Summary:

- Exxon Mobil is set to acquire Pioneer Natural Resources, which will increase its oil and gas sales and make it the largest player in the Permian Basin.

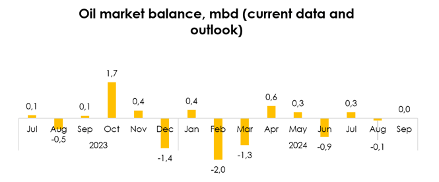

- The oil market balance is expected to be influenced by voluntary production cuts from OPEC+ countries and concerns over slowing global demand.

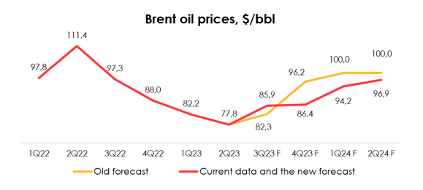

- The forecast for Brent oil prices has been lowered, but overall, Exxon Mobil’s financial results are expected to improve with the acquisition and increased oil and gas margins.

Joe Raedle

Investment thesis

We have covered the stock before, and since last quarter several things have changed, most importantly:

- Exxon Mobil Corporation and Pioneer Natural Resources jointly announced a definitive agreement under which Exxon Mobil will acquire Pioneer;

- We have lowered our forecast for Brent crude oil prices and provide an updated view of the oil market balance through Q3 2024.

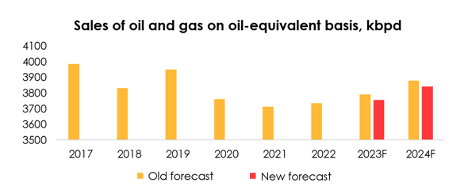

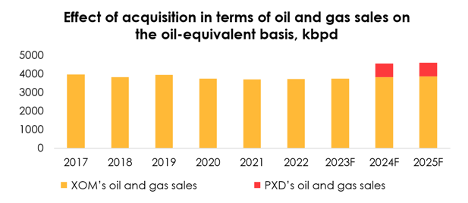

The acquisition of Pioneer Natural Resources is expected to increase Exxon Mobil’s oil and gas sales on the oil-equivalent basis from 3842 thousand to 4568 thousand barrels per day of oil equivalent in 2024 and from 3871 thousand to 4602 thousand in 2025, which is equivalent to a growth of 22% y/y and 1% y/y, respectively. The combination of XOM and PXD assets will make Exxon Mobil by far the largest player in the Permian Basin. Despite the downgraded oil price forecast, we expect oil prices to rise from current levels. The rating is BUY.

Oil market balance

Below are the main factors that have influenced the revision of the oil market balance forecast since our previous report.

On the supply side:

- Russia extended a voluntary 0.5 mb/d reduction in crude oil and petroleum product exports.

- OPEC+ will voluntarily reduce oil production in Q1 2024

At the OPEC+ meeting on November 30, Saudi Arabia extended the voluntary oil production cut by 1 mb/d for Q1 2024. In Q1 2024, several OPEC+ countries will also voluntarily reduce oil production: Iraq will reduce production by 223 thousand bpd, UAE – by 163 thousand bpd, Kuwait – by 135 thousand bpd, Kazakhstan – by 82 thousand bpd, Algeria – by 51 thousand bpd and Oman – by 42 thousand bpd.

Thus, OPEC+ stated that the production cut will be only 2.2 mb/d, but this volume includes a 0.5 mb/d reduction in exports from Russia and an extension of S. Arabia’s production cut by 1 mb/d.

In Q1 2024, we expect oil production to fall by 0.34 mb/d relative to October 2023, taking into account the fact that some countries (excluding Russia and Venezuela) will not meet their OPEC+ quotas. We expect OPEC+ oil production to decline from 37.7 mb/d in October (according to the US Department of Energy data, excluding condensate) to 37.4 mb/d in Q1 2024. Due to the voluntary OPEC+ production cut in Q1 2024, we have lowered our OPEC+ production forecast for 2024.

Also in 2024, OPEC+ will gradually lift the voluntary oil production cuts as global prices rise due to the glut. We expect the oil market to be generally balanced in Q2-3 2024 as a result of OPEC+ actions.

On the demand side:

- Concerns over slowing demand weigh on oil prices

Concerns about the global economic slowdown and weak demand are weighing on oil prices. In November, manufacturing PMIs in the U.S. and China declined and came in below forecasts. The US PMI decreased from 50.0 in October to 49.4 in November. China’s PMI decreased from 49.5 in October to 49.4 in November, missing expectations for the second month in a row.

