Exela’s Management Is Brilliant: Debt Reduction And FCF Generation

Summary:

- Exela is a global business process automation company with operations in the United States, Europe, and other regions.

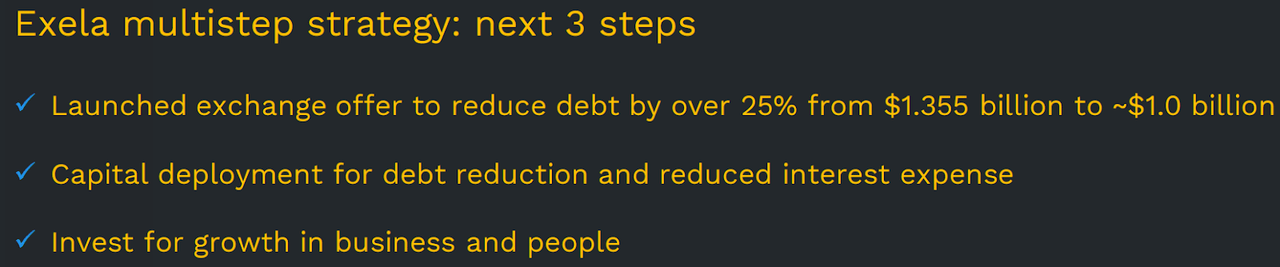

- The company believes that it can reduce its debt from $1.35 billion to close to $1 billion while at the same time increasing FCF in 2022.

- In my opinion, debt reduction would most likely lead to an increase in the stock price.

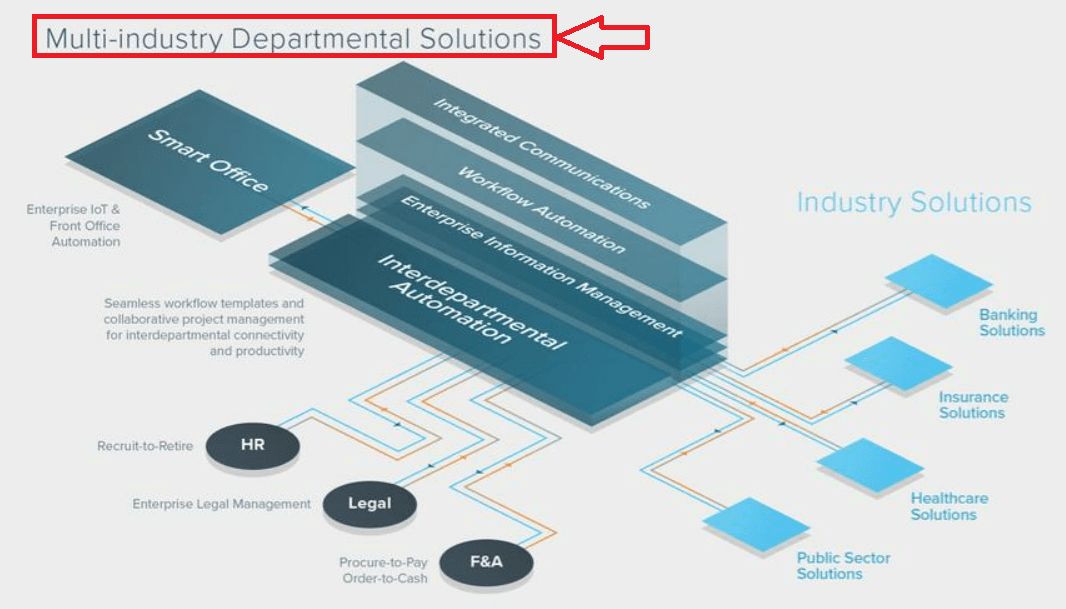

- I continue believing that Exela will most likely deliver sales growth if management further expands its solutions and services. Remember that the company is well-positioned to serve many different sectors, which would help Exela collect revenue.

- Note that management intends to implement robotic solutions on a per-user month basis. Robots can be an extremely profitable tool because they may be approximately the same for all clients.

