Summary:

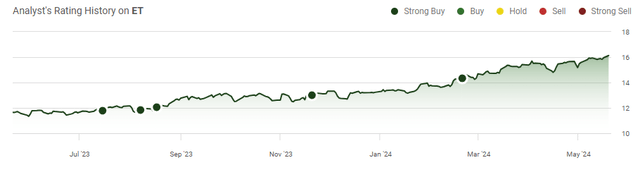

- Energy Transfer is trading above pre-pandemic levels, with units appreciating by 16.88% in 2024.

- The demand for energy and the need for energy infrastructure continue to grow, providing opportunities for companies like ET.

- ET’s revenue and profitability are protected by fee-based contracts, and it is undervalued compared to its peers in the industry.

PM Images

Energy Transfer (NYSE:ET) is finally trading above its pre-pandemic levels, after crashing to below $5 during the pandemic. Units of ET have appreciated by 16.88% in 2024, and my claims that ET should trade for a minimum of $17.26 look more realistic as time progresses (can be read here). While technology controls the narrative, there has been an opportunity in the energy sector that went unnoticed by many investors.

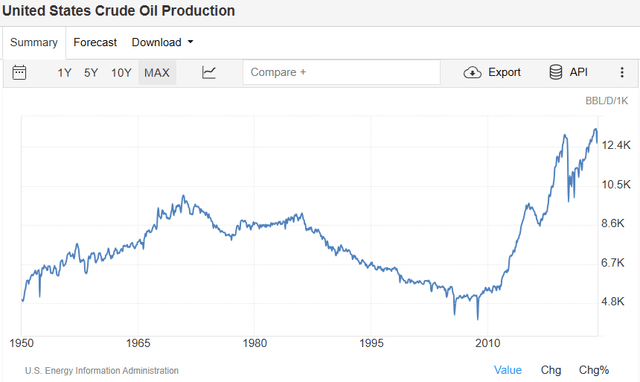

The narrative regarding eliminating oil and gas never made sense to me, considering how dependent the global economy is on traditional sources of energy. The United States is producing more than 13 million barrels per day (bpd) of crude as production is at all-time highs. Many are trying to figure out what is the next big play in Artificial Intelligence (AI) after seeing how big the demand for Nvidia Corporation’s (NVDA) chips is and how quickly companies are trying to adopt generative AI tools from cloud computing and SaaS platforms.

What isn’t being talked about much is that the AI infrastructure being built to facilitate the demand is expected to increase the power required by data centers by 160%. The Energy Information Agency’s (EIA) forecast is that production of oil and gas will continue to increase for decades to come, and as we see technology require additional levels of power, the idea that our dependence on oil will end anytime soon isn’t probable.

I think there is still an opportunity in energy infrastructure companies, as takeaway capacity and storage demand should increase with the demand for energy. ET is the largest midstream operator by revenue, and there still looks to be value left to be unlocked within its units. I am still long on ET, and while units have appreciated by more than 225% since their lows, I think ET will continue higher, and investors can collect a large single-digit distribution along the way.

Following up on my previous article about Energy Transfer

I have been bullish on ET prior to the pandemic, and while it made unprecedented lows. Since my last article was published on February 20th (can be read here), units of ET have appreciated by 9.12% while the S&P 500 has climbed 6.35%. When the distribution is taken into account, ET has a total return of 11.30%. In that article, I discussed their 2023 fiscal year results and why I felt shares were still undervalued. Now that Q1 2024 is in the books, I am revisiting this investment idea as units continue to increase. I still believe that there is room for ET to run, and while it may not be a double anytime soon, investors can feast on a large single digit distribution yield with the potential for further upside.

Risks to investing in Energy Transfer

ET faces a different set of risks than most companies as they compete in a highly regulated and scrutinized sector. ET operates one of the country’s largest energy infrastructure conglomerates and faces risks that are out of their control. ET’s main components are transporting fossil fuels throughout its pipeline network, providing storage capacity, and operating import and export facilities. ET faces federal and local government regulations. Rules and regulations about everything from emissions to zoning rights could negatively impact ET, and these are factors that are outside of its control.

