Google: The Recent Surge Is Far From Over

Summary:

- I had predicted that the AI FOMO surge would reach Google soon.

- The recent explosive surge in GOOGL stock played out as I had anticipated.

- The market finally realized that Google’s tech stack allows it to monetize AI at scale.

- Google’s ability to drive down AI-related costs while scaling up across Search, YouTube, and Cloud is remarkable.

- GOOGL stock’s valuation gap with META stock has finally closed, and deservedly so. I explain why you should consider staying invested.

Prykhodov

My Prediction On GOOGL Stock Played Out

I’ve maintained my Strong Buy rating on Google (NASDAQ:GOOGL) (NASDAQ:GOOG) stock since October 2023, as I assessed the market was too pessimistic about Google’s prospects. I reiterated my strongly bullish thesis on GOOGL in early February, urging investors to buy before GOOGL enters FOMO mode. The FOMO mode was triggered in the past three months, as GOOGL stock significantly outperformed the S&P 500 (SPX) (SPY). Google’s Q1 earnings release underscored the AI revenue growth inflection in Google’s well-diversified business model. In addition, it also underscored my conviction about the market’s unjustified pessimism.

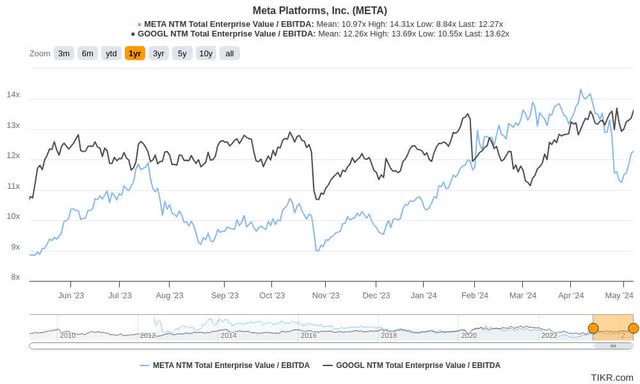

GOOGL Vs. META forward EBITDA multiples (TIKR)

Accordingly, GOOGL surged to a new high after its Q1 earnings, as its valuation gap with Meta Platforms (META) stock closed. It also culminated with a sharp drop in META’s valuation, as the Mark Zuckerberg-led company highlighted a surge in CapEx spending. However, the lack of clarity in near-term monetization surprised the market, as investors grew increasingly worried about Meta’s AI ambitions.

In contrast, Google’s first-quarter earnings release underscored the robust growth opportunities for the search advertising leader. Google Cloud’s 28% YoY growth bolstered the market’s assessment of opportunities in enterprise AI. Moreover, Google management’s confidence in delivering a combined $100B annualized revenue run rate (an average of $25B per quarter) in YouTube and Google Cloud demonstrates its growth vectors beyond search. Based on YouTube and Google Cloud’s total revenue of $17.7B in Q1, there are significant opportunities for Google to capitalize on.

Google Shows Off Its AI Research Capabilities

Therefore, Google’s AI investments have paid off, despite initial concerns about a surge in AI costs. Investors were worried about the potentially dilutive impact on Google’s operating margins as the Mountain View-headquartered company integrates AI into its core search engine experience. However, Google management highlighted that it has significantly reduced the costs of AI search. Accordingly, CEO Sundar Pichai telegraphed that “machine costs associated with SGE responses have decreased 80% from when first introduced.” The substantial reduction demonstrated Google’s remarkable execution prowess across its tech stack, which was “driven by hardware, engineering, and technical breakthroughs.”

As a result, it has become increasingly clear that AI is a sustaining innovation for Google, given Google’s market leadership and dominance. While Google’s lawsuit with the Justice Department could result in near-term uncertainties, high-conviction Google investors could assess potential downside volatility as attractive buying opportunities. In addition, an internal email between Microsoft’s (MSFT) senior management underscored that the Redmond-headquartered company was behind Google in its AI capabilities. Accordingly, Microsoft CTO Kevin Scott “expressed deep concern over the gap in AI model-training capabilities between Alphabet and Microsoft.” Scott added, “Microsoft lacked the infrastructure and development speed to catch up with OpenAI and Google’s DeepMind.”

Therefore, the pivotal partnership between OpenAI and Microsoft has narrowed and possibly even surpassed the assessed capability gap between Microsoft and Google. Microsoft’s recent hiring of DeepMind co-founder Mustafa Suleyman to lead its consumer AI efforts corroborates the underlying strength of Google’s AI leadership.

Is GOOGL Stock A Buy, Sell, Or Hold?

Consequently, I believe the market has finally awakened to the reality that Google isn’t an AI dinosaur, but a dominant market leader with significant resources to be reckoned with. In addition, Google’s decision to initiate a small dividend payout of $0.20 per share (forward yield of 0.3%) and authorize a $70B share repurchase program underscores its capital return priorities. While I don’t expect these to be a significant allocation relative to GOOGL’s $2.13T market cap, it highlighted management’s cognizance of driving shareholder value.

Google’s ability to drive down AI-related costs in its core search business is a testament to its demonstrated tech leadership. Google Cloud’s growth momentum underscores its ability to monetize its AI ambitions early. YouTube’s solid growth highlights the company’s growing opportunities in shorts and ad-supported streaming. As a result, I assessed that GOOGL has a more well-diversified revenue model deserving of a premium valuation ahead of META. Consequently, the recognition of Google’s fundamentally robust business model has finally been reflected in GOOGL stock’s recent surge.

GOOGL’s forward EBITDA multiple has increased to 13.6x, ahead of its 10Y average of 12.5x. As a result, I assessed that GOOGL is likely fairly valued now, as the market better understood its AI growth prospects.

Despite that, I didn’t assess a reason to revise my rating to a cautious one, as its AI opportunities are still nascent. Furthermore, GOOGL isn’t significantly overvalued, and there are no sell signals observed in its price action.

While I have decided to lower GOOGL stock to a Buy, I assessed a bullish bias as appropriate.

Rating: Downgrade to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, MSFT, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!