Tesla: Q1 Wasn’t Great, But The Growth Story Is Better Than Ever

Summary:

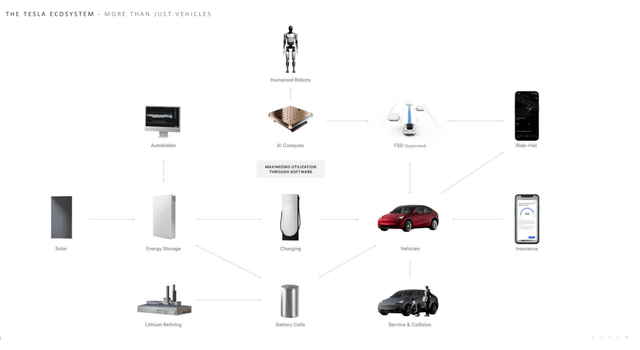

- Tesla’s Q1 earnings showed a decline in revenue and profitability, but the market is giving the company credit for its vision and product roadmap.

- The author has changed their position on Tesla and is now bullish, citing the potential of Optimus, humanoid robots, FSD, Robotaxi, and the charging network.

- While there are risks and the company is still expensive, the author believes in Tesla’s potential to become the most valuable company in the market.

wellesenterprises

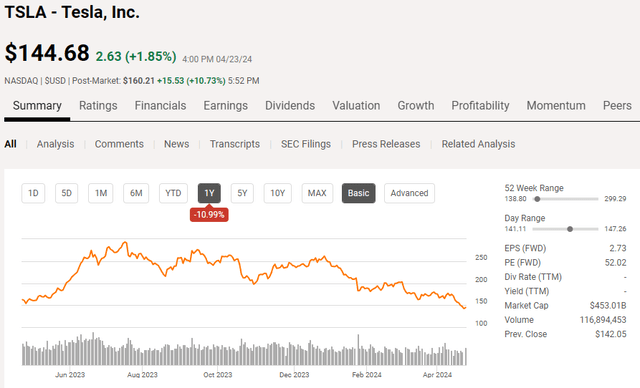

The bar was low going into Q1 earnings, as everyone expected, a top and bottom-line decline. The main concerns were how Elon would conduct himself and what the product roadmap would look like. There is no secret that I was bearish on Tesla (NASDAQ:TSLA) for years, and the turning point was the introduction of Optimus. While the Q1 numbers showed a QoQ and YoY decline in revenue and profitability from EBITDA to net income, the market looks as if it’s giving the team at TSLA tremendous credit as shares are up over 10% after hours. I am going to eat my previous words and come out and say that TSLA is not just a car company. At this point, you either believe in TSLA’s vision and product roadmap, or you don’t. From a financial perspective, this wasn’t a quarter to get excited about, and looking at the numbers on a trailing twelve-month (TTM) basis, TSLA looks overvalued. The market is forward-looking, though, and TSLA is positioning itself as the company that will crack the code from robotics to autonomy. I have been adding to my position in TSLA throughout Q1, and I plan on adding to my position throughout the rest of 2024 as the next phase of growth could be more explosive than the first phase for TSLA.

Following up on my previous article about Tesla

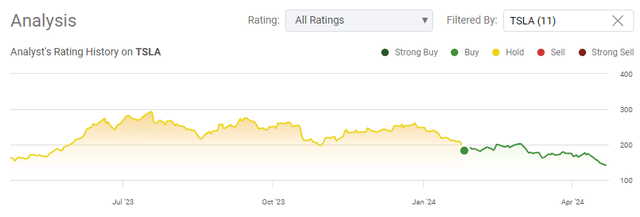

On January 26th, 2024 I officially changed my position on TSLA when my last article was released on 1/26/24 (can be read here). Since then, shares have declined by -22.01%, and I had indicated that I couldn’t predict where the bottom will be, but I believe that TSLA will be much higher in several years than it was trading for on the 26th. As shares sold off, I dollar cost averaged into my position, and I plan to continue buying throughout the year. In my article over the winter, I discussed the long-term opportunity if TSLA could deliver on its bot product, Optimus. On today’s earnings call, Elon and the team at TSLA provided critical insights to the product roadmap, and TSLA is now one of my top picks for the next 5 years as long as they can deliver. I am following up to discuss why I am now extremely bullish on TSLA.