Also, weather plays a factor in energy utilization rates, which can impact the amount of fuel that moves throughout ET’s infrastructure season by season. ET also faces technological challenges as tremendous amounts of capital are flowing into alternative energy investments. If breakthroughs are made on fusion or other advancements in energy production, ET could incur a declining demand for the fuels it transports coast to coast. While I am bullish on ET, there are many risk factors that should be considered.

Why I am still bullish on Energy Transfer after the appreciation in units

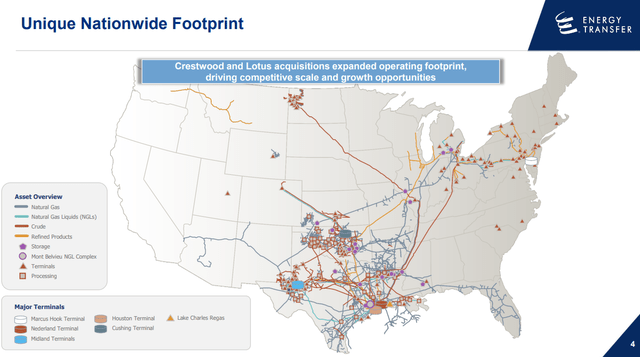

I am bullish on energy infrastructure companies because their assets are needed to sustain our way of life. The demand for energy has gradually increased, and as the global population expands, the demand for energy should continue to grow. ET is one of the largest energy infrastructure companies in the United States, with more than 125,000 miles of pipelines that connect to export facilities that reach more than 50 countries globally. The barriers to entry within the midstream sector are immense because of the government regulations, land requirements, zoning permits, capital required, and connectivity to storage and marketing facilities.

Somebody can’t just go out and raise billions in capital and decide to compete. Pipelines require the Federal Energy Regulatory Commission (FERC) to review applications for construction and approve projects before a shovel can go into the ground. Outside of current competitors, ET faces limited competition from a new company entering the space. This is why I remain bullish on the sector and believe we will see further consolidation rather than additional competitors.

ET is producing strong results as it generated $21.63 billion in revenue, $3.88 billion in Adjusted EBITDA, and $2.36 billion in Distributable Cash Flow (DCF) throughout Q1 2024. ET moved a record amount of crude throughout its system during Q1 as crude terminal volumes increased by 10%. ET transported 6,102 MBbls/d of crude in Q1, which was an increase of 43.98% YoY. ET’s other segments are also seeing increased activity as natural gas liquids (NGL) transportation volumes increased by 5.19%, midstream gathering volumes increased by 0.87%, and natural gas interstate transportation volumes increased by 5.04%.

This is critical to the investment thesis, as it’s an indication that the demand for energy continues to increase across the United States. ET is projecting that they will generate between $14.5 and $14.8 billion in Adjusted EBITDA throughout 2024. By acquiring companies that have complementary assets, ET is expecting to recognize roughly $65 million of annualized cost savings in 2024, which could increase to $80 million by 2026 on an annualized basis.

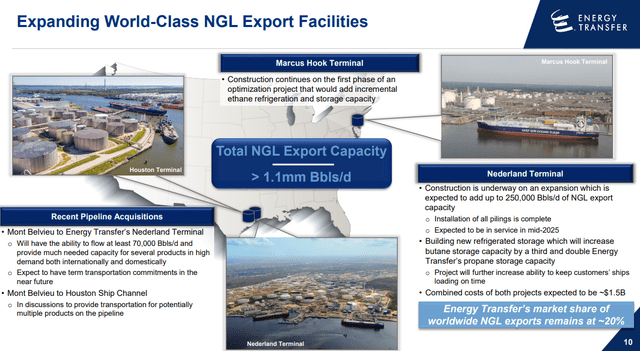

I believe that there is a major opportunity in exporting and that ET will generate additional revenue and incremental DCF as the global demand for energy expands. ET is one of the few companies that will benefit across multiple segments of the value chain as they have the capacity to transport, provide storage capacity, and exporting services to global markets. In Q1, ET recognized a 6% YoY increase in NGL export volumes as international demand increased. ET is responsible for exporting roughly 20% of NGL exports globally, as they loaded 14 million barrels from the Nederland facility and 7 million barrels from the Marcus Hook terminal throughout Q1.

