Thermo Fisher Scientific: I Am Still Waiting For An Attractive Buying Opportunity.

Summary:

- Thermo Fisher Scientific Inc. has established itself as a leader in their industry.

- Their revenue, margins, and returns are still experiencing a small amount of post-pandemic renormalization.

- With a calculated a PEGY of 2.979x, and an Inverted PEGY of 0.3357x, it appears to be currently overvalued.

- I presently rate TMO a Hold.

jetcityimage

Thesis

With the Fed diligently working to destroy the wealth effect and the bond market inverted for months now, I have been watching for upcoming opportunities to buy good companies at attractive valuations.

Thermo Fisher Scientific Inc. (NYSE:TMO) has established itself as a leader in their industry. Because I believe they have significant moats, they are on a short list of companies that I would love to purchase if they ever go on sale. In my last article about Thermo Fisher, I expressed my belief that elevated rates were likely to continue slowing the economy while pushing valuations lower. The share price has decreased somewhat, but not enough yet for me to consider it attractive enough. It experienced a bottom in late October, but it may experience an even deeper one in the future. While it is possible I missed the best buying opportunity we will be presented with for some time, I believe the more attractive buying opportunity I was anticipating may still be approaching. After looking over their present financials and valuation, I currently rate Thermo Fisher as a Hold.

Company Background

Thermo Fisher Scientific Inc. is a producer of medical equipment, analytical instruments, reagents and consumables, and software services. They were formed as a result of a 2006 merger between Thermo Electron Corporation and Fisher Scientific International, Inc. Their headquarters is located in Waltham, Massachusetts.

Long-Term Trends

The global scientific instrument market is projected to have a CAGR of 4.99% until 2028. Analytical instrumentation is expected to experience a CAGR of 4% through 2028. Medical devices are expected to have a CAGR of 3% until 2028. The molecular biology enzymes, kits, and reagents market has a projected CAGR of 17.8% through 2028. The life science software market is projected to experience a CAGR of 8.1% until 2027.

When the pandemic broke out, the company was able to increase its output to match the elevated demand. Their situation has since renormalized.

Guidance

Their most recent earnings call revealed that the company is in the middle of a significant amount of M&A activity. This company has a long history of meeting the ever changing demands of the industries it services by folding other companies into its umbrella of capability. Typically, innovation comes with significant R&D costs, so taking this approach has served the company well. I am only going to highlight the portions of the earnings call that I feel are interesting, so I encourage investors to go read it in its entirety.

Because of the state of the global macro economy, they have adjusted their growth projections for core market growth from 0-2%, to slightly negative.

TMO Guidance 1 (Q3 2023 Earnings Call Transcript)

They have adjusted their expectations and are projecting their revenue to come in around $42.7B, and their adjusted EPS to end up around $21.50.

TMO Guidance 2 (Q3 2023 Earnings Call Transcript)

An overview of their segments reveals that most of them are stable except for their Diagnostics and Healthcare segment which is still experiencing the effects of post-pandemic normalization. Pharma and Biotech growth declined by 1%. Academic and Government grew by high single digits. Industrial and Applied was stable. Diagnostics and Healthcare was down about 20% compared to four quarters ago.

TMO Guidance 3 (Q3 2023 Earnings Call Transcript)

They recently launched Astral, which they expect will find use in the field of protein discovery.

TMO Guidance 4 (Q3 Earnings Call Transcript)

They launched the EXENT Solution in Europe, also related to protein diagnostics.

TMO Guidance 5 (Q3 Earnings Call Transcript)

They introduced the Gibco CTS Detachable Dynabeads for cell therapy. They also launched Thermo Scientific Hydro Bio Plasma focused ion beam for high-resolution imaging.

TMO Guidance 6 (Q3 Earnings Call Transcript)

They have completed an expansion at their facility located in St. Luis. They will now be manufacturing DynaDrive bioreactors.

TMO Guidance 7 (Q3 Earnings Call Transcript)

They also opened a new facility on Ohio to produce kits for clinical trials.

TMO Guidance 8 (Q3 Earnings Call Transcript)

They completed the acquisition of CorEvitas.

