Summary:

- Energy Transfer announces improvement in business, but earnings per share remain steady.

- Legal disputes with Williams Companies and DT Midstream are ongoing, with uncertain outcomes.

- The Dakota Access Pipeline dispute is probably on hold until after the election. An unfavorable outcome could prove to be significant.

- Return on Capital and Return on Assets are among the lowest figures of any company I follow.

- The lack of per share earnings improvement calls into question the downside risk in any cyclical downturn even with the take-or-pay provisions.

Jacobs Stock Photography Ltd

Energy Transfer (NYSE:ET) announced a sizable improvement in the business. But earnings per share held steady with the year before at $.32 per share. This suggests that there is more to the story than management presented both on the conference call slides and during the conference call. This company has long had one of the lowest returns of any company I follow, and it has a fair number of legal issues, even given that the company is large. For those reasons, I tend to watch this issue from the sidelines until I see significant improvement.

Legal Disputes

The last article discussed the legal dispute with Williams Companies (WMB). Since that time Williams management has publicly updated shareholders that they expect to win that dispute. It was mentioned during this announcement that the appeals court overturned a favorable ruling for Energy Transfer in its dispute with DT Midstream (DTM). Williams management views this ruling as favorable for their case, which is a change in strategy from my original article.

Energy Transfer management stands by their quarterly report notes at this time and has nothing to add until there is a formal update from management (if there is a formal update from management). As of the latest filing (which is the 10-K) management cannot predict the outcome of this dispute.

The problem is that if there are too many losses in court, any company runs the risk of the court looking askance (to say the least) at a company that brings the same likely losing action repeatedly. Supposedly management has more of these pending based upon various reports that would be in the “normal course of business” section of the annual report. One would hope that management would settle these disputes before they run up serious legal bills.

” Several developers have said Energy Transfer (ET) is blocking them from building projects by not allowing them to cross over its existing conduits; the company has said the companies are asking for an unreasonable number of crossings and failing to go through proper regulatory review.”

This comment came from the referenced DT Midstream article in the paragraph below the heading. If “several” are similar enough that the losses pile up, then shareholders likely should be concerned. On the other hand, if management changes their strategy to conform to court rulings, then this issue could fade away.

Dakota Access Pipeline

This dispute is supposedly on hold until after the election. Until then, as the previous article noted, the Army Corps is evaluating the alternatives. At that point, it is highly likely that one of the two parties could head back to court. As Phillips 66 Midstream Partners noted (before they were acquired by Phillips 66), this dispute could drag on for years. While I like the company’s chances of winning, I do not like the uncertainty involved for a midstream company that is typically considered an income issue.

The 10-K

The 10-K and likely the 10-Q when it comes out will list the significant issues and place the rest under the “normal course of business”. It is up to the investor to decide the risk of these issues.

Any specific event listed separately with detail has a risk (but not a certainty) of being significant to the company in the future.

Operations

Management listed the following operational improvements during both the conference call and in the presentation.

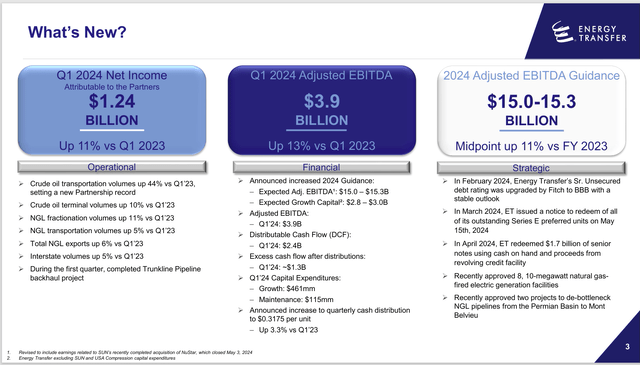

Energy Transfer First Quarter 2024 Earnings Summary (Energy Transfer First Quarter 2024, Earnings Conference Call Slides)

Management does show some excellent growth in the above slide. Evidently much of this growth comes from the acquisitions because the net income per share shown on the earnings press release is the same $.32 that it was in the previous fiscal year.

