Summary:

- Unity’s game engine provides it with a solid competitive position and a large and growing opportunity. The company has made strategic missteps and executed poorly in recent years though.

- Unity’s poor performance relative to AppLovin raises concerns about its Grow business and the value of the ironSource acquisition.

- There is a significant potential downside if the Grow business continues to struggle, particularly if expected margin gains are not realized.

- The share price could increase significantly if Unity can improve its monetization solutions and reignite growth in its Grow business.

Devrimb

I have long supported Unity (NYSE:U) due to the growing importance of game engines and the technical difficulty of creating a cutting edge game engine. Unity’s engine is currently monetized primarily through advertising though, and this is an area in which Unity has been left trailing its competitors. While Unity is investing to change this, it is not currently clear how successful the company will be.

I previously suggested that Unity was attractively priced given its potential, but that it still needed to demonstrate it could capitalize on its opportunity. Unity’s poor performance relative to AppLovin (APP) suggest real problems in Unity’s Grow business and call into question the value of the ironSource acquisition.

While the negative impact of runtime fees appears to have been modest, and cost-cutting efforts should see Unity transition to profitability, the company’s near-term future hinges on its ability to improve the performance of its advertising products. In this regard, I don’t have much confidence, but Unity’s valuation should limit further downside provided margin gains are realized.

Market Conditions

While market conditions remain soft, much of Unity’s recent struggles appear to be due to poor management decisions and execution issues. Unity has stated that its Grow business has seen increased competition, which appears to be a reference to the strong performance of AppLovin.

Shifts in the market wrought by privacy changes and the switch from waterfall to in-app advertising have reshaped the competitive landscape and Unity is still trying to adapt to current conditions. This situation could have been exacerbated by the fact that Unity has been trying to integrate ironSource, rather than improving its adtech. While this is now changing, if this was a simple fix, it is likely Unity would have already addressed its problems or even not acquired ironSource in the first place.

Unity’s Create business is performing better but is also facing its own headwinds. For example, the Create business has been negatively impacted by restrictions in China. China-based game developers doing business outside of China have been performing well though. Macro uncertainty and higher interest rates also appear to have impacted demand from industrial customers.

Strategic Pivot

Unity’s strategic pivot is taking shape, beyond just cost cutting. The company is refocusing on its Engine, Cloud and Monetization solutions for gaming. Unity is referring to this as its strategic portfolio. The company also plans on continuing to extend its real-time 3D capabilities to non-gaming customers.

A two-phase reset was commenced in the fourth quarter. In phase 1 Unity is focusing on its core business and right sizing its cost structure. In phase 2, the company’s focus will shift back to generating growth.

Unity is exiting businesses where it does not believe it can provide unique value to customers. This includes its professional services business, the hardware component of its multiplayer business, the independent development of professional artistry tools, and ironSource’s Luna business. In aggregate, these businesses generated 283 million USD in revenue for 2023 and operated at a significant loss. Unity hasn’t quantified this loss but has suggested that it was significant.

Professional Services Sale

Capgemini is acquiring Unity’s Digital Twin Professional Services business. Unity had already been pulling back on this part of the business and trying to use partners to provide services. Unity’s Digital Twin Professional Services team will join Capgemini. Focus sectors for Capgemini include automotive, consumer products & retail, energy & utilities, aerospace & defense, healthcare & life sciences, and industrial products/manufacturing.

Unity Business Updates

Unity continues to try and improve the scalability and performance of its Engine, with a focus on multiplayer games and LiveOps. Unity 6 is scheduled for release later this year, although this appears to be a fairly incremental update to the platform. Unity is introducing support for WebGPU, which will improve graphics rendering fidelity for Unity web applications.

Unity also continues to scale its generative AI solutions, Unity Muse and Unity Sentis, increasing productivity and enabling developers to create more engaging experiences. Muse is now generally available, and Unity has stated that customer interest in the product is strong. These types of solutions, along with improved artistry tools, could provide upside going forward. The tangible benefits of acquiring Weta and Ziva Dynamics appear to be limited so far though.

Unity is partnering with Meta to bring Unity titles to HTML5 Instant Games. Instant Games enables users to play games directly in the Facebook feed or Messenger conversations.

Unity’s industrial business continues to grow at a healthy pace. Unity recently partnered with a leading US retailer that is integrating its commerce APIs into games and apps to sell physical goods in real-time 3D experiences. Unity has also partnered with Mercedes Benz in support of their new MBUX real-time navigation system.

Creating a more competitive monetization solution is a focus area for Unity in 2024. The company wants to strengthen its Monetize solutions through the use of better data and models, including the use of neural networks to optimize return on ad spend. While this could lead to outperformance and shift the narrative surrounding the company, Unity’s recent struggles and the acquisition of ironSource suggest this is not a simple fix.

Runtime Fees

Unity introduced runtime fees on the Editor at the end of September, which was not well received by the developer community. While it is still likely too early to say definitively, Unity has suggested that the impact of the developer backlash has been fairly limited. Unity’s modification of the runtime fees and John Riccitiello’s exit probably helped to limit the fallout.

