Summary:

- I recommended doubling down on XOM at the end of January 2024, and my last call proved to be very successful. But what’s next for Exxon?

- The oil price is likely to be supported by a shortage of commodities on the physical market as 2024 is going like one of the worst years for oil inventories.

- The demand in developed markets continues to grow, which is especially noticeable in the US, according to EIA.

- I believe Exxon Mobil’s continued focus on operational efficiency and synergies will gradually boost its profitability and margins, which should lead to a higher stock price.

- I’ve decided to reaffirm my “Buy” rating today.

zodebala

Intro & Thesis

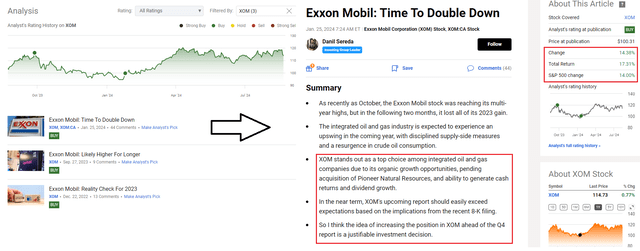

I first initiated coverage of Exxon Mobil Corporation (NYSE:XOM) stock at the end of December 2022. Unfortunately, I had no luck with timing at that time. However, when the stock started to turn around, I wrote my second article at the end of September 2023 and actually caught the local top of the stock. Nevertheless, I believed that Exxon Mobil could recover in the medium term as the company seemed resilient against the backdrop of global instability and relatively high energy prices. I therefore recommended doubling down on XOM at the end of January 2024, and my last call proved to be very successful.

Seeking Alpha, my coverage of XOM, notes added

Today, although I risk mistiming again, I still believe that considering the global economy, the price of oil products shouldn’t fall down much from current levels – thus XOM stock shouldn’t give up much of its recent gains. Yes, shocks are possible, but Exxon remains a stable and well-managed company capable of weathering them with limited losses. Therefore, I reiterate a “Buy” rating again.

Why Do I Think So?

Even though the crude oil price draws a sideway move when we look at the weekly chart, it hit 2024 low a few days ago, not looking promising for the medium term:

TradingView, WTI oil price chart (CFD)

Predictions of a further decline have already surfaced on Twitter (or X), but first, let’s find out why oil is generally weakening (at least on paper).

The primary factor is weak demand from China as the recent data shows China’s oil imports in July hit their lowest since September 2022.

China’s fuel oil imports fell for a third consecutive month in July, customs data showed on Tuesday. July imports totalled 1.38 million metric tonnes (about 282,000 barrels per day), 8% lower than in June and 9% down from a year earlier, according to General Administration of Customs data.

Some analysts link this to a temporary economic slowdown, but with New Energy Vehicles (NEVs) making up >50% of new car sales in July, China’s reduced oil demand may be structural. In August, OPEC slightly cut its 2024 global oil demand growth forecast from 2.25 million to 2.11 million barrels per day, citing reduced demand from China – this region really means a lot to the whole O&G story.

Citibank predicted back in May that oil prices could drop to $55 by the end of 2025 due to global vehicle electrification, Morningstar cited the source. Goldman Sachs recently supported Citibank’s forecast, suggesting Brent crude could fall to $68 per barrel if China’s demand doesn’t increase, implying a drop in WTI crude from $72 to around $64.

Another factor is the U.S. economic slowdown. The Bureau of Labor Statistics revised down job creation figures by 818,000 for the year up to March 2024, the largest revision since 2009, indicating “a labor market and economy closer to recession than previously thought.”

As we know from economic theory, as economic growth slows, most industries scale back production, further reducing the demand for oil and energy – so this can lead to a surplus in oil supply, putting downward pressure on prices.

Lastly, the seasonal end of the summer vacation period reduces gasoline and oil demand: Historically, oil prices often fall in August, and this year follows that trend.

So all this doesn’t look good for the oil industry going forward. However, it’s not quite that simple. The $70 per barrel mark for WTI is a critical price point for the oil market – many oil companies are comfortable with prices above $70, while prices below this threshold could cause them to rethink their investment plans. If prices fall below $70, I think OPEC countries may also reconsider their decision to increase oil supply starting in October. I therefore do not see any bad prospects for WTI in the short to medium term.

