Summary:

- Exxon Mobil’s earnings have remained higher for longer than anticipated due to high oil prices and OPEC’s supply cuts.

- The company’s upstream segment has reported enormous profits, with crude oil prices playing a crucial role.

- The large-cap energy sector, including Exxon Mobil, is undervalued, and geopolitical tensions could further drive up oil prices.

Joe Raedle

It is not often that I fundamentally flip my investment thesis about a stock on its head, but this is the case here with Exxon Mobil Corp. (NYSE:XOM) which I suggested was overvalued and starring at the prospects of an oil price crash about a year ago, in October 2022.

Since this coverage, however, WTI crude oil prices have remained sky-high, supported by OPEC’s supply cuts. In turn, Exxon Mobil’s earnings have remained far higher for far longer than I anticipated.

As a consequence, I have reviewed my investment thesis and have initiated a relatively minor long position with regard to Exxon Mobil for my own portfolio (less than 2% of my portfolio assets).

My Rating History

As I said in the introduction, my view on Exxon Mobil a year ago was informed and influenced by news of substantial output cuts from countries like Russia, Venezuela, and Iran at the time which I didn’t think would make a meaningful difference to crude oil prices.

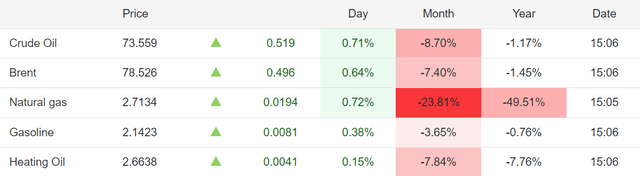

Since last year, however, a number of countries have scaled back their production outputs (or are in the process of doing so) and a barrel of WTI crude oil prices still sells for more than $73 today, which is about the same level WTI traded at last year.

Taking into account that oil prices stayed higher for longer, leading to substantial profit tailwinds for Exxon Mobil, I am modifying my stock classification from Sell to Buy.

Exxon Mobil Continues To Report Enormous Profits In Its Upstream Segment

Crude oil prices matter more than anything else when it comes to the profit prospects of large multinational energy companies such as Exxon Mobil. A barrel of WTI crude oil today still sells for about the same price as it did a year ago and OPEC’s supply cuts have played an important role in price stabilization.

OPEC members and aligned countries, known as OPEC+, agreed to cut their combined production by 3.66 million barrels per day in June which at the time represented approximately 5% of global demand on a daily basis.

While crude oil, both WTI and Brent, have seen virtually no real price declines over the last year, natural gas prices have slumped by almost half.

Crude Oil Prices (Trading Economics)

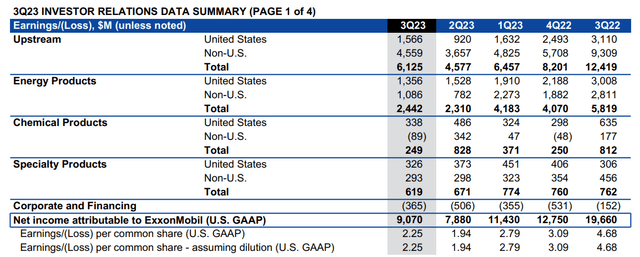

The higher-for-longer oil price environment has had a fundamentally positive impact on Exxon Mobil’s upstream profits. Exxon Mobil produced $6.1 billion in upstream profits in 3Q-23 which was $1.5 billion more than in the quarter before.

The upstream business was responsible for around about 68% of Exxon Mobil’s total profits, a profit share that increased substantially from last year’s 63%.

Upstream Profits (Exxon Mobil Corp)

Higher-for-longer oil prices obviously represent a big profit driver for Exxon Mobil and the latest round of supply cuts should be supportive of oil prices as well: Saudi Arabia, Iraq, the United Arab Emirates, Kuwait, Kazakhstan, Russia, Oman, and Algeria just agreed to additional voluntary supply cuts totaling 2.2 million barrels per day in 1Q-24.

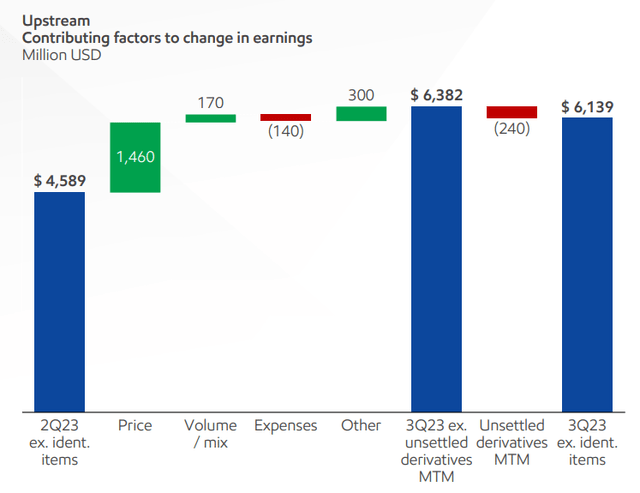

Oil prices were by far the most important catalyst for profit growth for Exxon Mobil in the third quarter. Higher prices for oil explained 94% of Exxon Mobil’s 3Q-23 QoQ profit increase.

