Summary:

- Despite our previous pessimism surrounding Exxon Mobil, we are finally rerating the stock as a Buy here, with the gap between the volatile crude oil prices/elevated stock valuations already closing.

- The management has also convinced us on its well-diversified 2050 Energy Transition Plan, attributed to the recent Pioneer Natural Resources merger and 2030 Lithium targets.

- We believe that OPEC+ may further tighten their production cuts through H1’24, supporting the elevated crude oil prices and the producer’s robust FCF generation.

- Combined with its improving balance sheet, inherent undervaluation, and massive growth prospects, we believe XOM may stay relevant in the energy market through the next few decades.

Liudmila Chernetska

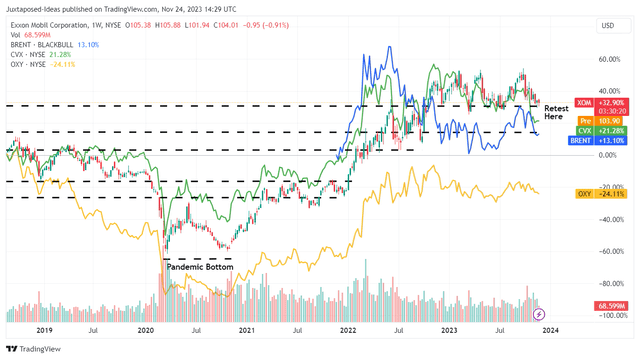

We previously covered Exxon Mobil Corporation (NYSE:XOM) in June 2023, discussing its uncertain prospects due to the widening gap between the declining crude oil prices and its elevated stock prices/ premium stock valuations.

We had believed that there might be more painful corrections ahead, with it remaining to be seen if the crude oil spot prices might remain elevated over pre-pandemic averages, resulting in our Hold rating.

Since then, the XOM stock performance has remained somewhat stable, despite the multiple acquisitions and raised growth prospects through 2050, implying that the gap may be finally closing up.

Combined with the stock’s inherent under valuation at current levels, we are cautiously rerating the stock as a Buy here, with the recent pullback offering opportunistic investors with the chance of adding.

We shall discuss further.

XOM’s Big Oil Investment Thesis Has Improved Drastically

For now, XOM has reported a double miss FQ3’23 earnings result, with revenues of $90.76B (+9.4% QoQ/ -19% YoY) and adj EPS of $2.27 (+17% QoQ/ -48.9% YoY).

Then again, its YTD Free Cash Flow generation of $25.98B remains more than excellent (-44.1% YoY) with margins of 9.9% (-4.7 points YoY), mostly attributed to the management’s intensified YTD capex of $18.6B (+22.3% YoY).

This is compared to it FY2022 peak FCF margins of 14.5% (+1.6 points YoY) and FY20219 margins of 2.1% (-3.7 points YoY).

We believe that XOM’s intensified capex is already bearing results, based on the expanded FQ3’23 production of 3.68M boe/day, with a net production growth of +80K boe/day QoQ and +79K boe/day YoY, driven by Permian and Guyana excluding any impact from divestments/ curtailments.

In addition, we believe that the $59.5B merger with Pioneer Natural Resources (PXD) is highly strategic, since the former holds significant assets in the Midland Basin of West Texas.

The asset has a proven reserve totaling over 2.3B barrels of oil equivalent (as of December 31, 2022) worth approximately $184B, based on the Brent crude oil spot price of $80.

In addition, PXD produces over 700K oil-equivalent barrels per day of production in Q2’23, with it likely to contribute approximately $224M to XOM’s annualized top-line based on a similar assumption.

For context, the merger is well within XOM’s means, attributed to its growing cash/ investments of $32.94B (+11.5% QoQ/ +8.3% YoY) and moderating long-term debts of $34.76B (-7.4% QoQ/ -11.4% YoY) by the latest quarter.

This feat is impressive indeed, since XOM has also retired 244M of its shares since FY2019 thanks to the sustained share repurchases, further underscoring why the PXD deal has been all-stock, with it being highly accretive to XOM’s existing capabilities while preserving cash on its balance sheet.

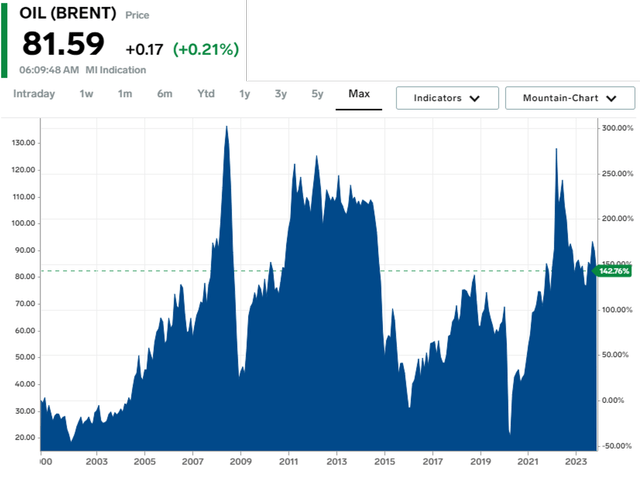

Brent Spot Prices

For now, the Brent crude oil spot prices remain elevated at $81.59 at the time of writing (+12.9% from its 1Y bottom of $71.84) compared to the 2019 averages of $60s.

The EIA still expects Brent to remain higher at $93.24 through 2024, implying that XOM’s conventional top and bottom line prospects remain excellent for the foreseeable future, no matter the slower ramp up of the Low Carbon Solutions segment.

