Summary:

- Energy Transfer is a major player in the pipeline industry, with the largest pipeline capacity of any company.

- ET has shown strong growth this year and has potential for future growth through acquisitions.

- The recent acquisition of West Texas Gathering (WTG) assets is seen as a positive move for ET, supporting the monetization of the gassier Permian Basin.

- ET remains a buy at current levels.

IL21/iStock via Getty Images

Introduction

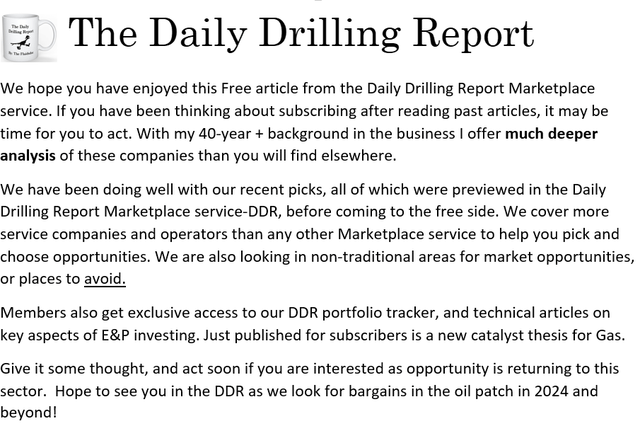

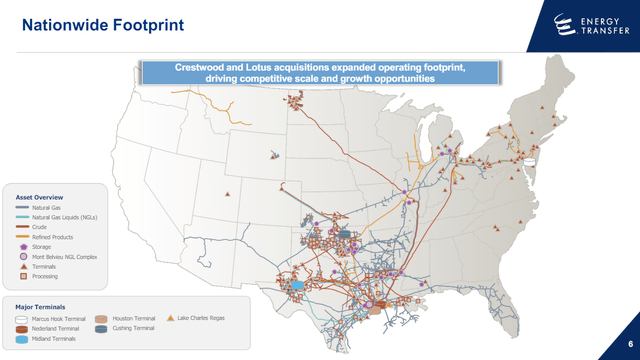

Energy Transfer, (NYSE:ET) is the Godzilla of the pipeline space, with more miles of carriage than any other. By a long shot. In their latest investor presentation, ET claims 125,000 miles of pipeline capacity, and who are we to argue?

ET footprint (ET)

We last covered ET in July of last year with a buy rating, and it’s up 31% so we will claim credit for a win. Sadly, ET isn’t part of my portfolio since I don’t invest directly in MLP’s for tax reasons, as my IRA is my primary investment vehicle. I am long Enbridge, (ENB), and the MLPA, (MLPA) ETF for broader exposure to the pipeline space.

Investors who don’t share my aversion to MLP’s, have done well in ET on a price improvement basis. The company has shown strong growth this year, outshined by only OKE, (OKE)-up a whopping 43% over the last year! As I noted in the ENB article, the pipeline space has just been on fire (an unfortunate metaphor in this context, I know) this year, with the likelihood of more coming. Hence, investor interest in ET.

MLP cohort price return (Seeking Alpha)

Analysts rank ET as a buy, with price targets ranging from $15 to $24 per unit. The median is $19, suggesting that the stock could be approaching stall speed. ET missed EPS by $0.05 in Q-1, and forecasts are lower for Q-2 by a penny.

With all of that, let’s review the high level thesis for the company and a couple of catalysts that may drive growth in the future.

The core thesis for ET

ET is well represented across the Midstream value chain, meaning once it grabs a molecule of energy, it doesn’t have to let it go until it reaches its final destination. This is the good stuff and propels Distributable Cash Flow-DCF that generates the quarterly distributions some investors cherish.

Service focus for ET (ET)