TMO Guidance 9 (Q3 Earnings Call Transcript)

After the end of the quarter, they announced an agreement to acquire Olink.

TMO Guidance 10 (Q3 Earnings Call Transcripts)

They reaffirm their more aggressive target for lowering their carbon output. It was shifted from a 30% reduction to a 50% reduction.

TMO Guidance 11 (Q3 Earnings Call Transcript)

They believe that although they expect for demand to drop another 1-2% in 2024, they can still achieve 1% growth. The implication here is that they expect to capture additional market share.

They expect most of the growth to come in the second half of 2024, and for total revenue to be very similar to 2023.

TMO Guidance 12 (Q3 Earnings Call transcript)

And lastly, they expect to be able to buyback roughly $3B in shares in 2024, and for this to mitigate their projected tax increase. This is how they expect to be able to achieve their expected 2024 EPS of $21.75.

TMO Guidance 13 (Q3 Earnings Call Transcript)

Annual Financials

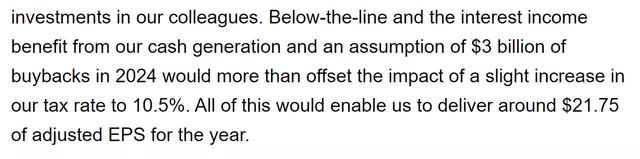

The company has grown their revenue significantly over the last decade. In 2013 they had an annual revenue of $13,090.3M, by 2022 that had grown to $44,915M; this represents a total increase of 243.12% at an average annual rate of 27.01%.

TMO Annual Revenue (By Author)

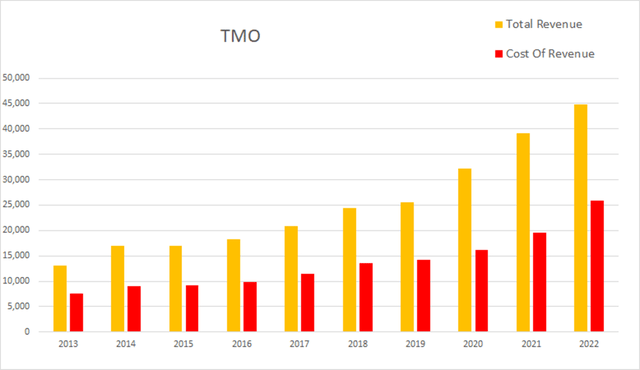

Their margins experienced a significant expansion as a result of the pandemic, but have been in the process of renormalizing since then. As of the most recent annual report, gross margins were 42.30%, EBITDA margins were 26.65%, operating margins were 19.12%, and net margins were 15.47%.

TMO Annual Margins (By Author)

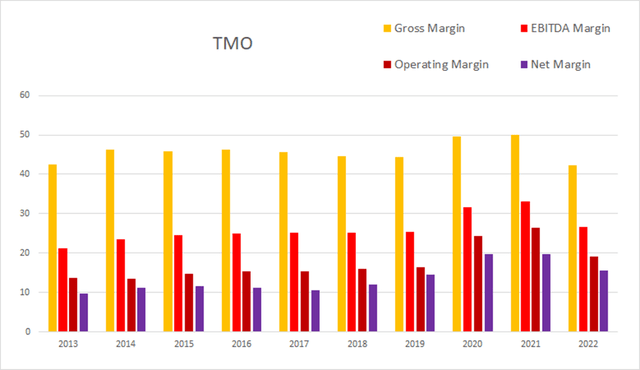

Total common shares outstanding was at 362M in 2013; by the end of 2022 that rose to 390.5M. This represents a 7.87% increase in share count, which comes out to an average annual rate of 0.87%. Over that same time period operating income rose from $1,789.4M to $8,587M, a 379.88% total increase, or an average rate of 42.21%. Their dilution has been accretive to income.

