Rivian: Kicking The Bankruptcy Can Down The Road

Summary:

- Rivian’s mixed Q1 report showed stronger-than-expected revenue performance driven by a vehicle delivery beat, but there was a disappointing miss on EPS due to deeply negative gross margins.

- Despite instituting cash preservation measures, Rivian’s management believes the EV maker only has enough liquidity to last through to R2 entering production in early 2026.

- In the absence of fresh capital infusion, Rivian could easily end up in bankruptcy. Read on to learn more.

hapabapa

Introduction

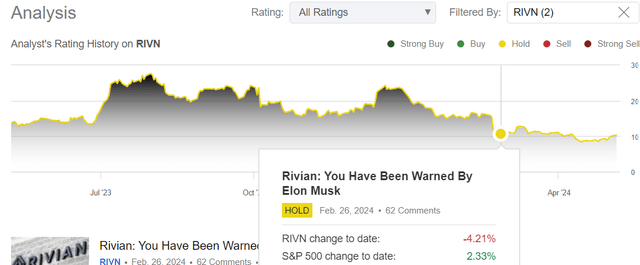

Back in February 2024, I rated Rivian Automotive, Inc. (NASDAQ:RIVN) stock an “Avoid/Hold/Neutral”, citing its ultra-high cash burn rate and desperate need for a cash infusion to avoid bankruptcy in the near future.

Trading only slightly above its cash balance, I think it is fair to say that Rivian is once again priced for bankruptcy. Unfortunately, that’s exactly where Rivian may be headed in the next year or two if management fails to raise additional capital for the EV maker. Amid tough macro [demand] conditions, Rivian is cutting costs and slowing production growth to elongate its runway; however, if the economy were to suffer a hard landing, Rivian may very well run out of money within 6-8 quarters in the absence of fresh capital infusion.

Since we are no longer operating in a zero-interest rate world, I am not at all confident about a money-burning furnace such as Rivian being able to get additional funding in its current form. Therefore, I still think Rivian’s bankruptcy odds are pretty elevated.

If you’re thinking – “Well, Rivian is already down so much; how much lower can it go from here?” – the simple answer is 100%. If bankruptcy can be avoided, RIVN stock could be a ~10x or ~20x investment from here; however, Rivian going bankrupt is a far likelier outcome.

While equity markets have scaled new highs since our last update on Rivian, RIVN stock has continued its slide lower over the last three months or so.

In light of reporting stronger-than-expected numbers for Q1 2024 and management announcing additional cash preservation measures, Rivian stock plunged -6%, only to recover those losses in yesterday’s session. In this report, we will briefly review Rivian’s Q1 report and review its liquidity.

Analyzing Rivian’s Q1 2024 Report

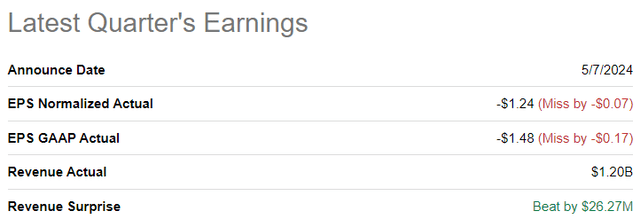

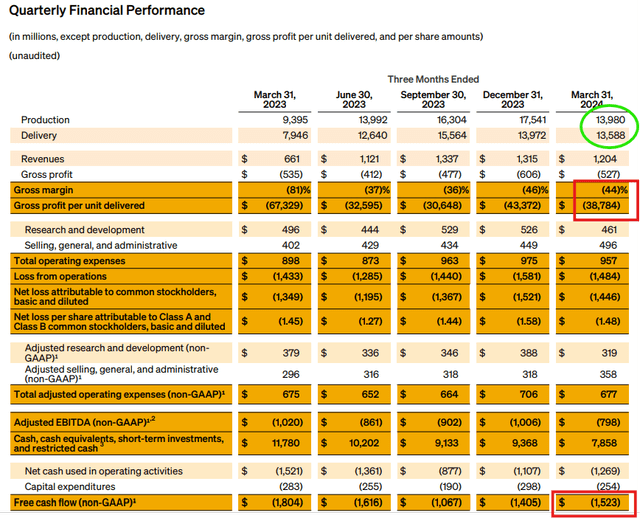

In Q1 2024, Rivian delivered revenues of $1.20B, beating street estimates by $26.27M, on the back of delivering nearly 13.6K vehicles. However, Rivian once again missed earnings estimates, with normalized EPS coming in at -$1.24 per share vs. est. -$1.17 per share.

Seeking Alpha Rivian Q1 2024 Shareholder Letter

While Rivian’s quarterly production and delivery numbers outperformed consensus street estimates, Rivian lost $38.9K per vehicle, i.e., a gross margin of -44%. During Q1, Rivian burned $1.5B, and its cash and short-term investment balance now stands at $7.86B.

Rivian Q1 2024 Shareholder Letter

Despite management reiterating confidence in achieving positive gross profit margins by Q4 2024 and meeting the annual production outlook of 57K vehicles, a realistic path to positive free cash flow generation remains elusive.