Deagreez/iStock via Getty Images

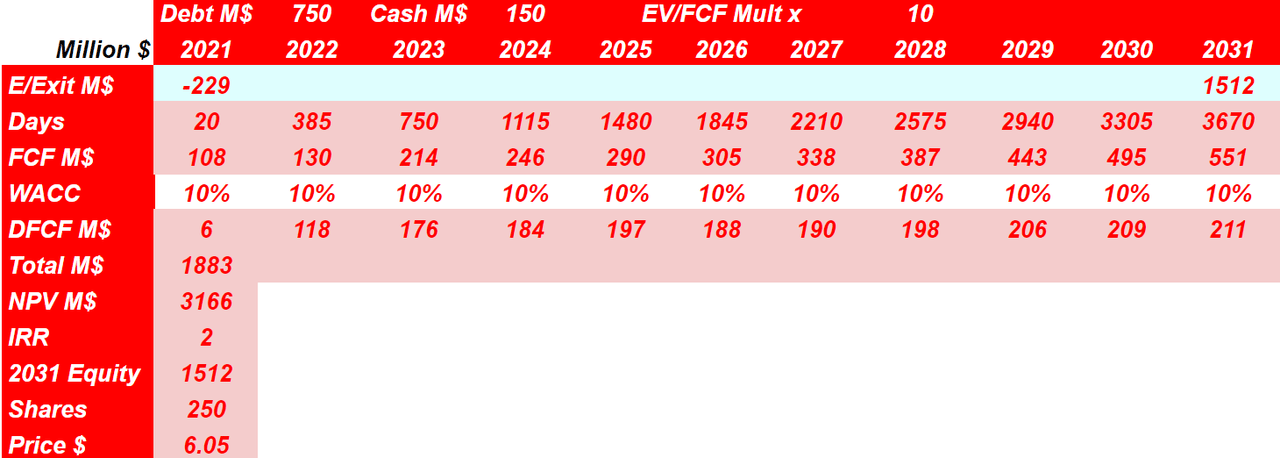

Exela (NASDAQ:XELA) announced a significant reduction in its debt and expects FCF to increase in 2022. With the target market increasing, if XELA designs and sells more robotic solutions, I expect a fair price of $6.05. Notice that I assumed conservative financial figures like an exit multiple of 10x FCF and a WACC of 10%. While I believe that Exela is only for non-conservative investors, everybody should take a look at Exela’s turnaround business strategy.

Exela’s Business Model: Small Decline In Sales, But Reducing Its Debt Level

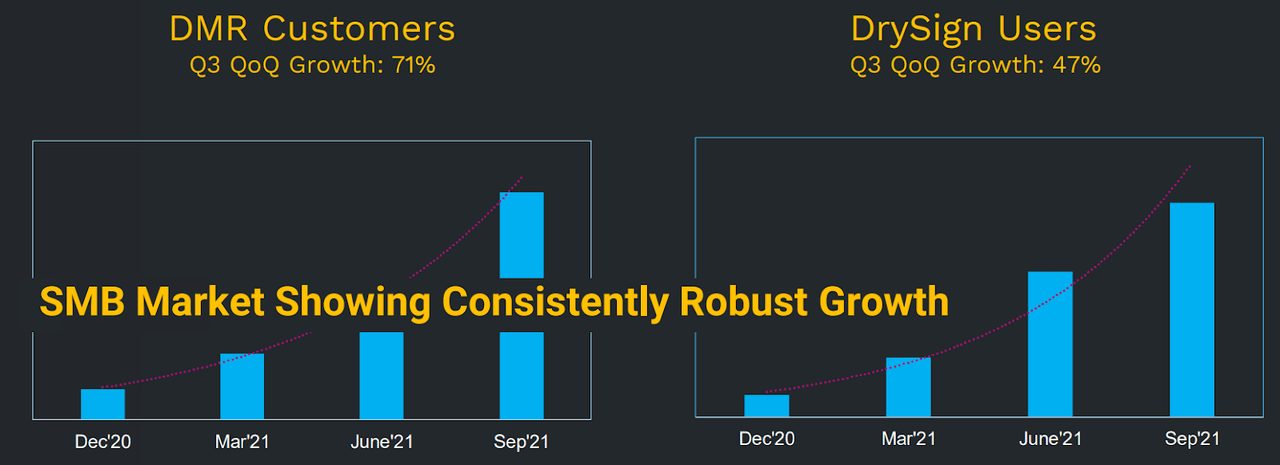

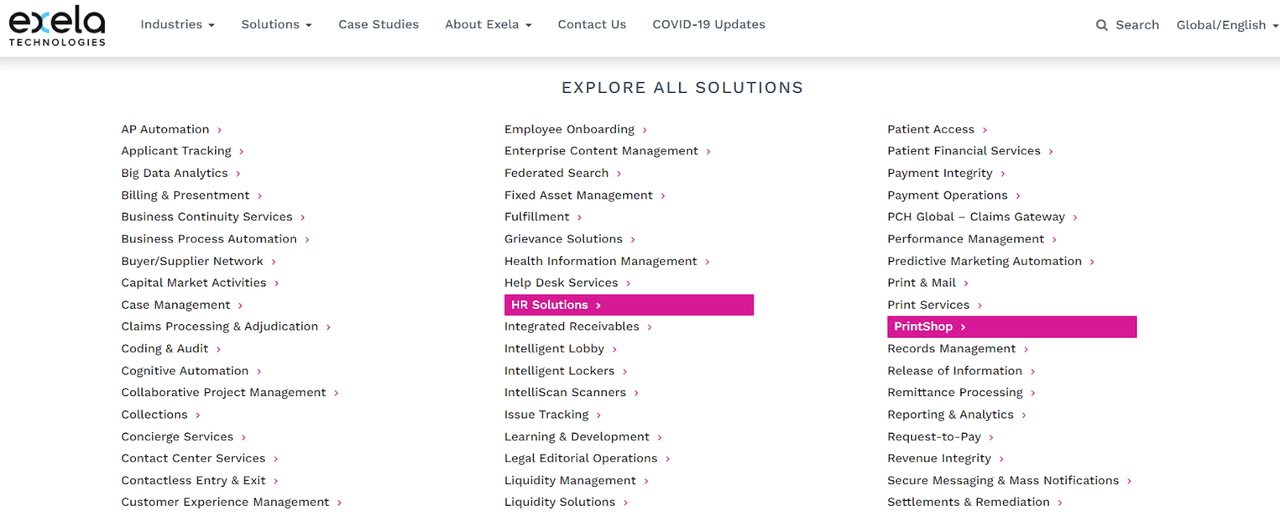

Exela is a global business process automation company with operations in the United States, Europe, and other regions. The number of tools and solutions offered by Exela is impressive, and the number of small- and medium-sized businesses that form the target market is increasing:

