Summary:

- Energy Transfer LP offers an impressive 8% forward dividend yield and has the highest Quant ranking among its peers.

- The company has a solid history of consistent dividend payouts and its financial position is healthy despite high leverage.

- Energy Transfer is undervalued and has a fair value of $28 per share, indicating significant potential for growth.

canakat

Introduction

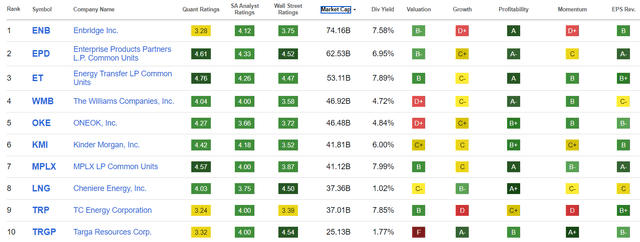

I continue to explore dividend stocks, and North American energy midstream appears to be a safe haven to me. The demand for hydrocarbons around the world is unlikely to decline in the foreseeable future, and there will also be a need to transfer and export them. Among the top-10 midstream companies in North America by market cap, I decided to dive into the fundamentals of Energy Transfer LP (NYSE:ET) because it offers an impressive 8% forward distribution (dividend) yield, and it has the highest Quant ranking from SA among its peers.

According to my analysis, the dividend is safe, and the stock is undervalued by almost two times. The balance sheet is healthy and the major portion of debt is not maturing soon. Therefore, I am inclined to set a “Strong buy” rating for ET.

Fundamental analysis

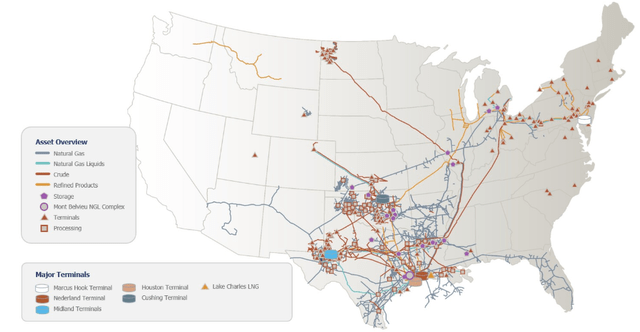

Energy Transfer is a limited partnership (“LP”) with primary activities involved in natural gas, crude oil, NGL, and refined products transportation, storage, and providing terminals. The company operates primarily in the United States.

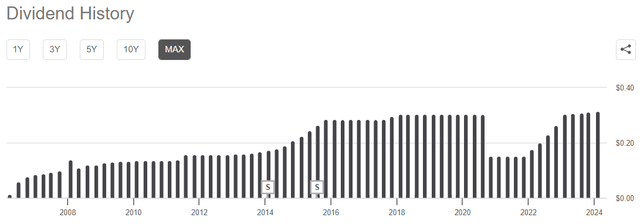

ET caught my attention due to its almost 8% forward distribution yield. Therefore, I have to assess whether the dividend is secure. The company has a solid history of 17 consecutive years of payouts. The dividend has remained consistent in recent years, with a dip during the pandemic crisis; however, the payout has since recovered. This might indicate that the dividend is secure. However, past dividend stability does not guarantee future stability.

To assess future prospects of ET’s stellar dividend I have to understand two things: the current financial position and sustainability of the company’s profits and cash flows.

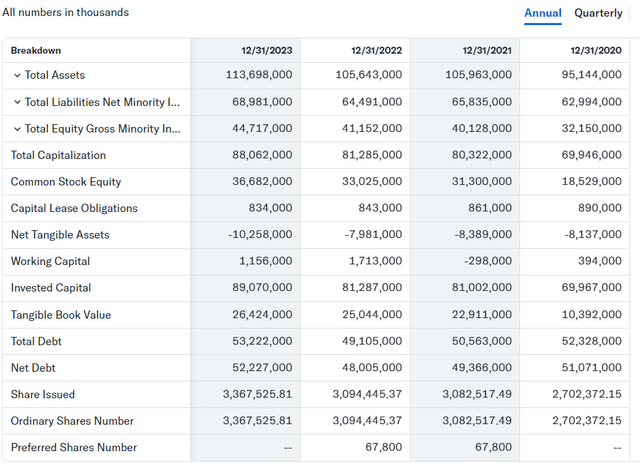

Let me start with ET’s financial position. As a midstream company, ET needs to invest substantial amounts in CapEx to expand its infrastructure and increase useful life of assets. Investment payback cycles are long, which means that ET raises debt finance for its CapEx. Therefore, a massive $53 billion total debt position, which is equal to the company’s market cap, should not surprise readers.