The EU PMI rose from 43.1 in October to 44.2 in November, beating expectations but still at levels that indicate a serious slowdown in industrial activity. Bloomberg also reported that industrial production in Germany and Italy fell 0.4% and 0.2% m/m in October. Current trends suggest that a recession is likely in the EU.

We expect oil demand in the EU to remain at 2023 levels in 2024 due to the economic slowdown, while in the US it will grow slightly by 0.17 mb/d. At the same time, we expect demand to grow by 0.5 mb/d in China in 2024 and by 1.2 mb/d in the rest of the world (excluding the US, EU and China). With OPEC+ production not increasing and this growth, the market is moving into deficit.

2. CFTC Crude Oil speculative net positions fell to lowest since August

Net speculative positions in oil fell to the minimum since August 2023 amid growth of short positions, but have not yet reached the minimum for 2023. Speculation and the growth of short positions put pressure on oil prices.

Notably, the decline in the net speculative position is not due to the closing of long positions, but to the growth of shorts. Future short closings will in turn trigger speculative price increases.

Invest Heroes

Outlook for Brent oil prices

The actual average Brent oil price in Q3 2023 was above our expectations and amounted to $85.9/bbl vs. our forecast of $82.3/bbl. Based on new oil market balance assumptions, we lower our Q4 2023 Brent oil price forecast from $96.2/bbl to $86.4/bbl. We also lower our 1H 2024 Brent oil price forecast from $100/bbl to $95.5/bbl. In Q3 2024, we expect $96.9/bbl.

Invest Heroes

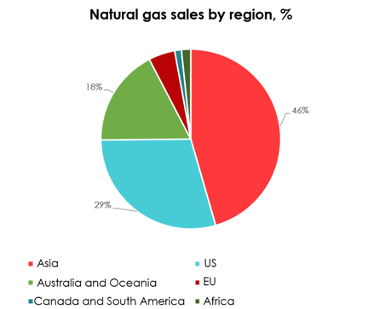

Macro outlook for the gas market

Every quarter, Exxon Mobil sells about 70% of its natural gas output outside the US. In 3Q 2023, most purchases of natural gas were still made by Asia (46%), the US (29%) and Australia & Oceania (18%). The EU made up about 5%.

Invest Heroes

Throughout the third quarter, according to Trading Economics, the manufacturing PMI in many Asian countries remained well above 50, indicating an increase in industrial new orders and, consequently, higher gas demand. The same indicator remained below 50 in the US and Australia.

Ahead of the 2023/24 heating season in the Northern Hemisphere, high natural gas inventories in Exxon Mobil’s strategic markets cause “cautious optimism.” Even so, record high inventories do not guarantee immunity to wintertime volatility and the risk of renewed tensions on the market. Given these and geopolitical risk factors, the upcoming heating season could be characterized by significant fluctuations in gas storage trajectories. This in turn will increase the likelihood of price volatility and possible supply disruptions. Further structural reductions will be required to ensure a stable gas balance during the winter of 2023/24. These measures could include improvements in energy efficiency, active promotion of renewable energy and accelerated adoption of heat pumps.

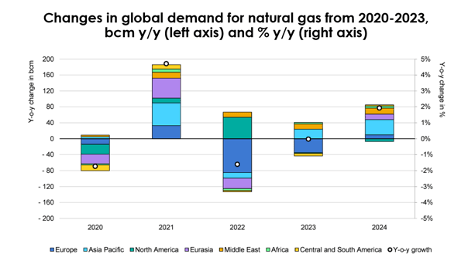

According to the International Energy Agency, slower economic growth in the US is expected to cause reduced demand for gas in the manufacturing industry, while the unseasonably mild weather in the first quarter prompted lower gas consumption in the residential and commercial sectors, which is taking a toll on full-year forecasts.

The economic downturn coupled with increased use of renewable energy is expected to cause slower growth in gas-fired power generation in the second half of 2023. Gas consumption in North America is expected to decline by 0.5% in 2024. It is assumed that residential and commercial gas demand will experience a recovery if weather conditions remain stable. Also, the increasing use of renewable energy is expected to reduce gas consumption in the power sector.

As for the Asia-Pacific region, after a 2% decline in 2022, natural gas demand in the region was generally stable in the first half of 2023. Growth in gas consumption in China and some emerging Asian markets was almost entirely offset by lower demand in Japan and Korea. Gas demand in Asia is forecast to increase by 3% in 2023, assuming normalized weather conditions and moderate gas consumption growth in India and other emerging Asian markets. We expect gas demand to continue growing at a rate of more than 4% in 2024.