ET is the only company with exporting capabilities from either the East or Gulf coast and has the ability to export 1.85 million Bbls/d of crude and 1.1 Bbls/d of NGLs. As the United States continues to increase the amount of crude exploration and production, ET should be a significant beneficiary. ET is working to expand its NGL export ability into other products to fulfill customer demands.

ET’s revenue and profitability is protected by how its contracted volumes are structured. ET has 90% of its contracts tied to a fee-based methodology where payment isn’t tied to commodity pricing. ET gets paid a specific fee for the capacity their clients utilize, and the revenue generated is derived from volume. I prefer fee-based contracts as the volatility from commodity pricing is less of a risk to revenue. Regardless if crude goes to $100 a barrel or drops to $70 per barrel, ET is generating its revenue from the volume it moves rather than tying its revenue to a spread on commodity prices.

ET is expecting that they will be able to buy back units, and grow the distribution by at least 3% annually, which is attributed to their contract structure, asset base growth, and growing demand for energy. ET’s asset base and the reputation it has created with clients are next to impossible to replicate, and I think ET will be an indirect player that benefits from the growing energy demand.

Energy Transfer still looks undervalued compared to is peers

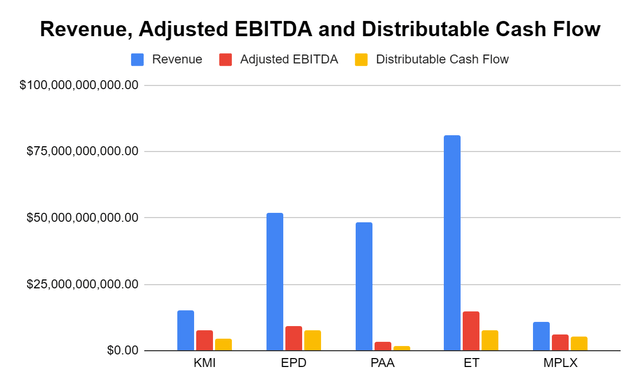

While units of ET have continuously appreciated in value, they still look attractively valued compared to their peers. I have compared ET to Enterprise Products Partners (EPD), Kinder Morgan (KMI), Plains All American (PAA), and MPLX LP (MPLX) across different metrics to see how the market is valuing ET. On a trailing twelve-month (TTM) basis, ET is the largest midstream operator by revenue and Adjusted EBITDA, and there is a compelling case to be made for units to continue higher.