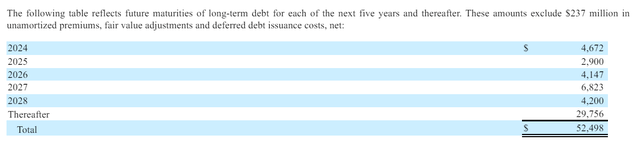

Due to the specific nature of the industry, which I mentioned above, ET’s high leverage appears to be sound. However, when there is a massive debt amount, it is crucial to understand main conditions of this debt: interest rates and maturity. Interest rates on senior notes are mostly fixed and vary between 4% and 7%. There were some notes with above 8% interest, but amounts are insignificant compared to the total debt.

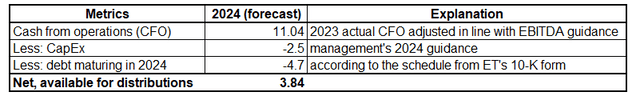

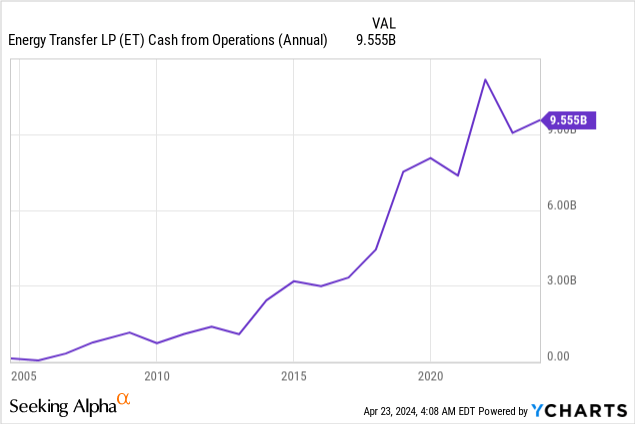

A notable portion of debt is due this year, around $4.7 billion. I have the management’s guidance EBITDA and CapEx guidance for 2024 from the latest earnings call. Therefore, I think I have enough information to project whether ET will be able to deleverage in 2024 or it will refinance its debt. The management expects EBITDA to be around $14.65 billion in FY 2024, which means a 15% YoY increase. Therefore, I think it will be approximately reliable to project that cash from operations will expand by the same percentage in FY 2024.

After I deduct $2.5 billion FY 2024 CapEx and $4.7 billion of senior notes maturing in FY 2024, I get $3.84 billion available to be distributed to shareholders. According to ET’s cash flow statement, the company distributed $3.77 billion to shareholders in FY 2023. Therefore, it appears that ET is likely to sustain its dividend in FY 2024. It is also important that in case ET generates $11 billion in cash from operations, the company will not only sustain dividend, but will also deleverage notably.

While CapEx and senior notes principal amounts repayments are figures which are unlikely to change dramatically. There is uncertainty around the ability of ET to generate $11 billion in CFO. The last time ET generated $11 billion in annual CFO was FY 2021. Two subsequent years were weaker from the CFO perspective, delivering less than $10 billion.

Nevertheless, If the company is unable to deliver $11 billion in CFO in FY 2024 and remains in line with FY 2023, it is still unlikely to be a disaster for dividends. This year, ET’s credit rating has been upgraded to BBB (investment grade) by Fitch, meaning that ET is highly likely to be able to refinance its debt maturing in 2024. This will result in less aggressive deleverage, but the total debt still is poised to decline without dividend cuts.

