Summary:

- The formation of a joint venture between Disney, Fox, and Warner poses a major threat to fuboTV Inc.’s position in the sports streaming market.

- The new streaming service is expected to offer access to a wide range of popular sports events, potentially undercutting fuboTV’s pricing.

- In my opinion, fuboTV needs to rebrand itself as more than just a sports streaming platform to differentiate itself from the upcoming competition.

- fuboTV is far from being expensively valued in the market, but as I discuss in this analysis, investors need to prepare themselves for a rough few months.

SOPA Images/LightRocket via Getty Images

I have been bullish on fuboTV Inc. (NYSE:FUBO) for quite some time. As an investor with a primary focus on the small-cap space, I am comfortable taking on the risks associated with small companies that are yet to enjoy durable competitive advantages. Last July, after acknowledging the risks facing fuboTV, I assigned FUBO stock a price target of $7.29 based on a DCF model with conservative assumptions for growth. Last November, I claimed that fuboTV was in better shape than ever to achieve its 2025 cash flow goals.

Earlier this week, news broke out that The Walt Disney Company (DIS), Fox Corporation (FOX), and Warner Bros. Discovery, Inc. (WBD) are forming a joint venture to create a new streaming platform to share their sports assets. This news, not surprisingly, sent fuboTV stock lower. The new streaming service is reportedly set to go live this fall.

For fuboTV – a young streaming company that relies on content licensing to thrive – this JV sounds like terrible news. A closer evaluation of this competitive threat has forced me to downgrade FUBO to a hold rating with no adjustments to my intrinsic value estimate until there is more clarity about the new service.

The Threat Is Real

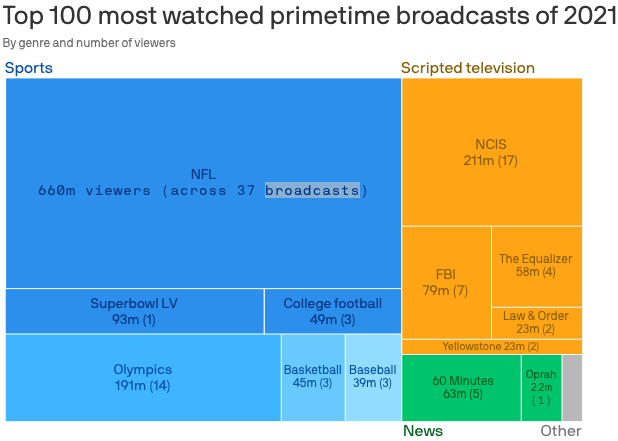

For the best part of the last decade, we knew that live sports was the saving grace for cable TV. When cord-cutters aggressively ditched their cable TV subscriptions for digital streaming services, sports fans had little choice due to the unavailability of OTT sports streaming. As shown below, viewership data from 2021 confirms how live sports streaming dominated most-watched primetime broadcasts.

Exhibit 1: Top 100 most-watched primetime broadcasts of 2021

Axios

Live sports streaming was the saving grace for cable TV in recent years, but there was never a question in my mind about the eventual launch of sports streaming platforms. The launch of ESPN+ is a classic example of this. I found fuboTV’s value proposition appealing – despite the threat posed by cable TV providers going digital – given the wide access it provides to various sports channels through one subscription. For this same reason, I thought fuboTV was well positioned to capture a meaningful share of the OTT sports streaming market.

Today, the playing field is changing dramatically with the expected launch of a JV between Disney, Fox, and Warner, which is a threat that I did not see coming. To put it simply, I did not expect these big players to join hands in their efforts to monetize sports assets. By offering access to almost all the major sporting events in the U.S. through a single subscription, this new platform will directly compete with fuboTV. I believe this new platform will try to undercut fuboTV based on pricing, too, given that fuboTV has been charging premium prices in light of the substantial licensing costs it pays to the likes of Disney, Fox, and Warner. Ironically enough, fuboTV will now have to compete with their licensing partners. To me, this sounds like a battle that would be difficult to win.

The threat posed by this JV becomes even more visible when we look at the sports events this new platform will have access to. NBC and CBS are not part of this JV, so it is safe to assume that the NFL will not be available on this new platform for now (Paramount+ has streaming rights for the NFL). However, many other popular events such as MLB, NBA, MLS, NASCAR, the PGA Tour, UFC, and the FIFA World Cup should be available on this platform, which would make it a near-complete sports streaming provider in the United States.