Risks to my investment thesis

There are several risks to my investment thesis, and just because I can see the vision doesn’t mean it will actually play out the way I envision it. The first risk is Elon himself because we never know what we’re going to get. While he says his main focus continues to be TSLA, he is leading several large companies, and there is always a chance that he will go down the rabbit hole and focus the majority of his energy somewhere else. The next risk is execution, and while TSLA has made tremendous progress in several areas, it still needs to finish building FSD, implement a Robotaxi network, improve Optimus, and get past federal and local regulations regarding self-driving. Just because the roadmap looks great doesn’t mean it will play out that way and today if you look at TSLA from a pure numbers aspect without taking into consideration future potential, the valuation can look stretched. While the market seems to be buying into the vision, we could see some of its projects get delayed, and the market turn on TSLA just as quickly as it is lifting shares from the recent bottom.

Tesla’s Q1 numbers weren’t good, and the company is still expensive, no matter how you value the company

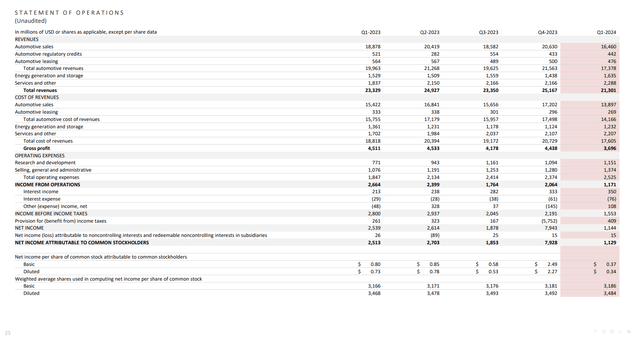

For years, I had valued and argued that TSLA was just an automotive company, but not anymore. Some will agree, and some will argue that TSLA is just a car company, as it’s about perspective at the end of the day. I am looking at the numbers and how TSLA is diversifying its business to provide a roadmap of what is on the horizon when its other business ventures come online. In Q1 2023, total automotive revenue accounted for 85.57% of its total revenue ($19.96 billion / $23.33 billion). After the cost of the automotive revenue was factored in, TSLA generated $4.21 billion in gross profit from automotive, which was 93.28% of their total gross profit, which came in at $4.51 billion. Fast-forward a year to the numbers we received today, TSLA generated 81.58% of its total revenue from automotive ($17.38 billion / $21.3 billion). Automotive’s accounted for 86.91% of TSLA’s gross profit in Q1 2024 ($3.21 billion / $3.7 billion). While the macroeconomic environment hasn’t been favorable for the automotive industry in general, the amount of revenue generated by energy generation and storage, and the services business segments increased by 16.55% YoY. Energy generation and storage watched its Q1 revenue increase by $106 million (6.93%) YoY, while services increased by $451 million (24.55%) YoY. TSLA is slowly becoming more diversified, and this helps the narrative about them not being just a car company.

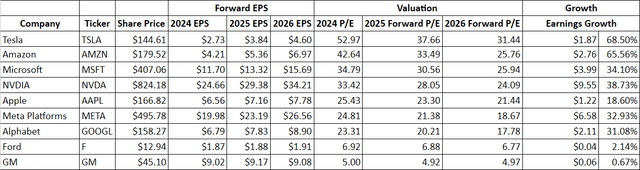

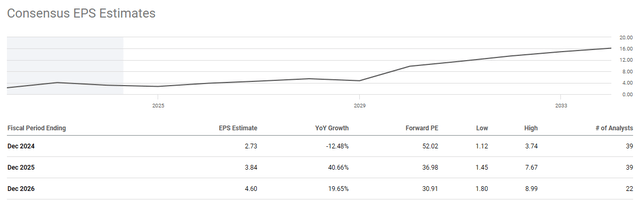

This wasn’t TSLA’s shining moment from a numbers’ aspect, and if you look at TSLA as just a car company, then it looks overvalued. TSLA has a market cap of $453 billion and just put up its worst quarter in 5 quarters. Revenue declined -9% YoY in Q1 to $21.30 billion, while its net income dropped -55% and its free cash flow (FCF) was non-existent. Looking at TSLA as a Magnificent Seven stock and also as an automotive company, TSLA looks overvalued today, and over the next several years. For investors who choose to look at TSLA as strictly a car company, its 52.97x multiple on 2024 earnings will look crazy against Ford (F) trading at 6.92 times and GM (GM) trading at 5 times 2024 earnings. As a Magnificent Seven stock, TSLA also looks overvalued as it trades at 52.97 times 2024 earnings compared to NVIDIA (NVDA) at 33.42 times 2024 earnings. Even looking out to 2026, TSLA trades at a forward P/E of 31.44 times, which is more than any of the companies in the Magnificent Seven.

