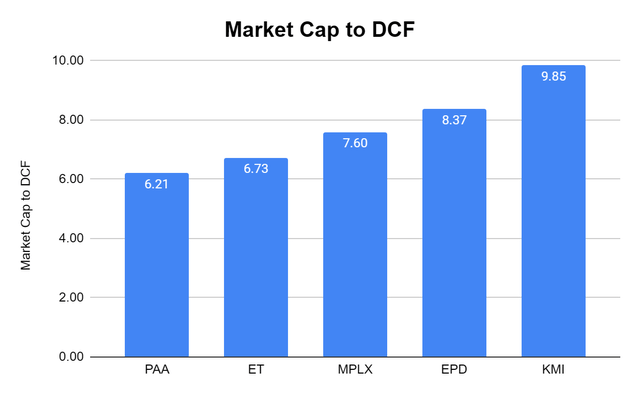

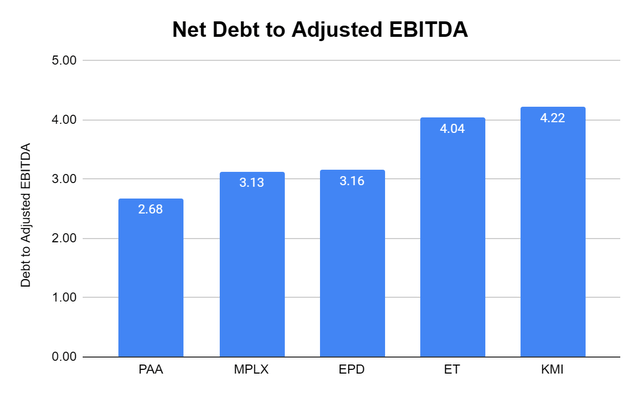

When I look at ET based on its DCF compared to its peers, ET is trading at 6.73 times its DCF, which is below the peer group average of 7.75x. On all 3 levels of profitability, ET looks undervalued compared to its peers. I also look at the net debt to Adjusted EBITDA levels to see if ET is taking on too much debt to fund its growth compared to its peers. Even after the recent acquisitions ET is still trading at 4.04x its net debt, and this ratio should decline as the next 2 quarters materialize and bring their Adjusted EBITDA higher. Based on everything I am seeing, I believe that ET is still a bargain.

Steven Fiorillo, Seeking Alpha Steven Fiorillo, Seeking Alpha

Energy Transfer is interesting as an income play as we enter a lower-rate environment

The next official FOMC meeting is 35 days away, and CME Group is projecting that there is a larger probability that the Fed will cut rates by 50 bps than 25 bps. The chances of getting a 50 bps rate cut are now 53.5%, while a 25 bps cut is now 46.5%. As rates start to decline, individuals who have been using money markets, CDs, and short-duration bonds as a proxy to equities to generate income should shift. There is only an 18.6% chance at this point that we won’t get 100 bps of cuts or more in 2024, so the yield from the risk-free rate of return is likely to change quickly. When this happens, I think a lot of people will be looking at companies that operate hard assets and generate income because 5% risk-free yields will be a thing of the past for anyone who didn’t lock in long-duration CDs or bonds.

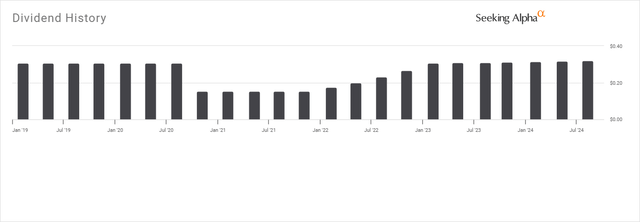

ET pays an annual distribution of $1.28, which is an 8.23% yield. After cutting the distribution in the summer of 2020, ET has increased its distribution 11 consecutive times since Q4 2021. The quarterly distribution has increased by 109.84% from $0.1525 to $0.32. The distribution is larger than its pre-pandemic levels, and management is committed to increasing the distribution as they produce additional DCF. I think that ET will be a flight to safety for some investors as the distribution has been restored and could eventually pay double the yield than the risk-free rate of return.

Conclusion

I think ET is still undervalued, and the recent retracement is an investment opportunity. ET has been trading range bound, and I think we will see shares climb past $16.50 and head toward the $20 level before 2024 is over. Regardless of what AI becomes, the amount of capital being spent on hardware requires new data center infrastructure, and this is making ET a 3rd derivative play in the AI boom. To train LLMs and advance generative AI companies, they need hardware from NVDA, the data centers need electricity, and electricity needs natural gas.

I want to be in strong companies that are supplying the fuel needed to produce electricity as consumption expands in the years to come. Due to regulations, ET has a gigantic moat around its business and is in a winner take most position. As rates start to decline, I think that income-producing assets will have their day, and ET will be looked at differently. I am long ET as I believe this has the potential to generate a yield that will continue to outpace the risk-free rate of return while also producing capital appreciation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ET, EPD, KMI, META, AMZN, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.