Teva Pharmaceutical: 6 Takeaways From Q1 2024 Earnings Results

Summary:

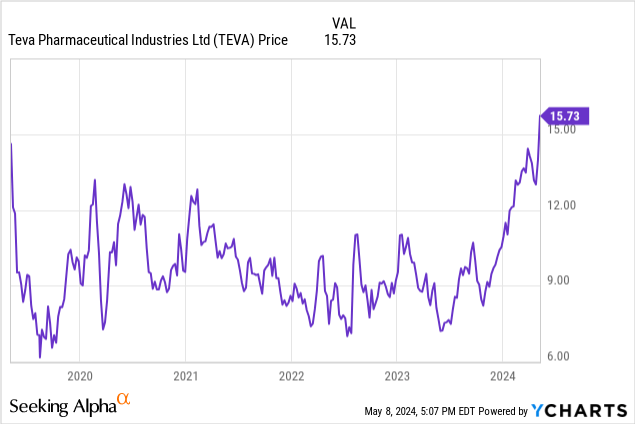

- Teva Pharmaceutical stock has been trending higher since October 2023, closing at nearly $16.00.

- The company reported strong first-quarter results, with increased revenue and growth in key metrics.

- Teva has a positive business outlook for 2024, with a forecast for adjusted EBITDA of up to $5.0 billion and potential blockbuster drugs in its pipeline.

JHVEPhoto

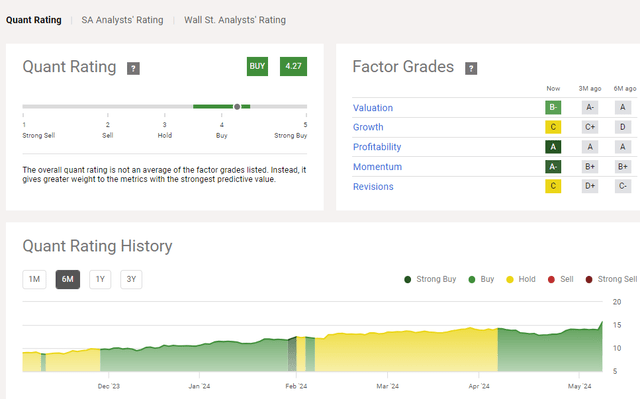

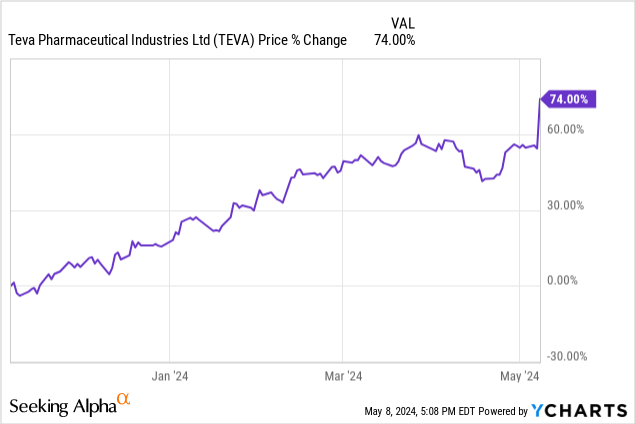

Since October 2023, shares of Teva Pharmaceutical (NYSE:TEVA) trended higher from around $8.00 to close at $15.74. In addition to earning a bullish “Buy” quant rating in early April, what are the fundamentals that changed following Teva’s first-quarter results?

Investors have six things to consider from the first-quarter report.

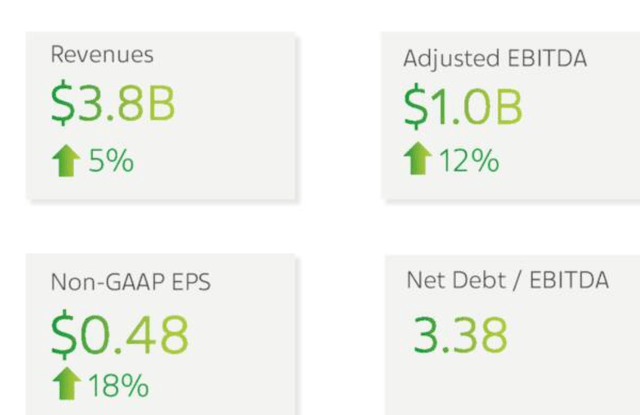

1/ Teva Pharmaceutical’s Profit in First Quarter of 2024

Teva posted a Q1 non-GAAP earnings per share of 48 cents. Revenue increased by 4.4% Y/Y to $3.82 billion. The firm delivered on its pivot to growth strategy by using just $124 million in cash flow for operating activities. Free cash flow was $32 million.

