Summary:

- As seen by Exela’s topline, not all digital transformation plays have been able to overcome Covid lows.

- Expenses have consistently been up in this competitive environment and the debt level is relatively high.

- However, the company’s superior employee productivity metric deserves consideration in view of the ability to take advantage of automation features.

- Also, in view of low valuations, diversification into different industry verticals as well as debt reduction measures, value investors should put the stock in their watch-lists.

- Now, for traders, the low price as well as potential catalysts, similar to CareSource could easily propel the stock higher. Here, I am thinking of the blockchain-based integrations the company is capable of.

metamorworks/iStock via Getty Images

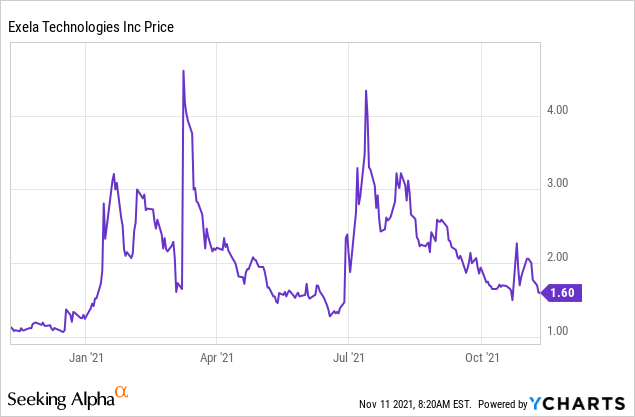

Exela Technologies (NASDAQ:NASDAQ:XELA) has been trending along a highly uneven path for the last year, but amid all these ups and downs, the stock has managed to deliver a performance of 41.5%. Part of the reason, as per SA was the rally at “23.8% higher after hours on partnering with CareSource, a nationally recognized nonprofit managed care organization, wherein the former will deploy its cloud-based PCH Global platform to help accelerate CareSource’s digital transformation journey”.

This shows that the stock has potential with digital transformation now having become a secular trend accelerated by Covid infection fears motivating companies to convert paper-based documents to electronic format. However, before investing, it is necessary to look at the fundamentals. I start with financial metrics.

Revenues and profitability

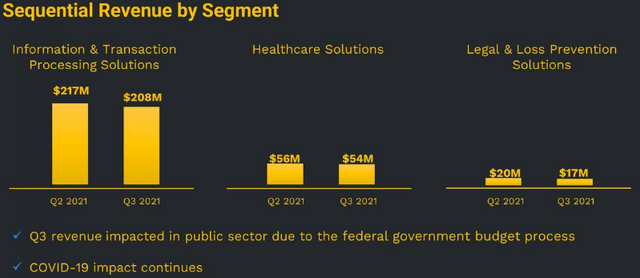

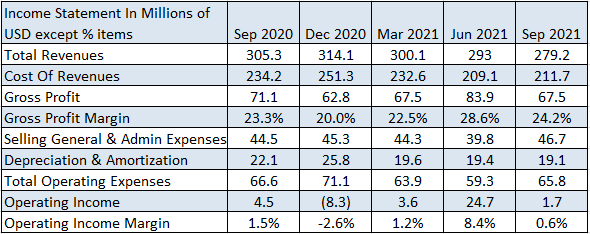

First, the revenues falling from the September 2020 quarter to Q3-2021, except for that bright spot in Q4 of last year, suggests that Exela has not been able to capitalize on digital transformation trends.

Looking into the reasons for the decline, it was primarily driven by continued COVID-19 impact due to delays in customers’ return to office plans affecting the on-site business, in addition to seasonality. Additionally, public sector revenues were pressured by delays in funding approvals.

For ITPS (Information and Transaction Processing Solutions), the company expects to see volumes and revenue improve in this segment once the COVID-19 impact subsides. Healthcare Solutions segment revenue decreased by $2.2 million sequentially, primarily driven by lower seasonal volumes on the payer business. For the Legal Loss and Prevention solutions (LLPS) segment, revenue decreased by $2.6 million due to certain one-time projects that were completed in Q2.

Source: Company presentation

Shifting to expenses, the company has been able to control costs of revenues (through better cost and capacity management), resulting in gross profit margins of 24.2% as per the table below, or an increase of 90 basis points year-over-year.

Still, these figures pale when compared to last quarter’s (Q2’s) sequential margins. The justification for this according to the executives is that the second and third quarters are not comparable “due to the seasonality impact”, and “underutilization of resources as a result of COVID-19”. As a matter of fact, Q2 benefited from an exceptional gain of $3.5 million realized from the derecognition of an operating lease liability.

Source: Seeking Alpha

Source: Seeking Alpha

Going deeper, the operating income margin decreased considerably to 0.6%, due to SG&A for Q3 of 2021 including a one-time charge of $3.8 million for the LLPS segment. Net of this charge, SG&A would have been $39.8 million or $6.9 million less. This would have translated into 3.1% of operating profitability as per my calculation, or a 2.5% increment from Q3-2020.

Still, SG&A, which comprises sales and marketing expenses, has been hovering at the $40 million-plus level for the last four quarters suggesting a high level of competition.

The competition

According to its website, the company proposes “business process automation (“BPA”) services leveraging on its proprietary technology to provide solutions aimed at enhancing quality, productivity as well as end-user experience”. Now, this is an area of need as several companies tend to operate their corporate functions in silos, which in turn results in inefficiencies.

Looking at the industry, according to KBV Research, the global BPA market size is expected to reach “$19.4 billion by 2026, rising at a market growth of 13.2% CAGR during the forecast period”.

