Summary:

- Exxon Mobil Corporation (XOM) is a large and valuable company in the energy sector with a market cap of $460 billion.

- XOM has been delivering significant earnings growth through expansion and rising commodity prices, making it a good investment opportunity.

- The company has been returning capital to shareholders through dividends and buybacks, leading to an appreciation in share price and making it a fitting buy.

spooh

Exxon Mobil Corporation (NYSE:XOM) is one of the largest in the space right now and has a massive market cap of $460 billion. The company is unlikely in my opinion to ever exhibit a significant discount to the rest of the sector because it is the sector. With that said, the company can still prove to be a very good investment opportunity as it continues to deliver significant earnings growth at the back of expansion and appreciating commodity prices. The company has made a clear contribution towards ensuring investors get a significant value for their holdings over the years. Even though some may argue that XOM is going to be phased out because the push for renewables is happening, well, I don’t think people quite grasp the sheer amount of capital and time that will take. In the meantime, I am happy to hold and add to a position in XOM as they accumulate more and more capital. A buy is the only fitting rating here.

Business Performance

XOM is actively involved in the exploration and production of crude oil and natural gas, both within the United States and on a global scale. The company’s operations are divided into several key segments, including Upstream, Energy Products, Chemical Products, and Specialty Products. In the Upstream segment, XOM focuses on the exploration and extraction of crude oil and natural gas resources, contributing to its extensive presence in the energy sector.

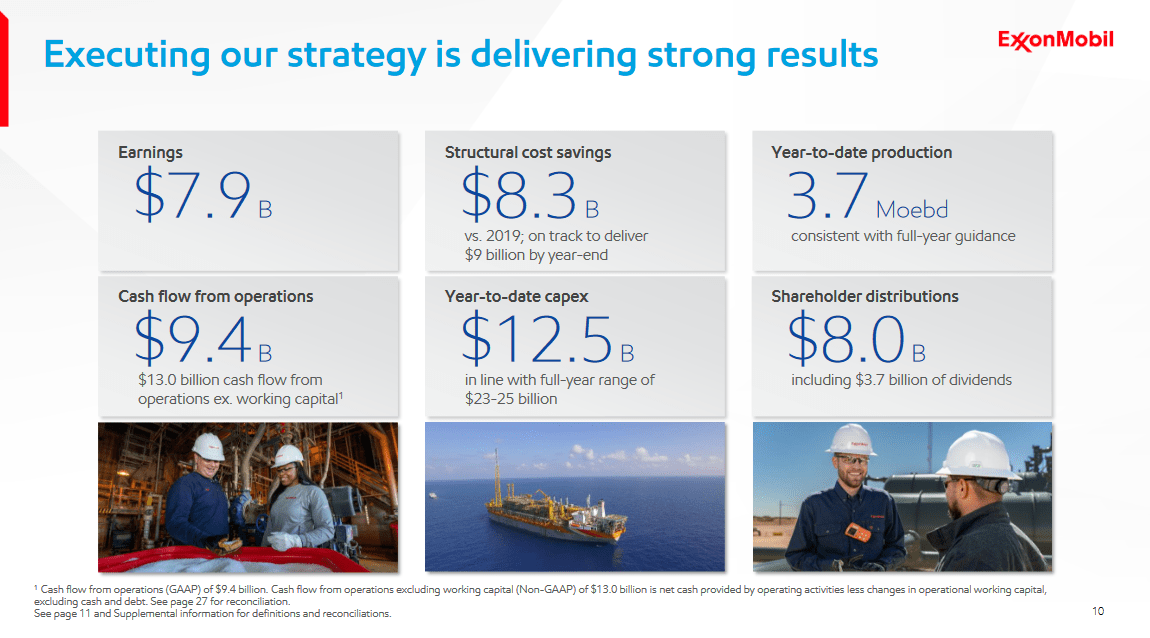

Company Performance (Investor Presentation)

Being one of the absolute largest in the sector, XOM produces some quite impressive numbers. The company in the last quarter alone managed to net $7.9 billion in earnings, which has significantly increased the amount of capital returns to shareholders. In comparison to the year prior, the earnings may be down, but I think that it was a reasonable thought to have that it would. Prices for oil and other commodities were at extreme highs following the invasion of Ukraine, and they remained elevated in the better part of 2022.

