Aerpio Pharmaceuticals: Is This Stock A Buy Or Sell? Not Until The Merger Is Over

Summary:

- Aerpio Pharmaceuticals, Inc. is a biopharmaceutical company that is developing compounds that activate Tie2 for various indications but has recently entered into a merger with privately-held Aadi Bioscience.

- Aadi is a private clinical-stage biopharmaceutical company developing precision therapies for genetically defined cancers with alterations in mTOR pathway genes and currently awaiting NDA results.

- Aerpio and Aadi entered into an agreement on May 2021 for a merger where Aerpio stockholders will only own 14.7% of the new entity expected to finalize in 2H 2021.

- Aerpio and Aadi’s consolidated financials outline an expected post-merger cash position of $182.6M (incl. of PIPE) with sales expected to reach $7M in 2023 growing up to $2.5B by 2030.

- In summary, the author projects Aerpio Pharmaceuticals, Inc. as a “hold” until after the Merger.

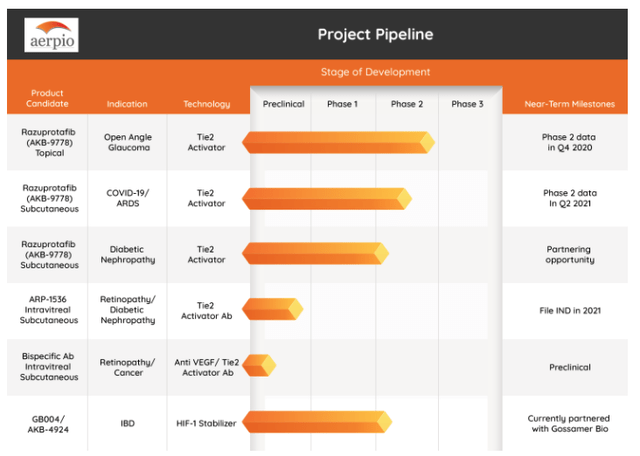

Graphic Source: Aerpio Pharmaceuticals, Inc.

Introduction: What is Aerpio Pharmaceuticals?

Aerpio Pharmaceuticals, Inc. (NASDAQ: ARPO) is a biopharmaceutical company developing compounds that active Tie2 for various indications including Open Angle Glaucoma, COVID-19, Diabetic Nephropathy, IBD, and more. Aerpio recently announced its reverse-merger agreement with Aadi Bioscience, Inc. which will entail taking the currently private Aadi to the public markets and saving an ailing Aerpio in the process. Aadi is a private clinical-stage biopharmaceutical company developing precision therapies for genetically defined cancers with alterations in mTOR pathway genes. Aadi’s business model aims to exploit problems in effective drug delivery, safety, or effectiveness with their pipeline including their lead mTOR inhibitor drug FYARRO (ABI-009). ABI-009 was accepted by the FDA and has set a priority review PDUFA date of Nov. 26, 2021.

The merger between Aerpio and Aadi has taken precedence over various other factors as it will directly affect investors of ARPO more than the current pipeline as will later be addressed. The major outcomes of the merger include serious dilution, but also access to Aadi’s high likelihood of approval therapeutic. This therapeutic is the core of the merger and share price upside for long-term investors, but it does not compensate for the merger’s dilution after PIPE investors. This dilution makes Aerpio a “hold” until the finalization of the dilution effects. The following report will emphasize this critical merger as well as provide investors a concise overview of the two companies.

Aerpio & Aadi merger

Investors should follow the recent news announced in May 2021 of the merger. Aerpio Pharmaceuticals Inc and Aadi Bioscience agreed to a planned merger to which Aadi will become a wholly-owned subsidiary of Aerpio. Although Aadi will become a subsidiary of Aerpio, investors of the privately held Aadi will receive approximately 4.9152 shares of Aerpio’s stock with valuations tentatively set as $82.5M (Aadi Valuation) and $41M (Aerpio Valuation). The share/ownership arrangement of the merged entity is subject to the reverse stock split of Aerpio before the merge adjusted for Aerpio’s net cash. The new combined entity will change its name to Aadi Bioscience, Inc. effectively clarifying that the larger private Aadi will retain the majority of control over Aerpio with its associated dilution effects on Aerpio shareholders. This will result in Aadi’s stockholders owning approximately 66.8% of the combined company (fully diluted basis) and Aerpio’s stockholders owning 33.2%. This however is still not the full dilution effect as a PIPE financing elaborated below will adjust these ownership levels down.