EIA

Thus, we expect US gas sales to drop slightly in 2024, which in part will be mitigated by higher gas sales in the rest of Exxon Mobil’s regions of operations.

Exxon Mobil’s revenue structure

We have slightly lowered the forecasts for oil and gas volumes available for sale due to:

- expectations of lower demand for natural gas in the US, which will be in part mitigated by rising demand in some other regions;

- lower oil production in 3Q 2023, which created a low base effect.

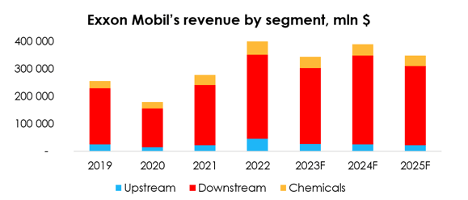

As a result, the average combined volume of oil and gas available for sale in 2023 was cut from 3791 kbpd to 3756 kbpd, and for 2024 the estimate was cut from 3880 kbpd to 3842 kbpd. Revenue from these sales is part of the revenue of the Upstream segment, which has made up an average of 9% of total revenue in recent years.

Invest Heroes

The biggest proportion of the revenue structure comes from the Downstream segment, which consistently brings XOM ~80% of its revenue and comprises oil and gas processing. We have lowered the forecast for this segment from $281.5 bln (-8% y/y) to $276.4 bln (-10% y/y) for 2023, and from $341.1 bln (+21% y/y) to $321.9 bln (+16% y/y) for 2024 due to:

- the reduction of the forecast for oil prices from $96.2/bbl to $86.4/bbl for 4Q 2023, and from an average of $100/bbl to $92.7/bbl for 2024;

- the reduction of the forecast for gas prices from $2.64/thousand cubic feet (Mcf) to $2.55/Mcf for 2023, and from an average of $3.41/Mcf to $3.26/Mcf for 2024;

- the decrease of oil product prices on the heels of falling oil prices.

Invest Heroes

Exxon Mobil’s financial results

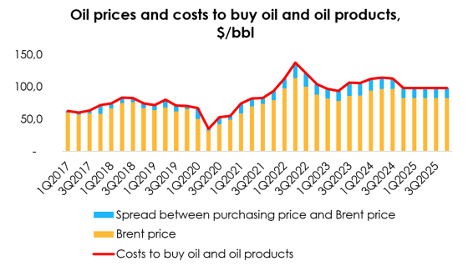

We used to project crude oil and oil product acquisition costs as a % of the company’s revenue. We now have revised our approach to forecasting these costs and the costs of oil and gas production and shifted to determining these costs relative to 1 barrel of oil equivalent. The costs of acquiring 1 barrel of crude oil and refined products with a beta of almost 1 follow the trend of Brent prices, as do the costs of oil and gas production, but with a lower beta.

The spread between the purchase price of crude oil and refined products and the Brent price has widened significantly. We believe the reason is the higher freight rates, which climbed amid escalating tensions in eastern Europe and Russia’s increased use of a gray fleet of tankers for the export of its crude oil – something that brought about in a shortage of oil tankers. We expect the spread to normalize by the end of 2024, which will gradually bring down gross costs.

As a result, we have raised Exxon Mobil’s gross costs from 54% of revenue to 56.7% of revenue for 2023, and from 53.6% of revenue to 55.7% of revenue for 2024, as we expect the spread to hold above average for some time down the line.

Invest Heroes

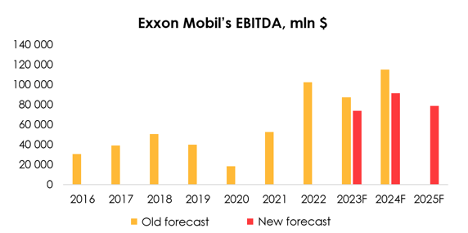

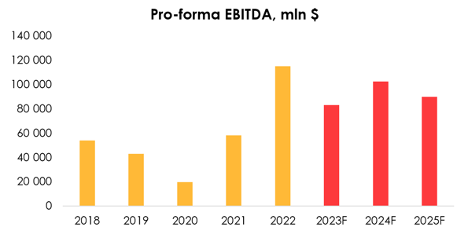

As a result of lower projections for the prices of oil, oil products and natural gas, along with higher forecasts for gross costs in 2023 and 2024, we are lowering the forecast for Exxon Mobil’s EBITDA from $87.5 bln (-15% y/y) to $73.9 bln (-28% y/y) for 2023, and from $115 bln (+31% y/y) to $91.2 bln (+23% y/y) for 2024.

