Summary:

- In this article, I’d like to share with you my analysis of the latest equity research reports from major investment banks on Exxon Mobil and its prospects.

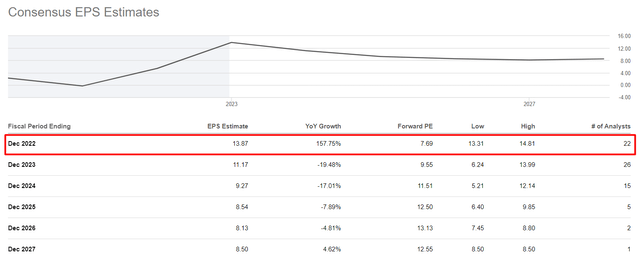

- Argus’ FY2023 EPS forecast is 25% higher than consensus – $13.98 vs $11.17 (above), assuming further growth in energy prices next year, driven by steady demand and supply constraints.

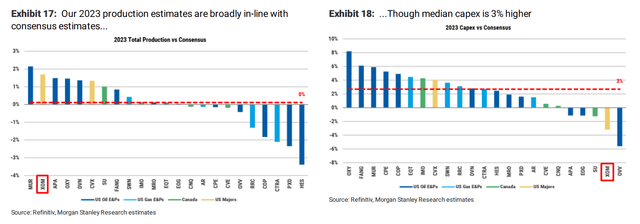

- Morgan Stanley urges to stay constructive, but selective – focus on strong and/or improving FCF and scale with asset diversity. So looking ahead, they think majors like XOM are best positioned.

- HSBC Global Research has the most modest outlook for XOM despite optimistic oil forecasts for Q1 2023 and beyond.

- On the weekly chart, we see a bearish divergence – I anticipate that even minor news events could result in a 10-15% decline in the short term. I recommend buying any large and unreasonable dips in XOM, price target of $125 by the end of 2023.

Andrzej Rostek/iStock via Getty Images

Thesis

In this article, I would like to share with you an analysis of the latest equity research reports on Exxon Mobil (NYSE:XOM) and its prospects – after a YTD run-up of >81% (total return, dividends included) this is probably one of the most interesting questions for investors. After analyzing reports from Argus, Morgan Stanley, Goldman Sachs, and others, I conclude that 2023 will likely be a bumpy ride, but there is still room for Exxon and other O&G companies. Let’s dive in.

Argus Equity Research

Analysis by Bill Selesky, November 10, 2022

The Argus analyst has reaffirmed his previously given “BUY” rating on ExxonMobil and increased his price target to $128 from $104. Despite the significant increase in the share price in 2022, the analyst sees potential for further growth due to favorable energy market conditions, an improving balance sheet, reduced CAPEX and increased FCF at the company. While management does not provide guidance, the analyst views XOM’s recent 3.4% dividend hike as a sign of confidence in the company’s prospects.

Exxon is taking action to address climate change and has set a target of achieving net-zero greenhouse gas emissions by 2050. To meet this goal, the company recently announced that it will achieve its 2025 emissions reduction targets ahead of schedule, by the end of 2022. In addition, the company is constructing a new hydrogen plant in Baytown, Texas, and has committed to investing $15 billion in low-emission projects by 2027. These efforts demonstrate the company’s dedication to addressing climate change and transitioning to a lower-carbon future.

Based on this thesis, the Bill is raising its 2022 EPS estimate to $13.43 from $12.12 based on the better-than-expected 3Q22 results and the Argus team’s expectations for continued high commodity prices.

Interestingly, this new bullish forecast is 3.2% below consensus, based on Seeking Alpha data:

Seeking Alpha, XOM, author’s notes

Why then such a high target price [over +18% upside potential]?

The point is that Bill’s FY2023 EPS forecast is 25% higher than consensus – $13.98 vs $11.17 (above), assuming further growth in energy prices next year, driven by steady demand and supply constraints.