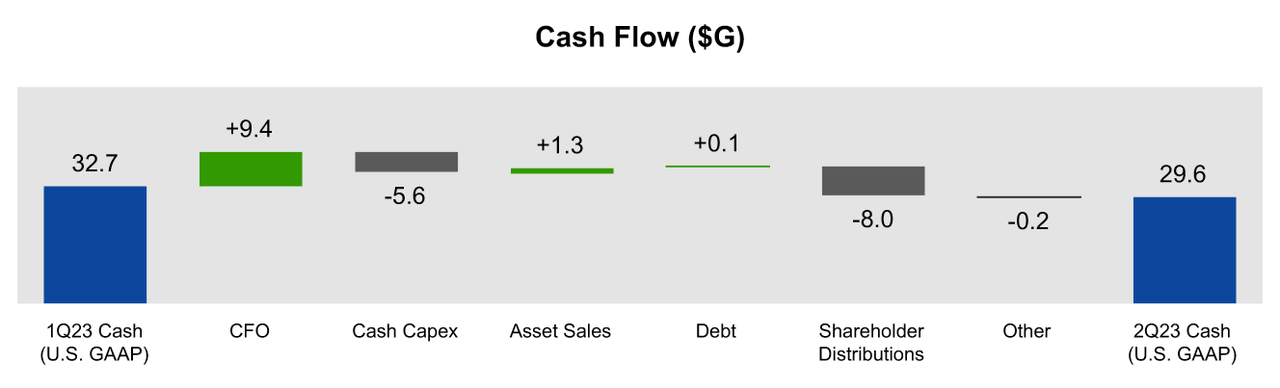

Cash Flows (Investor Presentation)

What has been a key difference in the last few years and a big reason for the appreciation of the share price is the amount of buybacks the company is doing. In 2022 XOM paid out nearly $15 billion in dividends but also added another $15 billion in shareholder returns through buybacks. Since then the company has had its share price go up a fair bit to reflect the diminishing amounts of outstanding shares.

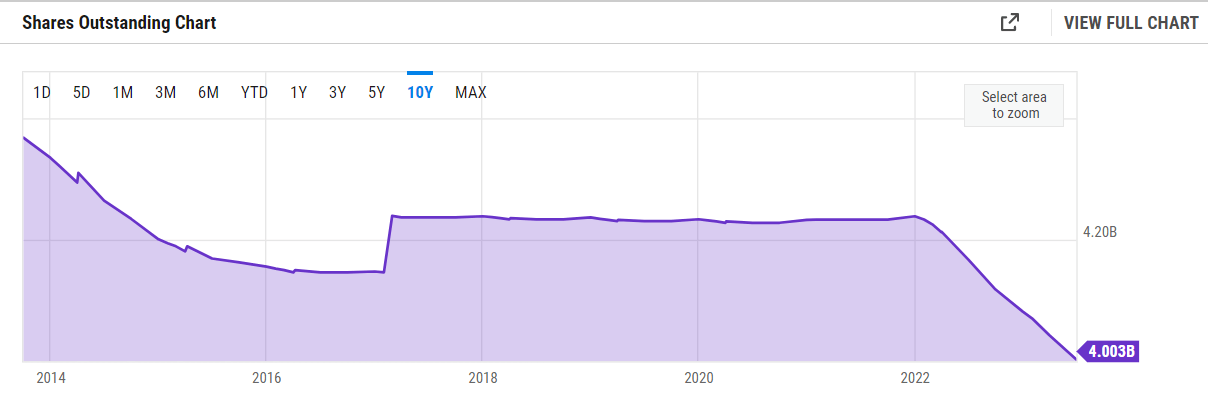

Shares Outstanding (Ycharts)

As we can see here, the outstanding shares for XOM have very quickly decreased following the announcement about buybacks. The company continued the trend in the second quarter of 2023 as $4.3 billion was used to buy back shares. The lack of incentives from the government side for companies like XOM to expand their business and supply more energy to the country is pushing them to instead use the capital for shareholders. With a cash position of nearly $30 billion, XOM is in a position where it could almost be buying back nearly 10% of the outstanding shares. For a company of this size, that is massive and a bullish argument for buying XOM right now.

