Summary:

- Exxon Mobil is up huge on the year.

- Everyone on the street is bullish on the stock, advising retail investors that the energy sector will continue higher ad infinitum and Exxon is still a buy.

- In the following piece, we provide a contrarian view that the stock may be setting up for a massive downside move lower.

JHVEPhoto

Exxon Mobil: A case study in irrational exuberance

Exxon Mobil (NYSE:XOM) has been the darling of the market for much of the past couple of years. Nonetheless, it hasn’t really been able to push much higher beyond its current level of $108.

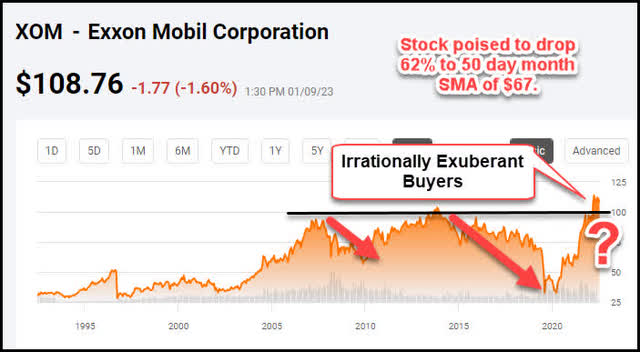

Exxon Mobil Current Chart

Finviz

This is even though everyone and their mother has been saying there’s nowhere to go but up. On top of this, the prevailing market mantra is that the energy sector is set for gains ad infinitum due to the tight supply/demand situation being locked in for years. Even so, I see a different scenario at play, and it’s referred to as “irrational exuberance.” The stock has gone straight up like a rocket and is now trading substantially above its historical highs.

Exxon Mobil Long-term chart

Seeking Alpha

If you look at the chart you can see that each time the stock has reached this level in the past it has fallen back down to earth in short order. The issue is magnified this time by the relatively parabolic move higher due the irrational exuberant buyers piling into the stock regardless of the price of oil, more on this later.

Exxon Mobil vs Oil correlation broken

Throughout history Exxon Mobil’s stock price has been highly correlated to the price of oil. That correlation was broken earlier this year in August when the stock price continued to explode higher even as the price of oil began to fall.

Exxon Mobil vs Oil price performance comparison

Seeking Alpha

Now if you talk to any of the newly minted energy sector geniuses they will tell you this doesn’t matter. Oil’s price is lower right now but will soon recover for various reasons and the price of Exxon Mobil will begin to rise right along with it. The problem with this theory is the fact that, even if it’s true, all the upside is already priced in. Like I said before, this is the consensus view and it’s been around for quite some time. Sooner or later you run out of buyers.

Really though, the fact of the matter is the “there’s no alternative – Exxon Mobil’s stock is going higher” chorus has gotten so profound I am starting to believe we’re entering Icarus Syndrome territory. If you’re unfamiliar with the story of Icarus I highly advise you to look into it. He was so overconfident and arrogant that he didn’t listen to anyone and flew so close to the sun that his wings burned off and he fell to his death. What’s more, there’s an extremely long way to fall at present, especially with an extremely high probability that we’re headed for a recession. Let me explain.

Exxon Mobil’s entire run at risk if hard landing recession materializes

I submit with the stock up nearly 60% in just the past year alone a majority, if not all – the gains are at risk.

Exxon Mobil up 60% in one year

Seeking Alpha

The stock has run up faster and higher than at any time in its history. I posit there’s a substantial chance once the supply/demand story changes it could easily fall back down to its 50-month SMA of $67 which implies a 38% drop. Why do I think this is in the cards? Because the signs of a severe recession are building up fast. Let’s see why.

Exxon Mobil Long-term chart

Finviz

Signs of hard landing recession adding up

I don’t know if any of you watch CNBC, but I do and I love Rick Santelli. He’s very animated and he has been around for ages. Today he was speaking of his major concerns regarding one of the best tells that we are on the brink of recession, the three-month to 10-year spread.

3 month to 10 year spread widest in history at 1.1

CNBC

Santelli also stated that the wider the spread, the worse the recession will most likely be. Further, the harder the landing as well. He also noted the extreme drop off in the 10- year yield as of late. This basically implies the bond market is saying we’re headed for a recession, take cover.

