Advanced Human Imaging Files For $24 Million U.S. IPO

Summary:

- Advanced Human Imaging has filed to raise $24 million in a U.S. IPO.

- The firm is commercializing body dimension scanning technologies.

- AHI is a tiny Australian firm that is thinly capitalized and is producing increasing losses.

Quick Take

Advanced Human Imaging Limited (NASDAQ:AHI) has filed to raise $24 million in an IPO of its American Depositary Shares representing underlying ordinary shares, according to an F-1 registration statement.

The firm has developed smartphone technology for determining body dimensions.

AHI is a tiny firm that is thinly capitalized and produces increasing losses.

I’ll provide a final opinion when we learn more IPO details from management.

Company & Technology

South Perth, Australia-based AHI was founded to develop its BodyScan technology that enables users of smartphones to accurately image and determine dimensions of their body.

Management is headed by founder, CEO and Executive Chairman Vlado Bosanac, who has been with the firm since inception and was previously founding partner and director of Greenday Corporation.

Below is a brief overview video of AHI:

(Source)

The company’s primary sector focus includes:

-

Mobile health

-

Teleheath and Wellness

-

Life and health insurance

-

Fitness

-

Consumer and apparel

AHI has received at least $38 million in equity investment from investors including Mad Scientist Pty Ltd, The Rain Maker Mgmt SDN BHD and Dr. Amar El-Sallam.

Customer Acquisition

The firm sells its software to partner companies via software development kits [SDKs] for use in their software programs.

AHI currently has 15 signed binding agreements with partners that it believes ‘have a total of over 400 million potential users.’

The company’s revenue model is primarily subscription-based but also includes a ‘demand-use’ basis as well.

Sales and Marketing expenses as a percentage of total revenue have varied as revenues have fluctuated, as the figures below indicate:

|

Marketing and Publicity |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Six Mos. Ended Dec. 31, 2020 |

77.0% |

|

FYE June 30, 2020 |

157.8% |

|

FYE June 30, 2019 |

7.6% |

(Source)

The Sales and Marketing efficiency rate, defined as how many dollars of additional new revenue are generated by each dollar of Sales and Marketing spend, swung back into positive territory in the most recent reporting period, as shown in the table below:

|

Marketing and Publicity |

Efficiency Rate |

|

Period |

Multiple |

|

Six Mos. Ended Dec. 31, 2020 |

0.8 |

|

FYE June 30, 2020 |

-0.2 |

(Source)

Market & Competition

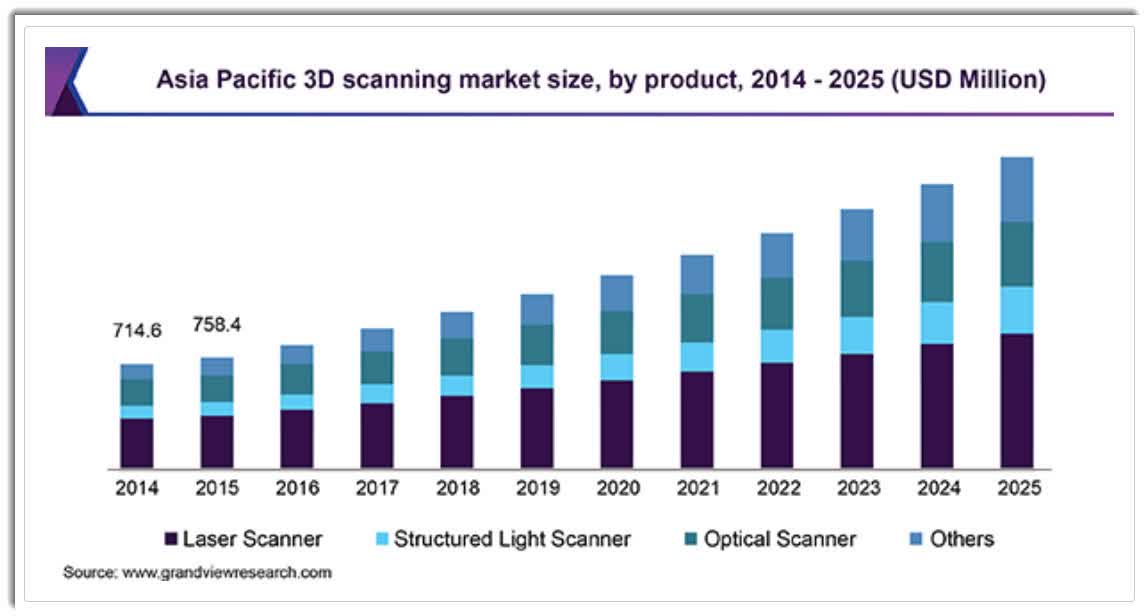

According to a 2019 market research report by Grand View Research, the global market for 3D scanning was an estimated $4.5 billion in 2018 and is forecast to reach $8 billion by 2025, although this market encompasses other scanning use cases.