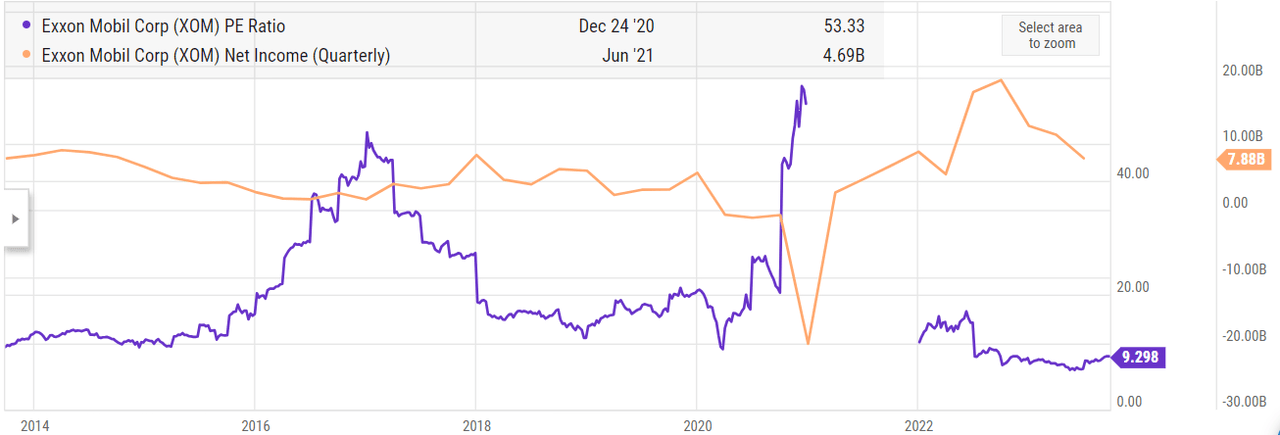

The net incomes for the company have been very solid over the years and the recent downtrend in the p/e has come from a worse sentiment around energy companies I think, and more specifically oil and gas companies. On the 10-year chart for the share price, there has only been a 32% return, with a large portion of that being in the last couple of years only. I think that going forward, the value you can derive as investors will come from the buybacks and the dividends of the business. As long as significant amounts of capital are being returned like this to shareholders, the price will continue to appreciate, I think and continue to be an appealing buy.

Dividend Evaluation

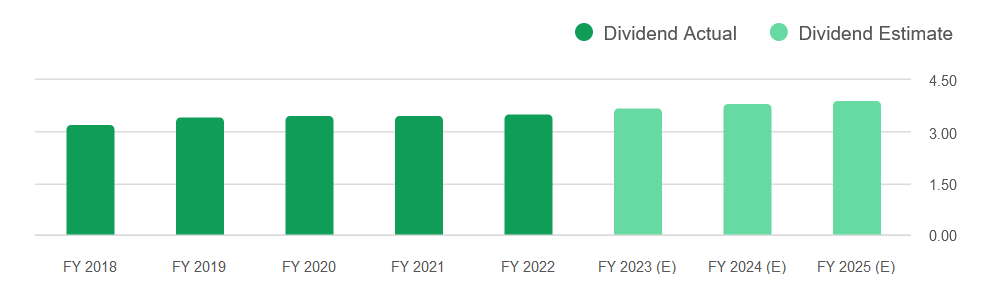

Dividend Estimates (Seeking Alpha)

The projections are that XOM will continue to be able to raise its dividend efficiently over the coming years. In the last 24 years, the company has been raising the dividend and in the last 5, it has averaged a growth rate of 2.74%. I wouldn’t expect this to drastically increase unless the price of oil exponentially increases and remains a lot higher for a prolonged period.