TSLA’s total production in automotives declined by -2% YoY, while deliveries declined by -9% YoY. Many had expected rate cuts to have already started by now, but it doesn’t look like they’re coming at the May meeting. The higher for longer rate environment is constraining capital for many individuals, and this hurts large ticket items such as automotives. We could be in a higher for longer environment that rolls into 2025 without a rate cut, and there is no telling what the Fed will actually do. Other manufacturers are shifting gears toward plug-in hybrids, while TSLA stays true to the EV market. From a valuation perspective, TSLA is expensive, and the recent bump after hours could be short-lived. If you don’t believe in the vision, TSLA won’t fit in your valuation model because there are many other opportunities that are attractively priced.

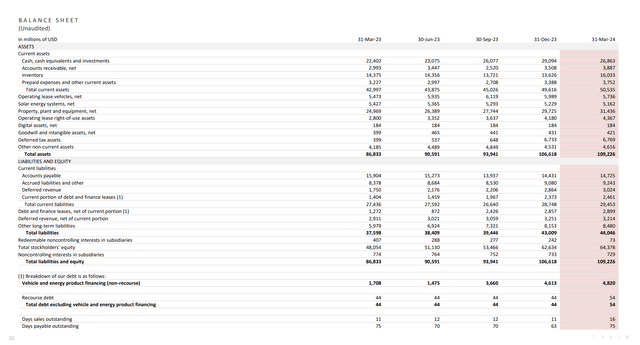

Steven Fiorillo, Seeking Alpha Seeking Alpha

The automotive business will fund TSLA’s vision and could make it the most valuable company in the market someday

While I admit that TSLA is trading at a large premium, I am not buying shares of TSLA for the company it is today. I am investing for 5-10 years forward because of the potential its businesses have. Put valuation aside for a moment, TSLA has created a company that can fund its future endeavors quite easily. TSLA is sitting on $26.86 billion in cash after allocating capital toward GPUs to advance its FSD vision. The operating aspect for TSLA is still profitable, and TSLA has less than $3 billion in debt on its balance sheet. TSLA has put themselves in a position where they are still generating billions in profitability, has a net-debt position of over $20 billion, and is continuing to put vehicles on the road, which will be the foundation of one of its future businesses. This isn’t a company tapping the debt markets trying to get proof of concept. TSLA is advancing in several areas, and the vision could make TSLA the most valuable company if the team can deliver.

For me, I am investing in TSLA because of 4 things, humanoid robots, FSD, Robotaxi, and the charging network. Since I became bullish on TSLA, I have said that Optimus could be larger than the entire car business. On the earnings call, Elon said:

Optimus is able to already do some small factory tasks in the lab. We may be able to sell it externally by the end of next year. Optimus may be more valuable than everything else combined.”

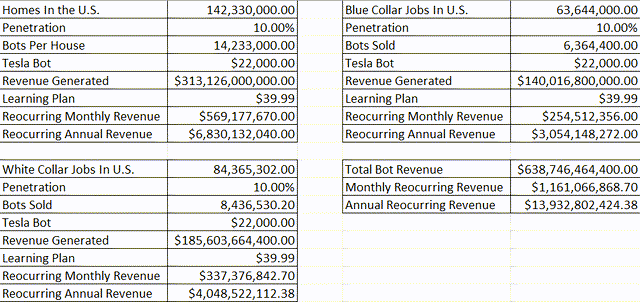

There are roughly 142 million homes in the United States, 84.37 million white-collar jobs, and 63.6 million blue-collar jobs. This is only a small fraction when you think about the global market. The potential for robots is limitless, and the company that is first to market will likely dominate the market. Personally, I will buy Optimus at the $20-$25,000 price point that has been discussed if it’s able to do simple tasks such as cleaning and doing laundry. When I purchase one, I am not going to purchase another one just because another company brought one to market. TSLA has a large lead, and if they’re able to start selling them externally by the end of next year, they will likely create a large moat in the sector. When I think about the impact on TSLA’s financials, Optimus could have its dramatic, especially if there is a service plan attached to it through TSLA’s AI network, which allows each Optimus bot to learn as tasks are performed across the network in real-time. If Optimus gains a 10% foothold in homes, blue-collar, and white-collar jobs at a $22,000 price point, it could generate $638.75 billion in revenue. If each bot has a learning plan at $39.99 per month, it could generate $1.16 billion in monthly recurring revenue. The scalability is huge when I think about the global market, from homes to warehouses.