Steven Fiorillo, Seeking Alpha

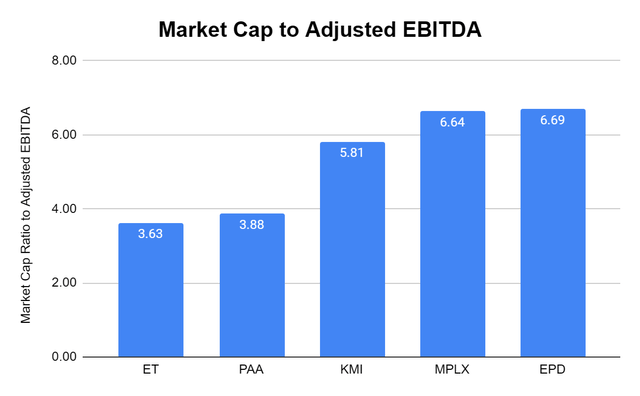

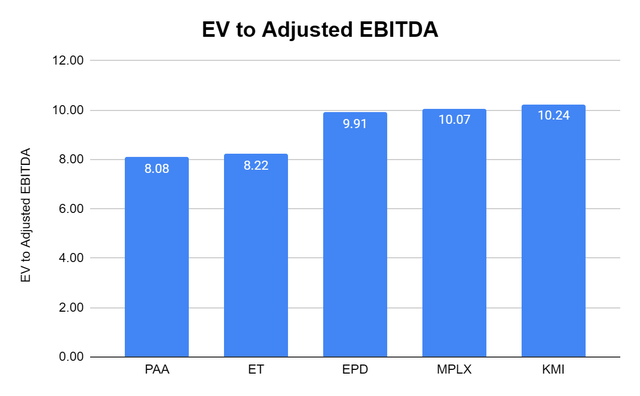

The first areas I will look at are the market cap to Adjusted EBITDA and Enterprise Value (EV) to Adjusted EBITDA. ET trades at a market cap to Adjusted EBITDA ratio of 3.63x and an EV to Adjusted EBITDA ratio of 8.22x. The peer group trades at an average of 5.33x its Adjusted EBITDA for market cap and 9.3x its Adjusted EBITDA for EV. ET has the lowest market cap to Adjusted EBITDA multiple and the 2nd lowest EV to Adjusted EBITDA multiple. Based on these metrics alone, ET looks like it’s trading at a discounted rate.

Steven Fiorillo, Seeking Alpha Steven Fiorillo, Seeking Alpha

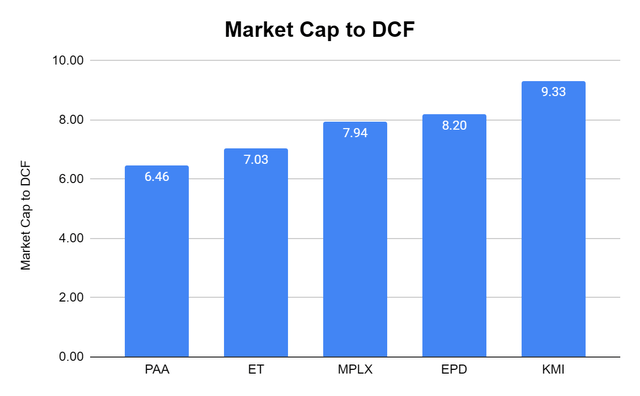

I also want to see how much I am paying for a midstream operator’s DCF. The peer group trades at an average market cap to DCF of 7.79x, while ET trades at a 7.03x multiple. Even after climbing past $15 per unit, ET is trading under the peer group average based on the amount of DCF it produces. This is very compelling considering ET’s expansion and efficiencies that can be recognized in 2024.

Steven Fiorillo, Seeking Alpha

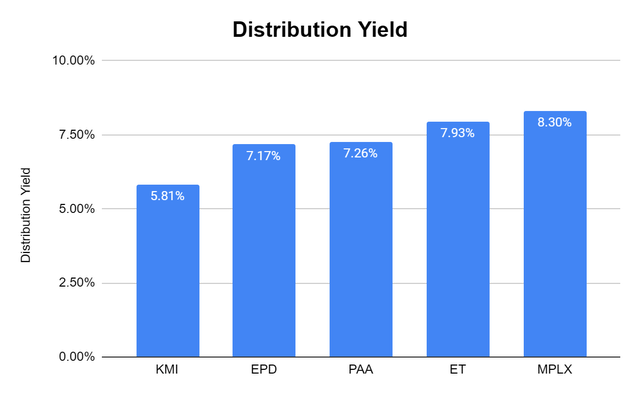

Midstream operators are often looked at as income-producing assets, so I always like to how their distribution yield compares against each other. ET is paying an annualized distribution of $1.27, which is a 7.93% yield. The peer group has an average annualized yield of 7.29%, and the only company that has a larger yield than ET is MPLX. Since reducing the distribution at the end of 2020, ET has increased the distribution 10 times, and it’s now larger than its pre-pandemic level.

Steven Fiorillo, Seeking Alpha

Conclusion

Units of ET continue to climb higher as they acquire companies and build out the largest energy infrastructure company in the United States. I believe the fee-based contract structure will greatly benefit ET in the coming years as more assets are brought online and the demand for energy increases globally.

I think units of ET are still undervalued after outpacing the S&P 500 in 2024 as ET trades at 3.63x its Adjusted EBITDA and less than 1x revenue based on the current market cap. Investors are getting paid almost 8% to wait through the distribution, and it looks like ET is committed to growing the distribution as its DCF increases. I think that units of ET will be much closer to $20 when 2024 ends and that ET is still a strong investment to generate income while producing capital appreciation in the future.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ET, EPD, KMI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.