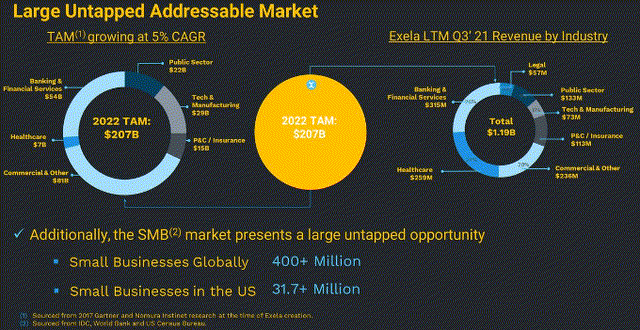

This constitutes a large market but is dwarfed by data from Exela, which puts the company’s total addressable market at $207 billion in 2022. The difference between KBV Research and Exela’s data seems to stem from the fact that the latter pertains to the more general Business Process Management field, which also includes Business Process Outsourcing (“BPO”) and BPA.

Source: Company presentation

BPO is basically outsourcing of finance and accounting activities to a third-party service provider, and in recent years, services proposed to allow finance organizations to achieve process improvement have also included automation software. In this case, with the blurring of boundaries between technologies, some companies like UiPath (PATH) have emerged which, instead of changing the whole business process which can be cumbersome, aim at using software robots, or bots to simply automate manual and repetitive processes.

Ultimately, the goal is to enable “digital optimization” of finance operations.

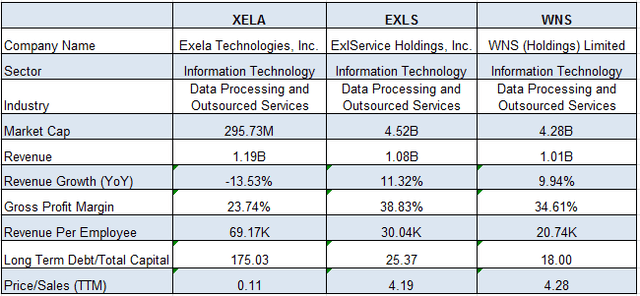

Taking a holistic view, the market has considerably evolved since 2017-2018 and several players have emerged. According to Gartner, two of these are ExlService (EXLS) and WNS Holdings (WNS) specifically for the “Finance and Accounting Business Process Outsourcing Services”. Now, these companies are much larger than Exela and their revenue growth is better too, and they were able to rapidly overcome the mid-2020 Covid lows. On the other hand, their gross margins are also higher which indicates better efficiency at building their solutions.

Source: Seeking Alpha

Furthermore, this is an industry that is synonymous with low barriers to entry with some of the big players like Accenture (ACN) and Tata Consultancy Services also proposing business process management or outsourcing services.

Potential and risks

Therefore, this is a highly competitive industry, but had it not been for Exela’s stunning Revenue per Employee metric (above table), which is more than two times EXL and three times WNS respectively, I would have simply underrated the company. For this purpose, despite its lower margins, Exela seems to have an efficient human resource strategy, and I also noted that its executives talked about “increasing efficiencies through the implementation of automation tools and leveraging the success of our work from anywhere model”. Thus, looking ahead, we can expect them to drive additional operating leverage from even higher utilization of manpower.

Moreover, while the ITPS segment remains challenged from lower volumes due to COVID-19, the company’s revenue base is stable and diversified from a geographic standpoint. Along the same lines, the customer base, which is over 4,000, spans across 14 industry verticals, including 60% of the Fortune 100, plus a large and diverse group of customers from small and medium-sized businesses.

Industry verticals encompass banking and financial services where it should play a more prominent role in combatting frauds for real-time payments as a provider of “confirmation of payee” solutions since the 1990s for the banking world.

In the meantime, its healthcare segment should benefit from the CareSource partnership to expand PCH Global, which enables “direct communication between payers, providers, patients, and data systems to reduce friction and simplify claims management”. PCH includes automation and data analytics capabilities as part of a cloud-hosted solution with one of the “best edit resolutions” for healthcare claims and can be accessed via a self-service model.

However, the stock’s relatively smaller market capitalization has contributed to its volatility and as per SA news, its mid-July fall of 15%, soon after establishing a peak was related to ” Exela being mentioned 17 times on the WallStreetBets subreddit in the last day (or July 14)”. Therefore, the stock has been engulfed in the meme stock movement with the volume of shares at “95 million making it the fourth-most active stock today (or on July 15)”. The shares eventually went down by more than 25%.

Continuing with my cautionary approach, long-term debt to total capital remains high as per the table above, but the company has launched an exchange offer to reduce debt by over 25% from $1.355 billion to around $1 billion.

Pursuing further, with trailing price to sales multiples of just 0.11x, valuations are attractive, but for value-oriented investors, it would be better to wait for clear signs of improvement on leverage before purchasing the stock.

On the other hand, for traders, at 60% off its July highs, there are catalysts that could easily propel the stock to the $2-2.5 range as seen with the CareSource announcement.

One of these catalysts could be blockchain’s Distributed Ledger Technology (“DLT”). In this respect, many companies still use legacy systems like ERPs which have to be migrated to the next wave of digital transformation including payment systems. This will especially be true for banks that will increasingly want to integrate with third-party payment providers with are not necessarily financial plays to scale up services. Here, Exela, with its real-time payment solutions stands to benefit as more blockchain players enter and require the type of integration that the company can provide with financial institutions.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is an investment thesis and is intended for informational purposes. Investors are kindly requested to do additional research before investing. This article has been edited with the help of Bhoshan Woodun.