TMO Annual Share Count vs. Cash vs. Income (By Author)

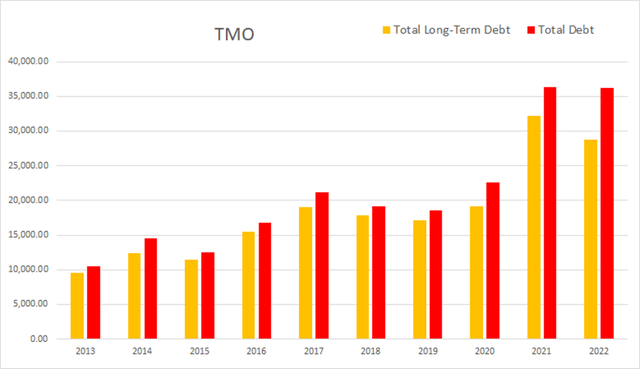

They have taken on additional debt over the last decade. As of the 2022 annual report, they had -$454M in net interest expense, total debt was $36,158M, and long-term debt was $28,795M. Considering their 2022 operating income of $8,587M, they are left with a debt to operating income ratio of 3.35x, so this debt still appears to be manageable.

TMO Annual Debt (By Author)

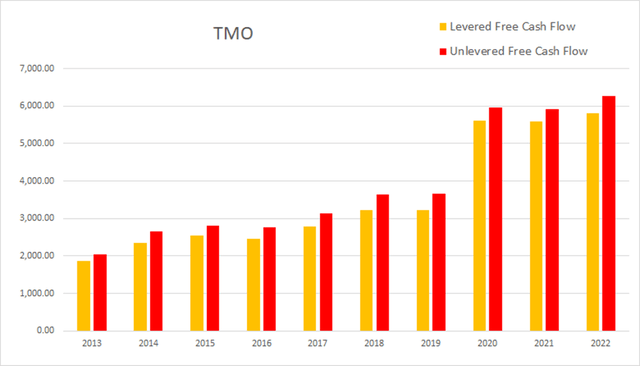

While their margins have contracted since the pandemic wound down, their cash flow has maintained its elevated levels. As of this most recent annual report, cash and equivalents was $8,524M, operating income was $8,587M, EBITDA was $11,968M, net income was $6,950M, unlevered free cash flow was $6,268.9M, and levered free cash flow was $5,815.1M.

TMO Annual Cash Flow (By Author)

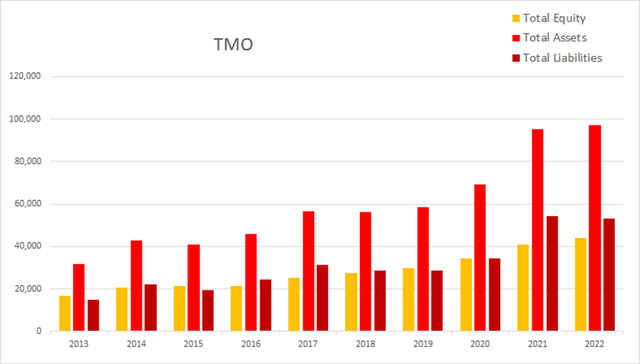

Their total equity has been increasing at a fairly steady rate.

TMO Annual Equity (By Author)

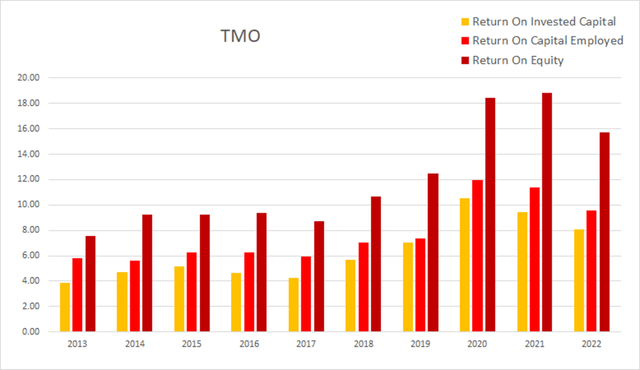

Similar to their margins, their annual returns have been renormalizing, but are still above pre-pandemic levels. As of the most recent annual report ROIC was 8.07%, ROCE was 9.56%, and ROE was at 15.74%.

