Summary:

- Fiverr’s Q4 FY23 earnings showed revenue growth of 7.1% YoY, with increased spend per buyer and growth in complex services, while earnings grew 142% driven by margin expansion.

- I believe that the company’s strategy to progress upmarket and unlock opportunities in complex services should drive long-term growth and improve profitability.

- The company is expected to grow its revenue and earnings by 5.9% and 17% YoY respectively in FY24.

- While a weakening labor market and competition from platform like Upwork can derail Fiverr’s growth prospects, I believe that the stock is attractively priced, making it a “buy”.

MoMo Productions/DigitalVision via Getty Images

Introduction & Investment Thesis

Fiverr (NYSE:FVRR) is a digital marketplace that connects freelancers to businesses looking to hire. The company has severely underperformed the S&P 500 and Nasdaq 100 YTD. The company reported its Q4 FY23 earnings in February, where revenue and earnings grew 7.1% and 142% YoY, respectively.

Fiverr is expected to report its Q1 FY24 earnings on May 9, and I believe it is important to pay attention to the company’s strategy in moving upmarket and unlocking opportunities in the complex services category to drive higher spend per buyer as it continues its innovation to improve both the buyer and seller experiences on the platform. At the same time, the management is focused on driving margin expansion, as it reigns in Sales & Marketing spend as a percentage of revenue while benefiting from increasing spend from their repeat buyers on the platform.

Although there are risks to Fiverr’s growth thesis should the US and the global economy see a weakening of the labor market, given the uncertain macroeconomic conditions, the company has thus far been able to navigate well, where overall Gross Merchandise Value (GMV) on the platform grew despite declining job openings in the US, with growing spend per buyer and complex services accounting for 32% of total GMV.

Assessing both the “good” and the “bad,” I believe that the worst may be priced in the stock, presenting an attractive opportunity for long term investors to initiate a position, given the potential upside of 38%, making it a “buy.”

About Fiverr

Fiverr is a digital services marketplace that reduces the friction and uncertainty for businesses (buyers) looking to hire talent, while providing freelancers (sellers) with flexibility, choice of work, and the opportunity to make more money by leveraging their platform that is built over 700 categories of productized service listings, called Gigs and an efficient search, find, and order process that mirrors an e-commerce transaction.

Their buyers include businesses of all sizes, and as of December 2023, Fiverr had over 4.1M active buyers on the platform, while their sellers include freelancers and agencies. The platform includes ten verticals that include Graphics & Design, Digital Marketing, Video & Animation, Programming & Tech and more.

In terms of their business model, the company derives about 74–75% of their revenue from transaction fees that are based on the total value of transactions ordered through the Fiverr platform. While repeat buyers on the platform contributed 66% of total revenue in Q4 FY23, the company is focused on driving new buyer acquisition through a combination of organic and paid marketing channels. Meanwhile, the remaining 25% of the revenue is generated from value-added services that include Promoted Gigs and Seller Plus subscription programs to accelerate seller monetization.

The good: Focus on up-market and complex services boost spend per buyer, coupled with seller monetization, Robust innovation and Improving EBITDA.

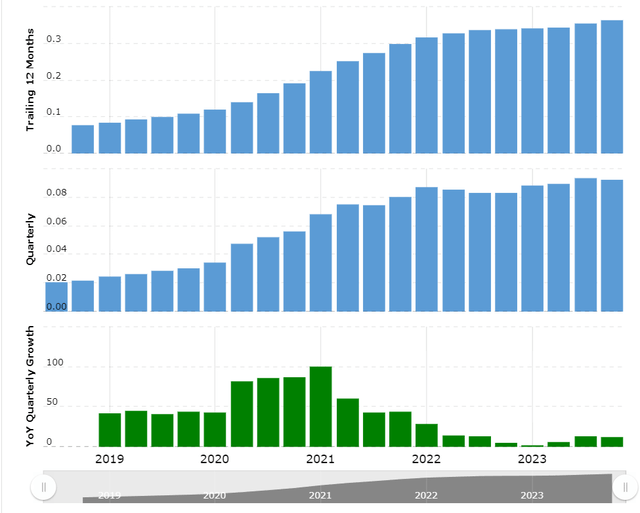

Fiverr reported their Q4 FY23 earnings, where revenue grew 7.1% YoY to $361M. Even though Active Buyers on the platform declined 5% YoY to 4.1M in Q4, spend per buyer increased by 6% YoY to $278, as their investments in AI and highly skilled categories led to a 4% net positive impact on GMV, with complex services growing 29% YoY, accelerating from a 12% growth rate from the previous year. At the same time, Fiverr saw an improvement of 160 basis points in their take rate to 31.8%.