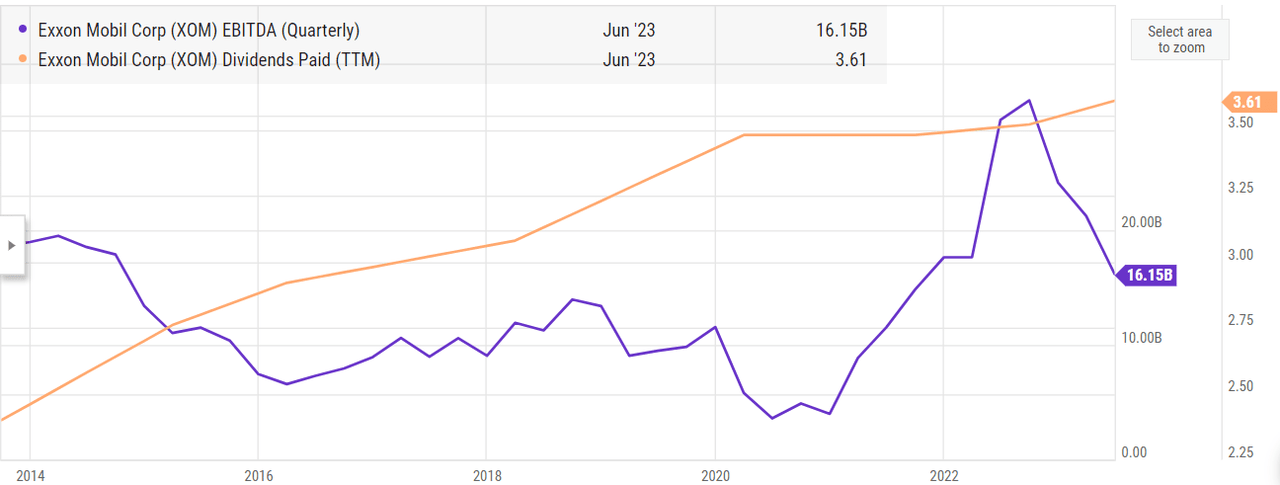

Over the years, the company has been significantly increasing its dividends and growth. But it has also been possible thanks to the increase in EBITDA for the company during the same period. The only reason that I can see that would disrupt this would be deteriorating commodity prices, which doesn’t seem to be the case right now. Even if that happens, XOM has a war chest of nearly $30 billion that it can use to support the dividend payout.

Risk/Reward

The most significant risk that XOM faces is the potential decline in average prices for petroleum and natural gas products. This is particularly concerning because the production segment of the company contributes significantly to its earnings and free cash flow. When market prices for these products decrease, it results in reduced profit margins and lower free cash flow. Ultimately, this can necessitate a downward adjustment in the company’s valuation to align with the challenging market conditions.

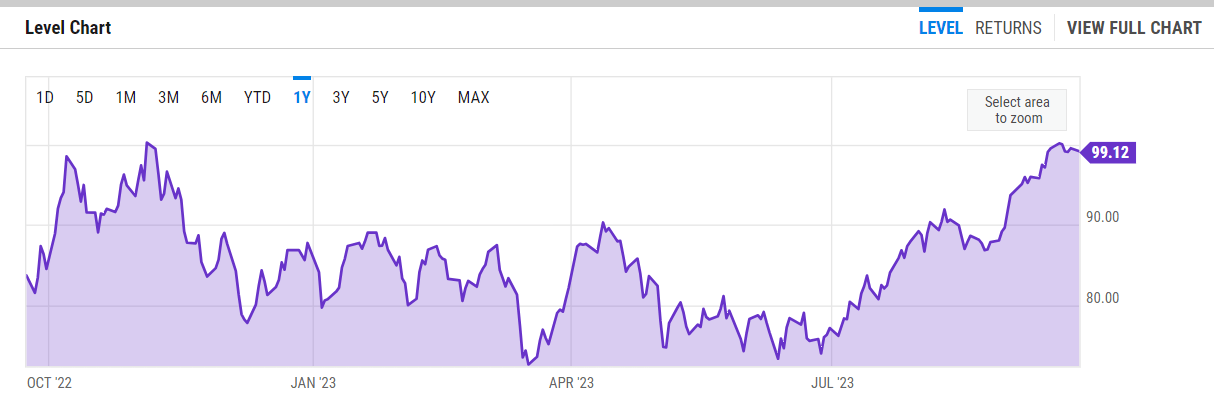

Price Chart (Ychart)

With oil appreciating so much in price in the last couple of months, I think that a short-term pullback could be possible. Depending on the severity of the pullback, investors may be scared and sell out of positions affected, which could likely be XOM. With fewer earnings potential, the company looks expensive to some and the risk is a sliding share price. But as I remain bullish on the business, I would be viewing this as another opportunity to be adding to a position.

Key Notes

Investors who are looking at the energy sector will most likely come across XOM. It’s a massive company that made headlines when it announced its heavy increase in the share buyback program to over $15 billion in 2022. Investors who want something solid that can deliver a strong return over a long period should be considering XOM right now, I think. With rising oil prices, that opportunity for XOM is to continue and raise the dividend. The company has a massive market cap as we know and will unlikely display a significant discount to the sector given the sheer amount of coverage and attention it receives. It then becomes a case of buying based on belief in the fundamentals of the business and the market environment, which I am bullish on. This all accumulates to me rating XOM a buy now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.