Summary:

- Nvidia Corporation slumped 10% last Friday without any negative data points, as the market interpreted AI-related data as negative.

- TSMC guided to strong 2024 growth rates of over 20% due to AI demand.

- Super Micro Computer’s lack of a guide up for the March quarter does not indicate a sudden drying up of AI demand.

- The stock is fairly valued at 25x FY26 EPS targets, though investors need to ultimately price in margin compression in the future.

BING-JHEN HONG

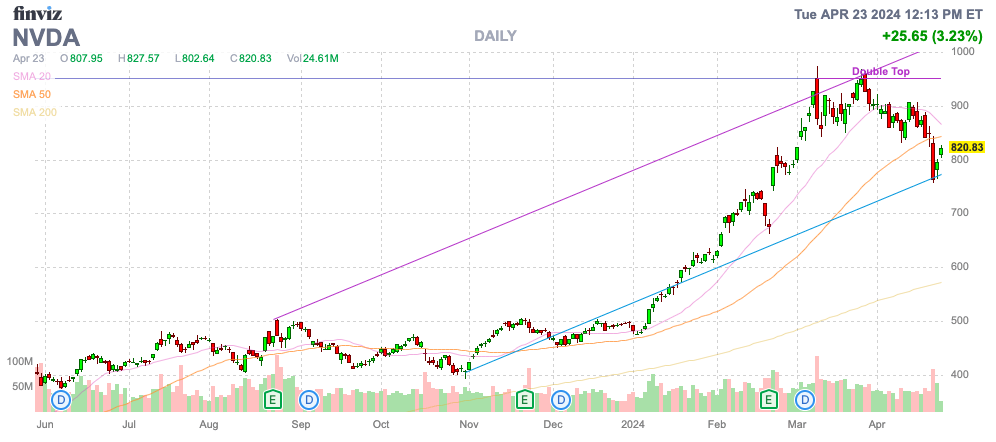

The stock market wasn’t in a good mood last week and the AI stocks took a beating. Nvidia Corporation (NASDAQ:NVDA) slumped 10% on Friday and over 200 points from the high from last month without even a negative data point. My investment thesis remains Neutral on Nvidia, as the stock got too stretched on the big rally to $974.

Source: Finviz

Solid AI Data Points

Nvidia collapsed last week due to the stock getting far ahead of the actual results. The AI related data points from last week weren’t negative, though the market made such interpretations.

The main tidbit was Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM), aka TSMC guided to strong 2024 growth rates of over 20% due to strong AI demand. The foundry company did downgrade overall chip demand, but TSMC suggested the issue was traditional server CPU chip demand favoring chip production for Nvidia over foundry chips produced by Intel (INTC):

On the Q4 ’23 earnings call, the CEO C.C. Wei made the following statement:

The budget for a hyperscale player, their wallet share shifted from traditional server to AI server is favorable for TSMC. And we are able to capture most of the semiconductor content in an AI server’s area as we define the GPU, networking processor, et cetera. Well, we have a lower presence in those CPU-only, CPU-centric traditional server. So we expect our growth will be very healthy.

The secondary tidbit was Super Micro Computer (SMCI) announcing the FQ3 ’24 earnings call without the company updating guidance. The stock market interpreted the server and storage solutions company as providing a bad signal for the blow away AI GPU demand via strong guide ups for the last few quarters. The reality is that Super Micro doesn’t have a consistent pattern of guiding up as follows:

- FQ3’24–April 19, 2024: No Guidance Update

- FQ2’24–January 18, 2024: Net Sales $3.6 to $3.65B vs. $2.7 to $2.8B

- FQ1’24–October 18, 2023: No Guidance Update

- FQ4’23–July 20, 2023: Net Sales $2.15 to $2.18B vs. $1.7 to $1.9B

- FQ3’23–April 24, 2023: Net Sales of $1.28B vs. $1.47B.

The odd part about the huge negative reaction to Super Micro announcing the FQ3 ’24 earnings call update without a big guide up is that the company had only guided up during 2 of the prior 4 quarters. Revenues tripled from the time of the FQ3 ’23 disappointment pre-announcement until the reported FQ2 ’24 report. In addition, the server solutions company reported meager results in FQ1 ’24 when the company didn’t guide up similar to this quarter.

Due to seasonality, the March quarter is usually slow for the semiconductor space. The consensus analyst estimates are inline with company guidance for 200% growth at $3.94 billion and analysts forecast a massive step up in the June quarter to sales of $4.88 billion.

Any investor trying to read negativity into the Super Micro lack of a guide up for the March quarter is over extrapolating far too much. Nvidia, Advanced Micro Devices (AMD) and others in the AI chip race have all prescribed to a market with vastly higher demand over the next 5+ years.

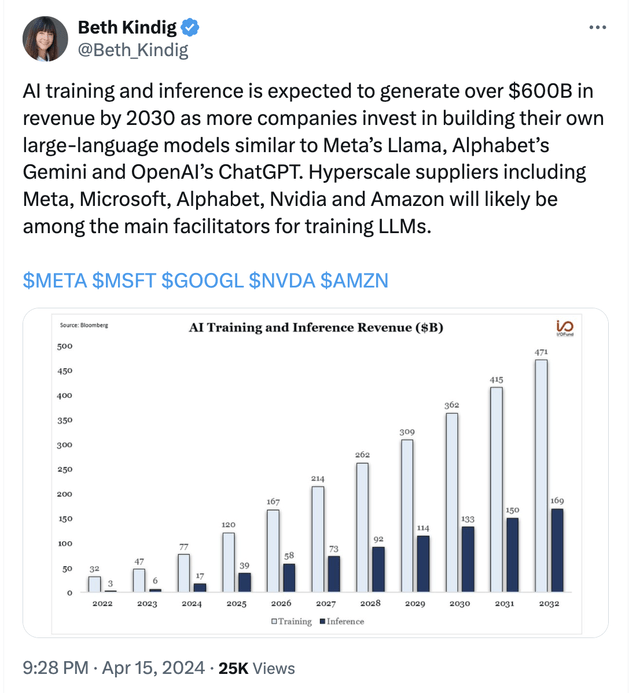

AMD continues to forecast AI chips sales of $400 billion by 2027. The AI training and inference market dominated by Nvidia GPU sales is forecast to reach $600 billion alone by around 2030.