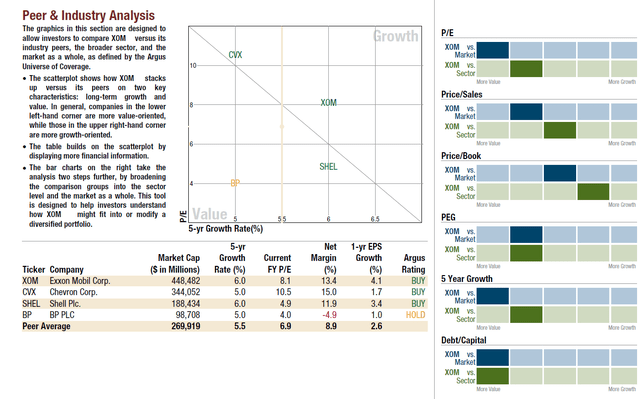

I also like the comparison between XOM and Chevron Corp (CVX), BP plc (BP), and Shell plc. (SHEL) in the context of comparing current P/E multiples and 5-year growth rates – in this sense, we see XOM outperforming CVX but trading at a premium to SHEL:

Morgan Stanley

Analysis by Devin McDermott, Joe Laetsch, CFA, et al., December 14, 2022

According to the analysts, there is potential for further positive performance in 2023, but there are also increasing risks to consider. They have identified three main arguments supporting their thesis:

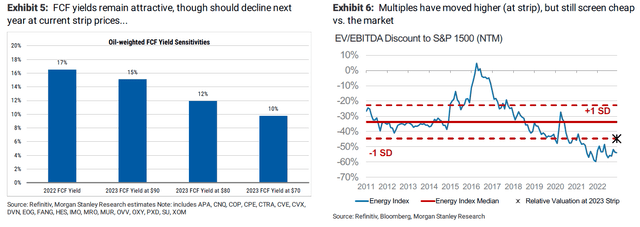

1. FCF yields likely decline YoY, but remain strong. If WTI oil prices remain around $75 per barrel, free cash flow yields are projected to drop from 17% in FY2022 to approximately 11% in FY2023. However, these yields are still around 2x higher than the S&P 500 and are considered attractive. If WTI prices rise to the mid-to-high $90s range, FCF yields are expected to remain stable year-over-year. And if prices reach $100 per barrel, FCF yields are projected to increase modestly to 18%.

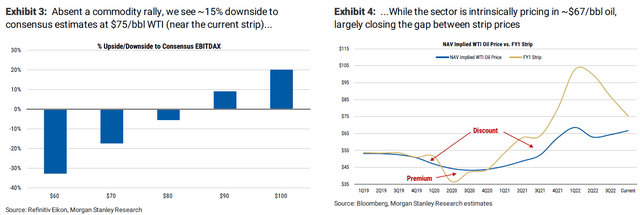

2. Relative valuations remain attractive, but earnings revisions are a risk. The sector trades at a ~55% discount versus the S&P on next year’s EV/EBITDA multiple, ~2x the average over the past decade. That said, the 2023 consensus reflects mid $80s WTI, and estimates are ~15% too high if the strip holds. Intrinsically, MS estimates the sector now reflects ~$70/bbl oil.

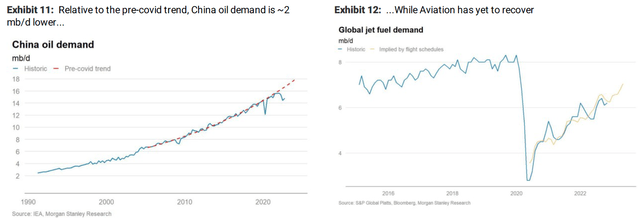

3. The macro backdrop becoming more challenging, but analysts continue to see a positive risk-reward for oil. In the near term, macroeconomic headwinds have pushed the oil market into a slight oversupply. However, this flips to a deficit again by mid-next year from rising demand (China reopening and still recovering aviation) and continued supply tightness.

Morgan Stanley oil strategist Martijn Rats expects Brent to rally back to $110 per barrel by mid-2023 – a level that would support year-over-year FCF growth and upside to consensus.

