Summary:

- Ford investors showed why being a legacy automaker is sustainable.

- Ford has a profitable core business bolstered by an increasingly robust Ford Pro commercial business.

- Ford can manage its EV investments prudently as growth and adoptions slow.

- Pure-play EV makers don’t have the luxury, as they put all their chips in one segment.

- Betting on an undervalued Ford stock to recover seems astute, as Tesla and its EV peers suffer from a persistent EV growth slowdown.

Marina113

Ford is Fashionable Again

Ford Motor Company (NYSE:F) investors have escaped the battering observed in the pure-play EV space as EV growth slowed markedly. As a result, Ford’s well-diversified business segments have provided F investors some respite, even though Ford’s crosstown rival, General Motors (GM), has seen GM stock outperform F stock significantly. Accordingly, GM delivered a 35% total return over the past year, outperforming F’s 6.2% total return over the same period.

In my previous Ford article, I urged investors to maintain their bullish view of F stock. I assessed that the EV growth slowdown affords the Jim Farley-led company more time to milk its core business while prudently investing in long-term BEV growth opportunities.

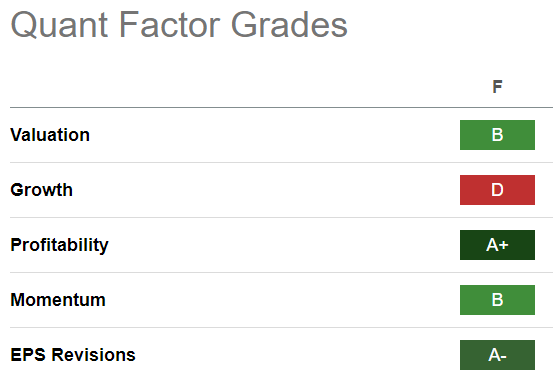

F Quant Grades (Seeking Alpha)

Ford delivered its first-quarter earnings release last week. While F has pulled back from its early April 2024 highs, I assessed F stock’s momentum has remained robust. My observation is supported by F’s “B” momentum grade, which highlights constructive buying sentiments.

As a result, the resurgence of the leading legacy automakers like F has likely surprised the pure-play EV evangelists, as Tesla’s (TSLA) recent earnings release corroborated the market’s pessimism. Accordingly, Tesla’s weak Q1 earnings release highlighted the immense challenges facing pure-play EV stocks, as Tesla posted negative free cash flow. CEO Elon Musk’s decision to axe 10% of Tesla’s workforce demonstrated the significant challenges that could hamper a broader EV adoption.

F Stock Fell As Tesla Cut Its Charging Infrastructure Team

Interestingly, TSLA also decided to fire most of Tesla’s charging infrastructure team, possibly surprising the legacy automakers. The market will likely reassess whether Tesla has considered pulling back on investing more aggressively in EV charging infrastructure to improve its operating performance. Or could it be something more “sinister,” suggesting that even the EV leader believes a further structural slowdown in EV growth could be in store?

It led to a steep decline in TSLA on April 30, as TSLA stock fell 5.6%. Ford investors also felt the impact, as F stock dropped 4.7% on the same day. As a result, F gave back all the gains it made last week, as Ford posted robust Q1 earnings.

Observant Ford investors should be aware that Ford Pro drove solid earnings performance for the company in Q1. New investors should note that Ford Pro is its commercial segment, connecting Ford with customers across SMBs, enterprises, and government agencies. The segment has also lifted Ford’s EV adoption opportunities, demonstrating Ford’s influence with fleet customers. As a result, Ford Pro delivered a 36% increase in revenue growth, as adjusted EBIT more than doubled to $3B. Ford Pro’s profitability was instrumental in bolstering Ford’s corporate adjusted EBIT of $2.8, as the automaker posted -$1.3B in adjusted EBIT for its EV business, down further from last year’s $700M losses.

Ford management has committed to investing prudently in the EV business in 2024. However, Ford’s full-year guidance of between -$5B and -$5.5B in adjusted EBIT losses for Ford Model e suggests challenging EV growth dynamics are expected to persist.

F Stock Has Solid Profitability

Despite that, Ford’s ability to continue generating solid profitability from Ford Blue and Ford Pro increasingly has provided a near-term respite from EV growth challenges. It has underpinned Ford’s best-in-class “A+” profitability grade as auto investors reallocated from pure-play EV stocks suffering from their unprofitable business models.

F stock’s sum-of-the-parts valuation framework (according to Trefis) suggests Ford Model e accounts for less than 5% of its valuation. Moreover, Morgan Stanley (MS) analysts believe the market could have understated the value of Ford Pro’s growth opportunities, as fleet customers capitalized on the retail weakness to transition their fleet to EVs. Furthermore, high-margin software and services opportunities have improved the attach rates for Ford to drive margin accretion.

Notwithstanding Ford’s solid business model, the market will likely still assess Ford’s long-term EV roadmap. As a result, Tesla’s unanticipated firing of many employees on its charging team likely weakened investor sentiments on the industry’s EV ambitions. While F’s valuation seems predicated on Ford Pro and Ford Model e for now, I believe a further transition toward Ford Model e is inevitable. As a result, investors must continue to monitor the nascent developments concerning the impact on EV growth adoption, as Ford loses a potentially attractive opportunity to ride Tesla’s aggressive investments in EV charging infrastructure through their partnership.

Is F Stock A Buy, Sell, Or Hold?

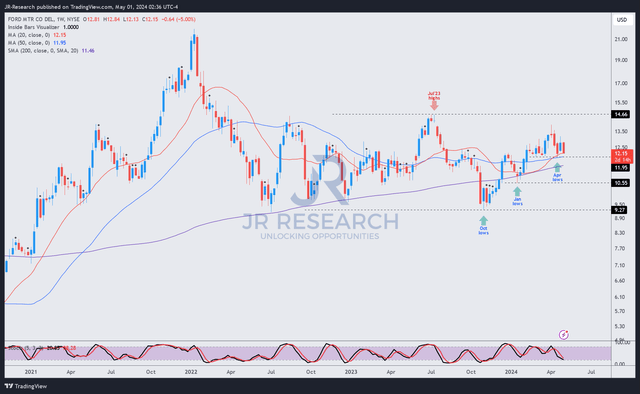

F price chart (weekly, medium-term, adjusted for dividends) (TradingView)

As seen above, F has already moved past its October 2023 lows. In addition, I assessed that F buyers have returned with conviction, notwithstanding the recent pessimism.

F has continued to manage higher lows and higher highs, indicating solid buying momentum. F’s relatively attractive valuation (“B” valuation grade) corroborates F stock’s dip-buying support, as investors reduce their exposure to unprofitable EV plays. The structural de-rating on pure-play EV stocks has benefited Ford and its legacy peers.

With the recent pullback reducing the optimism surrounding Ford’s Q1 earnings release, Ford investors have been given another solid opportunity to add more shares.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!