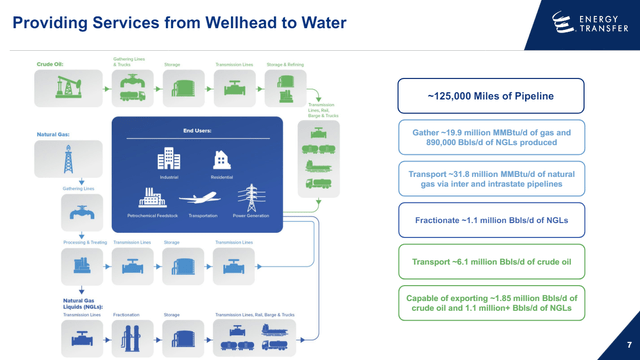

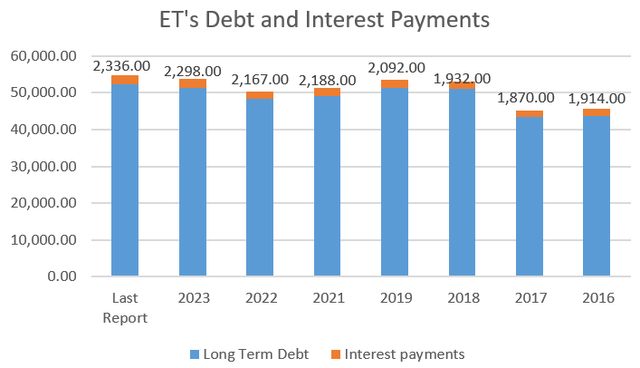

ET in its present form has been built through acquisitions, at an accelerating pace in recent years. In the long run, these acquisitions will prove to have been accretive to the company, although they aren’t reflected in the stock as yet. Investors interested in ET should accept that growth through acquisition will likely remain the company’s strategy for the foreseeable future, with the debt burden and interest payments that come with it. This is the bad stuff, and you probably don’t have to look harder for a reason why ET stock is still in the teens. With debt topping $52 bn and interest payments on a pace to top last year’s $2.3 bn, by almost $400 mm, we can’t be blamed for keeping an eye on the balance sheet. More on this later.

ET consolidation track record (ET)

ET pays a well covered distribution of $1.27 per unit and is on track to generate $9.8 bn in DCF in 2024. The Yield on Cost at current prices exceeds 8%, which is pretty high and implies risk. There are currently 3.3 bn units outstanding, so the Payout ratio against Net Income of 90% bears watching. Historically, this has run in the 80-90% range, so it’s nothing new. As a final point on this topic, it should be noted that the entire MLP cohort runs pretty hot in this metric with competitors Kinder Morgan (KMI) and OKE (OKE) in the same range.

The skinny on the Permian

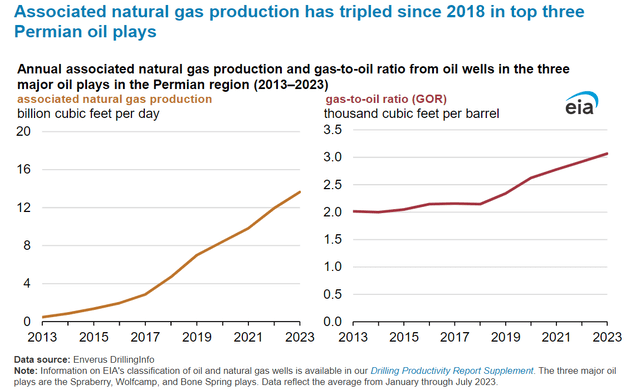

The Permian has accounted for most of the shale production growth since 2020. A consequence of that has been an increase in the production of associated gas. In all likelihood, this will continue, making infrastructure to support continued drilling a vital necessity.

GOR from Permian (EIA)

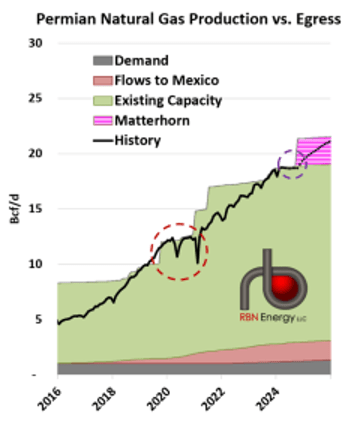

So with the fact of associated gas being on the rise, the issue of takeaway constraints-the inability of Midstream providers to take increasing amounts of gas to market, becomes an issue. The lack of installed gathering, and transport-pipelines, leads in only one direction, decreased drilling activity, until new pipeline capacity for gas is available. Explaining in part the flattening of Permian output since the first of the year, the graphic below from a blogpost by RBN Energy with credit to Natural Gas Intelligence, illustrates the bind in which Permian producers find themselves currently.

Permian gas egress (RBN-used with permission)

Against that backdrop, the business case for pipeline takeaway infrastructure is fairly obvious. Further, these are assets that don’t come to market every day. Given all of that, the acquisitive mindset of ET management can be well understood.

ET buys WTG

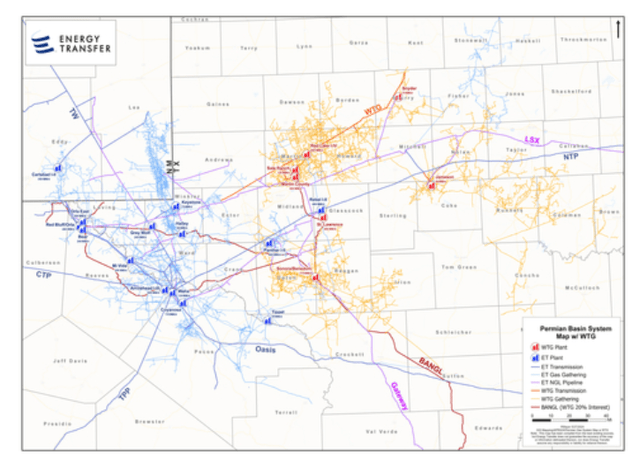

News landed a couple of weeks ago of another consolidation move by ET in a bolt-on transaction for assets of West Texas Gathering-WTG. Consideration for the transaction will be comprised of $2.45 billion in cash and approximately 50.8 million newly issued Energy Transfer common units. The transaction is expected to close in the third quarter of 2024, subject to regulatory approvals.

