Summary:

- My caution on Exxon Mobil in April was timed to perfection, as XOM stock has underperformed the S&P 500 since then.

- Energy investors were too optimistic about oil prices staying higher for longer back then.

- With oil prices potentially bottoming out, XOM’s recovery thesis should be bolstered.

- Exxon’s closure of Pioneer Natural Resources should bolster the visibility of improved production capacity, improving its earnings outlook.

- I argue why XOM’s bottom is increasingly close, suggesting it’s time to consider increasing exposure.

JHVEPhoto

I urged Exxon Mobil Corporation (NYSE:XOM) investors to be cautious about XOM’s surge toward its April 2024 highs. In my previous XOM article in early April, I highlighted why XOM stock’s rally was too fast for its own good. I have confidence in Exxon’s fundamentally strong business model as a leading oil major. However, I assessed that the market was too optimistic about oil prices staying higher for longer, raising the risks of impact from unforeseen downside volatility.

My caution on XOM panned out over the past two months, as XOM underperformed the S&P 500 (SPX) (SPY) significantly. Energy investors likely rotated out as they reassessed the headwinds linked to OPEC+’s decision on production capacity. As a reminder, OPEC+ extended its production cuts but telegraphed the possibility of gradually bringing production back into the market. As a result, it led to a selloff in crude oil futures (CL1:COM) (CO1:COM). However, the downside seems to have faded off, as crude oil futures found buying support in the same week. CL1’s price action then followed through with a bullish reversal last week, suggesting we could approach the start of a potential recovery in underlying oil futures.

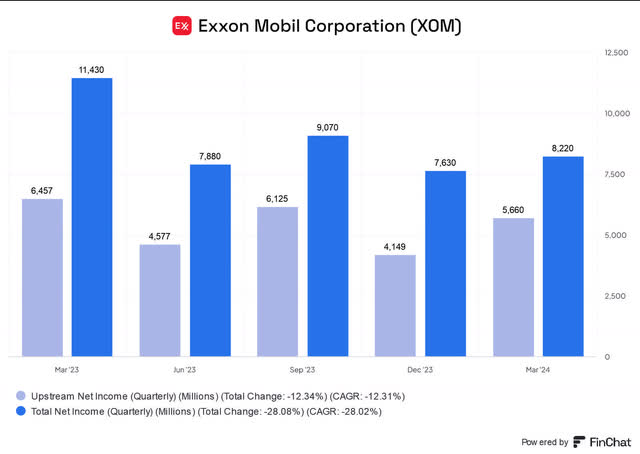

Exxon Mobil upstream net income (FinChat)

Consequently, it should provide more confidence for investors anticipating a growth inflection in Exxon’s Upstream earnings. As a reminder, Exxon’s Upstream earnings took a significant hit in Q1. Lower realizations impacted the YoY comparisons, particularly due to weakness in natural gas price realizations (fell 32% YoY). Given the sizeable earnings exposure of Upstream to Exxon’s net income (as seen in the chart above), investors need to pay attention to Exxon’s growth opportunities to expand capacity to boost earnings.

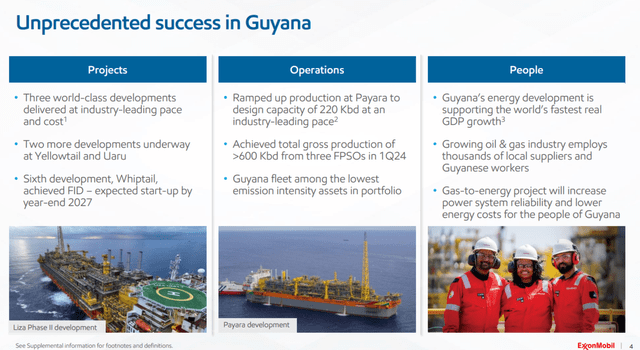

Exxon Mobil developments (Exxon filings)

As a result, Exxon Mobil will likely need to rely on its high-quality assets in Guyana and Exxon’s integration with Pioneer Natural Resources to drive growth in the near to medium term. As a reminder, Exxon is confident that its Permian production will rise from 1.3M boe per day in 2023 to 2M boe per day in 2027, lifting its production outlook. With the high-margin Guyana portfolio, Exxon is well-positioned to capitalize on a capacity-driven growth opportunity despite facing near-term oil price volatility.