This represents a forecast CAGR of 8.4% from 2019 to 2025.

The main drivers for this expected growth are improvement in technology offerings and growing R&D investment in various scanning methods.

Also, below is a historical and projected future growth trajectory for 3D scanning in the Asia Pacific region:

(Source)

Major competitive or other industry participants include:

-

MySize

-

Halo

-

Select Research

Financial Performance

AHI’s recent financial results can be summarized as follows:

-

Variable topline revenue growth, from a tiny base

-

Increasing comprehensive losses

-

Lowered cash used in operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Six Mos. Ended Dec. 31, 2020 |

$ 647,577 |

150.3% |

|

FYE June 30, 2020 |

$ 487,054 |

-25.7% |

|

FYE June 30, 2019 |

$ 655,946 |

|

|

Comprehensive Income (Loss) |

||

|

Period |

Comprehensive Income (Loss) |

|

|

Six Mos. Ended Dec. 31, 2020 |

$ (3,994,246) |

|

|

FYE June 30, 2020 |

$ (3,939,454) |

|

|

FYE June 30, 2019 |

$ (3,180,728) |

|

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Six Mos. Ended Dec. 31, 2020 |

$ (855,074) |

|

|

FYE June 30, 2020 |

$ (1,969,003) |

|

|

FYE June 30, 2019 |

$ (2,378,925) |

|

(Source)

As of December 31, 2020, AHI had $3.5 million in cash and $2.2 million in total liabilities.

Free cash flow during the twelve months ended December 31, 2020, was negative ($1.6 million).

IPO Details

AHI intends to raise $24 million in gross proceeds from an IPO of its American Depositary Shares representing underlying ordinary shares, although the final figure may differ.

The firm’s shares are listed on the Australian Securities Exchange under the symbol “AHI”.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Management says it will use the net proceeds from the IPO as follows:

We plan to use the net proceeds we receive from this offering primarily for research and product development of our current products (19%) and business development and marketing (17%), with the remainder of the proceeds to be used for general corporate purposes, including, without limitation, investing in or acquiring companies that are synergistic with or complimentary to our technologies (including, without limitation, a potential investment in Jana), and working capital.

We believe that the expected net proceeds from this offering and our existing cash and cash equivalents, together with interest thereon, will be sufficient to fund our operations for the next 18 to 24 months, although we cannot assure you that this will occur.

(Source)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says it is not aware of any legal proceedings against the firm.

The sole listed bookrunner of the IPO is Maxim Group.

Commentary

AHI is seeking U.S. capital market investment to continue to commercialize its body scanning technologies.

The firm’s financials show very little revenue and increasing losses in recent periods.

Free cash flow for the twelve months ended December 31, 2020, was negative ($1.6 million).

Sales and Marketing expenses as a percentage of total revenue have fluctuated as revenue has varied; its Sales and Marketing efficiency rate swung to a positive 0.8x in the most recent six-month period.

The market opportunity for various body scanning technologies is large and likely will grow significantly over the coming years, although it is difficult to obtain specifics for AHI’s market segment.

Maxim Group is the lead left underwriter and IPOs led by the firm over the last 12-month period have generated an average return of 115.2% since their IPO. This is a top-tier performance for all major underwriters during the period.

The primary risk to the company’s outlook is its very tiny size with potentially large competitors able to create the same technology offering.

I’m not sure why the firm wants to list in the U.S., other than perhaps it can’t find expansion capital in Australia.

When we learn more about the IPO, I’ll provide a final opinion.

Expected IPO Pricing Date: To be announced.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investing in IPOs is an inherently volatile and opaque endeavor. My research is focused on identifying quality IPO companies at a reasonable price, but I’m wrong sometimes. I analyze fundamental company performance and my conclusions may not be relevant for first-day or early IPO trading activity, which can be highly volatile and unrelated to company fundamentals. This report is intended for educational purposes only and is not financial, legal or investment advice.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!