Details of the deal from the press release-

- Expands Energy Transfer’s natural gas pipeline and processing network in the Permian Basin

- Includes eight gas processing plants (~1.3 Bcf/d) and two more under construction (~0.4 Bcf/d)

- Adds more than 6,000 miles of complementary gas gathering pipelines

- Includes a 20% ownership interest in the BANGL NGL Pipeline

- Supported by high-quality customers with an average contract life of more than eight years

- Structured mix of cash and equity consideration expected to provide strong equity returns while maintaining leverage target

- Estimated DCF accretion of ~$0.04 per common unit in 2025, increasing to ~$0.07/unit in 2027.

WTG pipeline map (ET)

I think we should view this in a positive light for a couple of reasons. We’ve noted how the Permian is getting gassier. Any sort of infrastructure that supports monetizing this trend makes sense, and particularly given ET’s already impressive footprint in the basin.

Notionally it also supports the thesis for ET’s proposed Warrior pipeline, running from Midland to the Dallas area, where it would connect with hubs to move it southward to the LNG mecca of the Gulf Coast.

A potential future catalyst

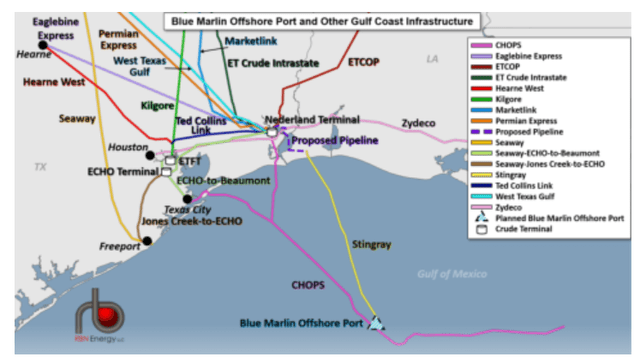

ET has had an application in the bin with MARAD for a few years to build a deepwater offshore port-Blue Marlin Offshore Port. If approved, it would use an existing production platform at West Cameron 509 to enable loading of VLCC’s without reverse lightering. RBN notes that a couple of new pipelines would have to be built to accommodate this venture. There are a number of these ports being considered, and with information available, it’s difficult to know the exact status of this project. This looks like low-hanging fruit to me and could be accomplished in fairly short order once, and if, they get the go-ahead. It’s noteworthy to me that an HOA has been signed with TotalEnergies (TTE) related to term crude oil offtake from, Blue Marlin Offshore Port for 4 million barrels per month, subject to ET taking an FID on the project.

Blue Marlin offshore oil port (RBN-Used with Permission)

Risks

As always, the risk in ET lies in the prodigious amount of debt it carries. One thing we know about the oilfield is that debt will eventually sink you if it goes on forever. As big as it is, ET is not the Federal Government.

ET Debt (Seeking Alpha-chart by author)

It should also be noted for the record, ET may face issues with its Dakota Access Pipeline and its planned LNG facility at Lake Charles. For those who are interested, I discussed the truth behind the Standing Rock Tribe’s constant legal challenges to the DAPL in this article a few years ago. What it boils down to is the DAPL is full of another tribe’s oil when it passes their reservation. Read the article for more background on the DAPL brouhaha. The Lake Charles LNG concern is more complicated and was discussed in an article last year.

The good news here is that these adverse outcomes, which in the long run we do not expect, have little potential to impact the thesis for owning ET.

Your takeaway

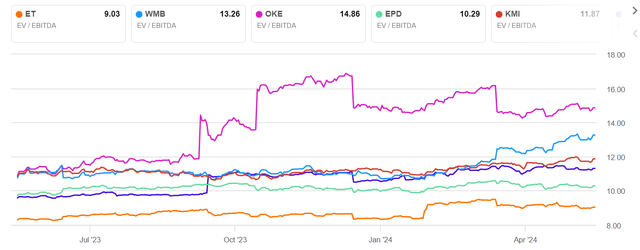

ET is trading at 9X EV/EBITDA at its current price after the sustained rally that’s taken place since Feb-24. Normally, this would put us off, but it should be noted the entire cohort trades in an elevated range for this metric, with ET dragging on bottom.

ET EV/EBITDA against cohort (Seeking Alpha)

If ET had KMI’s multiple, the units would rerate to $43. With that in mind, the upper end of the analysts’ range doesn’t seem too crazy.

The long and the short of it is ET is a well run business with more going right than wrong. I see the WTG pickup as positive for the scenario we have discussed developing in the Permian, and think it was a sound strategic move. The debt involved should be balanced with increased cash flow from rising takeoff rates coming out of the Permian. The unit dilution is a drop in the bucket against their 3.3 bn unit float.

I think the analysts are on target and can easily see increased cash flow, allowing their multiple to rise incrementally over the short run to obtain the middle range of analyst estimates. Beyond that, time will tell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is not advice to buy or sell this stock or ETF in spite of the particular rating I am required to select in the SA template. I am not an accountant or CPA or CFA. This article is intended to provide information to interested parties and is in no way a recommendation to buy or sell the securities mentioned. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to do their own due diligence before investing their hard-earned cash.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.