Summary:

- Exxon Mobil continues to defy gravity even as markets rolled over in 2022.

- Although the dividend is relatively safe, there are better alternatives for those looking for passive income streams.

- I remain optimistic on Exxon Mobil’s long-term success, however, shareholders should be prepared for more turbulence ahead.

muhammet sager

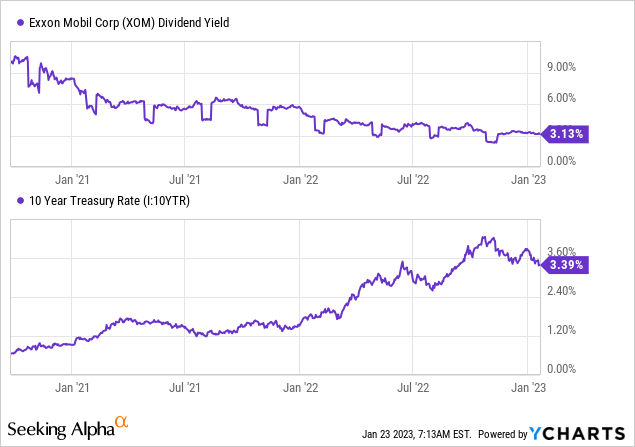

After falling out of the Dow Jones Industrial Average index in 2020 and being labelled as a dinosaur headed for extinction, Exxon Mobil Corporation (NYSE:XOM) is back with a vengeance.

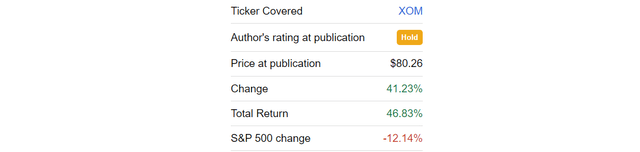

The company is back within the Top 10 most valuable companies within the S&P 500 and has returned nearly 270% since my controversial thought piece back in September of 2020.

During the same period, the S&P 500 returned almost 25% which is still a decent return for a period of roughly two and a half years. The new entrant into the Dow Jones that replaced Exxon, however, did not fare that well. Even at the time, it was plain to see that Salesforce (CRM) would most likely underperform the market, while Exxon was near its bottom.

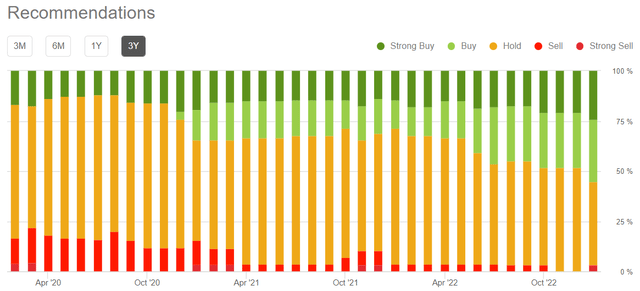

Having said that, Exxon now trades much closer to its fair value and thus future expected returns are far lower than they were back in 2020. The sentiment towards the company, however, has now improved considerably with more than 50% of Wall Street Analysts’ rating it a ‘buy’ and only one having a ‘sell’ rating.

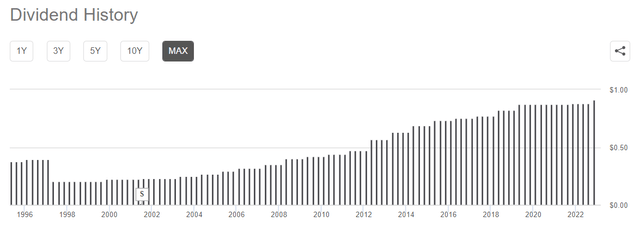

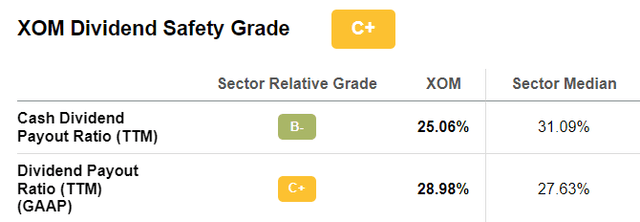

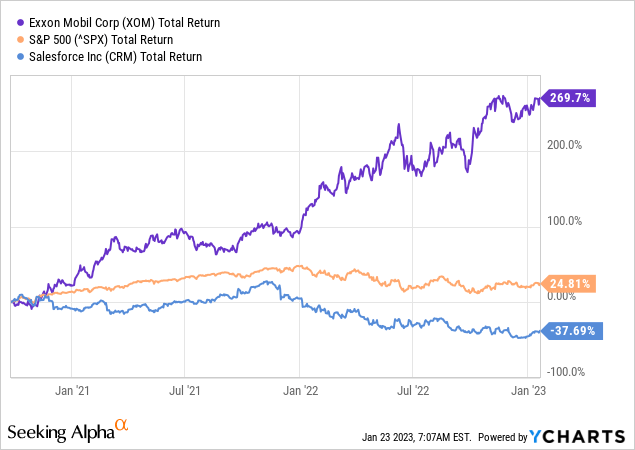

In addition to the positive narrative that has developed by market commentators, most of which were utterly wrong on XOM only two years ago, Exxon Mobil offers a relatively high dividend yield of 3.2% and a long track-record of growing dividend payments (see below).