TMO Annual Returns (By Author)

Quarterly Financials

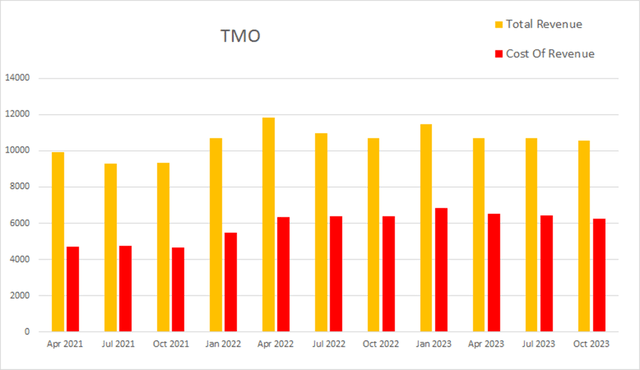

Their quarterly financials are showing that although their revenue has risen significantly over the last decade, it has actually been dropping since its peak in April 2022. Eight quarters ago Thermo Fisher had a quarterly revenue of $9,330M. Four quarters ago that had risen to $10,677M. By this most recent quarter that had ended up at $10,574M. This represents a total two-year increase of 13.33% at an average quarterly rate of 1.67%.

TMO Quarterly Revenue (By Author)

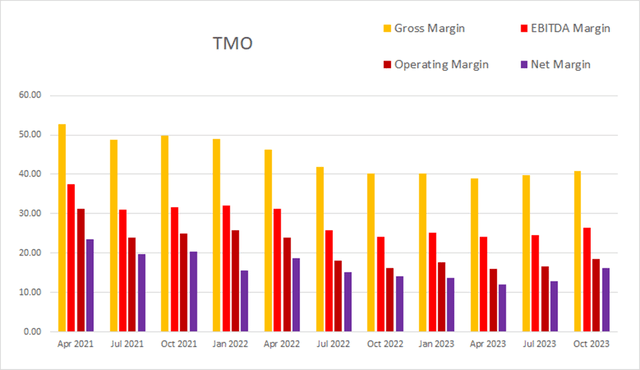

The gross margin contraction that showed up on their annual chart shows up more clearly here. They have been fairly stable since October 2022. As of the most recent quarter gross margins were 40.86%, EBITDA margins were 26.50%, operating margins were 18.43%, and net margins were at 16.22%.

TMO Quarterly Margins (By Author)

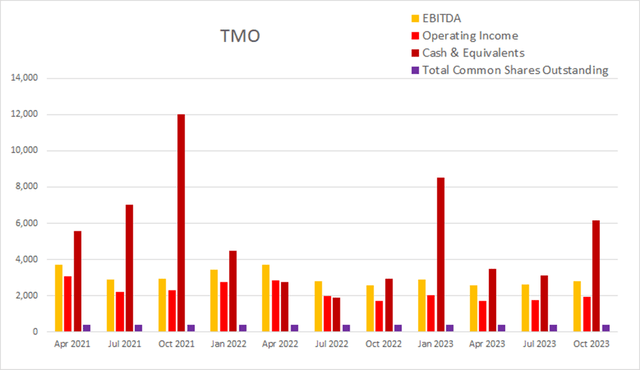

They have been buying back shares. The sum of their last eight quarters of buybacks comes to 1.94%; over the last four quarters this comes to 1.48%.

TMO Quarterly Share Count vs. Cash vs. Income (By Author)

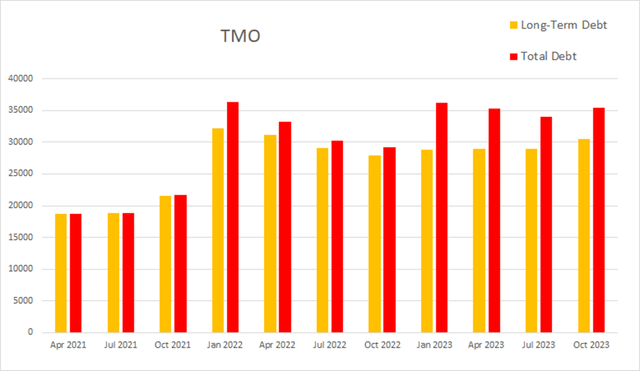

Their long-term debt reached a peak in early 2022. It then fell into a low in late 2022, but has been rising since then. The most recent quarter, Thermo Fisher had -$113M in net interest expense, total debt was at $35,436M, and long-term debt was at $30,441M.