Catalyst For Growth (Exxon Mobil Corp)

Exxon Mobil, Large-Cap Energy Sector Is Undervalued

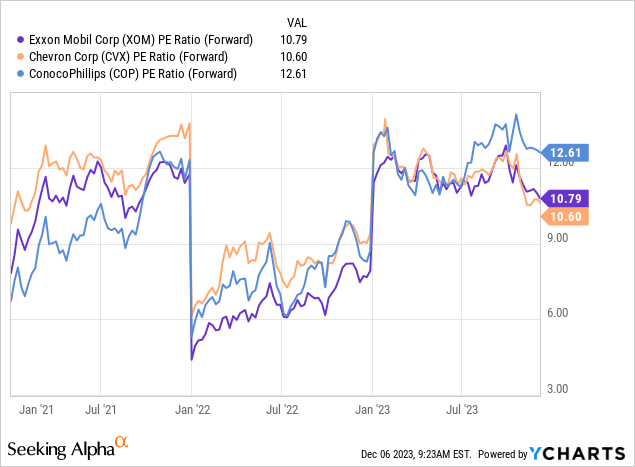

My last criticism about Exxon Mobil related to the idea that the company’s P/E ratio was misleadingly low. I made this argument in the context of the assumption that oil prices were headed drastically lower as fear premiums in the market have historically diminished over time and crude oil prices never hovered around 10-year highs for long. This assumption has proven to be faulty, partially because OPEC has intervened in oil markets much more aggressively than I anticipated.

OPEC supply cuts have positively influenced profit estimates for Exxon Mobil and the market now models $9.50 per share in profits for next year which means the energy company is set to see 3% YoY growth.

Until recently, the market was a lot more bearish. Exxon Mobil’s stock sells at 10.7x next year’s earnings whereas Chevron Corporation (CVX) has a P/E ratio of 10.6x and ConocoPhillips (COP) is priced at 12.6x profits. Taking into account the higher-for-longer economic backdrop, I think that the sector is broadly undervalued, not just Exxon Mobil.

Geo-Political Headwinds And Opportunities

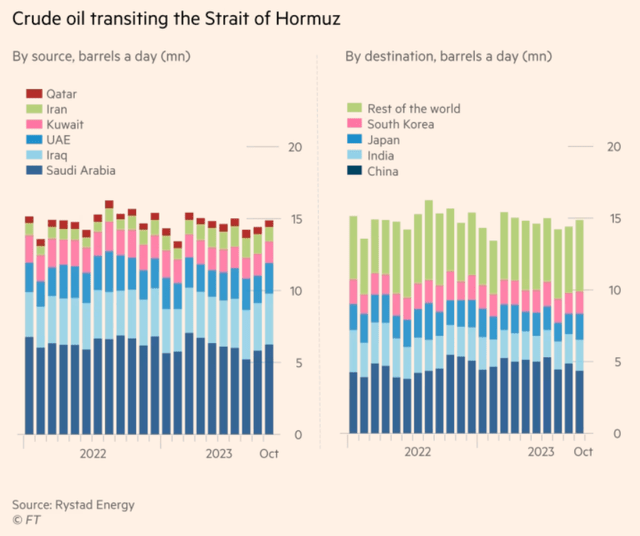

The reality is that oil prices may stay higher-for-longer as the world deals with new geo-political tensions, particularly in the Middle East and the Strait of Hormuz, a waterway that connects the Gulf of Oman with the Persian Gulf. It is estimated that about 20% of the world’s global oil supply goes through the Strait of Hormuz, most of which comes from Saudi Arabia.

Strait Of Hormuz (Rystad Energy)

An Iran-led shutdown of the Strait of Hormuz, Houthi-driven cruise missile/drone attacks on Israel, and attacks on container ships in the Red Sea could drive oil prices sharply higher which would be a profit driver for Exxon Mobil.

A de-escalation of tensions in the Middle East, on the other side, could drastically impair Exxon Mobil’s profit prospects, particularly in the upstream business.

My Conclusion

It is not often that I fundamentally flip my investment rating on its head, but this is the case with Exxon Mobil which is facing a much stronger earnings picture for a much longer period of time than I initially anticipated, thanks to OPEC.

Though it is impossible to ascertain what exact price impact voluntary output cuts have had, I think that I misjudged the potential for a higher-for-longer oil price environment quite substantially.

Since a number of OPEC countries just decided to cut production in 1Q-24, I think the odds favor a higher-for-longer oil price environment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.