Summary:

- Ford’s shares have the potential to continue rallying as negative sentiment regarding EV players doesn’t affect the company very much.

- Ford’s slowdown in the EV segment is not a major concern due to its reliance on ICE vehicles.

- Ford has a ton of income value for dividend investors, with a stable amount of free cash flow expected in FY 2024.

Lukas Schulze

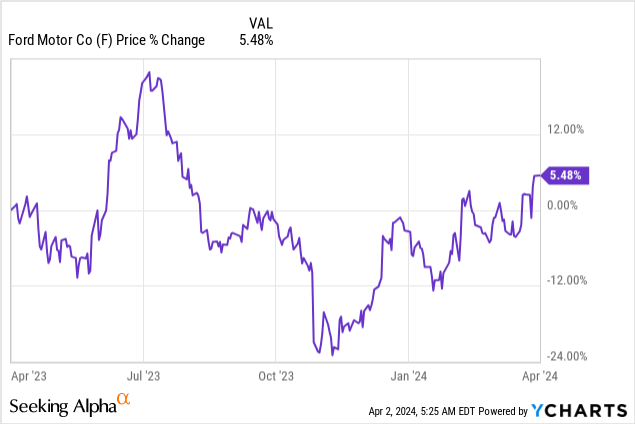

Shares of Ford (NYSE:F) entered into a new up-leg in November and the current rally, in my opinion, has potential to continue even as the market realizes that EV demand is not going to be as strong as initially expected. Ford said earlier this year that electric vehicle demand is slowing and that it would scale back its production for the F-150 Lightning pick-up truck as a result. However, I see considerable potential for Ford to declare incremental supplemental cash dividends going forward as the company is guiding for at least $6.0B in free cash flow in FY 2024. Ford is also, despite aggressive investments in electric vehicles, highly dependent on the sale of ICE vehicles… which is unlikely to change in the near term. With shares continuing to sell for very competitive earnings and FCF multiples, I believe Ford could be an excellent income investment in FY 2024 even if the EV market underperforms!

Previous rating

I recommended shares of Ford in January before the car brand reported results for the fourth-quarter — Still A Buy Ahead Of Q4 — because Ford reached a negotiated settlement with the United Auto Workers that removed uncertainty from an investment in the car brand. Since then Ford has seen an 11% increase in its share price, despite dipping temporarily after the company guided for a slowdown of F-150 Lightning pick-up truck production in January. I believe Ford will be able to navigate the slowdown in EV sales better than other companies due to its still overwhelming reliance on ICE vehicles.

Why I am not concerned about the EV slowdown

Ford made an announcement in January that said that the car company would scale back F-150 Lightning production amid a weaker demand environment and therefore slow its transition to electric vehicles. General Motors (GM) made similar comments in the context of the release of its fourth-quarter results. The take-away: weaker demand for electric vehicles is leading to a slowdown in production.

The issue with slowing demand, which also affects companies like Li Auto (LI) in China and the largest EV manufacturer in the world, Tesla (TSLA), is that Ford is not yet profitable in its electric vehicle segment, so a miscalculation of demand implies higher short term losses for companies with increasing electric vehicle line-ups.

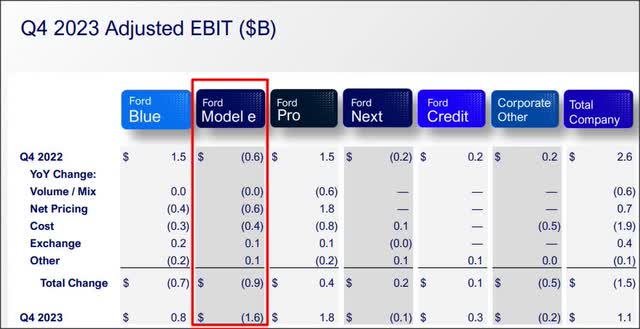

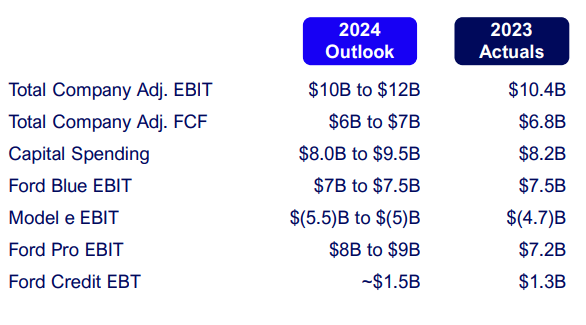

Ford generated a $1.6B EBIT loss on its EV operations in the fourth-quarter and a total full-year loss of $4.7B. These losses are apparently set to expand in FY 2024 as the car brand guided for EV division losses of $5.0-5.5B this year amid growing pricing pressure as well as slowing production.

The slowdown in the electric vehicle market has already taken a toll on the industry as companies like Fisker are at risk of going out of business. A number of EV makers have recently scaled back their projections for deliveries and expected electric vehicles sales in FY 2024, including Tesla and Li Auto.

The reason why I am nonetheless bullish on Ford in light of these changing market trends is that although the EV segment is seeing the fastest growth, Ford is still overly reliant on ICE vehicles… which provides a natural hedge against deteriorating fundamentals in the EV industry. Therefore, legacy car makers with sizable ICE divisions will be much less affected by slowing demand for electric vehicles than pure-play EV manufacturers like NIO (NIO), Li Auto or Tesla.