Source: Company’s Website

Source: Quarterly Presentation

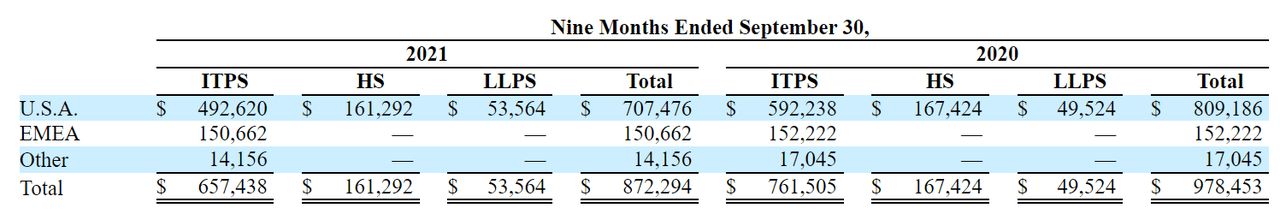

The largest business segment is ITPS, which offers services to help in assessing information and distributing to clients in the financial services, commercial, public sector, and legal industries:

Source: 10-Q

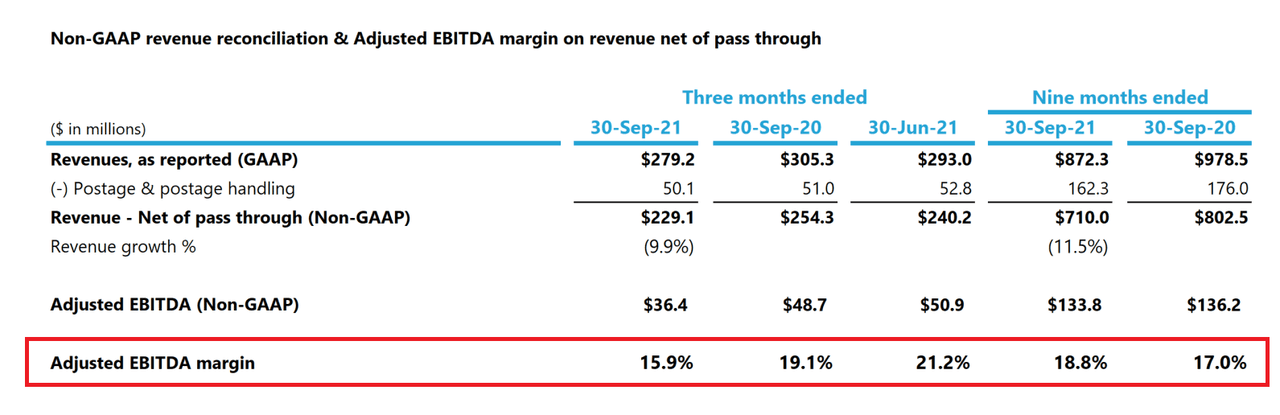

In 2021 and 2020, the company saw a small decline in revenue, which was attributed to existing contracts from certain clients and a decrease in the budget of governments. Management believes that those clients didn’t represent a strategic fit for the company’s long-term success:

The majority of this revenue decline is attributable to existing contracts and statements of work from certain customers with revenue that we believe was unpredictable, non-recurring and were not a strategic fit to Company’s long-term success or unlikely to achieve the Company’s long-term target margins. Source: 10-Q

