Summary:

- Exxon Mobil’s FY23 earnings were impacted by soft commodities pricing, particularly in the natural gas market. Exxon is well positioned to navigate the flat O&G market in eFY24.

- Exxon continues to invest in their core assets in the Permian and Guyana while divesting non-core to enhance operational efficiencies.

- Exxon is actively investing in carbon capture, utilization, and storage (CCUS) projects and lithium mining to enhance its carbon reduction efforts and tap into the growing electric vehicle market.

STEFANI REYNOLDS/AFP via Getty Images

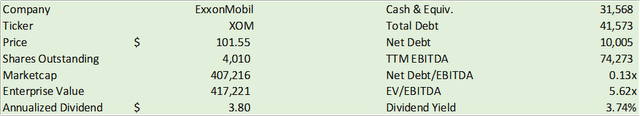

Exxon Mobil (NYSE:XOM) posted a mixed end of FY23 with strong production being offset by softer commodities pricing from their upstream, refining, and chemicals segments. Though these headwinds are expected to persist with JPMorgan commodities analysts anticipating Brent to reach $83/bbl mid-2024, I do expect a continuation of a soft chemicals market as we navigate this coming year. Despite these challenges, management is being proactive in their cost-cutting initiatives and actively investing in their next-generational projects including CCUS and lithium mining. I believe XOM shares continue to present a strong buying opportunity as the firm exhibits their dedication to shareholder returns in the form of consistent dividend growth and share buybacks. I provide XOM shares a BUY recommendation with a price target of $124.34/share.

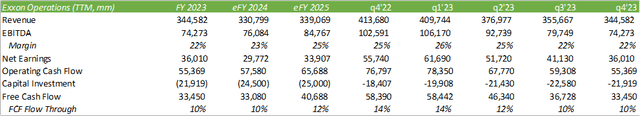

Operations

Exxon’s earnings were largely impacted by a soft commodities market with eFY24 guidance suggesting that the commodities prices will remain in a flattish state throughout eFY24. JPMorgan (JPM) forecasts that Brent oil prices could reach $83/bbl in 2024 and potentially edge down by -10% in 2025. The bank’s analyst estimates that oil demand will rise by 1.6MMbbl/d in 2024 as a result of higher utilization in emerging markets, primarily China, holding steady in the US, and some stable weakness in Europe.

Despite sustained economic headwinds, we see oil demand rising by 1.6 million barrels per day in 2024, underpinned by robust emerging markets, a resilient U.S., and a weak but stable Europe.

Natasha Kaneva, Head of Global Commodities Strategy, JPMorgan

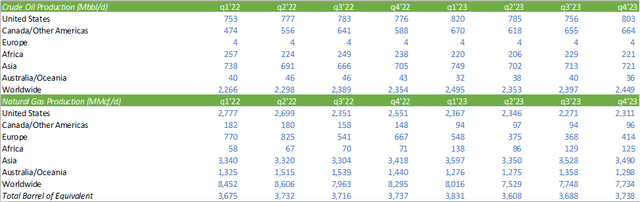

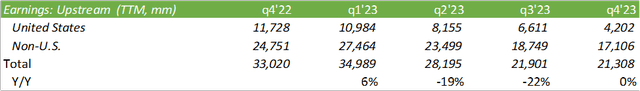

Upstream production increased sequentially by 136Mboe/d to 3.8MMboe/d as a result of growth in their Permian and Guyana assets. As alluded to in my last report covering Exxon, Exxon brought their 3rd Guyana development online in November, increasing the block’s production by 220Mboe/d for total net production of 252Mboe/d in the region.