In addition, the oil price is likely to be supported by a shortage of commodities on the physical market as 2024 is going like one of the worst years for oil inventories globally.

At the same time, demand in developed markets continues to grow – especially noticeable in the US, according to EIA (XOM’s biggest end-market, 41% of revenue in Q2 FY2024):

… demand in advanced economies, especially for US gasoline, has shown signs of strength in recent months. The US economy, where one-third of global gasoline is consumed, has outperformed peers, with a resilient service sector buttressing miles driven. As a result, OECD oil consumption flipped from a 300 kb/d annual contraction in 1Q24 to growth of 190 kb/d in the second quarter.

So, first of all, I wouldn’t dismiss oil and predict its collapse because of EV adoption – it’s just too early to say. Additionally, I wouldn’t underestimate the fact that shares of companies like Exxon Mobil, despite the recent small correction, are still quite high relative to their quotes from a few months ago.

Speaking of XOM specifically, let’s take a closer look at this earnings release and subsequent corporate events.

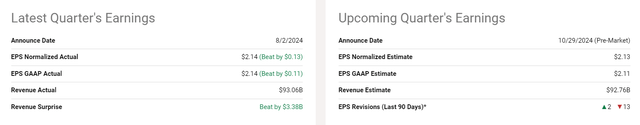

In Q2 Exxon’s revenue went up by 12.2% YoY to over $93 billion, beating the consensus estimate by ~$3.38 billion or 3.77%, according to Seeking Alpha (that was actually the biggest revenue surprise since 2022). As per the 10-Q filing, the revenue increase was supported mainly by improved realizations and increased volumes from advantaged upstream investments, particularly in the Permian Basin and Guyana.

Despite that impressive revenue growth, Exxon faced challenges with its margins: The company experienced a decrease in industry refining margins, which negatively impacted earnings by ~$860 million. However, this was partially offset by structural cost savings, which increased earnings by ~$180 million. The market consensus was generally expecting more modest results and much greater damage on margins, so in terms of the bottom line, Exxon Mobil also managed to beat the consensus by ~6.77%.

I don’t quite understand why the company’s results for Q2 FY2024 led analysts to significantly reduce their estimates for Q3, but the fact remains: 13 out of 15 analysts, or almost 87%, lowered their expectations for the next quarter’s earnings.

At the same time, as Argus Research analysts noted (proprietary source, August 2024), Exxon expects to realize ~$1 billion in synergies beginning in the second year after the closing of the Pioneer acquisition, with a gradual increase to ~$2 billion per year over the subsequent decade. It expects approximately two-thirds of the synergies to come from improved resource recovery, with the remainder from capital spending and operating expense efficiencies.

I’ve already written about this before, but again: I believe that Exxon made the right move by acquiring its competitor from the market, significantly expanding its base of high-class assets with potentially high ROI, as the transaction provides leading scale and significantly enlarges XOM’s Permian Basin inventory to 15-20 years at a cost of supply of ~$35-$40 per barrel. As oil inventories begin to gradually replenish worldwide – a process that is inevitable, in my opinion, due to constantly growing consumption – oil prices are likely to remain stably high, with potential for further growth in the coming years (regardless of what decarbonization adepts might suggest). So this environment should allow Exxon’s new asset base to flourish and generate substantial FCF. Even now, the cash flow is significant, without accounting for the positive synergies expected to materialize in a few years.