As such, XOM has become very attractive for dividend investors looking to protect their passive income stream from the raging inflation.

Exxon Mobil As A Dividend Aristocrat Stock

With a long history of dividend payments, large size, high dividend yield and relatively low dividend payout, Exxon has retained its status as a dividend aristocrat even through the recently challenging headwinds for the sector.

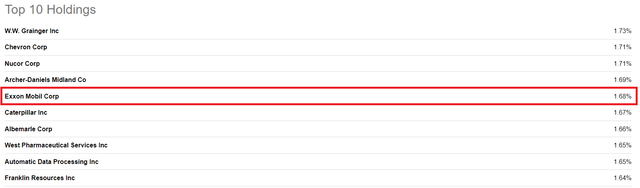

That is why Exxon is now one of the largest holdings of the ProShares S&P 500 Dividend Aristocrats ETF (NOBL), which is focusing exclusively on high-quality S&P 500 dividend aristocrats which have managed to grow their dividends for more than 25 years.

However, the dividend yield gap between XOM and NOBL has narrowed down significantly in recent years and is now at its lowest level ever.

Although Exxon’s dividend yield is still higher, there is a strong case to be made for sticking to NOBL when it comes to dividends. The reason being that NOBL significantly reduces idiosyncratic risks for shareholders through diversification.

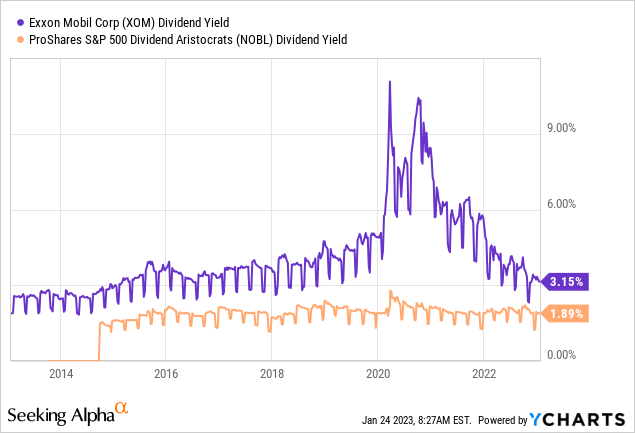

The gap between Exxon Mobil’s dividend yield and the yield on U.S. government bonds has also reversed in a matter of just two years. Back in 2020, Exxon’s dividend yield stood at nearly double digits, while the yield on Treasuries was below 1%. At the moment, however, U.S. Treasuries appear as the better choice between the two when considering yields alone.

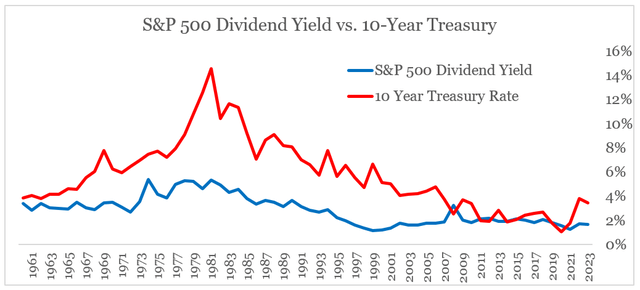

The same holds true for the equity market more broadly as Treasury yields are now much higher than the S&P 500 dividend yield (see below).

prepared by the author, using data from multpl.com

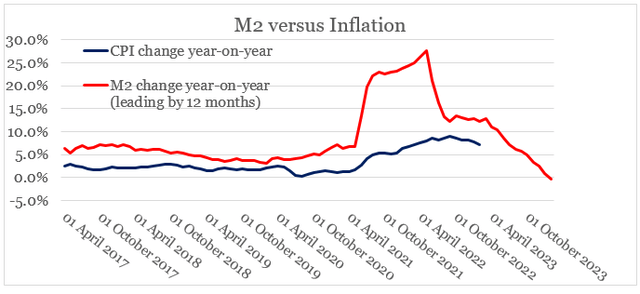

The gap between the two has not been as wide since the Global Financial Crisis of 2007-08 which favors fixed income over equities. Having said that, should inflation continue to accelerate, equities such as Exxon Mobil will offer significant downside protection. However, as I recently showed, inflationary pressures should most likely be dissipating in the short-run.

prepared by the author, using data from FRED

Is Exxon A Good Long-Term Investment?

My initial investment thesis for Exxon relied on three main pillars. Firstly, was the overall positioning of the Energy sector, which is facing both structural changes and major geopolitical shifts. Secondly, it was Exxon Mobil’s superior capital allocation when compared to most of its direct peers. And lastly, it was the extremely conservative valuation back in 2020.

