Summary:

- Despite PayPal Holdings, Inc.’s solid Q4 outperformance, and the recent introduction of new features and cost-savings initiatives aimed at restoring growth and margin expansion, PayPal’s flat guidance for 2024 was a setback.

- However, a deeper dive would reveal that the recently implemented strategies are in the works and underpins acceleration in PayPal’s recovery prospects exiting 2024.

- The company’s momentum in Europe and impending operational tailwinds also remain overlooked value accretive factors to the stock.

- Taken together, we believe PayPal’s prospects for a sustained trajectory of long-term profitable growth, as well as its consistent capital returns program underpinned by robust cash flows, remain underappreciated at current levels.

Justin Sullivan/Getty Images News

Admittedly, the latest introduction of revolutionized checkout features at PayPal Holdings, Inc.’s (NASDAQ:PYPL) “First Look” event was underwhelming. The disappointment had essentially carried over to the latest Q4 earnings release, where management had guided flat transaction margin dollars and EPS for the year despite recently announced optimization efforts.

Yet robust Q4 results, which outperformed management’s guidance and consensus expectations, continue to underscore PayPal’s strong participation in resilient holiday season sales. A deeper dive into the composition of management’s guide for the flat full-year 2024 EPS suggests sustained organic improvements to core business unit economics, nonetheless.

Specifically, uncertain macroeconomic conditions have incentivized the company to take a “prudent and active approach” to managing its credit exposure. This inadvertently impacts PayPal’s take-rate and volumes pertaining to Small and medium-sized business, or SMB, loans going forward. The impending rate cuts will also impact other value-added services revenue growth, which consists primarily of high-margin interest income on customers’ stored deposits. Yet flat transaction margin dollars and EPS suggest continued momentum in core Braintree, PayPal Complete Payments (“PPCP”), and, more importantly, more profitable branded checkout volumes.

Taken together, we remain confident that management is taking positive steps towards expanding margins at a sustained pace. This includes PayPal’s focus on not only one-time cost-cutting efforts (e.g., job cuts), but also through shoring up growth in core businesses, particularly in more profitable branded transaction volumes, at scale. Although management has guided limited near-term contributions from the recently announced payment and checkout features, we expect them to play a key compensatory role in 2H24. Specifically, as ongoing pilots gradually enter general availability, the ensuing favorable contributions will be critical for offsetting anticipated headwinds in higher-margin other value-added services revenues due to impending rate cuts.

The “engagement loop” enabled by the newly announced features will also reinforce branded transaction volumes heading into 2024 as PayPal’s operating backdrop normalizes. The setup continues to underscore PayPal’s recovery. Albeit a slower ramp due to near-term headwinds, PayPal’s emerging recovery is well positioned to compound quickly exiting 2024 as sustained growth drivers enable margin expansion at scale.

Downsizing is Rightsizing

One of the key focus areas for management under CEO Alex Chriss’ leadership is to restore operational efficiency at PayPal by becoming leaner. This has been viewed as one of its key strategies in ensuring sustained profitable growth. In addition to reducing its investment footprint and “consolidating legacy PayPal payment services” in recent quarters, the company has also announced a 9% reduction in force earlier this month. And management intends to reinvest the resources into higher growth areas, such as sales and product development, to ensure PayPal is innovating efficiently.

Specifically, PayPal’s reduced investment footprint ensures the company remains focused on key transaction volumes stemming from checkout and payment processing. This is corroborated by the recent slew of new features introduced, which focuses on rebuilding and reinforcing PayPal’s market share within its payments ecosystem. By combining AI-enabled frictionless checkout, post-sales value-add services, and business profiles through the PayPal and Venmo apps, the company essentially propels an “engagement loop” critical to its flywheel.