Financial Analysis

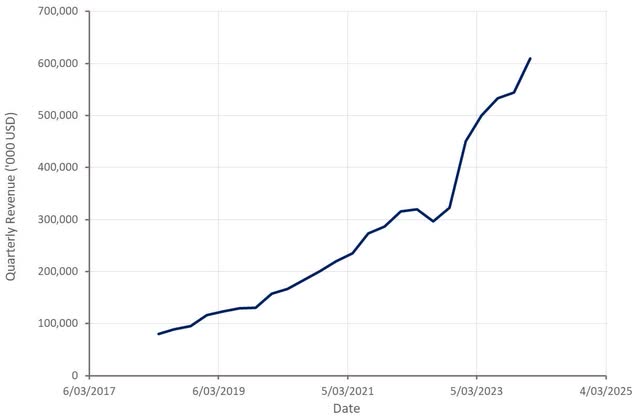

Unity generated 609 million USD revenue in the fourth quarter, up 35% YoY. This figure is misleading though, with underlying growth remaining weak. Weta recently transitioned to a perpetual license agreement for the use of Unity’s Weta tools, resulting in 99 million USD of incremental revenue in the fourth quarter. Excluding this transaction, revenue would have been down 2% YoY on a pro-forma basis.

Create revenue was up 47% YoY in the fourth quarter, to 290 million USD. Excluding incremental revenue from Weta, Create revenue was down 4% YoY. Unity attributed this decline to its portfolio reset, particularly Professional Services and Unity Gaming Services. Core subscriptions excluding China grew 18% YoY and Industry growth continues to outpace gaming growth, with Industry now representing 23% of core subscriptions.

Grow revenue was 319 million USD in the fourth quarter, an increase of 26% YoY, or flat on a pro-forma basis. Unity attributed softness to increased competition and its runtime fee policy.

Unity expects 415-420 million USD revenue from its strategic portfolio in the first quarter, which would be flat relative to Q1 2023. For the full year, Unity expects 1,760-1,800 million USD revenue from its strategic portfolio, up 2-4% YoY. Revenue growth is expected to accelerate in the back half of the year, with Unity pointing towards a double-digit growth rate at the end of the year. This acceleration is expected to be driven by improved monetization performance.

Figure 1: Unity Revenue (source: Created by author using data from Unity)

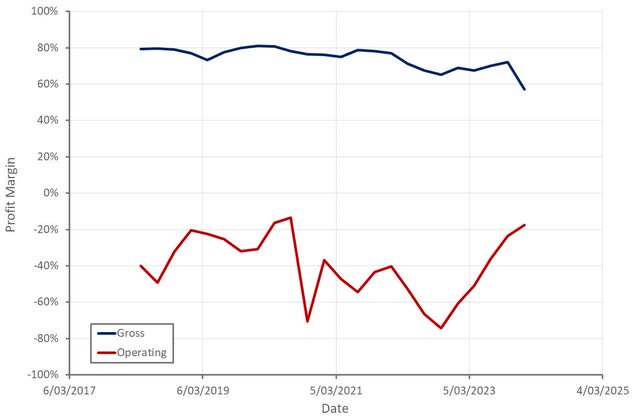

Unity is cutting costs in a number of areas in order to accelerate its transition to profitability:

- 25% workforce reduction

- Cloud hosting cost reductions

- Office footprint consolidation

- Software license optimization

Most of these changes are expected to be implemented by the end of the first quarter. This should reduce non-GAAP operating expenses by approximately 250 million USD, along with reduced SBC and cost of revenue. As a result, Unity expects to exit 2024 with an adjusted EBITDA margin of over 25%. While this should ultimately help limit downside, the prioritization of near-term profits calls into question the company’s long-term opportunity.

Figure 2: Unity Profit Margins (source: Created by author using data from Unity)

Conclusion

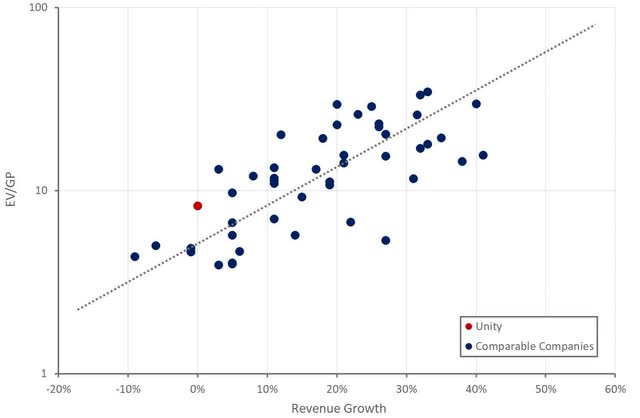

While Unity’s share price has declined significantly in recent months, this has been driven by the company’s poor performance. Unity’s valuation could still be considered high given the company’s current growth rate and lack of profitability.

Revenue will decline in 2024 and underlying growth will remain weak, which will likely lead to pressure on the share price, unless Unity can outperform expectations. The company should transition to profitability though and begin to generate reasonable margins in the second half of 2024.

Despite near-term headwinds, there is still a large opportunity ahead of Unity and the company retains a dominant position in mobile gaming. Unity’s industrial business should also continue to see solid growth, particularly if the macro environment improves. It is hard to get excited about Unity’s prospects while its monetization business is struggling though.

Figure 3: Unity Relative Valuation (source: Created by author using data from Seeking Alpha)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of U, APP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.