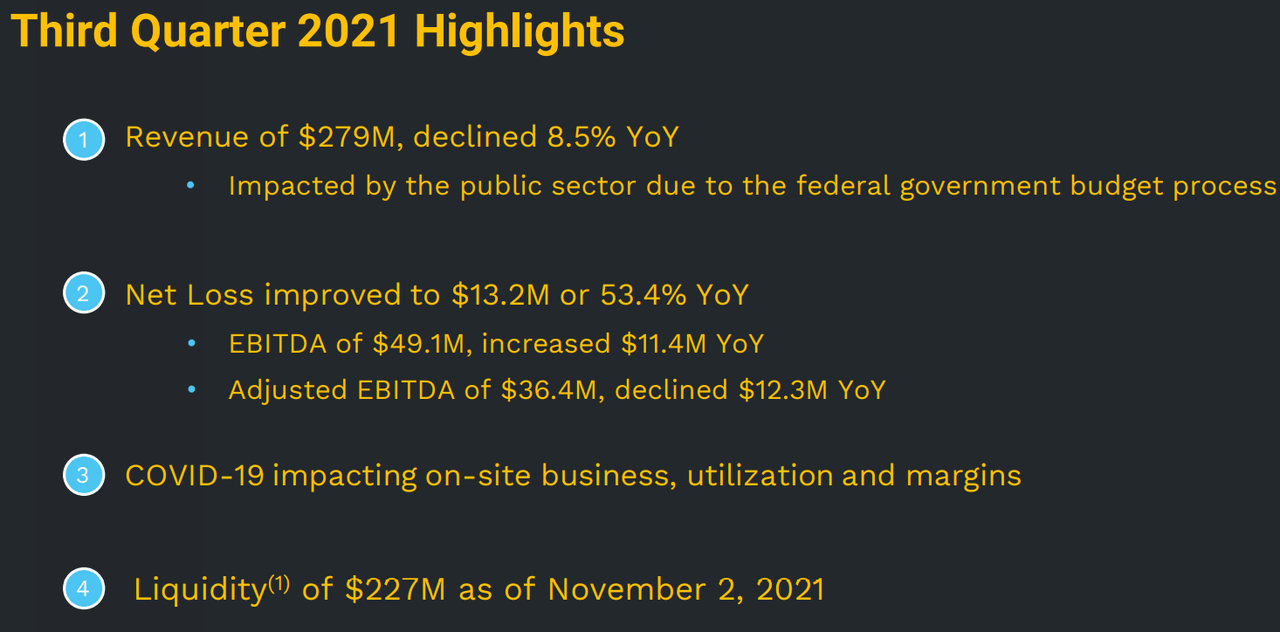

Source: Quarterly Presentation

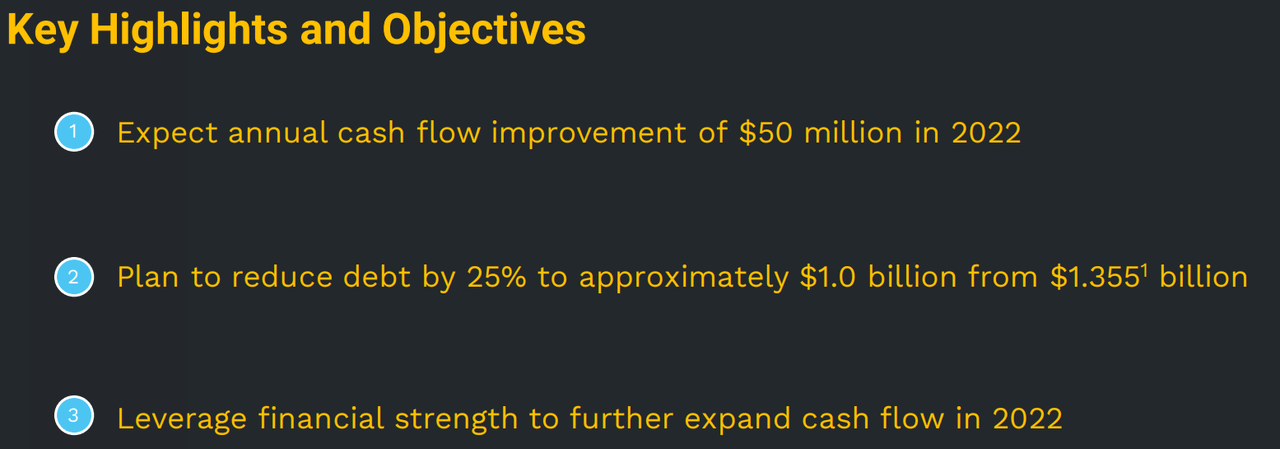

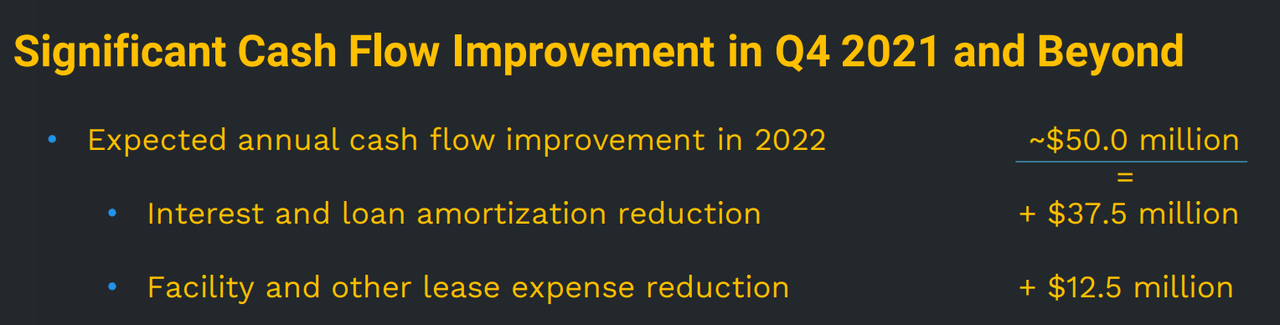

With that about the detrimental decrease in sales, in the last quarterly presentation, management reported great news. The company believes that it can reduce its debt from $1.35 billion to close to $1 billion while at the same time increasing FCF in 2022:

Source: Quarterly Presentation

Source: Quarterly Presentation

That’s not all. According to the last quarterly report, Exela could successfully decrease its debt by $190 million. Besides, it announced that management continues to look for the sale of certain non-core businesses. In my opinion, debt reduction would most likely lead to an increase in the stock price:

As of November 8, 2021, the Company has reduced net debt by $190.0 million under previously announced initiatives. With an objective to increase free cash flows and in order to maintain sufficient liquidity to support profitable growth, the Company is pursuing further reduction in debt and repricing of existing debt. The Company shall continue to pursue the sale of certain non-core businesses that are not central to the Company’s long-term strategic vision and invest in acquisition of businesses that enhance the value proposition. Source: 10-Q

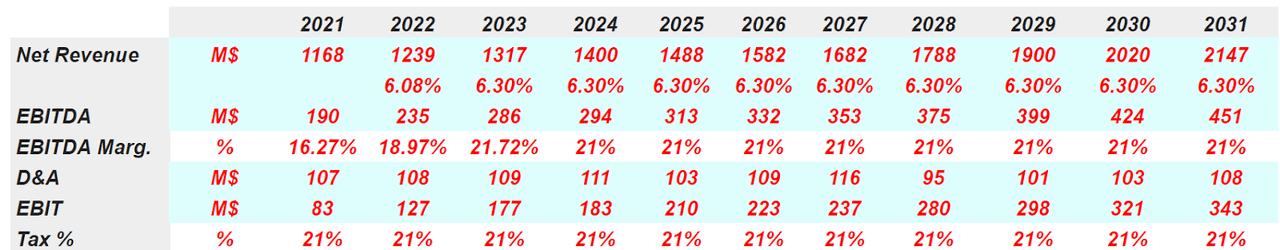

Base Case Scenario With Conservative 6% Sales Growth, And Digital Transformation For Multiple Sectors

With the recent decline in revenue in 2020 and 2021, I would be expecting a reduction in the sales expectations from most financial analysts. I appreciate that the company intends to reduce its debt from $1.3 billion to close to $1 billion. However, with less free cash flow in the near future, Exela’s fair valuation would most likely decline:

Source: Quarterly Presentation

I continue believing that Exela will most likely deliver sales growth if management further expands its solutions and services. Remember that the company is well-positioned to serve many different sectors, which would help Exela collect revenue. In my view, Exela has cash in hand to develop new solutions.