+PIPE financing

On top of the announced merger agreement, Aerpio Pharmaceuticals Inc entered into “subscription agreements” with various PIPE investors. Aerpio has agreed to sell shares of common stock and pre-funded warrants for aggregate proceeds of tentatively $155M. The execution of this arrangement is expected to occur concurrently with and conditional on, the closing of the merger. This will effectively result in Aadi stockholders owning 29.6% of the newly combined entity and its associated share count. Aerpio stockholders will own on a fully diluted basis 14.7% and PIPE investors retaining the other 55.7%. Further information on the potential adjustments to the exchange ratios and ownership percentages can be found on page 146 titled “The Merger Agreement-Merger Consideration and Exchange Ratio” of the July 2021 SEC-published proxy statement.

Products/Pipeline (Aerpio & Aadi)

To properly analyze both firms in their newly merged form, it becomes necessary to present both their pipelines here. In short, Aerpio Pharmaceuticals’ pipeline is fraught with little potential after the recent discontinuation of its lead program for OAG with razuprotafib; however, privately-held Aadi possesses a very promising therapeutic known as AIB-009 at the NDA stage with a priority review PDUFA date of Nov. 26, 2021. AIB-009 is expected on second/third indications to reach blockbuster status (sales > $1B) by 2028. Per the merger, Aerpio and Aadi have outlined a probability of success for Aadi’s pipeline’s approval which was set as 90% for PE Coma and 63.6% for TSC1 / TSC2. This was estimated by the investment bank hired for the merger.

Aerpio’s Pipeline

Graphic Source: Aerpio Pharmaceuticals Inc. (July 2021)

Aerpio Pharmaceuticals Inc’s pipeline consists of 6 programs (4 clinical-stage) and four unique therapeutics. Most of the pipeline’s promise has largely stemmed from its once-promising razuprotafib (AKB-9778), a small molecule vascular endothelial protein tyrosine phosphatase (VE-PTP) inhibitor. This changed in Dec. 2020 when the company announced its top-line results from razuprotafib’s double-blind placebo-controlled Phase 2 trial in patients with elevated intraocular pressure (“IOP”) associated with open-angle glaucoma or ocular hypertension. Although the results met the trial’s primary efficacy endpoint with twice-daily dosing, it did not show an IOP decrease sufficient to move to Phase 3. Although devastating, it has probed the firm to find new avenues of development which resulted in the new merger being announced.

The other clinical-stage programs run by Aerpio Pharmaceuticals Inc included razuprotafib for treating ARDS, razuprotafib for Diabetic Kidney Disease, and AKB-4924, for inflammatory bowel disease, the latter being licensed to Gossamer. The ARDS program was fraught with complications in both its two Phase 2 trials run during 2020 (mod-severe COVID-19 – RESCUE Trial and critical COVID-19 – I-SPY Trial) and resulted in various study-related complications (e.g. monitoring patients during ICU capacity constraints). Topline data from the RESCUE trial showed a mechanism-based dose-dependent reduction of blood pressure with an apparent dose-dependent decrease in Ang2 consistent with Tie2 activation. Unfortunately, the efficacy couldn’t be fully assessed due to too few patients for comparative purposes and an outcome of an equal number of deaths in each group. Aerpio is still analyzing the full data set. In the diabetic kidney disease segment, two trials were run (TIME-2 and TIME-2b) for subcutaneous razuprotafib which showed a reduction in UACR, but no further notes have been made of its progress. Lastly, Aerpio’s final clinical-stage program is run under the Gossamer license agreement from June 2018. It involved Aerpio’s out-licensed drug, AKB-4924 (now GB004) which acts as a stabilizer of HIF-1 alpha for treating IBD. Thus far, it has completed a Phase 1b trial in UC patients reporting adequate results in 2Q 2020 to move forward into a Phase 2 study for mild-to-moderate UC in 2H 2020. Gossamer has since effectively bought out AKB-4924 for a payment of $15M (May 2020) which reduced future potential milestones and tiered royalties for Aerpio leaving Gossamer responsive for all remaining development and commercial activities.

On the pre-clinical side, Aerpio still has ARP-1536, a humanized monoclonal antibody targeting the same as subcutaneous razuprotafib, and a bi-specific antibody binding VEGF and VE-PTP. Both are still pre-clinical, but the company is evaluating its development opportunities for diabetic vascular complications and AMD/diabetic macular edema, respectively.

