Summary:

- Exxon Mobil Corporation stock has outperformed the S&P 500 significantly in Q1, benefiting from a rotation towards energy stocks.

- My Strong Buy thesis has panned out, with favorable demand/supply dynamics benefiting oil majors like Exxon.

- The market has likely priced in higher oil prices for Q2 and beyond, but there are concerns about sustainability and potential resistance at the $100 level.

- I explain why the risk/reward profile is no longer as attractive as it was when the market shunned XOM in early 2024.

- XOM investors who joined the surge late need to brace for impact.

JHVEPhoto

Exxon Mobil Corporation (NYSE:XOM) investors have enjoyed a remarkable revival in Q1, as XOM outperformed the S&P 500 (SPX) (SPY) significantly. As a result, investors who bought into the pessimism in energy stocks have performed well. The energy sector (XLE) has also outperformed in Q1, as the market “quietly” rotated to beaten-down and relatively attractive oil and gas plays. While the market was focused on the AI hype driven by the leading semiconductor and SaaS plays, astute energy investors accumulated their positions.

I urged investors to capitalize on XOM’s pessimism in early January 2024 as I assessed a dislocation. I emphasized that sector rotation had already started in mid-December 2023 as buying sentiments improved. Therefore, I postulated that XOM was well-positioned to benefit from a sector rotation toward energy plays, leading me to upgrade XOM to a Strong Buy.

With XOM posting a nearly 21% total return YTD, I assessed that my bullish thesis has panned out, as the fears over energy stocks were overdone. As a result, analysts and traders have also turned bullish, anticipating positive demand/supply dynamics benefiting oil majors like Exxon.

Exxon Mobil posted its fourth-quarter earnings release in early February. While the company delivered a revenue decline of almost 17% for FY23, it didn’t surprise XOM investors after a stunning 2022 performance. As a result, investors are urged to pay heed to a forward-looking market when assessing opportunities in cyclical plays like XOM.

Notwithstanding a pre-Q1 earnings update that estimated $2.7B in upstream impairments, XOM’s buying sentiments have remained robust. Exxon Mobil also reminded investors that it projected up to a $400M sequential earnings impact on its upstream segment, attributed to “changes in oil prices.” As a result, Exxon could report operating earnings of $6.65B for Q1, down from $11.6B recorded a year ago. Despite that, the market seems unperturbed as XOM continued its upward trajectory, sustaining bullish sentiments of a more robust medium-term recovery.

Given the sharp recovery in underlying crude oil prices (CL1:COM) (CO1:COM), the market has likely attempted to price in higher realizations in Q2 and beyond. While Exxon has a well-diversified business extending into its downstream and chemicals segment, its upstream business remains sensitive to oil price volatility. Therefore, Exxon investors must question whether the resurgence in XOM and the energy market could be sustained through 2024, as Brent crude reached levels last seen in October 2023. In other words, should we expect XOM to have a more sustained cyclical upswing or a broader consolidation range with the $90 Brent level defining the critical resistance zone?

Calls for a $100 oil price level have resurfaced as analysts assessed the extension of the supply curbs from OPEC+ through June. However, I believe the $100 level will likely be a critical resistance zone that could hamper further upside bias as OPEC+ potentially looks to ramp up its production capacity. While the market seems to have underestimated the demand boost in 2024, supply dynamics are expected to remain uncertain. There are no clear signs that the Biden Administration could release more stockpiles for now. However, further price spikes aren’t likely to be welcomed since 2024 is an election year. Moreover, OPEC+ might not be keen to allow oil prices to spike to unsustainable levels, as it could induce potentially sharp downward volatility, as seen in 2022. Also, worries about demand destruction could resurface and deal a massive blow to the Fed’s ability to manage inflation dynamics.

As a result, I believe the risk/reward profile for XOM could be increasingly limited, moving ahead depending on the cyclical upswing of oil prices. What matters more could be how Exxon continues to drive higher margin projects through its Guyana stake and its strong presence through its Permian assets. Exxon is also on track to achieve $15B in “structural cost savings through 2027,” helping navigate the cyclical uncertainties better. In addition, Exxon is also pursuing transition opportunities in carbon capture and storage, or CCS, and direct lithium extraction, or DLE. It remains to be seen whether these opportunities could work out according to Exxon’s expectations, as they are still nascent. However, I believe Exxon’s fundamental robust business model across all cycles should underpin the market’s confidence in its ability to manage peak oil demand and energy transition in the medium term.

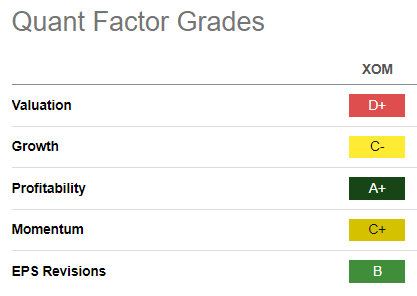

XOM Quant Grades (Seeking Alpha)

XOM’s valuation premium (“D+” valuation grade) relative to its sector peers doesn’t surprise me, given its fundamentally robust operating model (“A+” profitability grade). As a result, I’m confident that XOM remains well-placed to attract dip-buyers at crucial support levels as they reallocate to the energy sector.

While I assessed that XOM’s buying momentum could top out in the near term, I didn’t glean red flags, behooving investors to consider cutting exposure significantly.

Despite that, XOM’s risk/reward seems more well-balanced now, as the market realized its folly of being too bearish on its opportunities. With oil prices potentially peaking at the $100 level before facing selling pressure, further upside momentum on XOM could face more pressure as investors reassess uncertain supply headwinds from OPEC+ in H2 and a potentially softer economic outlook.

Rating: Downgrade to Hold.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!