Macrotrends: Revenue growth rate of Fiverr

I will focus on discussing two strategic priorities that the company is currently focused on to drive long-term growth in an environment where the overall macroeconomic environment is uncertain.

The first priority is centered around progressing “upmarket,” where Fiverr has seen a 4% YoY growth in Active Buyers, with an average spend growing 6% YoY to $500. During the earnings call, Micha Kaufman, CEO of Fiverr outlined that the company is innovating by expanding its Fiverr Business Solutions to help its larger business clients better engage with freelancers. I am personally optimistic about its innovations in matching its clients with talent using a combination of high-touch point of contact as well as AI-assisted brief and match functionalities, which can help businesses solve their skill gaps and create a more durable and longer-term relationship with higher usage of Fiverr’s Business Solutions suite. At the same time, the company continues to build solutions for sellers, such as Promoted Gigs to help them advertise their services on the platform, as well as offering a subscription program called Seller Plus to better equip sellers with tools to empower them on their freelance journey. In FY23, the company was able to grow their revenue from Promoted Gigs by 80% YoY as they improved their auction algorithms to increase ad placements across the marketplace, while growing Seller Plus revenue by 2.5x YoY by launching a two-tiered pricing model for sellers. For context, Fiverr generated 74.8% of their Total Revenue from transaction fees and the remaining 25.2% from service fees in FY23. I believe that the company’s strategy to go upmarket while building robust solutions for both buyers and freelancers will propel the monetization of their two-sided marketplace and position it for long-term success.

Their second priority is to increase their market share in complex service categories, which saw a big acceleration in FY23, growing 29% YoY, compared to a 12% growth rate in FY22. In FY23, Fiverr launched a dedicated AI services vertical to hire AI talent. During the earnings call, the CEO discussed that the company saw tremendous demand for AI-related services, with searches that contain AI-related keywords growing sevenfold YoY. I believe that the company’s focus on gaining market share in complex services is a step in the right direction in order to efficiently grow spend per buyer, as AI will increasingly automate simpler services such as translation, voice-over, and digital marketing, thus reducing the demand for those services. The management further noted that complex services constituted nearly one-third of all GMV on the platform, with longer-duration projects and average transaction sizes that are 30% higher than those of simple services. Moving forward, the management is looking to double down on the complex services opportunity to build experiences tailored to select verticals with high growth potential throughout FY24.

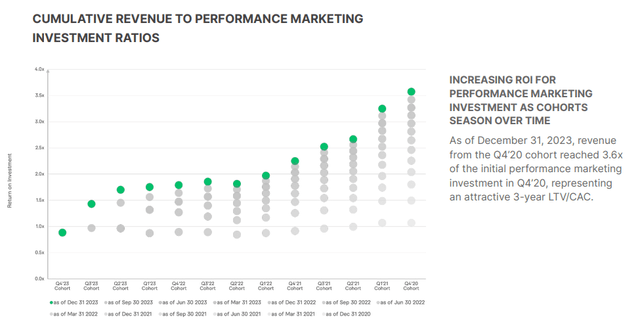

Shifting gears towards profitability, Fiverr generated $59.2M in Adjusted EBITDA with a margin of 16.4%, up 920 basis points from FY22. The management is focused on driving bottom-line expansion as it streamlines its operating experiences, where non-GAAP Sales & Marketing Spend as a percentage of revenue was 40.5% in FY23, compared to 45.8% in FY22. Simultaneously, the company also saw their existing customer cohorts increasing their spend, with repeat buyers contributing 66% of total revenue, compared to 63% a year ago. I believe that the growth in repeat purchase activity reflects the underlying strength and confidence in their existing customer cohorts, thus providing Fiverr with better revenue visibility and opportunities to unlock operating leverage as it focuses on progressing upmarket and increasing its market share in complex services to expand spend per buyer on the platform.

Q4 FY23 Earnings Report: Growing LTV/CAC for buyer cohorts

The bad: Slowdown in the US and global economy, coupled with a competitive landscape can contract spend per buyer.