Source: 10-K

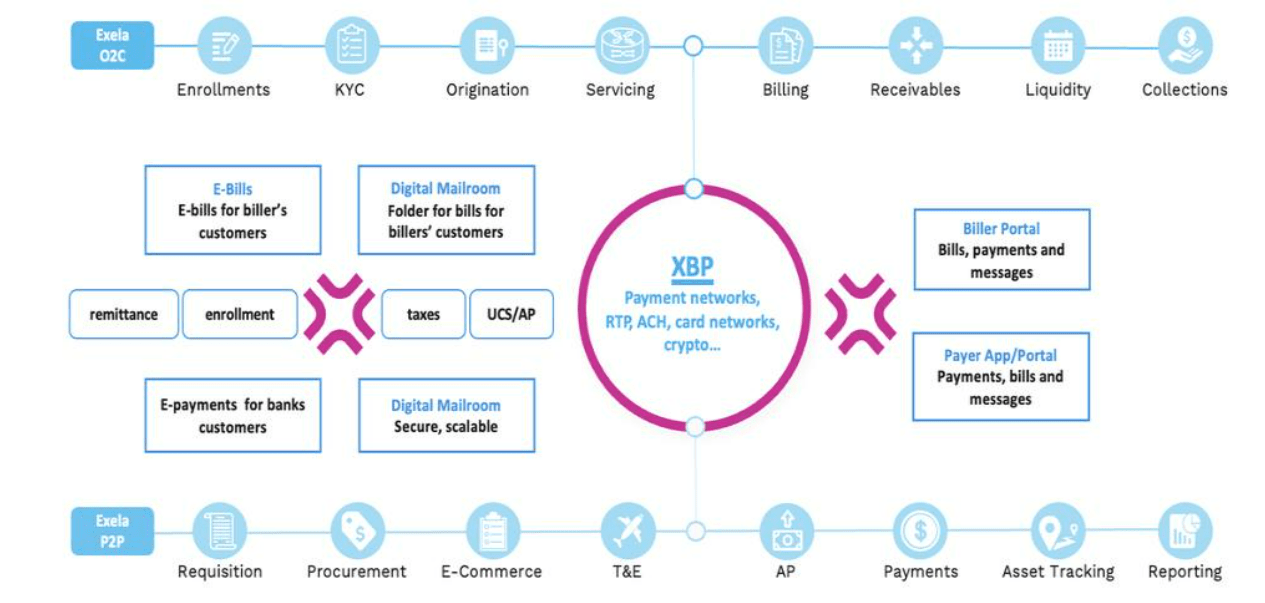

There is another beneficial factor. Exela has the tools that banks and governments need to enable digital transformations. Note that the company’s solutions can link digital data across different customer systems and standards, making the company’s software ideal for finance and accounting solutions. The number of potential clients and the target market for this technology are impressive:

As an enabler of digital roads carrying enriched biller, payer and transaction data, we provide process automation and enhanced services addressing the payments lifecycle from procure to pay (“P2P”) to order to cash (“O2C”). We use our own technology and our global operations to deliver these solutions. Source: 10-K

Source: 10-K

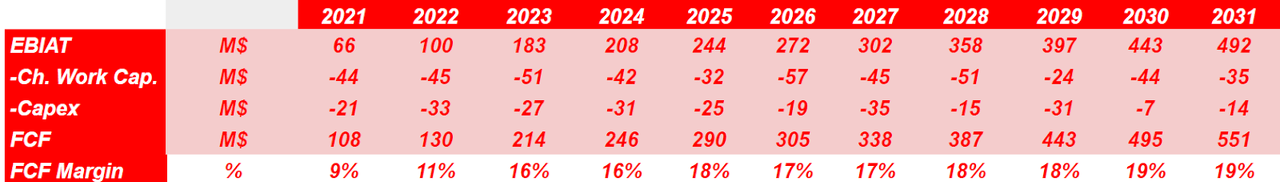

Under this case scenario, I will be using an EBITDA margin of about 19%-21%, which is pretty much what I saw in 2021 and 2020. Other analysts could be even more aggressive, but I will try to make conservative assumptions:

Source: Quarterly Presentation

Source: Monplanet

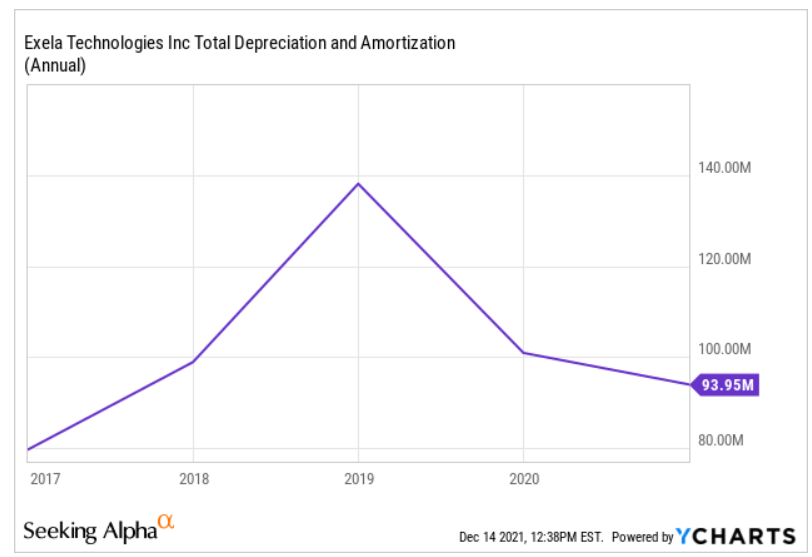

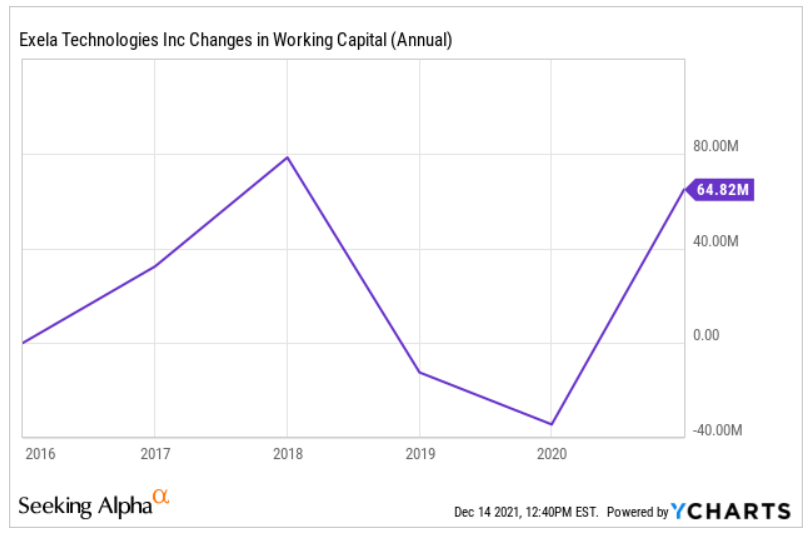

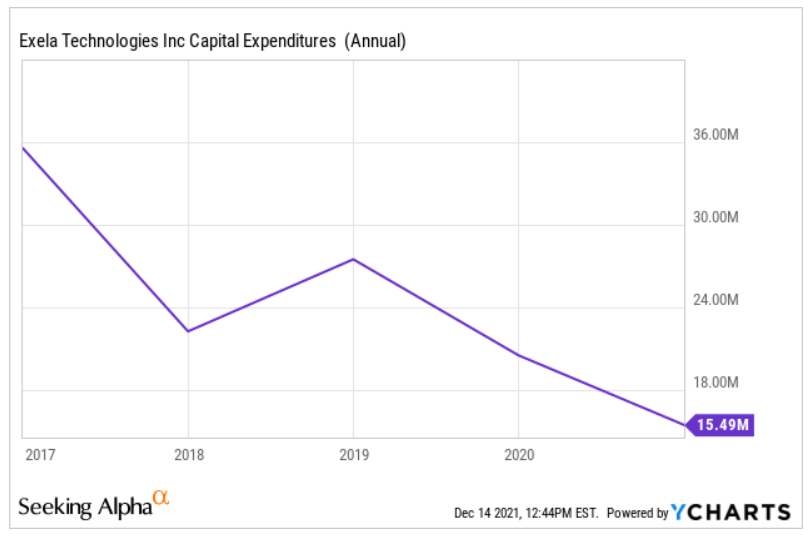

My assumptions regarding D&A, changes in working capital, and capital expenditures were also very close to what the company reported in 2017-2020:

Source: YCharts

Source: YCharts

Source: YCharts

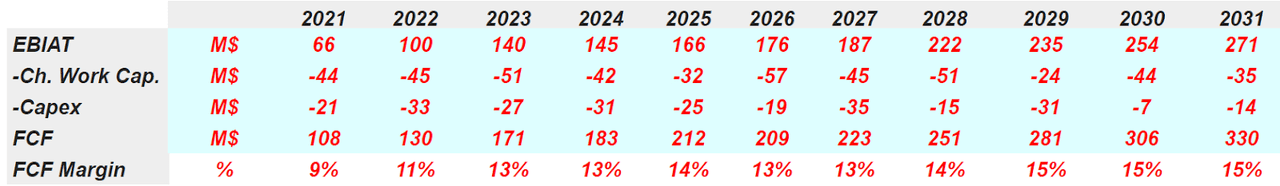

Putting it all together, I used changes in working capital of around $51-$35 million, and capital expenditures of $33-$14 million. The results include free cash flow of $130-$330 million and FCF margin around 11%-15%:

Source: Monplanet

If we assume that Exela successfully reduces its debt to $1 billion, my DCF model would include a net present value of $1.2 billion. Note that I used an exit multiple of 9x FCF, which I believe is quite conservative. Finally, notice that I assumed an increase in the share count, so that it stands at 199 million. With this figure, the stock price would stand at $1.34.