Next is FSD and Robotaxis. The global taxi market is expected to reach $120.89 billion by 2027. On the earnings call, Elon indicated that cyber-cabs were coming sooner than later, and with the amount of miles driven in FSD V12 it’s when, not if. What could be more important is that he said one of the large auto manufacturers is in talks to license FSD from TSLA. FSD and Robotaxis have been 2 areas that I am up in the air on due to regulation. I have no doubt that this is the way of the future and that TSLA is ahead of its competitors in these areas, but they will need to pass regulations to make them a reality. When they get there, TSLA will certainly generate organically from its customer base from FSD. TSLA should also have no problem building out a ride-hailing service, considering they pretty much have the U.S. mapped out from miles driven already. Even if ride-hailing through a Robotaxi fleet isn’t a reality until 2030, there is potential for this to become a $10 billion-dollar business if it takes less than 10% of the taxi market. Uber Technologies (UBER) is already generating $37 billion in annual revenue, and TSLA has the potential to disrupt the entire sector in the same regard that UBER did. The feather in TSLA’s cap could be licensing because if they license FSD to a large automotive manufacturer, theoretically those vehicles would also be able to utilize the Robotaxi network.

Steven Fiorillo, Allied Market Research

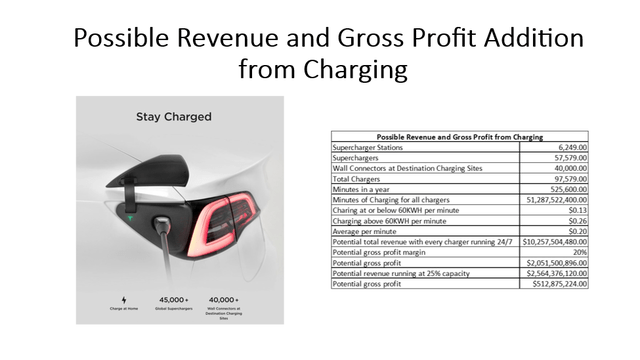

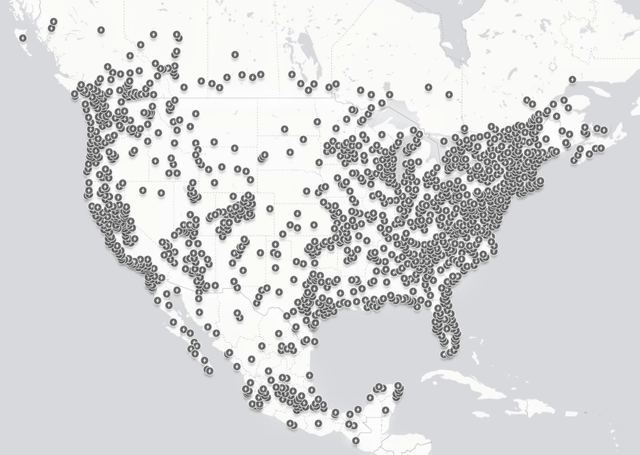

TSLA now has 6,249 Supercharger stations with 57,579 Superchargers. They also have over 40,000 wall connectors at destination charging stations. TSLA’s network has opened up to GM and Ford EVs as of February 2024, with other large manufacturers adopting the NACS connector in future EV’s. When I model out the potential for supercharging stations, it’s interesting, especially since this is in its infancy. There are 525,600 minutes in a year, which means that TSLA has roughly 51.28 billion charging minutes across its chargers. At $0.13 per KWH under 60KWH and $0.26 per KWH over 60KWH, TSLA has the potential to generate $10.26 billion in revenue if every charger is used 24/7. At a 20% gross margin, this would be a potential gross profit of $2.05 billion. If TSLA’s chargers had a 25% utilization rate, they could generate $2.56 billion in revenue and $512.88 billion in gross profit for TSLA. When you combine FSD and Robotaxi in the mix, if a TSLA needs a charge, it is likely to direct the car to a TSLA charging station. This business is certainly years away from being instrumental, but TSLA has laid the foundation with over 6,000 stations. Think about what this could look like in 20 years. Not only would TSLA generate revenue from the vehicles, but they would also generate revenue from the software and charging on their vehicles, in addition to licensing the software to other manufacturers and having those EVs charge at TSLA stations.

Conclusion

I am a reformed TSLA bear and have been buying shares into earnings. This earnings call was completely opposite from what occurred on the last earnings call, and the TSLA vision is in full swing. Shares of TSLA are still very pricey, and I would agree that for the earnings they are generating today and what they are expected to generate over the next couple of years, TSLA is expensive. At this point, you either believe in the future TSLA is trying to build, or you don’t. I am willing to pay for growth if I believe in the investment thesis, and if TSLA can pull all of this off, it could become the most valuable company in the market down the road. A lot has to go right, and there are many threats to my bull thesis, but Elon has been able to manage multiple companies, so if there is anyone who can pull off a massive multi-prong vision, it’s him. I could be incorrect, and the after-hours pop could disappear, but I believe Optimus will be larger than the automotive business, and technology only advances forward, making TSLA an interesting growth story for the next decade.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, AAPL, META, AMZN, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.