Based on the above the analysts urge us to stay constructive, but selective – focus on strong and/or improving FCF and scale with asset diversity. So looking ahead, they think majors like XOM are best positioned.

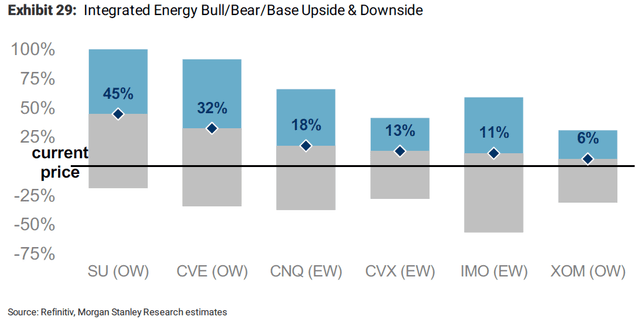

Morgan Stanley, December 14, author’s notes

However, XOM is far from the best company in terms of its growth potential in 2023 – even among the majors:

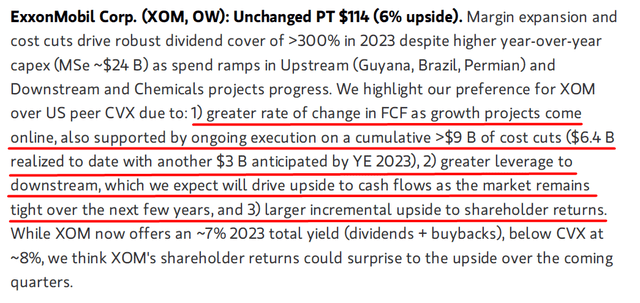

If XOM has a lower upside potential than CVX (6% vs. 13%), why do analysts highlight this stock over other majors? I found the answer on page 16 of the report:

Morgan Stanley, December 14, author’s notes

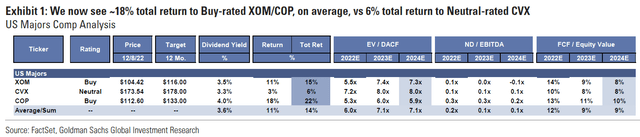

Goldman Sachs

Analysis by Neil Mehta and Nicolette Slusser, December 9, 2022

In this short 8-page analysis report, Neil and Nicolette updated estimates for the super majors they cover – XOM, CVX, and ConocoPhillips (COP).

The analysts previously estimated CAPEX at around $25 billion but have revised their estimate to be more in line with Exxon’s midpoint guidance (at approximately $24 billion). They have also revised their out-year CAPEX estimates to be ~$25 billion, which is slightly below the high end of the management’s guidance range of $20-$25 billion from 2024 through 2027.

In terms of share repurchases, XOM has guided for cumulative repurchases of up to $50 billion by 2024. GS previously estimated repurchases at $45 billion but has revised its estimate to $50 billion to align with Exxon’s new guidance. The analysts have also increased their annual repurchase assumptions for 2023 and 2024 from $15 billion to $17.5 billion while leaving their assumptions for 2025 and beyond unchanged at $15 billion per year. Exxon expects to complete around $30 billion in repurchases in 2022, with approximately 50% going toward dividends and 50% toward repurchases, which is in line with GS’s assumptions.

XOM has forecast that it will produce about 3.7 million barrels of oil equivalent per day (boe/d) globally next year, in line with analysts’ unchanged estimate. As for production in the Permian region, XOM expects more than 800 million boe/d by 2027 and beyond. Analysts have revised their 2026 estimate upward to about 860 million boe/d from their previous estimate of 800 million boe/d. XOM’s longer-term worldwide production target is about 4.2 million boe/d, slightly higher than the analysts’ previous forecast of about 4.1 million boe/d. The analysts have now revised their 2026 estimate to be more in line with XOM’s forecast at about 4.2 million boe/d, largely due to changes in production estimates for the Permian region in their updated model.