Although Fiverr has been growing its GMV on its marketplace at a time when Job openings in the US have been declining from its peak, down 11.8% YoY. The labor report in April also indicates that the US labor market is indeed slowing down as fewer jobs are added in April than expected, with the unemployment rate ticking higher to 3.9%. While this lifts the hope that the Federal Reserve will be able to cut interest rates earlier than expected, which increases the possibility of a soft landing, a further weakening of the labor market will spell trouble for Fiverr’s growth prospects as businesses will cut back on hiring and therefore limit their usage on the platform, leading to a decline in spend per buyer.

I would also like to bring your attention to Fiverr’s revenue mix by geography, where the US contributed about 50% to Fiverr’s Total Revenue in FY23, while Europe and Asia Pacific contributed 40%. However, it is worthwhile to note that revenue from both Europe and Asia Pacific grew at approximately 12% YoY, compared to the US, where revenue grew just 3.4% YoY. This means if we see a global slowdown that spreads beyond the US, especially with the US dollar steadily climbing, Fiverr’s revenue can be further dampened.

Finally, in terms of its competitive landscape, Fiverr competes with online and offline platforms that include traditional staffing service providers as well as online freelancer platforms such as Upwork (NASDAQ:UPWK). While Fiverr differentiates itself in the space through its highly innovative e-commerce style business model, it is important to note that Upwork is expected to grow its revenue at twice the rate of Fiverr in FY24, as per consensus estimates.

Tying it together: Fiverr is a “buy”.

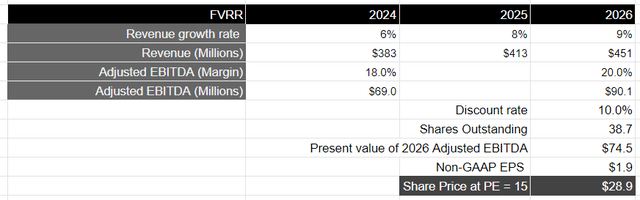

Looking forward, the company is reporting its Q1 FY24 earnings on May 9. For the full FY24, the company expects to generate revenue of approximately $383M, which would represent a growth rate of 5.9% YoY, where it expects to accelerate its GMV growth by 1-2% as it invests in progressing upmarket and complex services, while the take rate is expected to grow at a modest pace in FY24 compared to the previous year. While I believe that the US economy should weaken in 2024, given the tight monetary policy, which could cause an uptick in the unemployment rate, I believe that Fiverr’s focus on complex services gives them an edge as companies are not likely to cut specialized jobs in AI, where talent is scarce, even if there is a slowdown in the US economy. Plus, we have seen that complex services tend to be longer-duration projects with higher transaction values. Assuming that the US and global economy do not plunge into a deep recession, I believe that Fiverr should be able to grow at its projected 5.9% in FY24 and then accelerate in the high single-digit range after that, as it continues to drive robust innovation to propel its two-sided marketplace, thus generating approximately $450M in revenue by FY26.

Meanwhile, the company expects to generate approximately $69M in Adjusted EBITDA in FY24, which would represent a YoY growth rate of 17%. Meanwhile, its Adjusted EBITDA margins will also expand from 16.4% in FY23 to 18% in FY24. Over the next couple of years, I believe Fiverr will continue to improve its operational efficiencies as it streamlines its Sales & Marketing spend while successfully penetrating the upmarket, thus growing its spend per buyer, resulting in Adjusted EBITDA margins expanding to 20%. This would result in an Adjusted EBITDA of $90M by FY26, which would be equivalent to a present value of $74.5M, when discounted at 10%.

Taking the S&P 500 as a proxy, where its companies grow their earnings by 8% on average over a 10-year period, with a price-to-earnings ratio of 15–18, I believe that Fiverr should be trading at least at par with the index, given the rate of its earnings growth. This would translate to a price target of $28.9, which represents an upside of 38%.

I believe that while there are risks present with Fiverr, especially in the event of a global economic slowdown, I am optimistic about the company’s strategy to move upmarket and gain market share in complex services in order to drive higher spend per buyer while innovating their solutions for both businesses and freelancers on their marketplace to improve their customer experiences and enable better matching to fill the skills gap. Given the current risk-reward, I believe that the worst is likely to be priced in, and a long-term investor may consider initiating a position in this company to participate in significant upside.

Conclusions

I believe that Fiverr has upside over a 3-year investment horizon as the company continues to navigate an uncertain global macroeconomic environment while focusing priorities to progress upmarket and gain market share in complex services to increase spend per buyer while unlocking operating leverage. While there are risks pertaining to a global macroeconomic slowdown as well as competition, I believe the stock is attractively priced at the moment, making it a “buy.”

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in FVRR over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.