Summary:

- XELA offers exactly what most people are talking about these days: digital transformation. The difference with most companies that were recently created is that Exela offers decades of expertise.

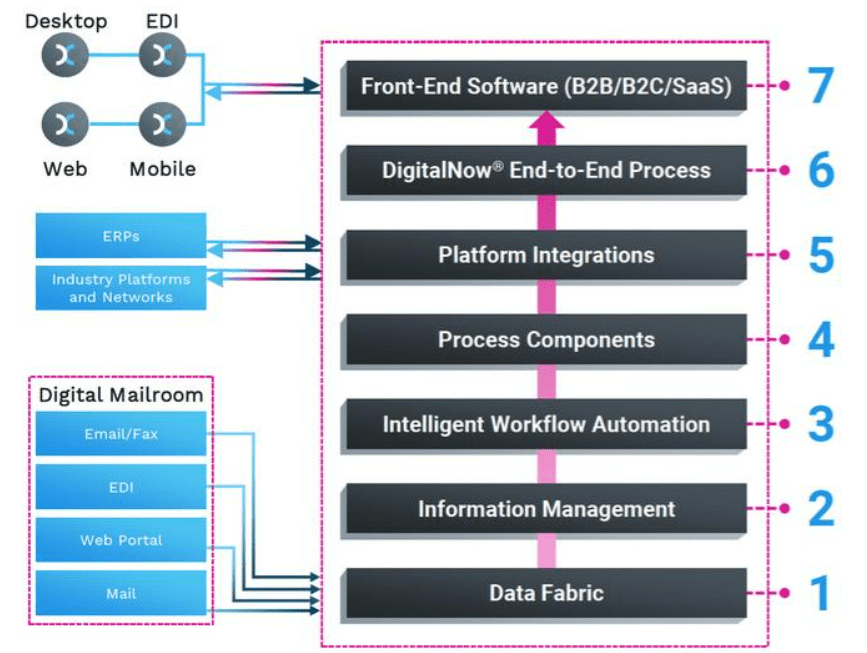

- In the best-case scenario, the company’s seven layers of technology-enabled solutions successfully go from discrete services to end-to-end processes, and they are used as front-end enterprise software.

- The demand for systems that support digital workflows, remote connectivity, and flexible facilities increases significantly. As a result, XELA’s revenue increases significantly.

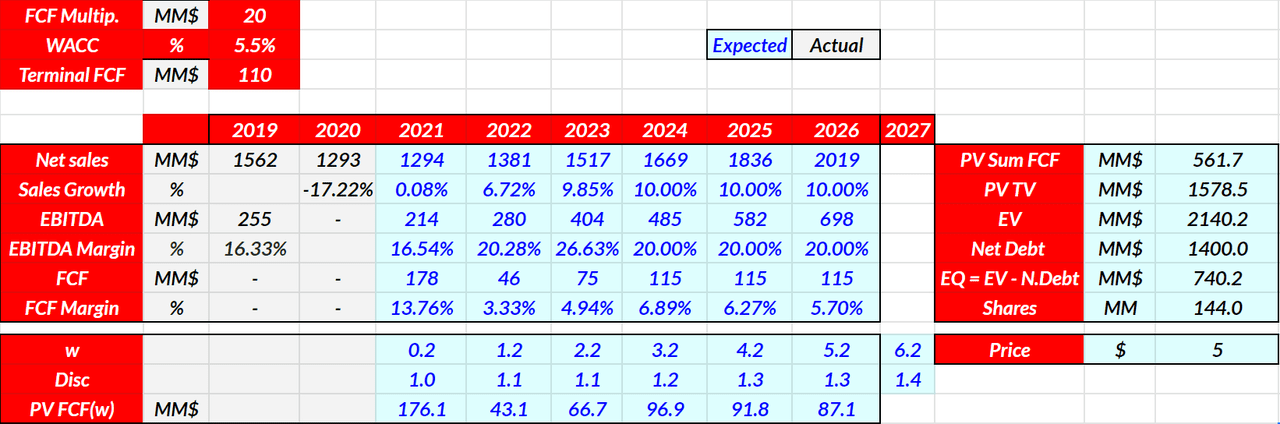

- I am using an optimistic sales growth of close to 10% from 2023 to 2026 with a free cash flow margin of close to 5%. The free cash flow stands at $115 million from 2024 to 2026 with a terminal FCF of $110 million. Summing everything, the present value of the FCF is equal to more than $560 million.

