Summary:

- Ford Motor is expected to report 1Q24 earnings with muted expectations due to weaker-than-anticipated electric vehicle demand and inflation challenges.

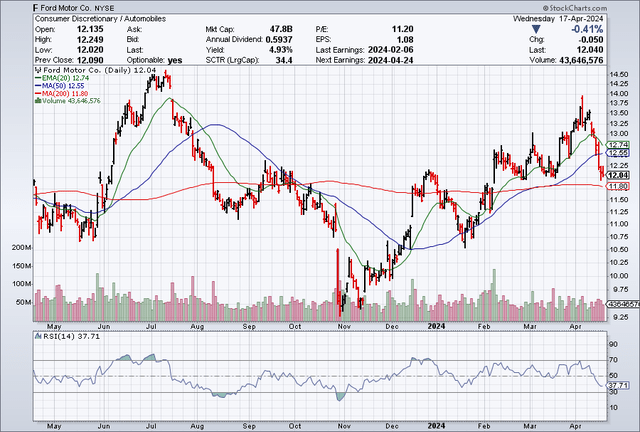

- Ford Motor’s stock price is dangerously close to the 200-day moving average line, indicating a vulnerable setup.

- Despite solid momentum in 1Q24, Ford Motor’s sales growth prospects are poor, leading to a low valuation and concerns about future growth.

Vera Tikhonova

Ford Motor (NYSE:F) is poised to report 1Q24 earnings on April 24, 2024, for which the market has relatively muted expectations.

Ford Motor, in January, announced that it would slash shifts for F-150 Lightning production amid weaker-than-anticipated electric-vehicle demand, a view that was shared by General Motors (GM).

Furthermore, inflation is rearing its ugly head again, which could pose new challenges for already weakening demand for high-priced electric vehicles.

From a technical point of view, Ford Motor is also presently in a vulnerable setup, as the company’s stock price has fallen dangerously close to the 200-day moving average line.

Though Ford Motor is cheap, based on earnings, there are very good reasons why Ford Motor is as cheap as it is ahead of the 1Q24 earnings release.

My Rating History

I sounded the alarm on Ford Motor’s profit trajectory after the automaker agreed with unions last year to pay workers considerably more money, which ultimately will come out of the pockets of either the company’s shareholders or customers.

Furthermore, inflation recently accelerated again which poses challenges to consumer spending. With demand weakening, investors should anticipate a mixed earnings release next week and potentially bad news about the company’s electric-vehicle plans.

The Market Has Very Muted Profit Expectations For 1Q24

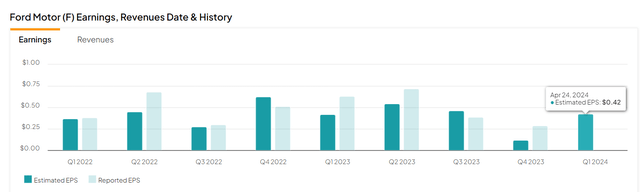

The market models $0.42 per share in 1Q24 profits, which compares against the same level of profit expectations last year. Ultimately, Ford Motor surprised last year and beat 1Q23 profit estimates by $0.21 per share, but I don’t anticipate to see such a large profit this year, primarily because of demand weakness for electric-vehicles.

Ford Motor has a strong beat history, with Ford Motor outmatching the Street’s estimates three out of four times in 2023. Expectations are muted primarily because the EV sector continues to make negative headlines: Tesla Inc. (TSLA) just announced that it was laying off people amid a severe demand downturn in the EV sector and Rivian Automotive Inc. (RIVN) just fell to a new all-time low, for that same reason.

Earnings And Revenue (Yahoo Finance)

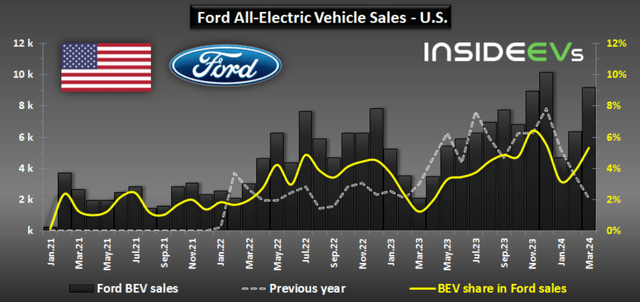

Despite slumping demand for electric-vehicles, Ford Motor actually saw some solid momentum lately, at least in 1Q24. Ford Motor’s BEV sales totaled 20,223 in the first quarter, up 86% YoY. This unit growth has been reflected in a growing sales share as well (see yellow line in the following chart) which reached 5.3% in 1Q24. Obviously, this momentum is not enough to move the needle for Ford Motor which sold a total of 181,274 new cars in March, mostly non-BEVs.

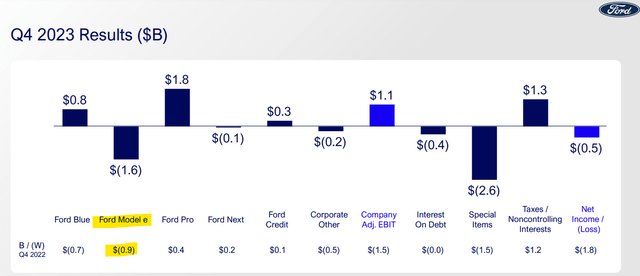

The question is how much of a difference is the upsurge in 1Q24 deliveries going to make for Ford Motor’s highly loss-making EV segment. My guess is that Ford Motor will continue to see mounting losses, despite an overall good trajectory for EV sales, particularly as far as the F-150 Lightning is concerned (which is popular).