RBC

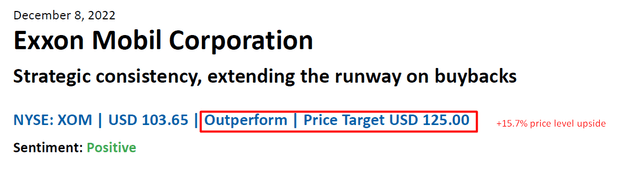

Analysis by Biraj Borkhataria, CFA, December 8, 2022

The analyst has reiterated the points made by other banks and expects XOM to emphasize the growing significance of its role in the energy system in the coming years, through the provision of low-cost energy and the implementation of measurable GHG reductions in the business. He thinks the long-term plan for share buybacks is likely to be well received, as it offers visibility compared to some peers that guide every quarter.

RBC’s price target reminds the one given by Argus:

RBC, December 8, author’s notes

HSBC Global Research

Analysis by Kim Fustier, Ajay Parmar, et al., December 1, 2022

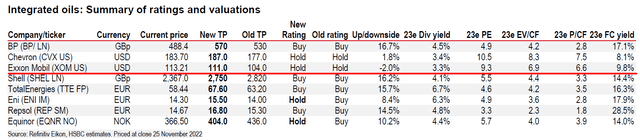

According to Hong Kong Bank analysts, the FCF of major oil companies is expected to remain higher for an extended period due to the ongoing energy upcycle, which will support record shareholder distributions. This upcycle is different from previous ones due to the strict capital discipline maintained by the major oil companies, despite high commodity prices and increasing costs. In 2023, overall capital expenditures are expected to return to pre-pandemic levels, but the upstream CAPEX is expected to remain below pre-COVID-19 levels as companies have no incentive to increase spending. For European oil companies, low-carbon spending is expected to represent one-fifth of total spending, in line with their energy transition strategies. The analysts predict that there will be a continuation of mid-sized M&A activity in the low-carbon space in 2023, but no large-scale acquisitions.

Based on the above, they see the highest upside in BP, Shell, TotalEnergies (TTE), and Repsol (OTCQX:REPYY), while maintaining their Hold rating on XOM and CVX and also downgrading Equinor ASA (EQNR) and Eni S.p.A. (E) [also to Hold].

HSBC Global Research, December 1, author’s notes

I also paid attention to the forecasts regarding a possible oil price spike in Q1 2023:

We see price upside as more likely in 1Q23 than in 4Q23 as the combined effects of the OPEC+ cuts and the EU embargo on Russian oil should be felt more in 1Q23. In particular, tightness in the diesel market due to the EU ban on Russian refined products, which enters into force on 5 February 2023, could pull up crude demand. Our 1Q23 Brent price forecast is for USD100/b, with an average of USD95/b for the full year 2023, implying a double-digit upside from current levels. It should be noted that oil company shares did not fall as much as crude prices in the past two weeks. As a result, it is possible that a recovery in oil prices back to the USD95-100/b range could fail to push the sector much higher in the near term.

Looking ahead 12-18 months, they write that the outlook for longer-term oil prices has significant implications for company valuations and is arguably more meaningful than short-term fluctuations. They believe investors remain very cautious about pricing in oil equities above USD65-75/b, which is below HSBC’s long-term Brent price of USD85/b from 2024.

What conclusions can be drawn from all this?

Overall, the analysts expect XOM – the world’s largest nongovernment-owned energy company with a strong moat – to continue to perform well in the coming years, with strong energy market fundamentals, an improving balance sheet, reduced capital spending, and higher free cash flow supporting the company’s growth.