Aadi’s Products/Pipeline

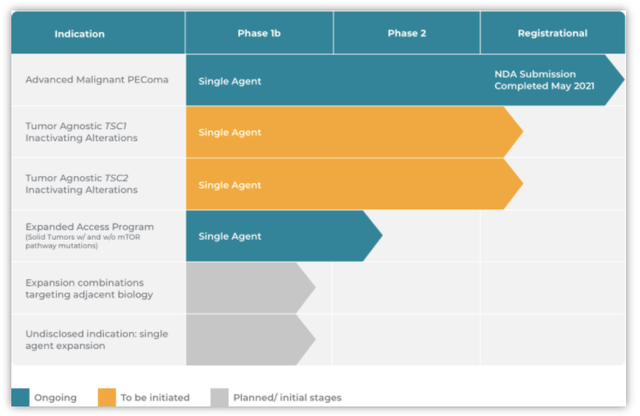

Graphic Source: Aadi Bioscience, Inc. (July 2021)

Aadi’s products and pipeline consist of 4-6 programs utilizing primarily ABI-009 across various indications. ABI-009 (FYARROTM, nab-sirolimus) is an mTOR inhibitor bound to human albumin. In May 2021, Aadi announced they completed the filing of the NDA for ABI-009 with the FDA for approval to treat patients with advanced malignant perivascular epithelioid cell tumors (“PEComa”). The FDA has granted ABI-009 Priority Review and set a PDUFA target action date of November 26, 2021. The NDA came after a promising Phase 2 trial (AMPECT) in advanced malignant PEComa, a first of its kind with no approved therapies in the US or a prior prospective trial. In Nov. 2019, Aadi presented great top-line results from AMPECT meeting its primary endpoint of overall response rate determined by a blinded independent central radiologic review (RECIST v1.1. criteria). Aadi has already begun commercial preparations supporting the US launch of ABI-009 if approved. The plans include building a specialist sales force targeting US physicians.

In addition to advanced malignant PEComa, Aadi is expanding ABI-009’s indication list. Aadi is planning a new registration Phase 2 study (Precision 1) for tumor-agnostic Tuberous Sclerosis Complex 1 and 2 (TSC1 & TSC2). Aadi has met with the FDA (Type B meeting) to refine the trial design for the Precision 1 trial which is expected to commence by FYE 2021.

On top of the above priority activities, Aadi has an exclusive license with Abraxis BioScience, now a subsidiary of Bristol Myers Squibb (BMY) to which Aadi gained exclusive rights to develop, manufacture, and commercialize ABI-009.

For more information on updates regarding the science and priorities of the therapeutic line, please see either Aadi’s Website or the most recent merger documentation.

Management | Changes to C-suite execs.

The merger outlines several new management changes to be executed once the merger finalizes. The new CEO of the merged companies will be Aadi’s current President/CEO, Dr. Neil Desai. The new team will also include a CFO, COO, and Chief Medical Officer who are yet to be determined. The board will also include seven members some from Aerpio Pharmaceuticals Inc. and Aadi Bioscience. Caley Castelein, M.D., will serve as the new Chairman. He has served on Aerpio’s board of directors since March 2017.

Dr. Neil Desai, the new CEO/President, is the founder and current CEO/President of Aadi Bioscience. Before Aadi, he was SVP – Global R&D of Abraxis Bioscience, VP of Strategic Platforms of Celgene Corp, and inventor of nanoparticle albumin-bound technology and ABI-009. Dr. Desai has led the Abraxane team through all developmental stages showcasing sufficient clinical experience. He possesses 25+ experience in novel therapeutic delivery systems with 100+ patents and 40+ peer-reviewed publications/book chapters with 200+ presentations at scientific events. He seems like an adequate fit for the newly merged entity.

Financial position

The announcement of the merger came with a proxy statement of consolidated financials of both Aerpio Pharmaceuticals Inc and Aadi Bioscience which will be presented below in their consolidated form. Neither company has commercialized any therapeutic yet, but revenues reached $29.6M in FY 2020 based on grants and milestone payments not expected to continue. 2020’s net losses reached -$82.6M alongside $182.6M (incl. of PIPE) in cash and equivalents forecasted for the merger. In Jan 2021, Aerpio also outlined their “realignment plan” which aimed at reducing costs and prioritizing ongoing business. Aerpio reduced its employee count by 7 people (-58% of the workforce). Total liabilities at March 2021 aren’t worrisome at a manageable $22.6M between the companies with a net positive pro forma book value per share of the combined entity at $0.51/share inclusive of 317.1M in expected shares outstanding noted March 2021. The cash position of $182.6M is inclusive of the potential PIPE financing expected to amount to +$155M sufficient for both pipelines to continue operations for at minimum 2 years. If approved, ABI-009 should strengthen the financial position.