Source: Monplanet

Best Case Scenario With More Robotic Solutions And Growing As The Global Business Process Automation Market Does

In the best-case scenario, I believe that sales growth could be close to double-digit. Take into account that from 2020 to 2026, the global business process automation market is expected to show growth of 13.2% CAGR:

The Global Business Process Automation Market size is expected to reach $19. 4 billion by 2026, rising at a market growth of 13.2% CAGR during the forecast period. Source: Global Business Process Automation Market By Component

With that about my sales growth expectations, I also believe that under certain circumstances, the EBITDA margin could grow significantly. Note that management intends to implement robotic solutions on a per-user month basis. Robots can be an extremely profitable tool because they may be approximately the same for all clients. The company may not customize its robotic solutions. If the company sells enough robots, I would be expecting an EBITDA margin of approximately 25%:

While we have been using robotic solutions as part of our internal processes for years, only recently have we made them available to our customers. Our domain experts and analysts can either use an existing bot, modify one or create new ones using our design studio. Our robotic solutions are available as programmable robots with a rules library for a specific industry or feature, or as an enterprise license or on a per user per month basis. Source: 10-K

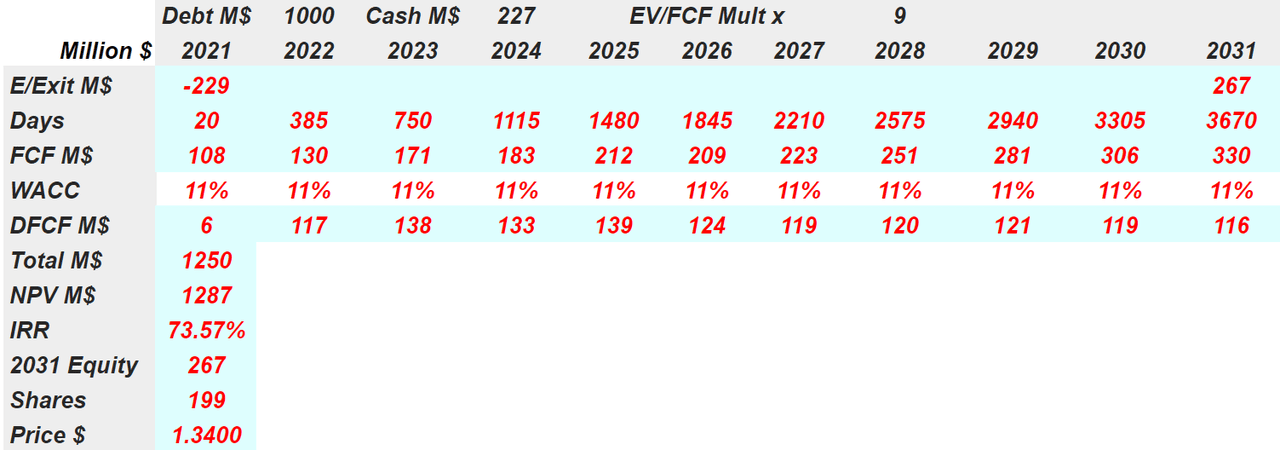

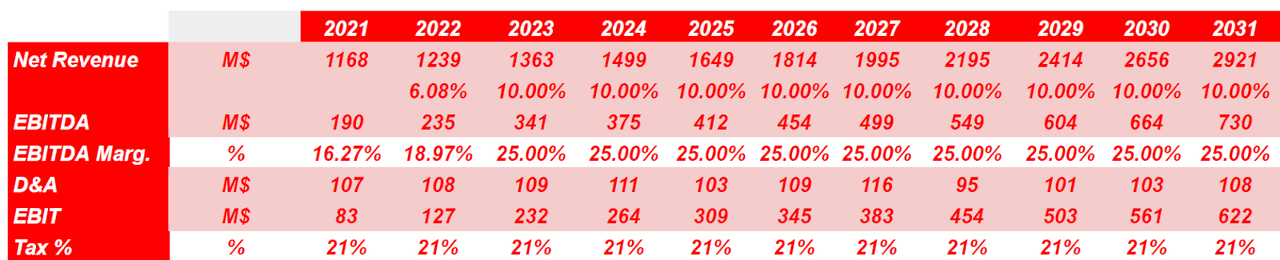

With 10% sales growth, 25% EBITDA margin, and D&A around $105 million, 2031 EBIT would stand at between $550 and $650:

Source: Monplanet

If we assume changes in working capital around $45-$55 million and capital expenditures of $15-$25 million, the FCF would stand at $130-$550 million. Notice that the FCF margin would be close to 20%, which is significantly higher than that in the previous case scenario:

Source: Monplanet

If we assume that the company reduces its debt to $750 million and holds $150 million in cash, I would expect a 2031 market capitalization of $1.5 billion. If we also assume a WACC of 10% and 250 million shares, the net present value would stand at more than $3.15 billion. Finally, the fair price would be equal to $6.05. Under the assumptions included in this case scenario, Exela clearly looks like a buy at its current market price.