The only concerning thing is the potential downside risk should the economy ever slow. If earnings per share do not increase with all those increases listed on the left-hand side, then what is the downside risk to earnings per share even given that there is take-or-pay protection because that protection does not protect all the volumes but rather a minimal amount.

Management did increase the distribution. Supposedly, that distribution is well enough covered that it would be safe even if the upstream part of the business has a cyclical downturn.

The diversification benefits were in full view as management noted several areas (like the dry gas Haynesville) where volumes were down. Still, overall business did improve as shown above.

Another concern is that the distributable earnings calculation uses only maintenance capital for the calculation. It would probably be considered conservative to use the whole capital budget instead, as some competitors use.

On the plus side, the credit rating for senior unsecured debt was upgraded to BBB by Fitch. For investors, there are still some preferred issues left even though management has called several preferred issues to reduce the amount of senior issues to the common units. The earnings press release shows roughly $5.6 billion of preferred. Even though management repaid some debt and called another preferred issue after the end of the quarter, the remaining preferred would likely significantly increase the financial risk to the common units over what the debt rating would appear to indicate.

Summary

Energy Transfer operations appear to have improved. But the acquisition of subsidiaries kept that improvement from raising the earnings per share over what it was one year ago before the acquisitions. This would call into question what a cyclical downturn might do to both earnings and cash flow (especially per share) for a midstream company like this one.

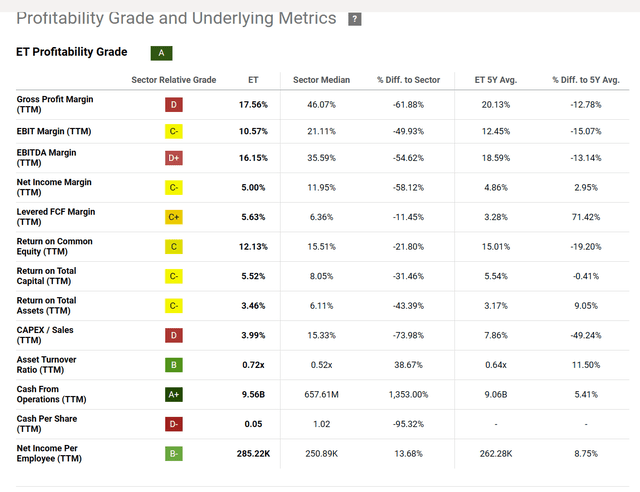

Seeking Alpha Website Quant System Profitability Evaluation (Seeking Alpha Website Quant System Profitability Ranking May 8, 2024)

It may be a bit of time before this gets upgraded with the latest results. Despite the overall “A” grade, the return on key factors like Return on Total Capital are among the lowest at 5.52% of any midstream that I follow. Return on assets is so low as to indicate there really should not be leverage involved in the capital structure of the company.

For me, this company rates a sell because the profitability as shown above is not high enough and because legal issues could drag that profitability down more should an unfavorable outcome happen.

As was noted in the last article, management had already paid one decent sized amount and still had a couple hundred million accrued on the balance sheet at yearend. Frankly, income investors do not need the worries of potential outcomes that are listed as part of the financial statement notes. I think investors can do better elsewhere without the drama here.

Risks

The legal risks that are listed where management cannot determine an outcome have a potential range of becoming a significant liability to complete exoneration. The worry here is how many more that go under the heading of “normal course of business” in that disclosure will become significant in the future. To me, there is too much risk here. I personally would seek an income issue without all of this in the financial statement notes.

The return on capital as shown above is very low and the return on assets is worse. The profitability tab on the website for the same day lists profitability in the 12% range. That is actually pretty close to average. I personally believe that investors should put their money in a place where that figure is consistently above average. With the return at average, there is always a risk of a bad year or series of years pulling that return lower. That could impact the common unit price more so than if the return was above average to begin with.

The loss of key managers could have a material effect.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I analyze oil and gas companies, and related companies like Energy Transfer in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.