Specifically, each of the six newly unveiled commerce solutions is linked back to the PayPal and Venmo apps and reinforces transaction volumes to its core growth drivers. This differs from PayPal’s history of siloed investments into various commerce solutions, such as the Honey coupons app. While they generate critical consumer data for the company, these legacy investments have been adjacent to PayPal’s growth and yielded nominal direct contributions to its most profitable transaction volumes. By leaning in on core existing businesses, and leveraging AI to optimize value on its massive trove of first-party consumer data, the new solutions effectively reinforce the flywheel of PayPal’s success.

Although the monetization of each newly announced product remains unclear, given most remain in the pilot phase, the bottom line is that they will help to reinforce PayPal’s market share gains and, inadvertently, growth if executed properly. This would also contribute favorably to its ongoing margin expansion efforts by improving operating leverage at scale, given the increased focus on revenue opportunities within existing businesses rather than external investments.

Specifically, PayPal’s increased leverage of nascent technologies like AI also enables indirect efficiency gains for the company. The technology essentially compensates for its upcoming workforce reductions and complements its ongoing expense discipline efforts by improving value generated from first-party consumer data across its ecosystem. This is primarily done through AI-enabled customer acquisition cost reductions.

Specifically, AI-enabled value-added services for PayPal users, such as personalized rebates and product recommendations through Smart Receipt and CashPass, reinforce consumer transaction volumes by encouraging repeated sales. AI-facilitated frictionless guest checkout through Fastlane also bolsters conversion, as evidenced by BigCommerce Holdings, Inc.’s (BIGC) recent integration of the solution for its merchants. By leveraging AI, PayPal essentially maximizes the value of its 1P data and optimizes revenue opportunities within its core payment services without incurring significant incremental sales costs.

The newly unveiled features also catapult PayPal into additional high-margin addressable markets and further reinforce its profitable growth trajectory. For instance, business profiles on Venmo and Smart Receipts could potentially become platforms for ad opportunities, which could make a high-margin adjacent revenue source for the company. Improved engagement and conversion by scaling the deployment of recently announced value-add services could also reinforce PayPal’s share capture of accelerating SMB opportunities as they move online. SMB transactions typically yield a higher take rate for PayPal, which would reinforce its longer-term trajectory of sustained transaction margin dollar growth.

Impending Tailwinds in Europe

We believe PayPal’s emerging strength in Europe remains overlooked and underappreciated when considering the company’s valuation prospects. Despite management’s continued allocation of limited airtime to its European operations during earnings updates, the region has likely demonstrated comparable results to its core U.S. operations. Specifically, PayPal’s international business has consistently accounted for more than 40% of the company’s quarterly total net revenues. And most of these are likely attributable to sales generated from its European operations, which represent PayPal’s largest market after the U.S. More than 90% of online storefronts in Germany have adopted PayPal checkout, underscoring the company’s momentum in Europe.

The emerging strength is also evident in PayPal’s latest results. International revenue grew 10% y/y in Q4, versus U.S. revenue growth of 9% y/y. Full-year results were also comparable, with international revenue up 7% y/y and U.S. revenue up 9% y/y. Robust international total payment volume (“TPV”) growth of 17% y/y was also primarily attributable to strength in Europe, leading U.S. TPV growth of 11% y/y and global TPV growth of 13% y/y.

In addition to emerging strength in the European region, especially in high-margin branded checkout volumes, PayPal is also well positioned for several impending tailwinds. These include continued market share gains in Europe, reinforced by the rolling availability of PayPal’s recently unveiled payment features, as well as local regulatory changes.

Specifically, Europe has recently implemented the Digital Markets Act (“DMA”). The regulatory overhaul levies strict scrutiny over competitive practices employed by big tech companies, such as PayPal’s payments rival Apple Inc. (AAPL). Coming March, one of the required changes to be implemented by Apple in the EU to ensure compliance with the DMA include the extension of its proprietary “tap-to-pay” technology to third parties.

Specifically, Apple Pay has been a significant disruptor to PayPal’s market share, primarily due to its convenience and pervasive adoption across consumer end-markets for both online and in-store transactions. By opening access to its tap-to-pay technology, Apple essentially provides PayPal with an opportunity to eventually enable frictionless tap payment in stores for its EU active members directly from the app. This would reduce the need for integration of PayPal payment methods into the Apple Wallet, and reduce PayPal’s exposure to related payment processing fees.

