Summary:

- Exxon Mobil and Chevron benefit from tight oil markets.

- China’s reopening and sanctions against Russia could drive up oil prices in 2023.

- The dividend yields are comparable, but XOM looks better than CVX apart from that.

bymuratdeniz

Article Thesis

The world is experiencing an energy crisis, and despite the fact that oil prices have pulled back in recent months, the macro picture for oil companies looks compelling. Companies such as Exxon Mobil (NYSE:XOM) and Chevron (NYSE:CVX) are doing well in this environment, but before investors put money into any oil stock, some things should be considered. In this report, we’ll compare XOM and CVX to see which one is looking better right here — I believe that it is XOM, thanks to a lower valuation and higher cash returns, in combination with a more attractive asset base.

Macro Picture

While oil prices have pulled back in recent months, I do believe that the macro picture for most oil companies is still very solid. With oil at $70 to $90 per barrel, oil companies are still highly profitable, including Exxon Mobil and Chevron. And there is a good chance that oil prices will rise in the coming months and quarters, I believe. First, the opening of the economy in China should drive demand, as more people drive and fly again, and as economic activity picks up. On top of that, Strategic Petroleum Reserve releases have ended, which will impact the supply-demand picture as well. Especially if the government wants to fill up the SPR again, oil markets could benefit quite a lot. Due to sanctions, oil output in Russia could also fall meaningfully this year — it’s not clear what the impact will be, but there are analysts that predict a 1-2 million barrels per day decline in 2023, which is 1-2% of world oil production. Gas-to-oil switching in Europe and some other markets, due to high natural gas prices, could also have a positive impact on world oil demand.

Oil prices have pulled back due to recession worries, but unless we get a very deep recession, oil demand shouldn’t fall too much. With the above factors being beneficial for oil prices, I do believe that there is a good chance that oil prices will remain at current levels or rise beyond them going forward.

Exxon Mobil Versus Chevron

Exxon Mobil and Chevron are the two largest Western oil companies by market capitalization, being valued at $460 billion and $340 billion, respectively. Both are US-based, which makes them comparable when it comes to governance risks — an argument by some investors against European supermajors such as Shell (SHEL) and BP (BP).

Nevertheless, there are some important differences when it comes to Exxon Mobil and Chevron, which is why I believe that they aren’t equally good investments right here.

Exxon Mobil has invested heavily in exploration and new production assets in recent years and will continue to reap the benefits of those investments for a long time. Its Guyana offshore assets are some of the best in the world, thanks to a very large reserve base, low production costs, low regulatory and political risks, and due to the fact that Exxon Mobil can scale up production at a hefty pace in the country. Just a couple of days ago, XOM’s partner Hess (HES) stated that an additional platform could make sense thanks to ongoing new finds in the area. Current plans see a production level of 1.2 million barrels per day in 2027 in Guyana, and with additional platforms, output could grow to an even larger level.

Chevron does not have a similarly attractive and massive growth driver, however. In fact, its output has declined in the most recent quarter, dropping by 3% in its International business. In the Permian Basin, Chevron is growing its production, but that holds true for Exxon Mobil as well and is thus not really an advantage for Chevron.

Let’s next look at balance sheet strength, as that has implications for both an investment’s risks and for a company’s potential to reward shareholders with cash returns.

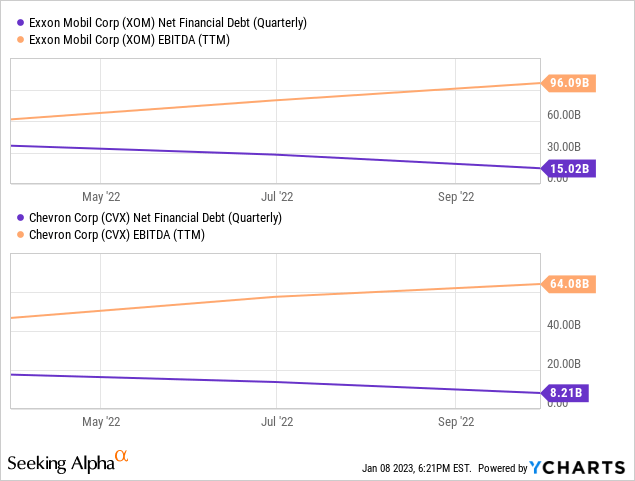

Exxon Mobil has a higher net debt level, at $15 billion, versus $8 billion for Chevron. On the other hand, Exxon Mobil also generates higher cash flows and profits. On a net debt to EBITDA basis, which is typically used to evaluate a company’s leverage, XOM sports a 0.16 ratio, versus 0.13 for Chevron. CVX thus uses slightly less debt, but the ratio is pretty low for both companies. XOM has an AA- credit rating, as does CVX. There is thus no major difference between the two companies when it comes to debt usage, as both have paid down most of their debt on a net basis over the last two years.

With clean balance sheets, both companies are positioned to reward shareholders with substantial cash returns. Some of that will come via dividends, but the two companies are also buying back their own shares. This drives earnings per share and cash flow per share over time, all else equal, and buybacks also make the dividend safer, as fewer dollars are needed to keep the dividend intact as the share count declines over time.