- If we use an exit multiple of 20x and a discount of 5.5%, the implied share price is equal to $5. That’s how it goes.

Exela (NASDAQ:XELA) offers a diversified set of solutions that help clients execute digital transformation. I expect significant demand for the company’s products as well as free cash flow. If the company’s seven layers of technology-enabled solutions and the new Big Data platform are successfully sold, my target price is $5. With that, the financial forecast does not seem easy. The total amount of debt is significant. In my view, traders need to understand what everybody knows. They should know that everybody talks to his/her pocket. Even if digital transformation could change the way we live, Exela has to pay its debts.

Business Model: Expertise And Diversification

In my view, XELA offers exactly what most people are talking about these days: digital transformation. The difference with most companies that were recently created is that Exela offers decades of expertise in connecting data through user-friendly software platforms and solutions.

We are talking about a corporation with more than 4,000 customers, out of which 60% customers are of the Fortune 100, and are serving the banking, healthcare, insurance, and manufacturing industry among others.

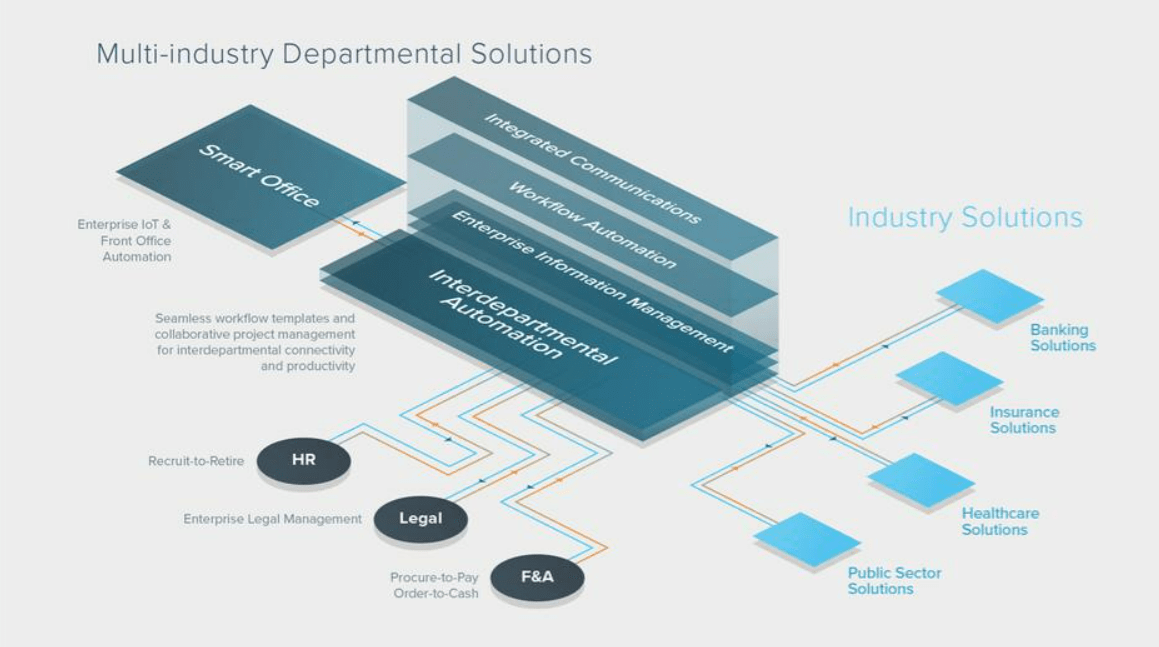

It is likely that XELA will obtain revenue because it serves different departments inside organizations. The activities are well diversified. Among the different solutions offered, I saw workflow automation, interdepartmental automation, solutions to legal departments, enterprise information management, and many other products:

Source: 10-K

Market Estimates, Financial Situation, And Forecast From Other Analysts

I am not sure whether the three analysts covering XELA had a look at Forecast by American poet Josephine Miles. I had a lot of trouble in forecasting how much valuation XELA is apt to have. Just like Madame Miles notes in its poem, forecasting was not an easy task:

How much sun then do you think is due them? Or should say, how much sun do you think they are apt to have? It has misted at their roots for some days now. The gray glamour addressing itself to them. Source: Forecast by Josephine Miles