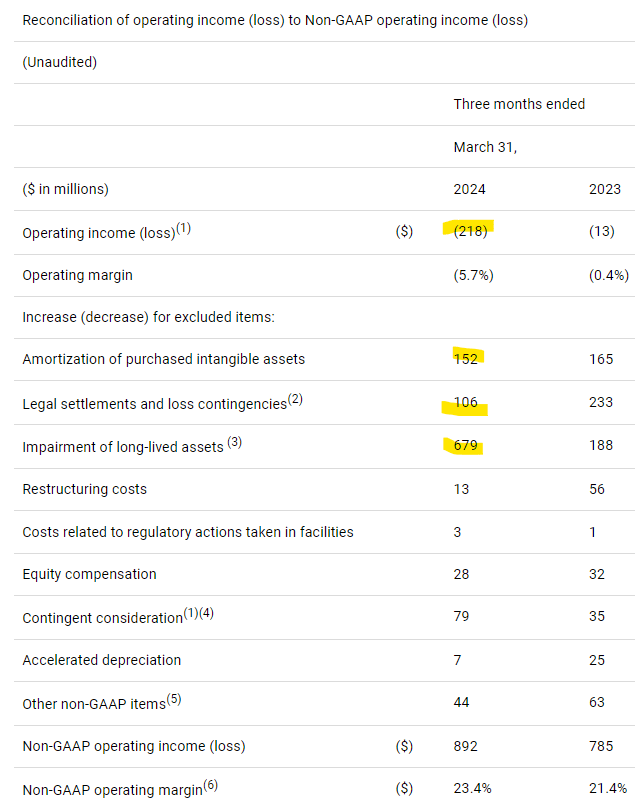

On a GAAP measure, Teva reported $218 million in operating losses. However, the three biggest items on the reconciliation of operating income are amortization, legal settlements and loss contingencies, and impairment of long-lived assets. This amounted to $950 million:

Teva

Teva characterized the first quarter as a return to sustainable growth, based on growth in these three metrics:

Moreover, revenue for Austedo grew by 67%, Ajovy grew by 18%, Global generics grew by 9%, and Teva api rose by 2%.

The net debt / EBITDA is the most important data point. At 3.38 times, Teva started the year on a strong note, enabling it to reaffirm its 2024 financial outlook. Stock markets guessed correctly that the drug firm would report areas of growth. Shares formed an undisturbed uptrend since bottom at around $8.00.

Above: Teva, 6-month chart

Zooming out of the chart, the stock price closed at lows not seen since before the pandemic. It last traded at above $15.00 in June 2019.

Above: Teva chart, 5-year

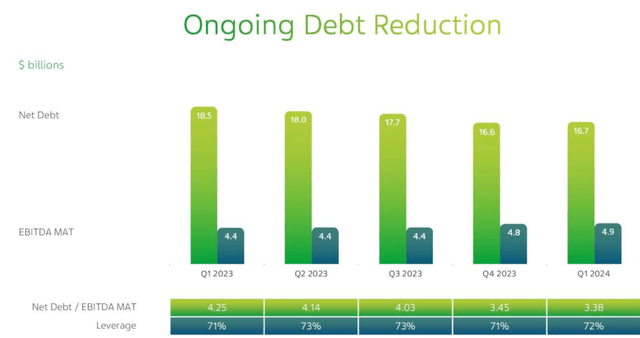

2/ Debt Levels

Teva ended Q1 with net debt of $16.7 billion, compared to 416.6 billion at the end of 2023. Although it benefited from exchange rate fluctuations worth $193 million, the higher EBITDA improved its net debt / EBITDA MAT leverage from 3.45 times to 3.38 times.