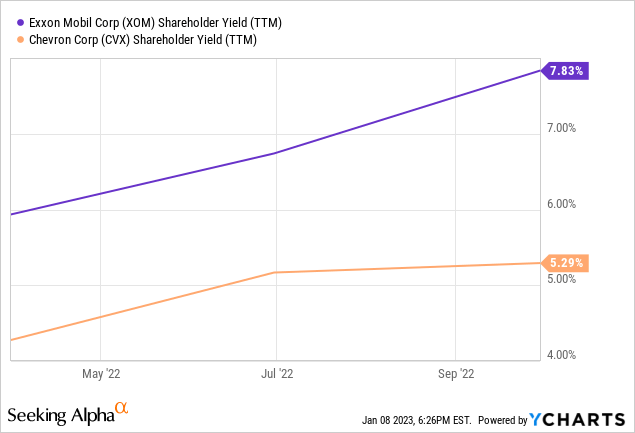

Looking at the last twelve months, Exxon Mobil has offered the more attractive shareholder yield by far. It returned 8% of its market capitalization to the company’s owners, which is around 1.5x what Chevron has offered over the same time frame. This is mainly due to larger buyback spending at Exxon Mobil, as the dividend yields are relatively comparable — XOM’s dividend yield of 3.3% is just marginally higher than that of Chevron, at 3.2%. Over time, Exxon Mobil’s much higher buyback spending should have a sizeable impact on its earnings and cash flow per share performance.

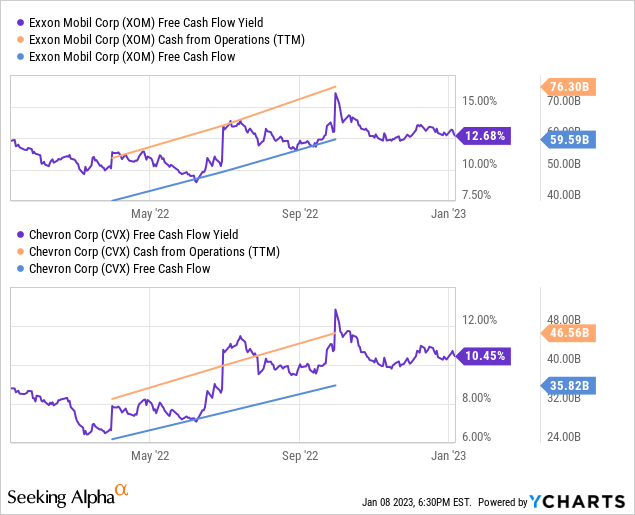

Exxon Mobil is able to buy back more shares, relative to Chevron, thanks to a better cash flow position. That, in turn, is due to advantaged low-cost assets that have higher netbacks.

Exxon Mobil has generated much higher cash flows relative to Chevron over the last year — its free cash flow totaled $60 billion, versus $36 billion for Chevron. That was possible despite substantially higher capital expenditures from XOM, due to the fact that XOM also had way higher operating cash flows versus CVX. Of course, Exxon Mobil has a higher market capitalization, thus its 67% higher free cash flow does not translate into an equally pronounced difference when it comes to the two companies’ free cash flow yields. But even when we account for XOM’s higher market capitalization, it still looks advantaged when it comes to cash flows — its 13% free cash flow yield is way higher than the 10% free cash flow yield Chevron trades at. It should be noted that Chevron’s free cash flow yield of 10% is far from bad, but Exxon Mobil’s is just better.

Looking at other valuation metrics, Exxon Mobil again looks like the more favorable pick. It trades for 9.9x this year’s expected net profit, while Chevron trades at 10.7x 2023’s expected earnings per share. Likewise, Exxon Mobil has the better Valuation Grade rating from Seeking Alpha’s Quant Algorithm, at C- versus Chevron’s D. How can a company that trades at a single-digit earnings multiple and that offers a 13% trailing free cash flow yield have a C- rating, some readers might ask themselves. The answer is that XOM is inexpensive in absolute terms, but some other oil companies are way cheaper still. This includes, for example, the European supermajors — BP is valued at just 5.1x this year’s expected earnings, for example. While XOM undoubtedly is a quality company, it is not trading at an overly attractive valuation versus some other oil companies — but it’s still cheaper than Chevron.

Takeaway

Exxon Mobil and Chevron have performed well over the last year, rising by 62% and 43%, respectively. Despite the larger share price increase, XOM still trades at a lower valuation today, relative to Chevron, and XOM also offers a slightly higher dividend yield.

On top of that, with its Guyana business, Exxon Mobil has one of the best growth assets globally, whereas Chevron does not own a similarly attractive business growth driver. Exxon Mobil’s industry-leading refining and chemicals footprint also offers advantages to create and sell value-added products and to capitalize on tight refining capacity this year and beyond.

When we account for the fact that Exxon Mobil also offers a way higher shareholder yield and generates stronger free cash flows, it looks like the better pick among these two to me. That being said, shares have run up quite a lot over the last year, and many non-US based oil companies are even more attractively priced, including European and Canadian names. I thus believe that XOM is a better pick than CVX today, but I won’t buy into XOM at current prices.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of BP, SHEL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!