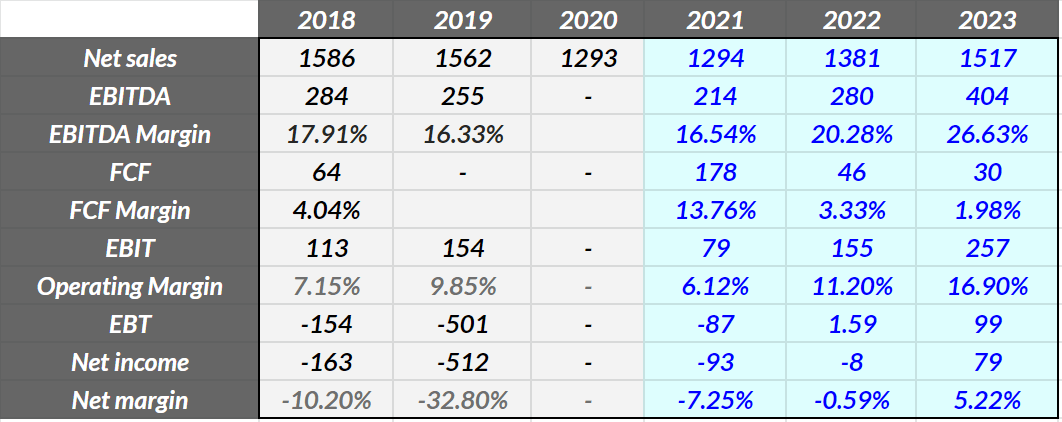

XELA offers a promising technology, and most of the people are expecting free cash flow generation and sales growth. Notice that analysts are expecting a free cash flow margin of 13%-3% from 2021 to 2023 and a positive net margin in 2023. However, with or without the favor of market analysts, the company has a significant amount of debt. If the company’s sales don’t grow sufficiently, I believe that only debt holders will make money:

Source: Market Estimates

Source: Market Estimates

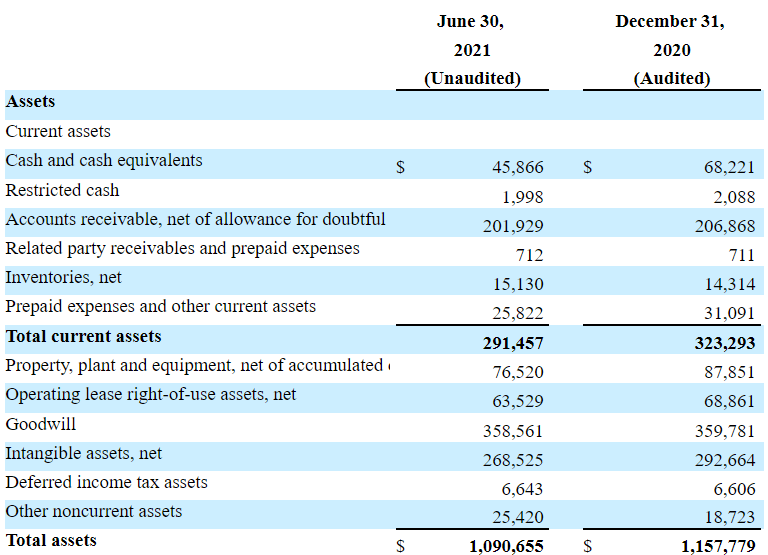

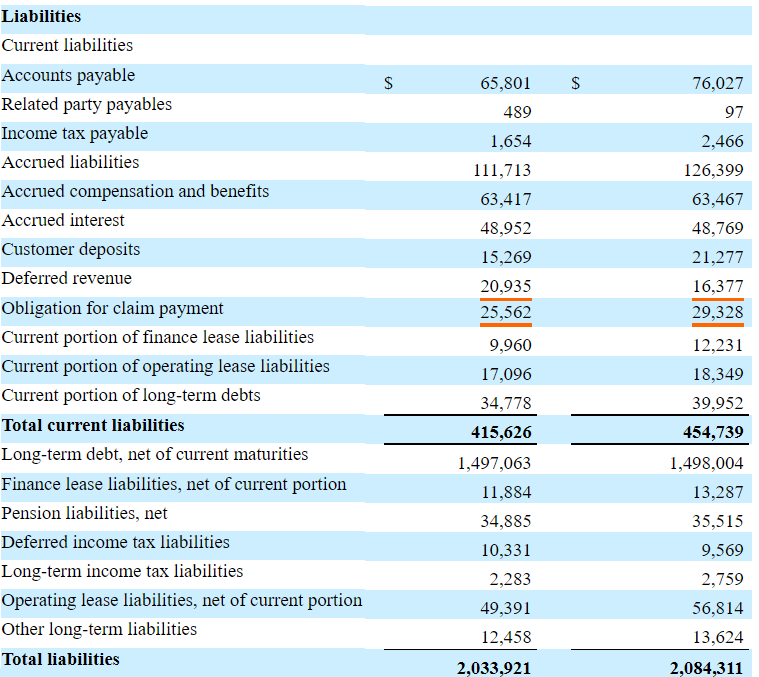

With an asset/liability ratio under one, $45 million in cash, and close to $1.41 billion in debt, it appears very clear that debtholders are financing the company’s operations. In my opinion, shareholders need to understand carefully the company’s financial situation before buying shares:

Source: 10-Q

Source: 10-Q

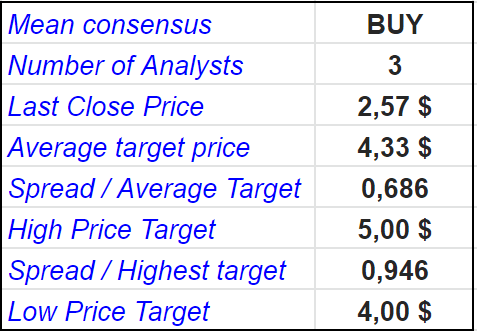

In any case, analysts believe that XELA’s technology will be successful. They gave the company a mean consensus of buy with a high price target of $5. With this in mind, I designed my own financial models to understand how much valuation XELA is apt to have:

Source: Consensus Estimates

Best Case Scenario, Which Appears To Be The Most Likely Scenario, Leads To A Target Price Of $5

In the best-case scenario, the company’s seven layers of technology-enabled solutions successfully go from discrete services to end-to-end processes, and they are used as front-end enterprise software. In this case scenario, the company’s sales are expected to explode up. The company’s seven-layer diagram is shown in the image below:

Source: Prospectus

When the penetration of the solution stack across the customers is successful, more clients want to know about XELA’s products. As a result, in this case scenario, the number of clients exceeds the existing base of over 4,000 customers. The number of customers increases at a 5%-10% rate y/y.

Besides, the demand for systems that support digital workflows, remote connectivity, and flexible facilities increases significantly. Notice that the company is expecting a scenario, in which its services are crucial for society because the modern workforce becomes more globalized and distributed. As a result, revenue increases significantly.

Finally, the company successfully invests in new innovations that help the management offer a new portfolio of solutions. According to the most recent annual report, the company is interested in a platform that offers an assessment of Big Data to predict customer behavior:

As an example, on behalf of our customers, we are deploying Big Data automation platforms to analyze individual consumer behavior and interaction patterns to identify opportunities for revenue enhancement and loss prevention, and configure optimal outreach campaigns to drive sales, loyalty, and profitability. Source: 10-K

With all these assumptions in mind, the following table offers my financial figures. I am using an optimistic sales growth of close to 10% from 2023 to 2026 with a free cash flow margin of close to 5%. The free cash flow stands at $115 million from 2024 to 2026 with a terminal FCF of $110 million. Summing everything, the present value of the FCF is equal to more than $560 million. Finally, if we use an exit multiple of 20x and a discount of 5.5%, the implied share price is equal to $5:

Source: Author

Worst Case Scenario: Target Price Is $2

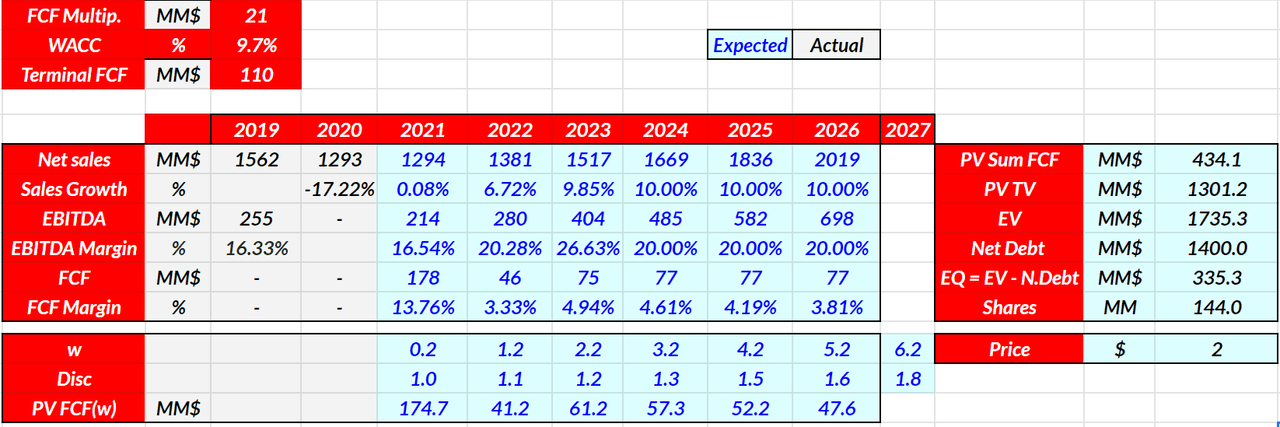

Under my worst-case scenario, I assumed that interest rates would increase in the coming years. As a result, the company has to pay a bit more interest expenses, and the WACC stands at 9.7%. Notice that in my view, the largest risk for XELA comes from its financial obligations.

I also expect that the free cash flow would grow to $77 million with the FCF margin of approximately 3.77%. Finally, I used an exit multiple of 21x, which implied a fair price of $2. The table below offers my results:

Source: Author

The Debt Obligations Represent A Relevant Risk

XELA’s total amount of debt is worrying, so it is good to learn the company’s strategy in this regard. According to the last annual report, the management expects to reduce its debt, which I believe could be an excellent catalyst for the share price:

As of December 31, 2020, we had approximately $1.5 billion of long-term debt, excluding current maturities. In the fourth quarter of 2019, we announced a debt reduction and liquidity improvement initiative, which is part of the Company’s strategic priority to position the Company to long-term success and increased stockholder value. Source: 10-K

With that being said about the company’s strategy, in my opinion, traders will most likely carefully read about the judgment against the company in the Delaware Court of Chancery. It is a bit worrying:

On March 26, 2020, the Delaware Court of Chancery entered a judgment against one of our subsidiaries in the amount of $57,698,426 inclusive of costs and interest arising out of the Appraisal Action, which judgment will continue to accrue interest, until paid, at the legal rate, compounded quarterly. In early February 2021, petitioners also filed a motion for a preliminary injunction in the derivative action in which they seek a court order freezing certain property and prohibiting certain transfers and payments by Exela subsidiaries other than SourceHOV, including preventing them from paying their creditors unless the payments are made equally among Exela’s other creditors and toward the Appraisal Action liability. Source: 10-K

Risk From Restatements Of Financial Statements

I also don’t appreciate that the company had to restate its financial statements for the years 2017 and 2018. If XELA had to restate its financial statements in the past, I believe that the risk of new restatements is elevated. If the company has to do so, I believe that the stock price may fall significantly:

We incurred unanticipated costs for accounting and legal fees in connection with or related to the restatement, and have become subject to a number of additional risks, costs and uncertainties, including the risk of related litigation, which may affect investor and customer confidence in the accuracy of our financial disclosures and may raise reputational issues for our business. Source: 10-K

Risk From Impairment Of Goodwill

I am not that worried about the company’s goodwill, but I need to note that 32% of XELA’s assets are comprised of goodwill. Take into account that technology companies usually have a large amount of goodwill from previous acquisitions. With that, there is a significant amount of intangible assets, which may get impaired. In that case scenario, I would expect significant declines in the share price:

As of December 31, 2020, our goodwill balance was $359.8 million which represented 31.1% of total consolidated assets. We are required under GAAP to review our intangible assets for impairment when events or changes in circumstances indicate the carrying value may not be recoverable. Goodwill is required to be tested for impairment at least annually. Source: 10-K

Conclusion

Exela runs a diversified business model and owns significant expertise in digital transformation. If we trust the numbers offered by experts, the global Digital Transformation Market is expected to grow at a CAGR of more than 15% from 2020 to 2028. With this in mind, XELA will most likely have a demand for its products.

If the company’s seven layers of technology-enabled solutions are really successful, and XELA’s new Big Data platform has a lot of demand, I believe that the company’s fair price is close to $5.

With that, there are many risks. In my view, XELA’s sales will have to grow significantly to pay its debts as well as to deliver a decent free cash flow margin. In sum, the products seem very promising, but the financial situation is a bit uncertain.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XELA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.