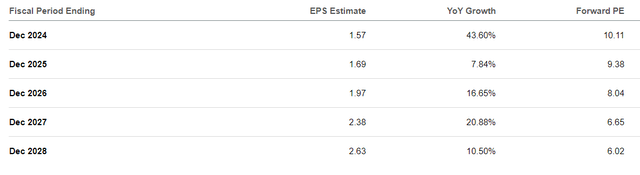

Finally, I want to share my opinion why I believe ET’s earnings will likely be stable in the next few years. While midstream companies’ earnings do not directly depend on energy prices, the overall health of energy commodities markets significantly affect financial performance. The demand for hydrocarbons affects physical volumes and products prices affect margins of midstream companies. According to consensus forecasts, ET’s EPS is expected to demonstrate positive dynamic every year by 2028.

This positive outlook seems sound to me, since the global GDP is expected to compound with around 3% CAGR over the next five years. The anticipated expansion of the global economy is the primary factor that will likely support the demand for energy. According to Sebastian Barrack from Citadel, the oil market is expected to be extremely tight in the second half of 2024. This highly likely indicates that no sudden supply increases are expected. In these circumstances, hydrocarbons prices are expected to remain elevated in the foreseeable future, ultimately supporting consistency in ET’s financial performance.

Valuation analysis

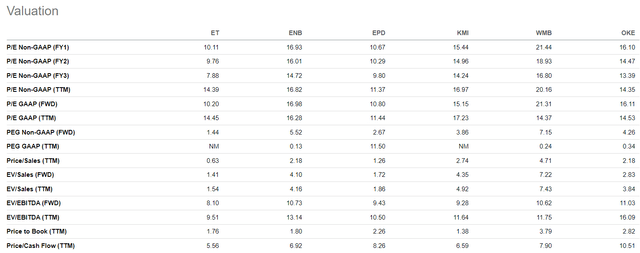

ET is one of the largest midstream names in the U.S. and I want to compare its valuation ratios with the closest peers in terms of market cap. As shown in the below comparison, ET is the cheapest among other big players across the board of valuation ratios. This likely indicates that the stock is undervalued.

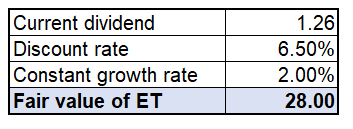

To cross-check, I must use one more approach as well. Since my bullish thesis is based around ET’s dividend, conducting a dividend discount modelling (“DDM”) is a logical step. I use a 6.5% discount rate, and given ET’s notable leverage, do not expect the dividend to grow faster than historical U.S. inflation averages. I use a $1.26 forward dividend payout as current dividend.

Calculated by the author

The DDM formula with the above input data incorporated gives me $28 per share as fair value of ET. This is almost two times higher than the current price, meaning that ET is significantly undervalued.

Mitigating factors

As shown in fundamental analysis, there is a possibility that ET might need to restructure its debt in 2024 in order to save is dividend payouts. Interest rates in the U.S. are still high, which means that ET is unlikely to raise new debt at the same rates as senior notes which are maturing in 2024 (most of them were issued with below 5% interest while most of the fresh notes were issued with around 6% interest). This will not dramatically hit the company’s EPS, but still a more expensive new debt issues will put pressure on the company’s profits.

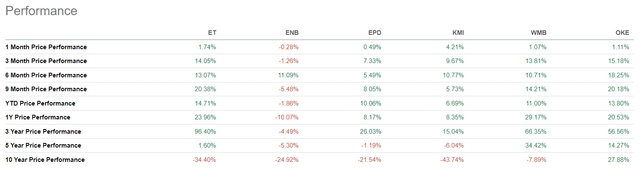

ET’s performance from the share price appreciation point of view has been impressive since the pandemic crisis. The stock delivered by far the best cumulative performance over the last three years, but it lost 34% of its value over the last decade. It is one of the worst performing stocks among the peers I have highlighted. While the recent performance has been solid compared to peers, I think investors have to know that over the past decade, it has been declining.

Conclusion

Energy Transfer is a fundamentally strong company which will highly likely be able to sustain its 8% forward dividend yield. The balance sheet is healthy despite notable leverage, but the most important thing is that the company is able to serve this debt. Moreover, the valuation is very attractive.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.