10 year dropping like a rock

CNBC

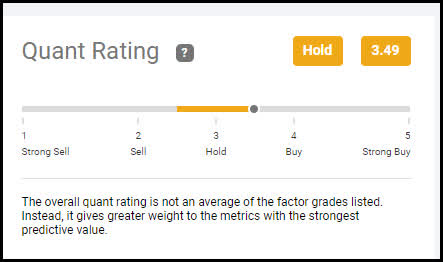

Over the course of my career I have learned that bonds usually lead the way. I see this as a huge signpost saying prepare for trouble. Moreover, with Exxon Mobil’s stock flying as close to the sun as it ever has just as we’re most likely heading into a major recession, the set up doesn’t look so great for the stock to continue the amazing run its had. In fact, the Seeking Alpha quant team has just changed the rating from Buy to Hold. Let’s take a close look at why.

Seeking Alpha XOM Quant Rating Hold

Seeking Alpha

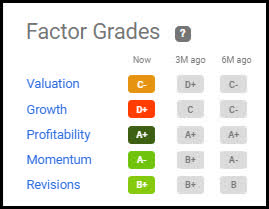

XOM quant factor grades

The quant tool is awesome. If you get a chance I highly recommend you always check it out before you initiate any new positions. The two factors that seem to be affecting the Hold rating are the Valuation and Growth metrics. Let’s dig deeper and see what the issues are.

Seeking Alpha

XOM Valuation grade C-

The company scores an average C grade when analyzing the foreword P/E ratio because it’s basically in-line with the rest of the sector. It’s not under or overvalued when looking at this metric.

Seeking Alpha

Yet, the problem arises when you look at the price to book values. They’re way out of whack. When evaluating oil companies it’s always important to review the price to book valuations because a large portion of their valuations are based on reserves. If the company has to mark to market down the value of its reserves, this can cause a major shift in the fundamentals. On top of this, with Exxon trading for a 50% premium to its five-year average price to book value, odds are greater the stock is actually overvalued at present. Now let’s look at the next negative metric, growth.

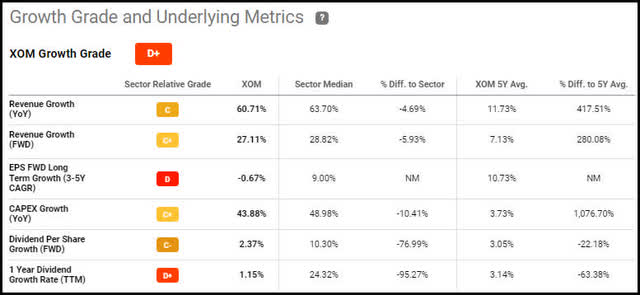

Exxon quant growth score D+

Now, many of you might say, how can the rating be a D+ when Exxon has been growing by leaps and bounds? Well that’s exactly what the problem is actually. An oil major like Exxon Mobil’s projects are long cycle. It’s hard to keep growing like a weed ad infinitum for companies like Exxon. Their five-year average revenue growth rate is 7%. The 27% they just posted is 280% higher than the five-year average. What’s more, like I said earlier, all the good news is already priced in. You can tell by reviewing the Momentum grade. Let’s take a look.

Seeking Alpha

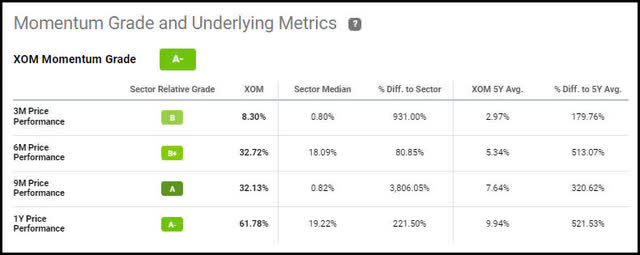

Exxon quant momentum score A-

If you asked me at any time prior to the last three years if Exxon Mobil would be considered a momentum play I would have said, “When hell freezes over.” Yet, here we are.

Seeking Alpha

The stock has been in a tear for the past couple of years. This is something I feel the bullish current shareholders and anyone jumping on the bandwagon now have been blinded to. These metrics are a glaring sign that all the good news is already priced in. Furthermore, when you couple this with all the other factors such as the broken correlation with oil, the fact the stock seems unable to break above the $110 mark, and we’re more likely than not heading into a deep recession, brought to you by our amazing Fed, the odds favor the stock going substantially lower from here. Not to mention the dividend yield is minuscule at this time. Let’s look at the current state of affairs regarding the dividend.