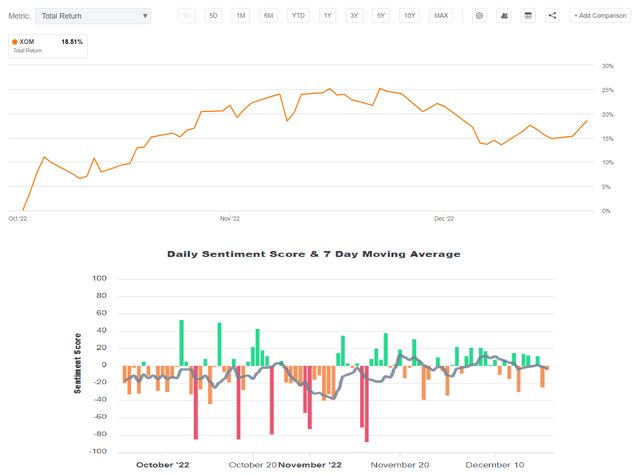

Ultimately, it will always come down to fundamentals and valuation, regardless of how the market reacts to oil price volatility, the risks of a global recession, the risk of a new wave of covid as China reopens, etc. – this is clearly illustrated when comparing social sentiment with the actual performance of the XOM share price, with absolutely no dependence in recent months:

Seeking Alpha Charting tool, SocialSentiment.io

The bursts of the bearish sentiment of late have only led to a faster rise in XOM’s quotes, as we can see in the chart above.

It should be clear that the company has returned to FY2013 in terms of revenue (TTM of $389 million vs. $390 million in FY2013), but at the same time, the EBIT margin is 574 b.p. higher, while EBITDA is 43.21% higher in absolute terms. During FY2013, XOM’s share price fluctuated between a low of $84.79 and a high of $101.74, which is not significantly lower than current prices.

Then, in 2013, Exxon spent $33.7 billion on CAPEX (and about the same amount in FY2012 and FY2014). Now we see a completely different picture – management is in no hurry to squeeze all the juice out of the current cycle, and analysts do not seem to understand why and include in their forecasts CAPEX estimates for the upper limit of management’s guided range (GS’s forecast above). What happens if XOM decides to end up spending a few billion less than these analysts forecast? I think such a move is possible – the current record FCF per share ($14.06 TTM – more than the amount of the last 4 years) may not drop as much as many people think now. Add to that the price of oil, which has held relatively steady in 2022 despite all the risks I briefly touched on above. What will happen if HSBC’s forecasts come true and the price of oil skyrockets? The consensus forecast for 2023, which assumes a year-over-year decline of nearly 20%, will prove to be simply absurdly low – something like what Bill Selesky from Argus writes about.

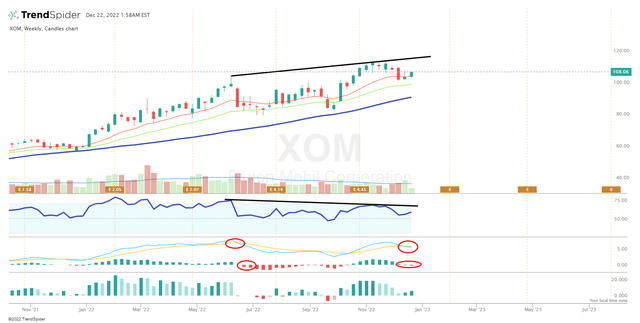

The kind of conclusion I draw carries risks, of course. XOM, the largest and most liquid stock in the sector, has become too crowded lately – and now on the weekly chart, we see a bearish divergence, which is a reversal signal:

I anticipate that even minor news events could result in a 10-15% decline in the short term, which is to be expected. 2023 may be a volatile year, but I believe XOM still has potential for good total return and recommend buying any large and unreasonable dips in XOM with the goal of reaching $125 per share by the end of 2023.

Thanks for reading!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in XOM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Struggle to navigate the stock market environment?

Beyond the Wall Investing is about active portfolio positioning and finding investment ideas that are hidden from a broad market of investors. We don’t bury our heads in the sand when the market is down – we try to anticipate this in advance and protect ourselves from unnecessary risks accordingly.

Keep your finger on the pulse and have access to the latest and highest-quality analysis of what Wall Street is buying/selling with just one subscription to Beyond the Wall Investing! Now there is a free trial and a special discount of 10% – hurry up!