Invest Heroes

Deal to purchase Pioneer Natural Resources

On October 11, Exxon Mobil Corporation (NYSE:XOM) and Pioneer Natural Resources (PXD) jointly announced a definitive agreement under which Exxon Mobil will acquire Pioneer. Pioneer Natural Resources is a US-based company engaged in the exploration and production of oil and gas in the Permian Basin, extracting 705,000-725,000 barrels of oil equivalent per day.

- PXD achieved 100% cube development in 2022 in the Midland Basin, where Exxon Mobil refined the approach back in 2019. Cube development requires detailed planning and therefore capital investment to apply it, but then delivers a 30-50% higher NPV than other state-of-the-art approaches. Exxon Mobil noted that its widespread utilization of this approach sets XOM’ apart from its competition, and the acquisition of Pioneer, which has also fully moved to using cube development, is in line with Exxon Mobil’s well development strategy.

- PXD has a low cost of oil and gas production compared to industry averages, which consequently will help XOM reduce production costs in the Permian Basin, and potentially other oil and gas production locations, through technology sharing with Pioneer, particularly their achievements in water recycling.

- We expect to see Exxon Mobil’s oil and gas margins increase, not only because of potential new capacity, but also because of the years of experience of people that are optimizing and managing refineries and chemical plants to get the most out of that capacity.

The deal is expected to close in the first half of 2024. As a result, Exxon Mobil’s oil and gas production capacity will increase from 3842 thousand to 4568 thousand barrels per day of oil equivalent in 2024 and from 3871 thousand to 4602 thousand in 2025, which is equivalent to a growth of 22% y/y and 1% y/y, respectively. The combination of XOM and PXD assets will make Exxon Mobil by far the largest player in the Permian Basin and give the company a more than 50% advantage over Occidental Petroleum, the second largest oil giant by production volume.

Invest Heroes

Pro-forma financial results

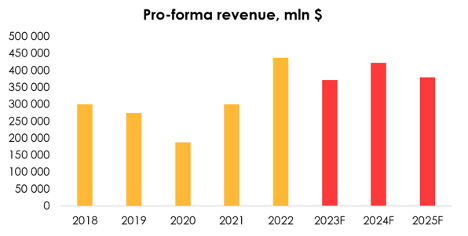

Exxon Mobil’s total revenue following the acquisition of Pioneer Natural Resources could be $371.9 bln (-15% y/y) in 2023, and $422.9 bln (+14% y/y) in 2024.

Invest Heroes

Exxon Mobil’s total EBITDA could reach $83.3 bln (-28% y/y) in 2023, and $102.5 bln (+23% y/y) in 2024.

Invest Heroes

Exxon Mobil expects the synergies to reach approximately $1 bln pre-tax annually, starting from the second year from the deal’s closure and averaging approximately $2 bln per year over the next decade.

Valuation

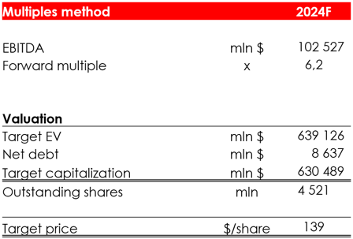

We are raising the target price of the shares from $137 to $139 due to:

- the increase of the fair EV/EBITDA multiple from 5.3x to 6.2x. Given the new outlook for the oil market balance and the new, lower forecast for oil prices, we assume that the world is entering a phase of lower oil prices, which follows a lengthy period of high prices. Therefore, the current reduced multiple for XOM reflects the cycle of lower oil prices;

- the shift of the FTM valuation period by one quarter forward.

Based on the new assumptions, we are assigning the BUY rating for the shares.

Invest Heroes

Conclusion

In line with the company’s portfolio diversification strategy, Exxon Mobil is actively pursuing M&A deals. Thus, the acquisition of Pioneer Natural Resources is expected to increase Exxon Mobil’s oil and gas sales on the oil-equivalent basis and to make Exxon Mobil by far the largest player in the Permian Basin.

Based on the new assumptions for the oil balance market and the gas market, we expect oil prices to rise from current levels, but US gas prices to decline slightly in 2024. Overall, we assign a BUY rating to the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.