Rivian Q1 2024 Shareholder Letter

In March 2024, Rivian revealed R2 (mid-size SUV) and R3 (mid-size Crossover) platforms, with management positing these cheaper models as a massive expansion of Rivian’s total addressable market and a viable path to profitability.

Rivian Q1 2024 Shareholder Letter

While I think Rivian R2 & R3 could replicate Tesla’s Model 3/Y success story, there’s serious doubt about Rivian surviving until the start of R2 production in early 2026! Here’s what I wrote in my previous update on Rivian:

On 7 March 2024, Rivian will be releasing details about its R2 platform and product lineup, and I am sure all eyes will be looking at what a $45-55K vehicle from Rivian has to offer. While Tesla hit the bullseye with the Model 3 (after skirting with bankruptcy fears for a good while), Rivian’s prospects of replicating Tesla’s success seem bleak right now. Why? Because for the R2 platform to be wildly successful, Rivian will have to survive until at least 2026 [when the first R2 platform vehicles are expected to be delivered].

Trading only slightly above its cash balance, I think it is fair to say that Rivian is once again priced for bankruptcy. Unfortunately, that’s exactly where Rivian may be headed in the next year or two if management fails to raise additional capital for the EV maker. Amid tough macro [demand] conditions, Rivian is cutting costs and slowing production growth to elongate its runway; however, if the economy were to suffer a hard landing, Rivian may very well run out of money within 6-8 quarters in the absence of fresh capital infusion.

By moving initial R2 production to its Normal plant, Rivian is projected to save $2.25B via capital expenditures, product development investment, and supplier sourcing opportunities. Furthermore, Rivian is set to receive ~$827M through an incentive package from the state of Illinois for getting the Normal plant ready for R2 production.

Rivian Q1 2024 Shareholder Letter

Now, despite Rivian’s management taking several actions to preserve cash [until the launch of R2], Rivian is still a cash-burning furnace that’s headed for bankruptcy by 2026 [barring a fresh capital raise].

Here’s the rough napkin math:

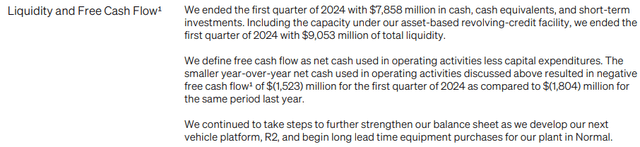

– Current cash burn rate: ~$1.5B per quarter (projected to reduce to ~$1B by the end of 2024)

– Total liquidity: ~$9B [Cash & short-term investments: $7.8B (~6-8 quarters of runway) + Available line of credit: $1.2B]

Even if Rivian achieves its goal of a positive gross profit margin by the end of 2024, it will still be burning ~$1B per quarter in 2025. With R2 now going into production in early 2026 at the Normal plant, existing production will likely be constrained in 2024-25, according to Rivian’s management. In the absence of another capital infusion, Rivian could easily run out of capital before R2 enters mass production in H1 2026. Also, at this point, it is unclear if Rivian will make any money on R2 vehicles!

Overall, I continue to view Rivian’s cash preservation moves as a tactical expansion of its window to find a miracle:

While Rivian’s management has blamed macro (demand) for its production guide for 2024, I think this is a deliberate attempt to slow Rivian’s journey to bankruptcy and hopefully find a miracle (fresh capital infusion) to survive!

Unfortunately, with long-duration treasury yields soaring higher, debt has gotten more expensive, and raising capital via debt may not even be a feasible option for Rivian at this point in time. Also, with Rivian’s stock sitting near all-time lows, raising equity capital here (or much lower) will likely lead to massive dilution for existing shareholders. Given the dire need for fresh capital, Rivian’s management is caught between a rock and a hard place.

Concluding Thoughts

Rivian’s Q1 2024 report was a mixed bag; however, this single report is inconsequential in the grand scheme of things. For the next couple of years, Rivian is unlikely to substantially grow the production of its existing models as the company looks to preserve cash until the launch of its next-gen R2 vehicle. While the R2 could be the next big thing in the auto industry, Rivian could still go bankrupt before R2 reaches mass production, and there’s no guarantee that R2 will be a profit machine.

In order to reach positive free cash flow generation, Rivian needs R2 to emulate Tesla’s Model 3/Y, but to even get to that test, Rivian will very likely require another cash injection or two over the next 12-24 months. Since we are no longer operating in a zero-interest rate world, I am not at all confident about a money-burning furnace such as Rivian being able to get additional funding in its current form. Therefore, I still think Rivian’s bankruptcy odds are pretty elevated.

If you’re thinking – “Well, Rivian is already down so much; how much lower can it go from here?” – the simple answer is 100%. If bankruptcy can be avoided, RIVN stock could be a ~10x or ~20x investment from here; however, Rivian going bankrupt is a far likelier outcome.

Key Takeaway: I continue to rate Rivian Automotive, Inc. an “Avoid/Hold/Neutral” at current levels.

Thanks for reading, and happy investing. Please share your thoughts, concerns, and/or questions in the comments section below.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

We Are In An Asset Bubble, And TQI Can Help You Navigate It Profitably!

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our investing group – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

At TQI, we are pursuing bold, active investing with proactive risk management to navigate this highly uncertain macroeconomic environment. Join our investing community and take control of your financial future today.