Source: Monplanet

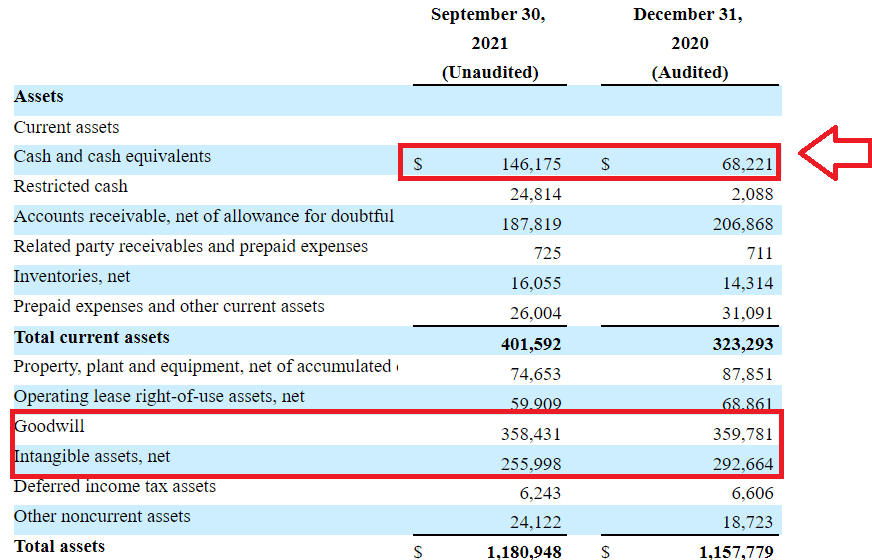

Exela’s Balance Sheet Includes A Large Amount Of Goodwill And Some Cash

I wouldn’t expect a liquidity crisis in Exela as the cash in hand appears to be growing in 2021. As of September 30, 2021, the company reported $146 million in cash, 114% more than that in December 2020. I also believe that the company’s goodwill, which was worth $358 million in September, could be quite a beneficial asset. If Exela has successfully calculated the synergies, shareholders will most likely enjoy an increase in the FCF margins:

Source: 10-Q

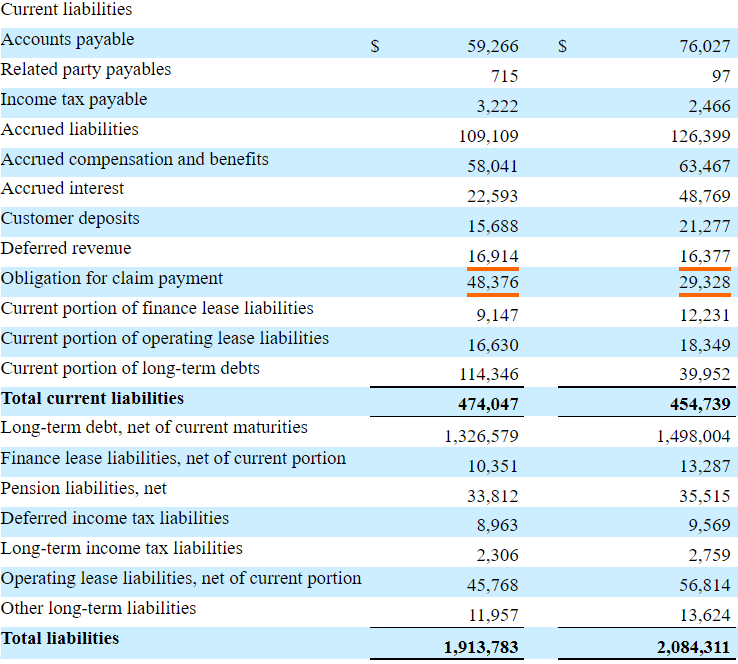

Currently, with $1.3 billion in debt, Exela will look much better once the debt level is reduced to $1 billion. I assumed 2031 FCF of $551 million, so I believe that financial debt of $1 billion is acceptable:

Source: 10-Q

Risks From The Level Of Debt

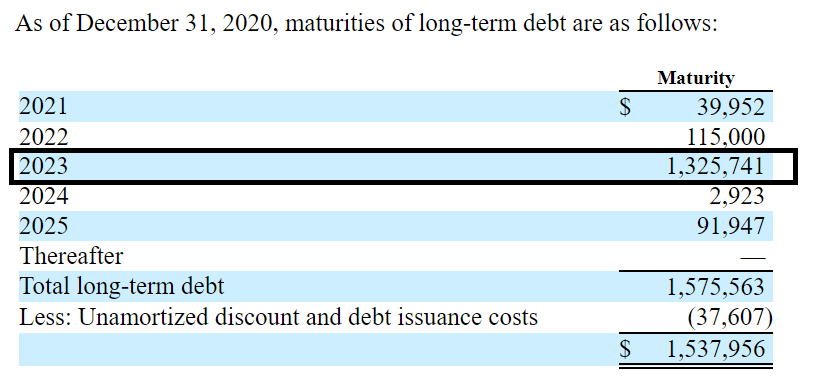

Management is trying to reduce its debt levels. However, it is always good to highlight when Exela will have to pay its debts. According to the annual report, investors don’t have to worry in 2021 and 2022 because Exela will have to pay most of its debt in 2023:

Source: 10-K

With that, the company appears to be dealing with several cases against some of its subsidiaries. If bankers or judges decide to reduce the number of activities that Exela can undertake, sales growth or FCF margins could decline.

On March 26, 2020, the Delaware Court of Chancery entered a judgment against one of our subsidiaries in the amount of $57,698,426 inclusive of costs and interest arising out of the Appraisal Action, which judgment will continue to accrue interest, until paid, at the legal rate, compounded quarterly. In early February 2021, petitioners also filed a motion for a preliminary injunction in the derivative action in which they seek a court order freezing certain property and prohibiting certain transfers and payments by Exela subsidiaries other than SourceHOV, including preventing them from paying their creditors unless the payments are made equally among Exela’s other creditors and toward the Appraisal Action liability. Source: 10-K

My Conclusion: Exela May Be A Suitable Investment For Risk Takers

Given the recent efforts to reduce the level of debt and the FCF expectations, Exela could end up being very profitable if we wait long enough. In my best-case scenario, I obtained a target price of $6.05 with a WACC of 10% and assuming that the company will sell robotic solutions. With that, I believe that holding shares of Exela may be risky. In my view, this is a stock for non-conservative investors because the level of debt is considerable.

Disclosure: I/we have a beneficial long position in the shares of XELA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.