Nvidia released the new Blackwell GPUs to further the leadership. The Blackwell B200 GPU “superchip” was predicted to offer substantially higher LLM inference workload performance while reducing the energy consumption by up to 25x over the H100 GPU. These new GPUs might cost up to $40K and don’t provide any indication of how AI demand would suddenly dry up.

Paying The Right Price

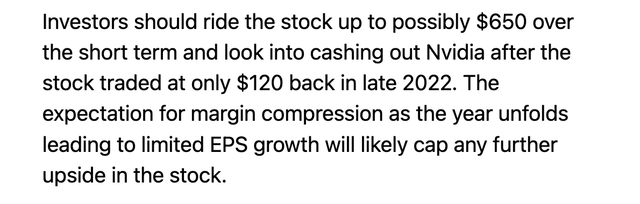

As my previous research highlighted, Nvidia was already aggressively priced at over $600 with a recommendation for investors to look at an option to exit the position on a further rally. The stock soared to $974 on an irrational appetite for AI investments that is now fading, at least in the short term.

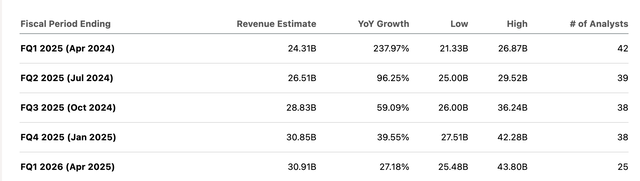

Nvidia is forecast to reach FY25 (2024) sales of $112 billion, with those numbers growing to top $160 billion by FY27. The company is forecast to see sales growth rates to normalize by the end of the fiscal year, with FQ1 ’26 sales growth forecast to dip below 30%.

The AI GPU company last reported results in late February with massive revenues of $22 billion, smashing analyst targets. Nvidia guided to FQ1’25 sales of $24 billion, easily surpassing analyst estimates by $2 billion, though the guide up only amounts to just 10% of revenues now versus the original quarterly estimate smash of $4 billion and over 50% of revenue estimates of only $7 billion.

Nvidia sales estimates for FY25 are now $20 billion above the estimates from just last quarter. The market might fear the AI boom has come to an end, but the real issue is paying the correct price for the ongoing sales growth, whether the rate of growth slows or not.

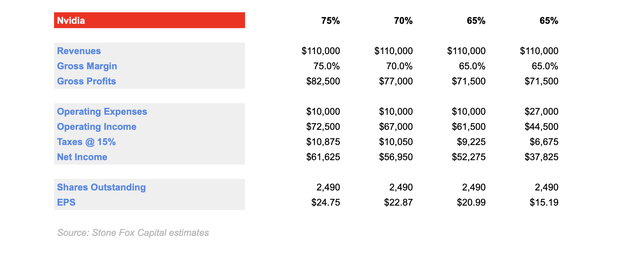

The AI GPU company faces another issue where unsustainable high margins eventually trickle lower. Management guided to FQ1 ’25 gross margins of 76.3% to 77.0% with very limited quarterly operating expenses of $2.5 billion. Over time, Nvidia will have to spend more to maintain such a highly profitable business.

The consensus analyst estimates are for Nvidia generating a FY25 EPS of nearly $25. Investors need to understand a return to more normal gross margins in the 65% range causes the EPS to fall to $21.

The operating expense base below 10% of revenues doesn’t appear sustainable either. Back in FY23 before AI GPU chip sales surged, Nvidia spent nearly $7 billion on opex, amounting to over 25% of revenues.

Under a similar scenario going forward, Nvidia would spend over $27 billion on opex. The company would watch opex soar by over $17 billion and dampen EPS by nearly $6 per share. Under a scenario where gross margins normalize back at 65% and opex soars to match the higher revenue base, Nvidia watches the EPS dip back to $15.

Back above $800 now, the stock isn’t aggressively priced at 26x FY26 EPS targets of $30. The company might not face the margin compression issues for another 1 to 2 years, but investors need to understand the negative margin scenario will ultimately play out similar to how Nvidia ran into FY23 gross margins of only 59%.

My prior research suggested the stock was fairly priced back in the $600 range. The substantially higher revenue base leaves the stock in a similar valuation range here above $800. Nvidia could definitely head higher on insatiable AI GPU demand, but the stock will ultimately face a reckoning of where sales plateau in a few years and margins eventually slip.

Takeaway

The key investor takeaway is that the AI boom isn’t ending without any data points justifying the bullish thesis forecast for the rest of the decade to just end overnight. The market is taking some profits on Nvidia, and investors shouldn’t be surprised to see the stock slump further during this digestion period.

Investors would be best served to let Nvidia Corporation stock slip further, with a possible move back down to the $600 range. An investor would face less risk from the inevitable margin pressure scenario, whether this happens in FY25, FY26 or in the future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start 2024, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.