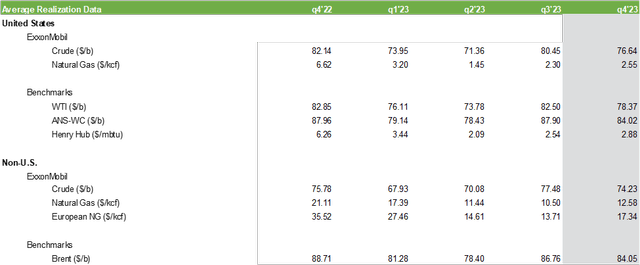

Much of Exxon’s q4’23 earnings headwinds were the result of a softer natural gas pricing market with an average price/Mcf of $2.56/Mcf. This compares to natural gas prices in q4’22 of $6.62/Mcf, a -61% decline in gas prices. Oil prices remained relatively stable but still came in softer on a year-to-year basis, with a decline in realized price of -6.7%. European gas prices experienced a significant downshift as well, declining by -51% from q4’22 to $17.34/Mcf with non-US crude declining only -2% to $74.23/bbl.

Volumes offset some of the price decline as Exxon continued their focus in their core assets across the Permian and Guyana.

Looking ahead to eFY24, aside from developments in Guyana, I anticipate Exxon to taper production growth as oil and natural gas prices remain flat on slow-demand growth. One point I had previously mentioned covering the Exxon & Pioneer Natural Resources merger was that as the industry consolidates, operators will have the flexibility to curtail some short-cycled production or refocus production into lower-yielding wells during soft commodities markets. Though, crude still remains significantly above breakeven prices, with Guyana production estimated to breakeven between $25-35/bbl.

Management mentioned that their Guyana assets may be taken offline for a brief period as the firm connects their gas pipeline to onshore Guyana to feed directly to their power utilities. Though this may interrupt production for the period, I believe that this may lead to some cost-reducing tailwinds for gas transport and will benefit the firm in the long-run as they further develop the Stabroek block.

Exxon generated over $4b in cash from divestitures in FY23 as management sought to exit non-core assets and focus in full on their highest cash-generating assets. This included exiting their East Texas upstream assets in q4’23.

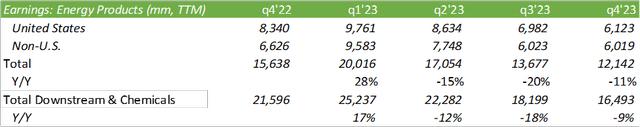

Refined products and chemicals production increased in FY23 and experienced some weaker seasonal headwinds across the crack spread. The energy products segment experienced some headwinds due to higher seasonal expenses and lower volumes resulting from increased scheduled maintenance in q4’23. This resulted in a -32% y/y decline in q4’23 and a decline of -11% on a TTM basis for the quarter in earnings for the segment. Though non-US energy products performed relatively flat y/y, US-based energy products experienced a nearly -40% decline in earnings.

Overall, downstream experienced significant headwinds throughout the year as the firm worked through the chemicals and refined products downcycle. Looking at chemicals competitors like LyondellBasell (LYB) for some guidance, it appears that the downcycle has remained persistent.

CCUS & Lithium

An exceptionally large portion of the FY23 earnings call was dedicated to carbon reduction as it relates to new projects on the horizon. With their acquisition of Denbury closing, Exxon will have the opportunity to further enhance their utilization of captured CO2 emissions at the wellhead. With the acquisition, Exxon now owns the largest CO2 pipeline system in the US at 1,300 miles along with 15 onshore CO2 storage sites.

I believe that this acquisition can be utilized on multiple fronts, including internal use, CO2 sales to other producers, sales of carbon credits, and sequestration of 3rd-party carbon emissions. I believe that this acquisition will elongate well life and enhance production as the firm seeks to reduce costs. I believe this solution will enhance efficiencies with their carbon capture technology as Exxon seeks to secure contracts with industrial firms like Nucor (NUE), creating an end-to-end solution that doesn’t just result in CO2 being stored underground.