Shareholders should expect this multiple to decline. In its amended revolving credit facility, the firm will not exceed 4 times in 2024-2025. By Q1/2027, the maximum leverage ratio is 3.5 times.

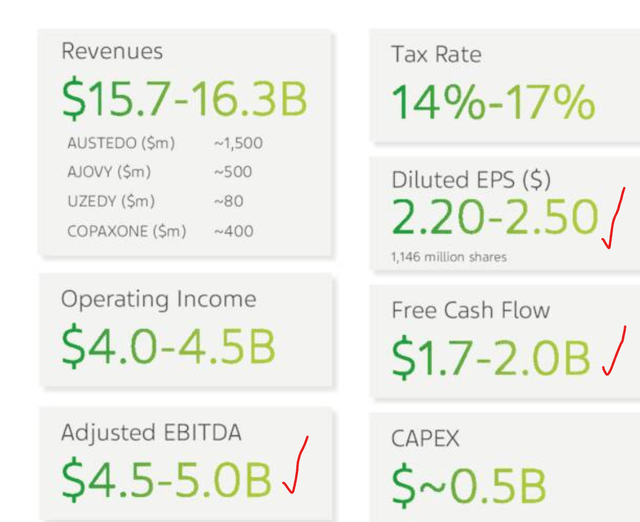

3/ Full Year 2024 Business Outlook

For 2024, Teva is forecasting adjusted EBITDA of up to $5.0 billion. Should it report $2.50 in earnings per share for the year, TEVA stock trades at a forward price-to-earnings of just 6.3 times.

Teva and MedinCell (OTC:MDCLF) announced that TEV-‘749, a drug for treating schizophrenia, reached its main goal in a Phase 3 Trial. Chief Executive Officer Richard Francis said that the subjects exhibited tolerance at all doses. Long-time followers of the study may review the full submission of the safety data later this year. With a significant unmet need for treating schizophrenia, Teva may have a blockbuster drug in its pipeline.

4/ Catalysts

The company reaffirmed a goal to achieve $2.5 billion in revenue from sales of Austedo by 2027. It will invest in D2C (direct-to-consumer) campaigns through television advertisements to increase awareness of both Austedo XR and tardive dyskinesia. The addressable market for TD is 785,000 patients, of which only 50,000 receive treatment.

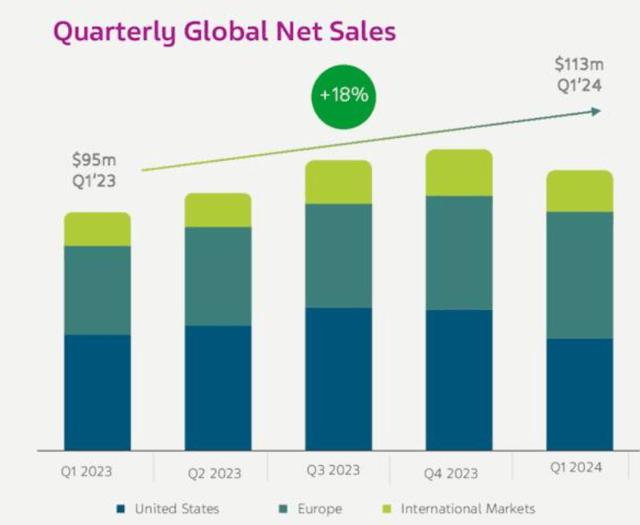

Teva expects Ajovy will post revenue of around $500 million in 2024. At $113 million in Q1/2024, the annualized run rate is already at $452 million. Ajovy has 27% of the U.S. market share and 31% of the market in Europe. Expect the firm to exceed its target thanks to strong new prescription growth rates.

Below is a chart of Ajovy’s global net sales.

The biosimilar portfolio will likely add meaningfully to Teva’s growth. It has three current products and two in the pipeline:

Simlandi is a Humira biosimilar that has strong prospects. The company received strong interest from the payers, PBMs, and the channel. Humira is an AbbVie (ABBV) drug. ABBV stock fell after it posted its Q1 report on news that Cigna (CI) planned to offer a Humira biosimilar.