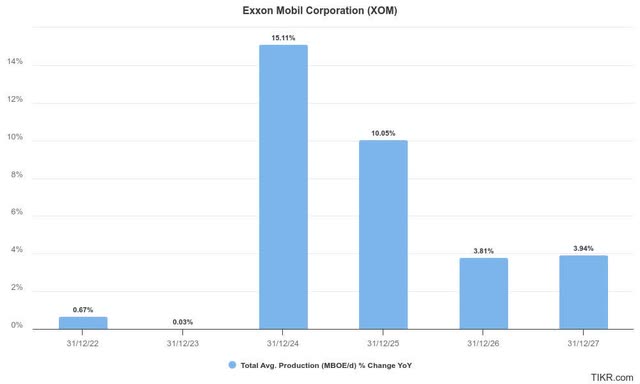

Exxon total average production change % (Mboe per day) (TIKR)

As a result, we should anticipate a surge in production levels in 2024 before tapering off from 2025 as growth potentially normalizes. Therefore, investors must carefully assess the synergies between Exxon and Pioneer as XOM seeks to unlock cost efficiencies following the closure of its acquisition. Wall Street highlighted the need for investors to be cautious, as XOM could underperform “due to high valuation and “digestion” after the $59.5 billion Pioneer deal.” As a result, near-term execution risks could lower the visibility of Exxon’s Upstream earnings profile, worsened by the uncertainties in OPEC+’s outlook.

Furthermore, the debate between OPEC+ and the IEA could heighten the murky outlook for long-term investors to assess the energy sector’s structural headwinds. It’s no secret that the secular growth of renewable energy is expected to affect investor sentiments about the long-term prospects of Exxon and its fossil fuel peers. The near-term growth prospects in EV and renewable energy projects have decelerated, bringing some respite to the energy sector leaders. However, the increasingly critical role played by China’s solar leaders suggests China is seeking to reduce its reliance on importing energy due to geopolitical headwinds. As a result, I assess that the long-term outlook on XOM and its peers is still shrouded in substantial uncertainties, suggesting a sustained valuation re-rating could be challenging.

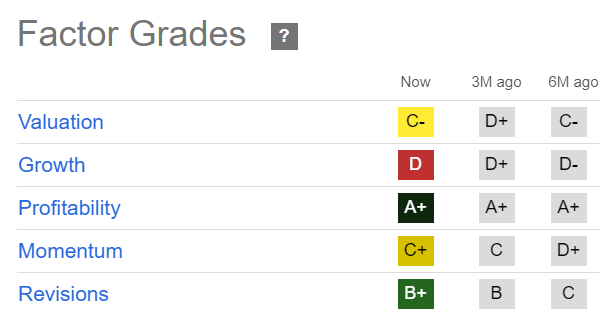

XOM Quant Grades (Seeking Alpha)

However, it’s arguable that XOM’s valuation has reflected the market’s pessimism on the energy sector’s (XLE) long-term outlook. XOM is rated with a “C-” valuation grade, a marked improvement from the “D+” grade three months ago.

Furthermore, XOM’s forward adjusted EBITDA multiple of 5.7x is aligned with its sector median. In other words, I assess that XOM doesn’t seem to be valued expensively, even when considering its tepid “D” growth profile. As a result, more robust buying sentiments could return as dip-buyers look to partake in XOM’s near- and medium-term capacity upgrade.

Moreover, XOM’s forward dividend yield of 3.5% should provide valuation support (vs. the sector median of 4%). Notwithstanding my optimism, I have not assessed XOM to be undervalued. Therefore, more intense downside volatility observed in crude oil futures could exacerbate negative investor sentiments on XOM. However, that isn’t my base case, as I highlighted a bottoming signal in crude oil futures, bolstering my thesis on XOM.

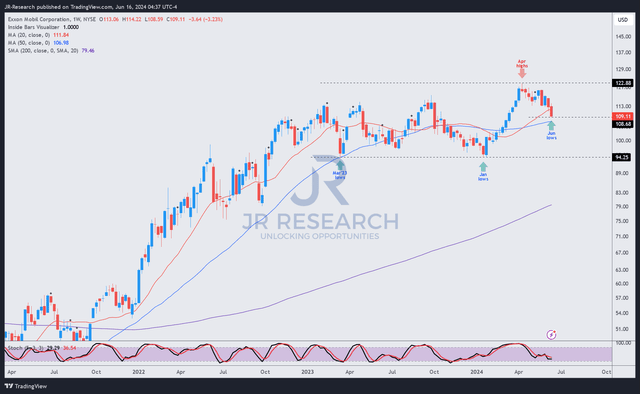

XOM price chart (weekly, medium-term, adjusted for dividends) (TradingView)

I must emphasize that I’ve not gleaned a bullish reversal signal based on XOM’s price action. Therefore, potential buyers must anticipate near-term weakness, suggesting it could be wise to add progressively.

However, XOM is assessed to have robust buying support above the $95 level. Notwithstanding my optimism, that level is more than 12% below XOM’s last close. Therefore, I find it unlikely for XOM to revisit those levels in the near term unless we have a significant economic downturn causing oil prices to collapse.

Otherwise, I observed that XOM has the potential to bottom above the $105 level, just under 4% below the current levels. As a result, I assess that the risk/reward has improved markedly since my previous cautious rating.

Rating: Upgrade to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!