XOM Is Also Making Great Efforts To Diversify To Other Energies

For now, the XOM management continues to expand its well-diversified energy portfolio, with the Smackover formation in southern Arkansas acquired in early 2023 expected to produce sufficient lithium for over 1M electric vehicles annually by 2030, or the equivalent of 87.5K MT annually at the midpoint.

While the amount of lithium used in EV batteries vary according to type and capacity, it is apparent that the current estimate is somewhat conservative, since the area holds the “equivalent of 4 MT of lithium carbonate, sufficient to power 50M EVs.”

While XOM’s capacity may still lag behind the leading lithium producers, we are not overly concerned, since this foray already demonstrates the management’s willingness to ensure its relevance in the electrification industry over the next decade.

For example, the two leading lithium producers are Albemarle Corporation (ALB) and Sociedad Quimica y Minera de Chile S.A. (SQM) comprise 36% of the global lithium production in 2022, with ALB already guiding 600K MT of production by 2030 and SQM at 265K MT by 2025.

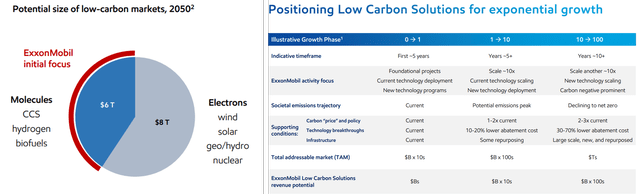

XOM’s Energy Transition Plan

The lithium strategy also builds upon XOM’s energy transition plan across carbon capture, hydrogen, biofuels with an estimated TAM of $6T by 2050. For now, the management has already aggressively guided tens of billions in Low Carbon Solutions revenues over the next ten years.

While the intermediate sum may be somewhat underwhelming compared to XOM’s FY2022 overall revenues of $413.68B, the management already guides a long-term revenue potential of over hundreds of billions in Low Carbon Solutions revenues over the next few decades, likely to match its current oil/ gas portfolios by 2050.

XOM Is Inherently Cheap Here

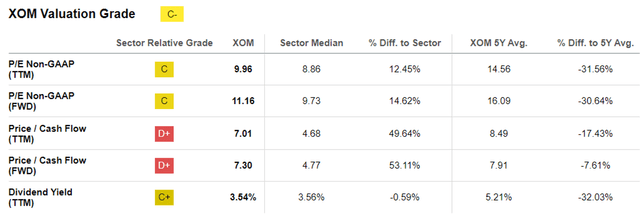

XOM Valuations

Despite these promising developments and the accretive acquisitions, XOM’s FWD P/E valuation of 11.16x and FWD Price/ Cash Flow valuation of 7.30x appears to be impacted compared to its 3Y pre-pandemic mean of 18.37x/ 9x, though improved compared to the sector median of 9.73x/ 4.77x, respectively.

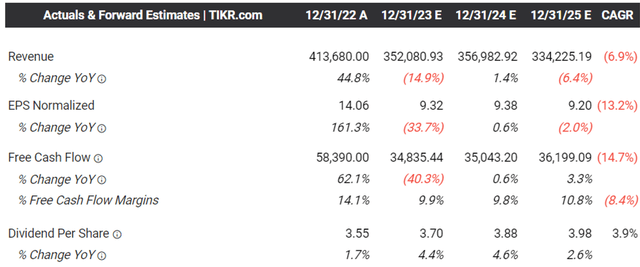

The Consensus Forward Estimates

Perhaps this is attributed to the supposed normalization in XOM’s top and bottom lines at a CAGR of -6.9% and -13.2% through FY2025, compared to its historical CAGR of +10.6% and +34.6% between FY2016 and FY2022, respectively.

In addition, the management has committed up to $25B for its FY2023 capex plans (+10.1% YoY), naturally impacting Free Cash Flow generation on a YoY basis as Brent normalizes from the 2022 peak of $123.07.

However, we believe that the depression observed in XOM’s stock valuations have been overly done since the producer is still expected to generate robust profitability through FY2025, sustaining both its well-diversified growth ambitions and shareholder returns.

XOM’s dividend investment thesis remains safe as well, based on its TTM Interest Coverage of 67.27x and Dividend Coverage Ratio of 2.52x, compared to the sector median of 7.64x/ 2.41x, respectively.

We also expect the management to achieve its FWD Dividend Per Share Growth of +3.56% compared to its 5Y average of +2.64%, thanks to the elevated Brent, further cementing its position as a dividend aristocrat.

So, Is XOM Stock A Buy, Sell, or Hold?

XOM 5Y Stock Price

For now, it is unsurprising that XOM has returned much of its 2022 and 2023 gains, with the stock appearing to retest its critical support levels of $100s as Brent fails to stay above $90s.

Depending on how market sentiments develop moving forward, we may see the stock trade sideways in the near-term if not retrace if Brent falls below $80s.

However, we believe that the upcoming OPEC+ meeting in November 30, 2023 may lead to deeper production cuts through H1’24 to support prices at current levels.

As a result of the expanded oil/gas production capabilities, the growing low carbon pipeline, and likely-well-supported Brent spot prices, we are finally cautiously rating the XOM stock as a Buy, especially after the much needed pullback from its 52 week highs of $120s.

This may be the best time to add one of the oil/gas aristocrats determined to stay relevant in the future of energy market through the next few decades.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.