Aerpio’s current therapeutic predicament makes it less likely to produce outstanding therapeutic success in the near term after razuprotafib’s Phase 2 didn’t produce sufficient therapeutic effect to move forward. This halts any potential upside from their current pipeline or sales projections in the near term. Aerpio’s value now comes from acting as a promising vehicle for Aadi’s reverse merger and its associated PIPE financing.

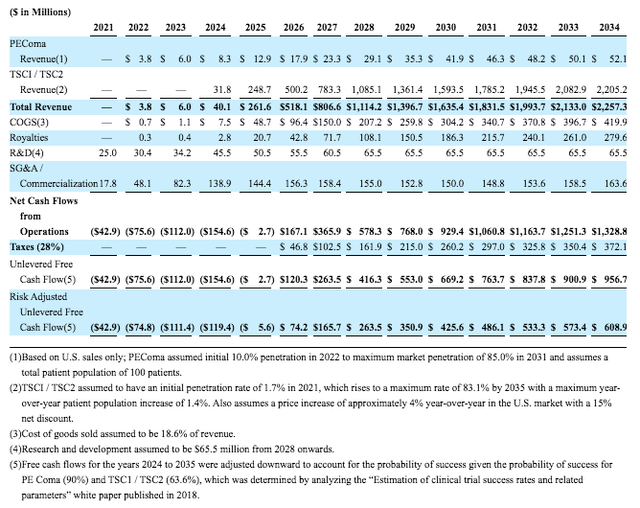

Tentatively, Aadi has presented some rough sales projections that were utilized in creating the valuation for the merger and are presented below. This showcases interesting dynamics. Firstly, ABI-009 for PEComa, currently pending NDA, isn’t expected to produce blockbuster sales and the ramp-up is quite slow starting from $3.8M in 2022 sales growing to $41.9M by 2030. The newly initiated trials using ABI-009 for TSC1/2 showcase a much larger market potential starting with sales with tentative approval by 2023-2024 and commercial launch in 2024. Sales for TSC are expected to grow from $31.8M in 2024 up to ~$1.6B by 2030, thus achieving the blockbuster status. It also showcases that investors will most likely realize much of their upside following 2023’s tentative approval for TSC thereafter appreciating significantly throughout the duration of high growth.

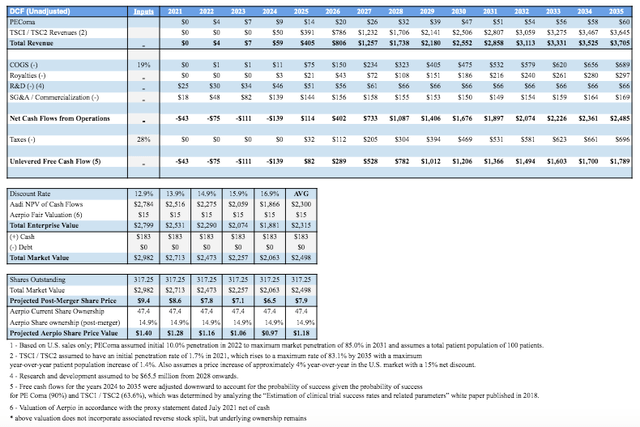

Table Source: DCF Figures of Aadi’s Valuation | Aerpio’s July 2021 Merger Proxy Statement

Risk discussion

Aerpio Pharmaceuticals Inc in its current state pre-merger is a very risky investment with a discontinued lead program and waning financial resources; however, the new merger established highlights a reduction in such risk for the long-term investors. This is due to the provision of financial resources and a significant stake in what may be a multi-billion-dollar drug by 2028. Additionally, the PIPE financing comes through at an opportune time for the firm, but there is no guarantee of its financialization which could reduce Aadi’s ability to commercialize properly and continue its trials for TSC1/2. TSC1/2 are the critical trials long-term investors should follow as they mark the real catalyst for long-term returns. This is due to their indications’ significantly higher expected sales potential. This merger may be likely to succeed, but if it does not, investors will certainly realize dilution and a continued holding in a firm with less than likely prospects of commercialization. Long-term investors should follow the merger closely and be cognizant of any August 17, 2021 disproval from ARPO’s shareholders at the special meeting.