Given the nature of this threat and where it is coming from, investors cannot afford to turn a blind eye to this new streaming platform. The threat for fuboTV is as real as it gets, in my opinion. The company management is certainly not playing dead. In a statement discussing the new JV, fuboTV suggested increased scrutiny behind the motives of this JV as this business venture could potentially distort fair competition.

The underlying motives and implication of this joint venture also command our scrutiny. Every consumer in America should be concerned about the intent behind this joint venture and its impact on fair market competition. This joint venture spotlights a concerning trend where an alliance with significant market share, reportedly controlling 60-85% of all sports content, could dictate market terms in a manner that may not serve the broader interests of consumers.

I appreciate this swift update by fuboTV, but at the same time, I view this statement as an acceptance of the massive threat posed by this proposed JV.

fuboTV Needs Some Rebranding

If you look at fuboTV’s current positioning in the streaming market and its product offering, it becomes evident that the company is more than a sports streaming platform. The company, in the recent past, has tried to position itself as a sports-first streaming company, not a sports-only streaming platform. This, in my opinion, is the right strategy going forward given that a subscription to fuboTV gives access to not just sports streaming but other types of content.

The base plan, fubo Pro, gives access to 183 channels across categories, and the fubo Elite plan gives access to 247 channels. Below are some of the tv channels included in each of these two packages, which gives an indication of the non-sports channels included in fuboTV plans.

Exhibit 2: Pro plan channels

Screen Binge

Exhibit 3: Elite plan channels

Screen Binge

The sports-first JV backed by Disney, Fox, and Warner will, in my opinion, fail to offer the same breadth of content as fuboTV does, but the company will have to ensure it is speaking to the right market to benefit from this. As things stand today, I feel fuboTV is looked at as a sports-only platform, which is not true. From a branding perspective, therefore, fuboTV has its work cut out in the coming months.

Valuation Implications

For now, we are in the dark about the expected pricing of the new JV between Disney, Fox, and Warner. For this reason, it is not easy to estimate the potential hit on fuboTV, if any. Realistically, I believe this new service will cost at least $50, which would still be significantly below fuboTV’s starting price of around $80.

Last July, my estimates pointed to $1.27 billion in revenue this year. As you can see from the below table, Wall Street estimates for revenue are above my estimates for the next few years.

| Fiscal year | Author’s revenue projection | Wall Street consensus |

| 2023 | $1.27 billion | $1.36 billion |

| 2024 | $1.54 billion | $1.62 billion |

| 2025 | $1.86 billion | $1.9 billion |

| 2026 | $2.23 billion | $2.23 billion |

| 2027 | $2.68 billion | $2.41 billion |

Source: Author’s projections and Seeking Alpha.

The primary risk today does not stem from absurd valuation multiples for fubo. In fact, the company is valued at a meager 0.55 of expected revenue next year, which is as cheap as you can imagine for a company that has grown at double or triple-digit rates in each of the last 10 quarters. The problem is that I expect Wall Street analysts to aggressively slash their earnings estimates in the next few weeks, potentially erasing millions of dollars from the company’s market value.

For a complete evaluation of the impact of this JV on fuboTV’s earnings, I will wait until there is more clarity about the pricing of the new service and the services catalog. Until I have more clarity, I am downgrading FUBO from a buy rating to a hold rating.

Takeaway

fuboTV Inc. is facing a major threat in the form of a JV between Disney, Fox, and Warner. I don’t believe investors should run away from FUBO purely based on this new development, but at the same time, there is no playing down the risk of this JV dealing a knockout punch. Given my cost basis of just over $2.5 and the fact that fuboTV accounts for less than 4% of my portfolio, I believe I can afford to take the risk of holding on to FUBO until there is more clarity.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FUBO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Unlock Alpha Returns With Our Comprehensive Investment Suite

Beat Billions offers a wide range of tools and resources to help you achieve superior investment returns. Our team of expert analysts uncovers undercovered and thinly followed stocks to supercharge your investment returns.

- Access our model portfolios and receive actionable ideas to build a successful portfolio.

- Join our community of like-minded investors and exchange ideas to maximize your investment potential.

- Keep track of the real-time activities of investing gurus.

Don’t miss out on our launch discount – act now to secure your subscription and start supercharging your portfolio!