TMO Quarterly Debt (By Author)

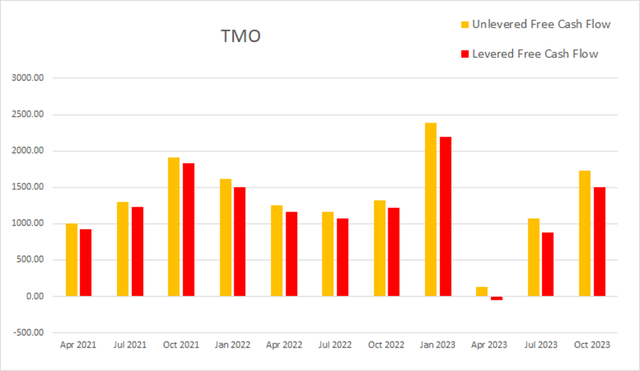

As of the most recent earnings report, cash and equivalents were $6,151M, quarterly operating income was $1,949M, EBITDA was $2,802M, net income was $1,715M, unlevered free cash flow was $1725.1M, and levered free cash flow was $1,500.8M.

TMO Quarterly Cash Flow (By Author)

Total equity has been fairly stable over the last 8 quarters.

TMO Quarterly Equity (By Author)

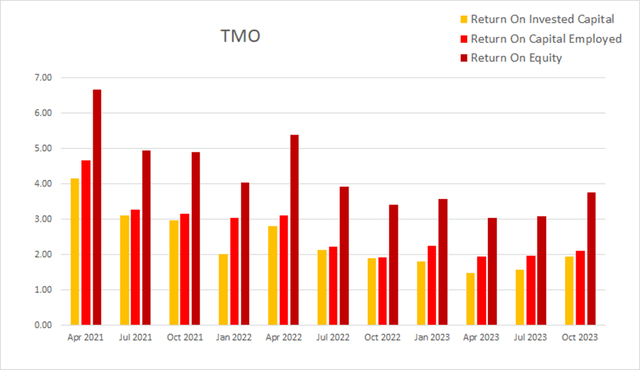

Their quarterly returns are clearly showing their returns renormalizing as the pandemic wound down. As of the most recent earnings report ROIC was 1.95%, ROCE was 2.12%, and ROE was 3.77%.

TMO Quarterly Returns (By Author)

Valuation

As of December 1st, 2023, Thermo Fisher had a market capitalization of $191.55B and was trading for $495.98 per share as I write this while the markets are still open. Using their forward P/E of 31.43x, their EPS Long-Term CAGR of 10.27%, and their forward Yield of 0.28%, I calculated a PEGY of 2.979x and an Inverted PEGY of 0.3357x. This implies that the intrinsic value is currently around $166.50 per share.

TMO Valuation (Seeking Alpha)

Risks

Thermo Fisher is diversified enough that if any one of the sectors it serves were to experience a slowdown, it is unlikely to cause severe problems for the company. This can be seen as the pandemic relates revenue has fallen significantly as it renormalizes, yet overall revenue has only fallen 11.8% since its peak in April 2022.

The potential recession which may materialize could end up deeper or last longer than I am currently expecting. While it is becoming clear that a severe recession is unlikely, the possibility of a shallow one is still real.

Catalysts

While the likelihood of another pandemic happening is low, it will remain a potential catalyst for the health care sector. Our overall interconnectedness through the global air travel network means the threat of another pandemic is always a possibility. Thermo Fisher has already shown that it is able to pivot to meet the needs of such a situation, so future events are likely to cause another significant rise in demand for their products.

Conclusions

Overall, this appears to be a solid company with a bright future. While they currently appear overvalued according to my PEGY estimates, good companies often are. It is possible I may never be presented with an attractive buying opportunity and the dip in late October may have been the best opportunity we are presented with for many years. With situations like this, I constantly have to remind myself that between just the NYSE and the Nasdaq, there are almost 6000 companies to choose from. If TMO never falls into an attractive price, I will just continue buying other assets.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.