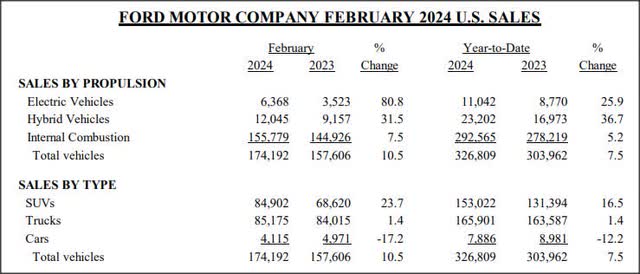

In fact, in the first two months of the year, only 3.3% of all sold Ford vehicles were electric vehicles (the share rises to 10.5% including hybrid vehicles). In other words, nine out of ten vehicles sold were non-EVs. The picture is the same for General Motors which had an EV sales share of only 2.9% in FY 2023.

Guidance for 2024 and valuation

Ford has guided for adjusted free cash flow of $6.0B to $7.0B in FY 2024, which, in the best-case, implies a $200M Y/Y improvement over last year. For context, General Motors projects $8.0B to $10.0B in free cash flow.

Ford

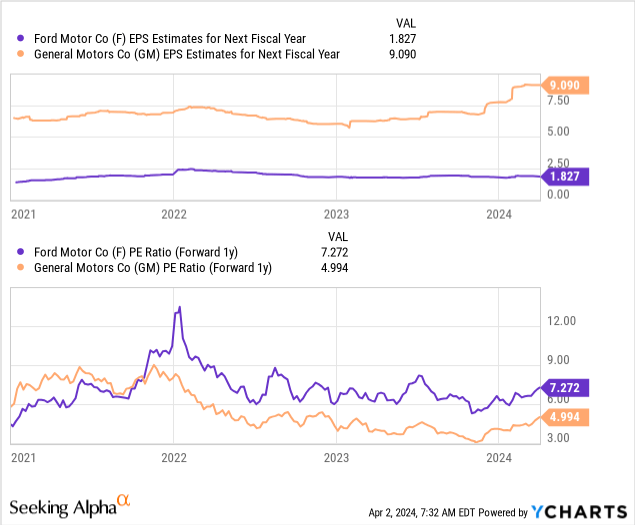

Based off of free cash flow, shares of Ford and General Motors are valued at price-to-FCF ratios of 8.1X and 5.8X, at the mid-point of their respective forecasts. Ford and General Motors also provide decent earnings value, in my opinion. Based off of earnings, Ford is valued at a P/E ratio of 7.3X… implying a massive earnings yield of 13.8%. Ford could trade at a fair value P/E ratio of 10X, in my opinion, given the strength of its free cash flow, reliance on ICE vehicles and the fact that shares pay a near-5% dividend yield. With a 10X P/E ratio, shares of Ford would be fairly valued around $18, implying 38% upside revaluation potential. General Motors’ FY 2025 P/E ratio is 5.0X and its current earnings yield stands at 20%. I recently recommended General Motors due to its insane earnings yield especially: An Auto Bargain With A 23% Earnings Yield.

Ford has income value for dividend investors

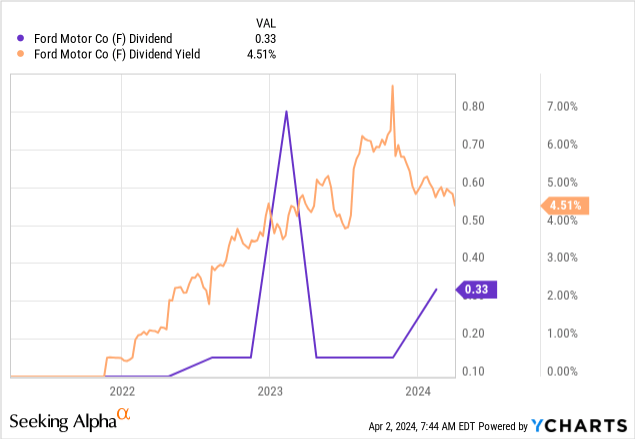

Ford pays a quarterly dividend of $0.15 per-share and the car brand declared a supplemental cash dividend in the amount of $0.18 per-share in the first-quarter. With Ford being much less exposed to the slowdown in the EV market and with a fairly stable amount of free cash flow expected in FY 2024 (on a Y/Y basis), the car brand may decide to distribute further supplemental cash dividends to shareholders going forward. The current $0.15 per-share quarterly dividend costs Ford $2.34B annually which implies a free cash flow payout ratio of only 36%, so the car brand would have a lot of room to increase its dividend, or pay supplemental cash dividends. Even without such incremental payments, Ford’s shares yield 4.5%… which is about 3.4X the S&P 500 dividend yield.

Risks with Ford

Due to its reliance on ICE vehicles, Ford is much less vulnerable to the EV market slowdown than more niche-focused companies. While a surge in EV vehicle demand wouldn’t benefit Ford as much as Tesla, as an example, the downside here is rather limited, in my opinion. What would change my mind about Ford is if the auto company would adjust its free cash flow forecast downward which may be the case if the U.S. economy skidded into a recession in FY 2024.

Final thoughts

Ford has considerable income/special distribution potential in 2024 and beyond, and I wouldn’t be surprised to see the company distribute a larger percentage of its free cash flow to shareholders in order to make up for the slowdown in the electric vehicle business. Ford’s shares are in an up-trend and they are still cheap based off of earnings and free cash flow. The slowdown in the EV market has not had a major valuation impact on Ford so far, and I believe for the right reasons: the percentage of EV sales (which represented approximately 3% of all sales in the first two months of FY 2024) is still relatively low… which provides a hedge against an EV market slowdown. Given that Ford’s shares pay a very decent 4.5% yield (and have income upside), I believe Ford is an appealing investment for dividend investors despite a slowing EV market!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of F, GM, NIO, LI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.