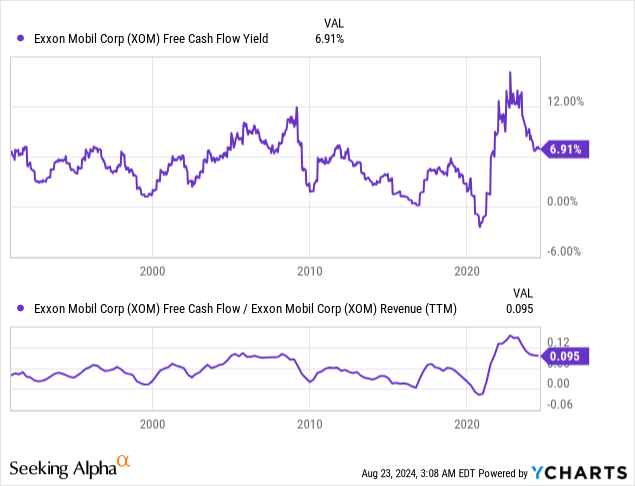

Free cash flow margin, as a ratio to revenue, stands at 9.5% based on the trailing twelve months (YCharts data). Meanwhile, the free cash flow yield is nearly 7%, which, in my opinion, makes the XOM stock very attractive for purchase, even at today’s still relatively elevated (for some people) price levels. The recent dividend increase (4% on October 27, 2023) and also the share repurchase program (~$35 billion in buybacks through 2024) further solidify XOM’s prospects, making the total shareholder return outreach 10% ($15.6 billion in dividends + $35 billion in buyback). What’s not to like here?

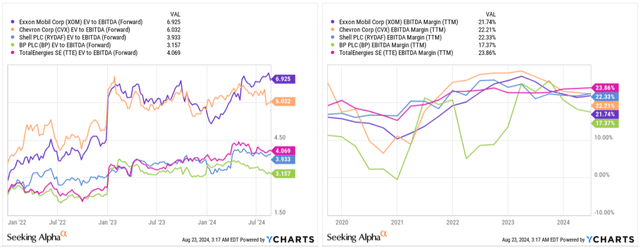

Compared to other peers – especially international ones – XOM indeed trades at a premium, with a valuation of nearly 7x its projected FWD EV/EBITDA, against the backdrop of average EBITDA margin. On the other hand, I think it’s important to consider that if management’s initiatives to expand the synergy effect succeed, the company’s profitability will likely be above average in a few years. Additionally, the premium valuation can be attributed to the uniqueness of the company’s assets base following recent acquisitions.

I expect the current valuation premium to persist longer, driven by better cost control going forward and the potential recovery of oil prices globally; that’s why I believe Exxon Mobil stock still has upside potential.

Where Can I Be Wrong?

As I mentioned in my previous articles, an investment in ExxonMobil involves various risks related to the nature of the commodities business and the company’s global activities. One major challenge is the limited control over product prices, as the company is dependent on a volatile commodities market. Exxon also operates in regions where there has been corruption and political upheaval in the past, which brings with it geopolitical risks. However, the company’s broad geographical presence helps to mitigate the impact of the risks associated with individual countries.

Transaction risks are relevant due to the acquisitions of Pioneer and Denbury by XOM. Also, XOM’s major ongoing capital projects could experience delays or budget overruns, which could weigh on the stock. If the company continues its acquisition strategy, integration risks could also arise.

In addition, I may be wrong in my conclusion that the premium on the company’s valuation will be sustainable in the coming years. Everything can change at any moment: If there’s a sudden adjustment to align with the valuation of its global peer, it could significantly impact investors who buy the stock at current prices.

So investors should keep the uncertainties associated with commodity markets, potential operational challenges, and geopolitical factors in mind before buying XOM.

The Verdict

Despite the obvious risks to both the company and the O&G industry as a whole, I believe Exxon Mobil remains one of the highest-quality companies in terms of its asset base and management. The stock’s valuation multiples relative to other peers don’t concern me; I focus on the overall return to investors through regular dividend increases and buybacks, and the numbers I see are more than satisfactory. I believe the current skepticism, especially as WTI prices approach their YTD lows, is overblown. Consumption is growing despite the obvious weakness in the Chinese market, and the American market is performing well. I expect that strength in Western markets, along with continued efforts to improve operational efficiency and realize synergies, will allow Exxon Mobil to gradually increase its margins and overall profitability. This should enable the stock to go higher, assuming it’s maintaining the valuation premium. That’s why I’ve decided to reaffirm my “Buy” rating today.

Thank you for reading!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!