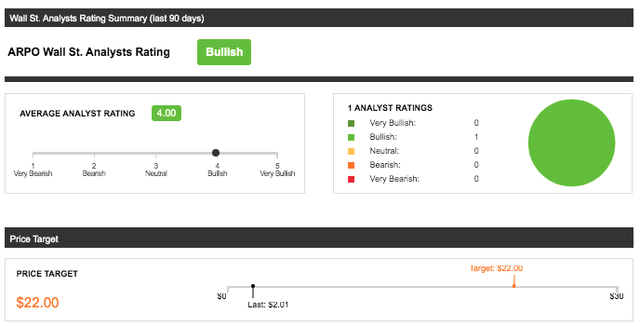

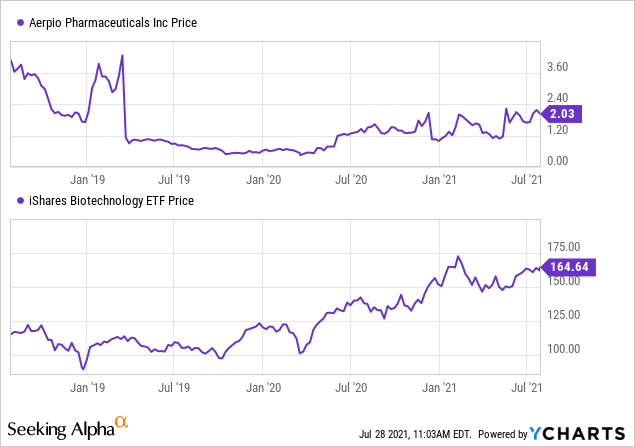

Price target and valuation | ARPO stock price

Aerpio Pharmaceuticals Inc is largely underfollowed by wall-street analysts, which makes the estimations difficult to interpret; however, the adjustment from March to July 2021 of analyst estimates has shown an upward price change from $2/share to $22/share following the announcement of the merger. The outlook by wall-street for ARPO is “bullish” after the merger announcement, but remains at risk of bias with only 1 analyst following. $22 is a high mark as further DCF analysis below will show and is considered quite optimistic. Long-term investors should know that this price target is not valid if the merger fails and if ABI-009 is not approved. Further factors that may affect this price target that should be followed are clinical-trial results from the TSC1/2 trials and the associated PIPE financing which both aren’t concerning as they seem on track.

Graphic Source: Seeking Alpha, Inc: Wall St. Analysts Rating

Can ARPO stock go up? | DCF Valuation

Based on the following valuation analysis, Aerpio Pharmaceuticals Inc is not a riskless stock buy. It is fraught with high-risk and significant dilution for the current or prospective ARPO shareholders. To further shed light on the merger’s potential outcome, the DCF model developed by Aerpio Pharmaceuticals Inc for the Aadi merger has been modified by the author to incorporate ARPO and the PIPE financings. Most of the major considerations remain unchanged from Ladenburg’s model from the proxy statement. The changes made by the author include adjusting revenues back to full-clinical success thus incorporating the upside factor and reducing the risk adjustments made. Additionally, in calculating total EV, ARPO’s fair value of $15M net of cash is incorporated and a range of discount rates was applied. The Total Market Value also incorporated the PIPE financing ($155M) / post-merger expected cash position. Finally, total shares utilized were post-merger ownerships presenting a very conservative 2022-2023 price target of $7.90/share for the new entity (not including reverse stock split considerations yet announced).

For current ARPO investors, a $1.18/share (-41% transaction loss) seems to reflect the most optimistic current value of their ownership post-merger following the massive PIPE+Aadi dilution effects. It’s not a near-term favorable transaction for investors who currently own ARPO, but following the consumption of the merger if the share price remains below $7.90/share (to be adjusted for changing reverse stock splits) then investors may have considerable upside to this figure.

Table Source: Developed by Gunner Hardy | Original Table/Data Source: DCF Valuation by Ladenburg Thalmann

Additionally, the model doesn’t incorporate any upside for ARPO other than the current fair value. If therapeutic success begins across its pipeline, then this figure may be too conservative. The original $2 mark set by wall-street analysts makes sense in light of further analysis. The new target set also makes sense based on the merger with Aadi and its associated $155M PIPE financing but is optimistic.

Conclusion | Is ARPO stock a good buy or sell?

To summarize, Aerpio Pharmaceuticals Inc’s merger with Aadi outlines the only real hope for investors to recoup their losses which will result in a massive dilution, but significant medium-term upside with a higher-than likely approval expected for Aadi’s lead therapeutic. The transaction infuses the company with sufficient financial resources and new management. The earnings potential of Aadi’s lead therapeutic, ABI-009, is sufficient to excite investors, but the dilution that must occur first is certainly going to increase the difficulty. Consumption of the merger would bring strong upside, but any failure to do so could certainly mean significant if not irreversible losses for Aerpio Pharmaceuticals in its current state.

In summary, the author projects Aerpio Pharmaceuticals, Inc. as a “hold” until after the Merger.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.