Summary:

- Headlines spark rumors of a potential invasion on Guyana by Venezuela, impacting Exxon’s investment in the region.

- If an invasion were to occur, it could affect 7% of Exxon’s daily production or 15% of 2027 production.

- Best-case scenario: Exxon maintains business as usual, continuing operations and future projects in the region.

Michael M. Santiago

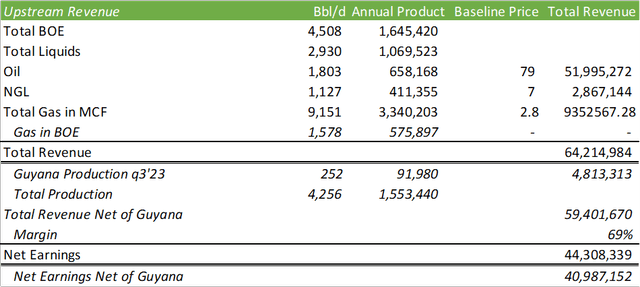

Headlines have sparked rumors of the risk of an invasion on Guyana by Venezuela. Though these headlines still remain as unverified rumors, we must consider the risks involved and weigh the potential results if an invasion were to occur and how it would affect an investment in Exxon (NYSE:XOM). At this time, Exxon’s net production in the region is 252mboe/d, assuming their 45% ownership rights. Exxon anticipates the Stabroek property to produce 1.2mmboe/d by the end of 2027 with 540mboe/d of production attributable to Exxon’s share. Overall, this will affect 7% [6% if considering the Pioneer Natural Resources (PXD) acquisition] of Exxon’s daily production, or 15% (12% with PXD production) of 2027 production if total production is held constant at the q3’23 rate. If an invasion were to occur, there’s no telling what the geopolitical repercussions will look like, whether the US restricts production in the region in relation to Venezuelan sanctions, allows Exxon to produce with limited growth, or allows business as usual. Given that this still remains just a rumor, I provide XOM a BUY recommendation with a price target of $107.55/share.

Note: models and figures include Pioneer Natural Resources

Scenario Analysis

Worst-Case Scenario

Let’s get the absolute worst-case scenario out of the way first. With the assumption that Venezuela invades Guyana with the situation treated in similar form to their Russian assets, this 11Bboe (4.95Bboe accounting for Exxon’s 45% interest) Guyana asset will be written down to zero and production will be transferred to the state oil company, Petroleos de Venezuela (“PDVSA”). Using Exxon’s proved reserves from their FY22 10-K, this accounts for 28% of their total 17.7Bboe proved reserves. With daily production of 252mboe/d and assuming an average price per barrel for FY24 of $79/bbl, we can expect Exxon to lose $4.8b in revenue and $3.3b in total net earnings. This accounts for 7% of my projected FY24 upstream net earnings. On a total corporate basis, this will reduce the net margin from 17% to 16%.

Best Case Scenario

Best case scenario, Exxon gets to maintain business as usual and continue to pump 252mboe/d. Using an average $79 brent based on FY24 oil futures, Exxon should be able to continue operations, bring online Payara’s 220mboe/d production, and continue with the 250mboe/d Yellowtail project in 2025.

All price assumptions are based on the CME Brent and natural gas futures.

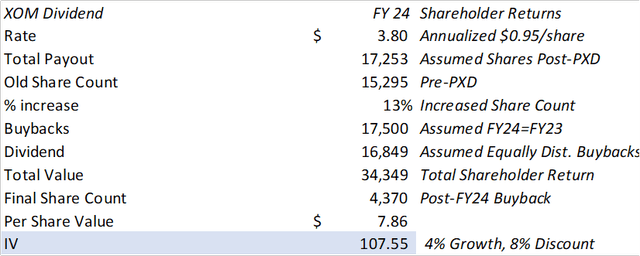

As Exxon should continue to generate excess cash flow with or without the Guyana assets, I believe it would be more prudent to value Exxon based on shareholder value, such as dividends and share buybacks. Using the DDM model based on total shareholder value, I value XOM shares at $107.55/share and provide XOM a BUY recommendation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.