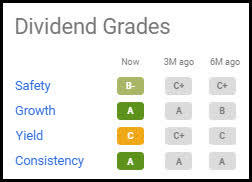

Exxon Mobil’s Dividend Analysis

The dividend scores high on the quant metrics for safety, growth, and consistency. The issue today is the measly yield.

Seeking Alpha

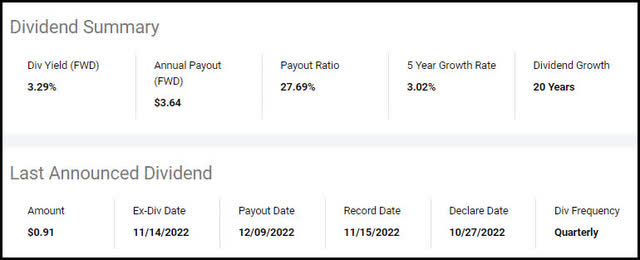

Seeking Alpha dividend summary

Seeking Alpha

I have no issues with the dividend myself except for the fact they should raise it substantially if they believe the current stock price is justified. The payout ratio of 27.69% seems to indicate that Exxon could raise it a good bit without feeling much pain. The Seeking Alpha quants metrics give the score a C.

Exxon dividend yield quant score C

Seeking Alpha

I believe the company isn’t increasing the dividend to keep up with the historical yield of closer to 5% for the same reason I have been stating throughout this piece – they know that the elevated level of the stock price is not going to last. Let me tie a bow.

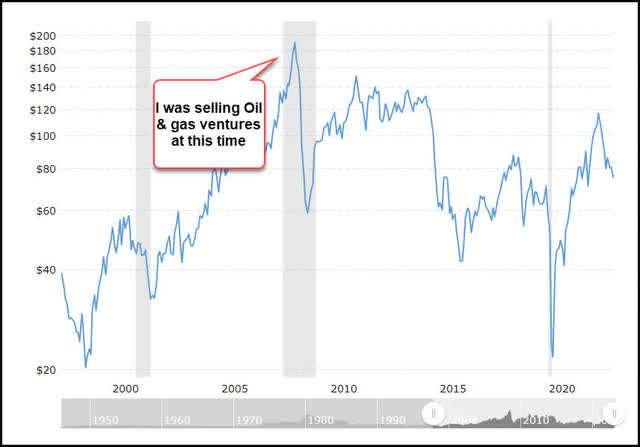

Investor takeaway

Let me start by saying I realize a lot of you reading this right now are long-term holders who have locked in a much better yield. Further, you’re satisfied with collecting the current dividend payment as income or are dripping it. What I would say to this cohort is look into ways to protect your unrealized gains this time. If you’re way up from your basis, but don’t want to sell outright, speak to your broker about ways to protect your position with options. Covered calls are a better option I feel than buying puts for my income positions. You collect the additional dividends on them. But everyone is different. If you’re fine with just letting it ride, that’s OK too. I’m not telling anyone to buy or sell the Exxon Mobil. I’m simply giving my assessment of the current state of affairs. I’m a former FINRA oil and gas securities broker and was active during the last oil run up in 2009.

Long-term oil price chart recessions in gray

Macrotrends

The present bullish atmosphere regarding oil’s future reminds me exactly of that time in 2009. It all changed on a dime. One minute we had a waiting list of buyers signed up for our next project, the next no one would answer the phone.

With the odds of a recession looming, I would find a way to protect my gains in the stock if they’re substantial. If you have been a long time holder, the amount should be substantial and worth at least finding out how much it would cost to insure it. Then when the stock drops you can use the proceeds to buy more! Those are my thoughts on the matter. I look forward to reading yours.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Join the #1 fastest growing new dividend income service! Our 6% SWAN and 12% High Yield Income Portfolios are substantially outperforming the market

We have opened up an addition 50 Charter memberships at a legacy rate and they are going fast! We have 10 FIVE STAR reviews in the first two months!

~ Quality High Yield Income – Current Yield – 12%

~ SWAN Quality Income – Current Yield – 6%

~ High Quality Growth

~ Ultra-High Growth

Join now for top income buys, timely macro insights, and a lively chat room! A portion of the proceeds are donated to the DAV (Disabled American Veterans).