Ford Motors’ 4Q23 losses in the EV segment totaled $1.6 billion, and the company is likely headed for a substantial ($1.0 billion or more) loss in the first quarter as well. Last year, Ford Motor lost $4.7 billion on its electric-vehicles, which translated into an unsustainable segment EBIT margin 79.7%.

Technical Analysis

From a sentiment perspective, there are reasons to be concerned because the news flow coming out of the EV sector is profoundly negatively, with a few EV companies struggling to keep afloat and some EV companies seeing their market valuations collapse in 2023 and 2024.

Ford Motor’s stock has fallen towards an important key level lately that Ford Motor must defend or risk falling into a deeper down-channel.

Ford Motor’s 200-day moving average line presently runs at $11.80 and the automaker’s stock price sits just 2% above this crucial support level at the time of writing. If the 200-day moving average line fails to hold, maybe because of a poorly perceived 1Q24 earnings release, Ford Motor has immediate downside potential to $10, which is where the next majors support zone lays.

Moving Averages (Stockcharts.com)

Cheap For A Reason

I often read that Ford Motors is exceptionally cheap based on earnings, but this argument fails to consider that the automaker effectively operates in a very low-growth environment.

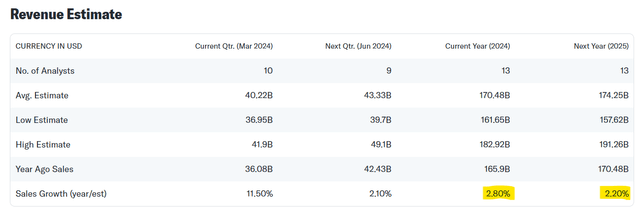

While Ford Motors is objectively selling for a low earnings multiple of 6.5x, there is a reason why the automaker is ‘cheap’: Prospects for sales growth are poor at best, with the average sales estimates for 2024 and 2025 implying just 2.8% and 2.2% sales growth.

While the market is quite focused on the slowdown in the EV market segment, Ford Motor’s overall vehicle sales (including BEV sales) are simply not growing very quickly. Ford Motor’s stock was priced at an average earnings multiple of 5-8x in the last year, implying that the stock is presently trading at the average of this range. From a valuation angle, Ford Motor might be thus fairly valued.

The same argument applies to General Motors, which is effectively in the same boat as Ford Motor: General Motors’ stock is valued at 4.7x leading earnings. General Motors’ sales expectations reflect a less than 2% annual growth rate in both 2024 and 2025. GM is cheaper than Ford Motor, but the low earnings multiple reflects the same kind of investor concerns – a lack of growth.

To facilitate an upside re-rating, Ford Motor would have to see stronger EV growth and, most importantly, a narrowing of losses in its EV segment. Only then would investors have a reason to bid up Ford Motor’s stock price. In the absence of a clear profit growth catalyst, I think that the automaker is primed to sell in the 5-8x P/E range for quite a while. Unfortunately, if the key level discussed above fails, further downside awaits Ford Motor investors.

Revenue Estimate (Yahoo Finance)

The lack of real sales growth is a major concern for me, and I would be even more worried about it if the economy had to grapple with a recession in the near-term.

Valuing Ford Motor at 6-7x leading earnings appears about right to me, which reflects an intrinsic value of $12. Taking into account that General Motors is selling for 5x leading earnings, I think that the latter may even, from a valuation angle, be a better deal than Ford Motor.

Risks Investors Should Consider

Expectations for Ford Motor’s 1Q24 earnings are low for a reason, as the sector has invested so much into EV technology that both GM and Ford Motors are scaling back their electric-vehicle plans. The demand from the consumer side simply isn’t there right now, which points to growing headwinds moving forward.

Moderating inflation might be a catalyst for consumer spending growth and a rebound in demand for electric-vehicles in 2024, but unless macro data supports this picture, I think that the market will continue to adopt a very cautious stance toward Ford Motor, preventing an upside re-rating in the process.

An acceleration of EV demand and much stronger 1Q24 earnings, particularly if they were driven by the EV segment, would be risks to the investment thesis as presented here.

My Conclusion

Ford Motor is headed for an interesting 1Q24 release, as re-accelerating inflation and a stream of negative news as far as electric-vehicle sales are concerned have dampened investor sentiment lately.

Ford Motor’s actual 1Q24 BEV sales did show some promise, but the automaker is unlikely to see any substantial improvement in its profit profile in its BEV segment any time soon.

Furthermore, sales growth expectations for this year and next year are very muted, and Ford Motor would need a major catalyst for the stock to move higher.

The recent down-channel, driven by negative sector news, has pushed Ford Motor’s stock price closer to the $11.80 per share key level that the auto company must defend to prevent further downside momentum.

Ford Motor is cheap for a reason: A lack of growth and softening confidence in the prospects of the EV divisions have taken a toll on the company’s valuation.

In order for Ford Motor to reverse its downtrend, the automaker needs to prove EV sales momentum and, most importantly, a clear path towards EV segment profitability. If Ford Motor fails doing that, the stock might remain cheap for a long time.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of F either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.