The first and the second tailwinds have not gone away, but in terms of valuation Exxon Mobil no longer trades at a significant discount. That is why, back in early 2022 I turned a bit more cautious, even though I still believe in the long-term success of the business.

Since then Exxon’s share price not only remained resilient as the market tanked in 2022, but in the meantime XOM delivered nearly 50% in returns.

Nevertheless, I am still advocating for caution over the short to medium term due to investor sentiment being able to overshoot both on the downside (as it was the case in 2020) and on the upside when the narrative becomes too optimistic.

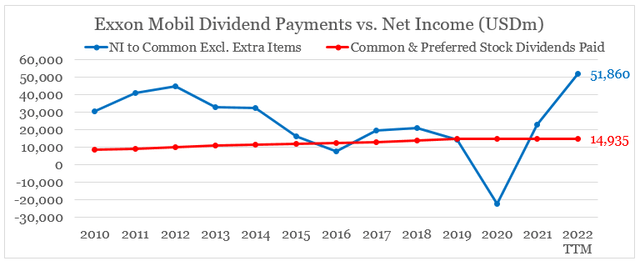

In terms of dividend growth going forward, I am also cautious. Although the skyrocketing net income figure in 2022 has resulted in a very strong dividend coverage, investors should always keep in mind that they are dealing with a highly cyclical industry where investments are made with decades-long time horizons.

prepared by the author, using data from Seeking Alpha

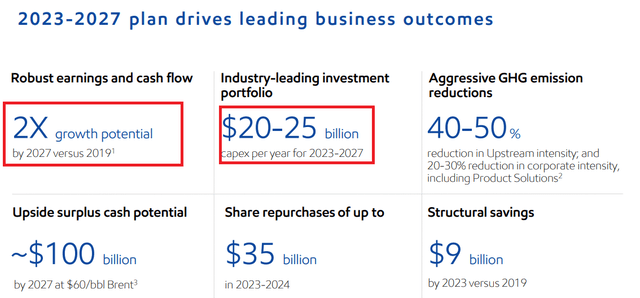

The prospects for the next 5-year period are indeed very bright and Exxon’s management expects earnings and cash flow to nearly double by 2027 versus 2019. At the same time, however, Exxon needs to capitalize on the major opportunity to expand production while also investing significant amounts in new energies in order to secure its competitive positioning in carbon capture & storage, hydrogen and biofuels.

Exxon Mobil Investor Presentation

As we see in the slide above, capital expenditure is expected to be within $20-$25bn range per annum for the period 2023 to 2027. This is up to a 50% increase on the company’s current capex run rate of almost $17bn.

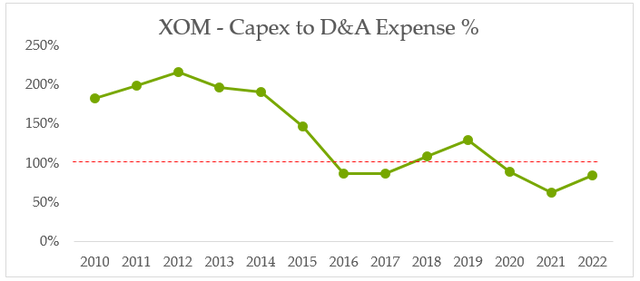

The increase, is not only needed to finance future growth, but also to sustain current operations since the Capex figure has been below the company’s annual Depreciation & Amortization expense for a third year in a row.

prepared by the author, using data from Seeking Alpha

In my view, all that puts Exxon in a very good position to remain competitive over the long-term and gradually transform its business model, without sacrificing its competitive advantages and high return on capital. In this process, however, I expect dividend increases to take the back seat as providing secure and clean energy at attractive rates of return is far more important.

Investor Takeaway

In a nutshell, Exxon Mobil is far less attractive than it was back in 2020, not only from the point of view for capital gains, but also as a vehicle for passive income. At present, there are more attractive opportunities to be found both within equities and in fixed income as far as yields are concerned.

Investors who are buying XOM at current levels, but were not considering the stock during the 2020 lows, should keep a long-term investment horizon, be well-disciplined when increasing positions and prepared to stick to their strategy through future market downturns.

Disclosure: I/we have a beneficial long position in the shares of CVX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author’s opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies’ SEC filings. Any opinions or estimates constitute the author’s best judgment as of the date of publication and are subject to change without notice.

All the research in this article is based on The Roundabout Investor strategy. An investment philosophy which finds high quality and reasonably priced investment opportunities. It capitalizes on inefficiencies in the market by avoiding short-termism, momentum chasing and narrative driven expectations.

In addition to exclusive roundabout investment opportunities, the service offers a concentrated portfolio based on the highest conviction ideas. A more holistic overview to the equity market is also utilized through the lens of factor investing techniques.

To find similar investment opportunities and learn more about how the roundabout investment philosophy could protect portfolio returns during market downturns, follow this link.