Summary:

- Exxon Mobil is not too far from its 52-week highs but the company has one of the most impressive and growing portfolios in the industry.

- The company is rapidly increasing its low-cost earnings which we expect to lead to a rapid increase in earnings.

- Exxon Mobil has numerous avenues to provide substantial shareholder returns highlighting how it’s a valuable investment.

Philiphotographer

Exxon Mobil (NYSE:XOM) is an American multinational oil and gas company and one of the largest in the world. The company has dropped modestly from its all-time highs by less than 10%, with a market capitalization of almost $450 billion. It recently had the accomplishment of overtaking Tesla in market capitalization, a traditional example of the young vs. old.

Exxon Mobil Price Averages

The company has seen strong price averages, which helps to highlight the strength of its portfolio.

Exxon Mobil Investor Presentation

Exxon Mobil Price Averages – Exxon Mobil Investor Presentation

Exxon Mobil has seen strong refining and natural gas margins, especially with international margins remaining strong. However, the company’s chemical margins have remained weak and the company’s crude price margins have remained reasonable. The company remains susceptible to continued price fluctuations for price averages.

Exxon Mobil Financial Performance

Exxon Mobil had an incredibly strong quarter, which we expect will enable continued returns.

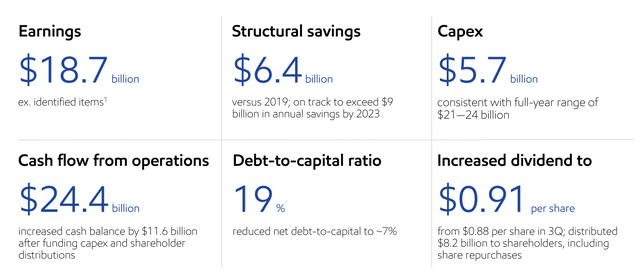

Exxon Mobil Investor Presentation

Exxon Mobil Financial Performance – Exxon Mobil Investor Presentation

The company had almost $19 billion in earnings with $24.4 billion in CFFO and almost $6 billion in capex. The company’s annualized FCF was $18 billion or $70 billion annualized, giving the company an almost 20% FCF yield annualized. The company’s debt-to-capital ratio and overall financial strength remain strong.

This capital strength will enable the company to provide additional shareholder returns.

Exxon Mobil Asset Growth

A central part of Exxon Mobil’s thesis is massive investment and growth in its core assets.

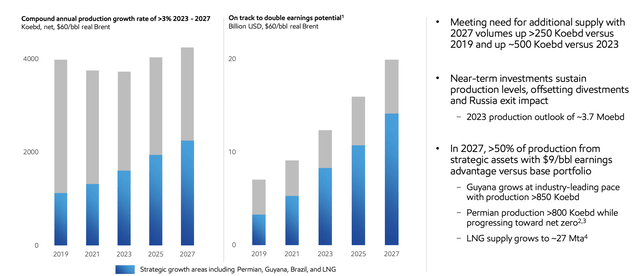

Exxon Mobil Investor Presentation

Exxon Mobil Asset Growth – Exxon Mobil Investor Presentation

The company is continuing to invest in substantial asset growth. The company expects production net to expand past 2 million barrels / day and double its earnings. The company expects by 2027 >50% of its assets will come from extremely low-cost strategic assets. Guyana will have >850 thousand barrels / day in production and the Permian Basin will be similar.

At the same time, the company’s LNG supply will grow massively to roughly 27 million tonnes / year. That’s roughly 25% of Qatar’s LNG production. The company’s impressive and continued growth of valuable low-cost assets will support additional cash flow growth.

Exxon Mobil Shareholder Return Potential

Putting this all together, Exxon Mobil has the ability to continue strong shareholder returns in a higher price environment.

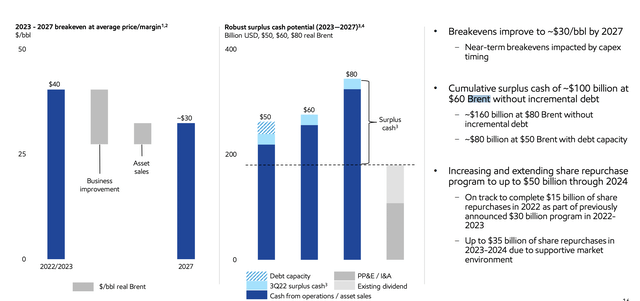

Exxon Mobil Investor Presentation

Exxon Mobil Shareholder Returns – Exxon Mobil Investor Presentation

The company’s excess cash flow for the 2023-2027 inclusive time period (5-years) is $160 billion at $80 Brent. That’s a roughly 7.3% annualized return, plenty to cover the 3.4% dividend and provide additional shareholder returns. The company is keeping its capital spending at the upper end of its guidance and upped its buyback guidance to $50 billion for the next 2 years.

The company is targeting repurchasing almost 10% of its outstanding shares in 2023-2024, something that it can comfortably afford. That will help the company reduce dividend expenses and continue additional shareholder returns.

Thesis Risk

The largest risk to our thesis is the company both growing volumes and maintaining strong prices. In chemicals and crude oil, the company’s margins in the most recent quarter, were in the lower-end of the 10-year price average. The same could happen for the company’s other assets which would hurt its ability to drive future returns.

Conclusion

Exxon Mobil is expensive based on its historic valuation. There’s no denying that. The company has a market capitalization of almost $440 billion, which means it needs to be earning $10s of billions in annual FCF in order to justify its valuation. The company has shown a continued ability to deploy its cash flow and generate strong returns.

Going forward, we expect Exxon Mobil will continue to invest in growth building up its portfolio of low-cost assets. Additionally, we expect Exxon Mobil to opportunistically repurchase shares with heavy repurchases in the 2023-2024 time period. Putting all of this together makes Exxon Mobil a valuable long-term investment.

Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.