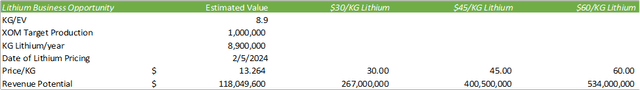

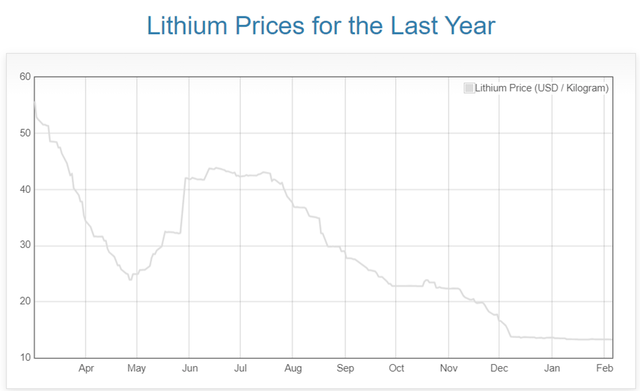

Exxon made significant headway towards becoming a primary lithium producer in the fourth quarter as the firm successfully drilled their first lithium well in November 2023. Management is targeting 2027 to begin their first lithium production with operations scaled by 2030 to service the growing electric vehicle space. According to the IEA, each electric vehicle requires 8.9kg of lithium. Exxon set its sights in mining enough lithium to build 1mm electric vehicles annually. At today’s lithium price, we can anticipate this business to generate north of $118mm/year in revenue.

Production remains roughly 3 years out with full ramp-up 6 years out, making valuing this venture challenging as lithium prices have been under pressure in the last year. Using an array of pricing, the business does have the potential to generate some serious revenue, though nowhere near upstream. Best case scenario to the extent of this analysis, at $60/kg of lithium, the lithium segment will account for only 1.65% of upstream revenue.

In terms of growth, Exxon ended FY23 with higher than expected capital & exploration investments totaling $26.3b for the year as the firm opportunistically accelerated activities in their two primary assets, the Permian Basin and offshore Guyana. I believe each of these assets will balance each other out in Exxon’s long-term operations as the long-cycle assets in Guyana can act as the firm’s foundation and the short-cycle assets in the Permian can be pushed or pulled to reflect commodity pricing. Though management discerned increasing production in the Permian, I believe that this feature can offer the firm tremendous flexibility if oil prices were to experience a decline in 2024 on the back of slower global growth.

Management also discussed their new value-enhancing product, Proxxima, which is made from lower-value products from gasoline production. Management believes that this product could provide $1b in earnings by 2040. Guidance suggests lower upstream volumes in q1’24 paired with some headwinds in energy products due to increased scheduled maintenance. Exxon does have some significant projects expected to come online in 2025, including the Yellowtail development in Guyana and the Golden Pass LNG terminal in Texas, amongst others. Management has budgeted $23-25b in capital investments for FY24 to improve their portfolio mix and low-carbon solutions. Longer-term, Exxon is pursuing over $20b in lower emissions opportunities.

Valuation & Shareholder Value

Despite the commodities-pricing headwinds experienced in FY23, Exxon has remained in a strong position and continues to reward shareholders through their robust buyback and dividend programs. As the acquisition of Pioneer is anticipated to close in q2’24, Exxon will resume buying back shares.

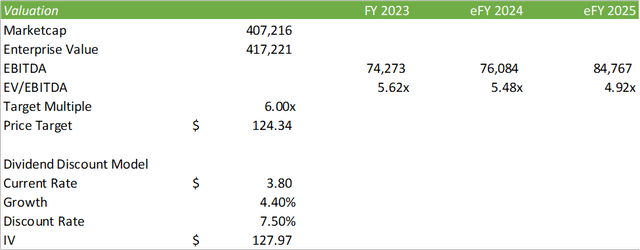

From a valuation perspective, I believe Exxon shares should be trading closer to 6x EV/EBITDA during this cyclical cycle. This would value XOM shares at $124.34/share based on eFY25 EBITDA. The same can be said using a single-stage dividend discount model, using their previous dividend growth rate as a baseline, discounted at 7.50%. I provide XOM a BUY recommendation with a price target of $124.34/share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.