Summary:

- fuboTV sparks debate with mixed outlooks, even as optimists project $2 billion in revenues as a forward run-rate at some point in 2024.

- Financial uncertainties escalate with FUBO’s current cash burn rate and net debt of approximately $140 million, intensifying worries about its financial health.

- The likelihood of negative $150 million in free cash flow within 18 months and the need for capital raising by early 2025 add complexity to the Company’s investment proposition.

SOPA Images/LightRocket via Getty Images

Investment Thesis

fuboTV (NYSE:FUBO) is a highly contentious stock. This business has very mixed prospects, which gives ammunition to both the bulls and the bears. The bulls can point to 2024 as being the year that fuboTV will at some point reach $2 billion in revenues as a forward run rate.

Meanwhile, the bears rapidly retort that this business is going to run out of cash in less than 18 months and will need to raise more capital on substantially burdensome terms.

Rapid Recap

Back in October, I said in a neutral analysis:

I find it too difficult to make a positive call on fuboTV. That’s not to say the business is uninvestable. Rather, FUBO is one tough bet.

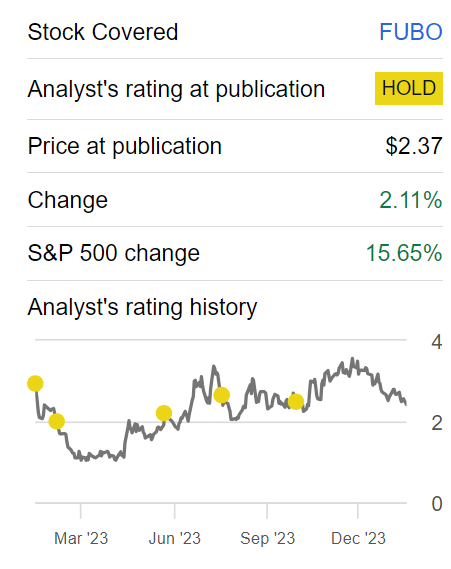

Author’s work on FUBO

Since I penned those words, the stock has underperformed in a very strong bull market. More specifically, FUBO is up 2%, while the S&P 500 (SPY) is up more than 15%.

And over time, I’ve found that this bet has become even more difficult. Here’s why.

2024 Could Deliver 20% CAGR

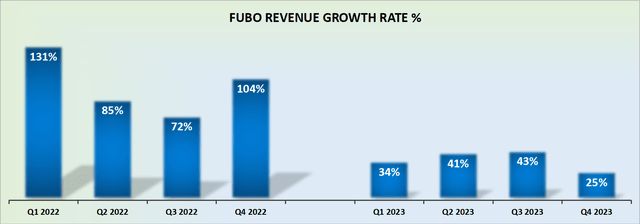

FUBO’s 2023 growth rates have significantly moderated relative to 2022. But what this means in practical terms is that these lower revenue growth rates would mean that 2024 will be up against an easier comparable base.

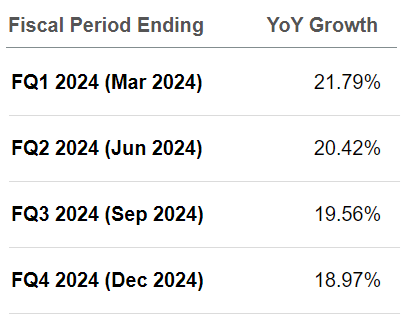

Consequently, it’s entirely possible that in 2024, FUBO could deliver around 20% CAGR. And to be clear, my estimates are nothing outlandish, in fact, they pretty much align with what analysts are also expecting.

SA Premium

However, what I believe this insight isn’t sufficiently highlighting is how investors in 2024 will look towards fuboTV as it continues to grow by 20% CAGR.

Essentially, rather than FUBO being perceived as a company with rapidly decelerating revenue growth rates, as was the case throughout 2023, it will be perceived as a business that has “found stability”.

And what do investors crave about all else? Certainty! It doesn’t even matter if bad news is expected and ultimately arrives. What investors dislike is uncertainty. And on that basis, I cannot issue fuboTV with an outright sell rating.

But that’s not where the story ends.

FUBO Stock Valuation – Too Challenging to Value

In my previous analysis, I said:

As it stands right now, fuboTV’s is on a cash burn run-rate of around $180 million of free cash flow. This means that fuboTV will have used the bulk of the cash on its balance sheet, which amounts to $300 million within 18 months.

After another set of quarterly results, its Q3 results, we must update these figures. FUBO holds approximately $260 million of cash, but once we factor in its debt, FUBO actually reaches approximately $140 million of net debt.

Therefore, I am inclined to believe that on a forward run-rate now, FUBO could reach negative $150 million of free cash flow, rather than the negative $180 million I previously estimated.

Nevertheless, it still seems reasonable to contend that in about 18 months, around early 2025, if not before, fuboTV will need to raise capital again. And this is where the plot thickens.

In January of this year, FUBO exchanged its 2026 senior notes which carried a 3.25% interest rate, with 2029 notes which carry a 7.5% interest rate. This means that creditors are increasingly stringent with lending capital to FUBO. And if creditors become nervous about lending more capital to fuboTV, fuboTV will be left in an extremely challenging situation.

The Bottom Line

In conclusion, fuboTV presents a divisive investment. While optimists envision a robust future with a projected $2 billion in revenues by 2024, skeptics raise red flags about the company’s cash position.

The company’s current cash burn rate, indicating a net debt of approximately $140 million, intensifies my concerns.

With a potential forward run-rate of negative $150 million in free cash flow within 18 months, the likelihood of FUBO needing to raise capital by early 2025 looms large.

Lastly, the recent shift to higher-interest notes signals a tightening lending environment, complicating the company’s financial outlook. This intricacy, marked by evolving growth rates and a challenging debt scenario, underscores the nuanced nature of FUBO’s investment proposition.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.