Teva buffered its Simlandi sales to account for risks. It is accounting for a slow initial launch and will update shareholders in its next quarterly earnings report.

When it launches six more biosimilars by 2027, the company should add at least $14 billion in revenue:

5/ Risks

Markets sent TEVA stock soaring after the Q1 report. This increases the risk of the stock pricing strong growth for biosimilars. Fortunately, the company adjusted its forecast by assuming risks in new product launches. In addition, it considered headwinds such as the timing of launches.

6/ TEVA Stock Quant Rating

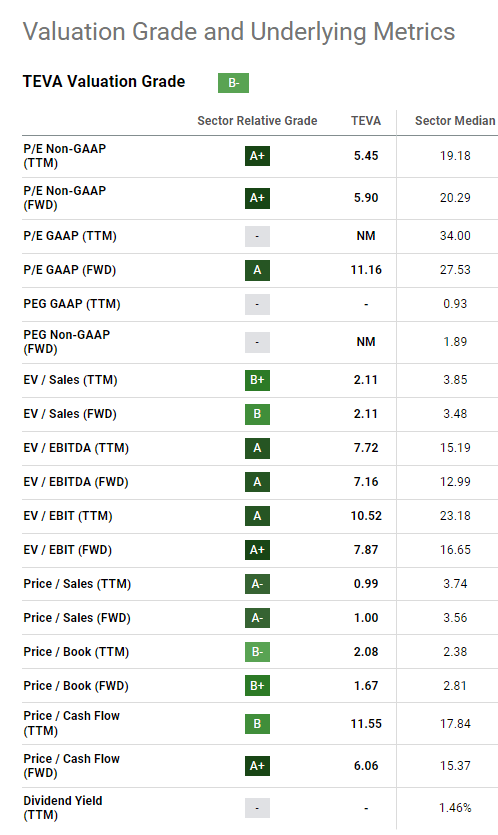

Teva earned a buy rating in early April and upgraded from a “hold” in March.

The stock has strong factor grades for valuation, profitability, and momentum. The valuation grade is most telling on the stock market’s dislike for the firm. It trades at multiples below the sector median on nearly all metrics.

Seeking Alpha

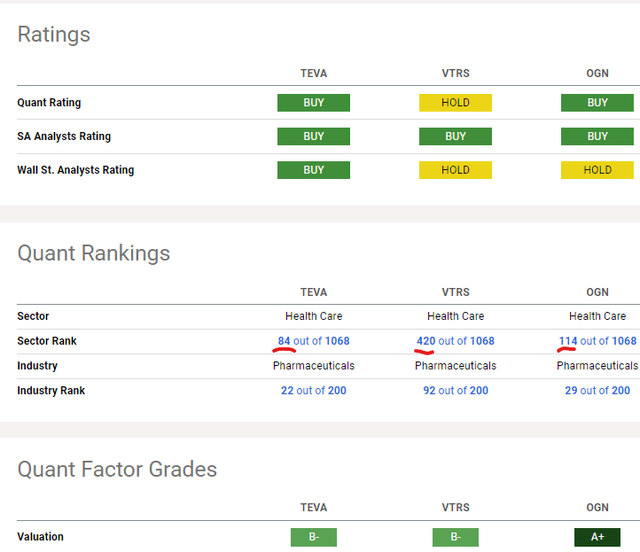

Teva does not pay a dividend, so it will not appeal to income investors. Although investors may consider Viatris (VTRS) and Organon (OGN) for its dividend payout, Teva has a higher sector rank:

Your Takeaway

Teva stock is trading in the opposite direction of a busted firm. A broken firm trades downward over several years. Finally, investors give up and sell the stock all at once. Teva gained 73.7% in the last year without anyone noticing. Long-term investors who waited to make a profit may sell the stock after the historical breakout today.

Patient investors who appreciate that Teva turned the corner will not sell the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Please [+]Follow me for coverage on deeply-discounted stocks. Click on the “follow” button beside my name. Get do-it-yourself tips and tricks for free here:

- Subscribe->[Y] Free

- Subscribe->[ ] Basic (69% off Full Service)

- Subscribe->[ ] Full Service