Open access to Apple’s tap-to-pay technology in the EU would also provide PayPal with an opportunity to in-store transaction dollars through merchant end-markets in the region. Specifically, PayPal’s Zettle POS business, which facilitates in-store payment processing for merchants and incorporates the convenience of tap-to-pay, is currently only available in the U.S. Yet demand for related services is growing abroad, particularly from SMBs, given their convenience compared to legacy POS systems. Contactless transactions currently account for almost half of payment volumes in Europe. And upcoming open access to Apple’s tap-to-pay technology in the EU would complement PayPal Zettle’s potential entry to the region and reinforce its growing share of the local payment processing market.

Fundamental Considerations

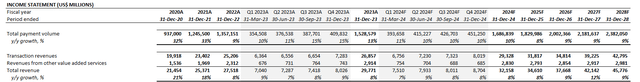

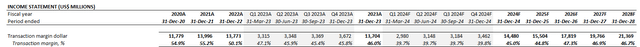

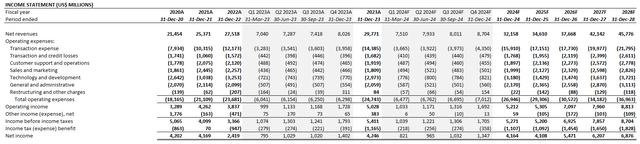

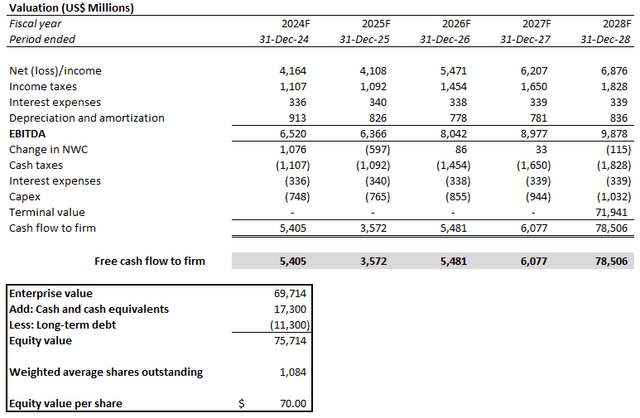

Adjusting our previous forecast for PayPal’s actual Q4 outperformance, management’s forward guidance, and our foregoing discussion on the company’s longer-term growth and profitability trajectory, we expect 8% y/y growth to total revenue of $32.2 billion in 2024. This will be primarily driven by transaction revenue growth of 9% y/y to $29.3 billion, underpinned by TPV growth of 10% y/y of about $1.7 trillion and a 1.74% take-rate in 2024. This is consistent with anticipated improvements to higher-margin PPCP uptake across SMBs and branded check-out momentum, offset by the continued impact of a less profitable Braintree revenue mix. Meanwhile, revenues from other value-added services are expected to decline slightly y/y to $2.8 billion. This is consistent with the anticipated impact of impending rate cuts on interest income generated from customers’ deposits in the latter half of the year.

On the cost front, we are expecting transaction margin dollars of $14.5 billion in the current year, which is largely consistent with management’s guidance for flat results y/y. The assumption also considers a reduced revenue share from PayPal’s credits business and a slower ramp of the recently launched features aimed at shoring up high-margin branded transaction volumes. And over the longer term, we estimate PayPal’s transaction margin to revert towards the historical 50% range.

This is consistent with our expectations that PayPal’s emerging recovery is well positioned to compound quickly exiting 2024. Specifically, margin expansion is expected to become more evident as the newly unveiled payment features ramp, alongside normalization within PayPal’s high-margin value-added services revenue stream from near-term headwinds. This combo would also complement PayPal’s ongoing disciplined spend management efforts and enable sustained profitable growth.

PayPal_-_Forecasted_Financial_Information.pdf

Valuation Considerations

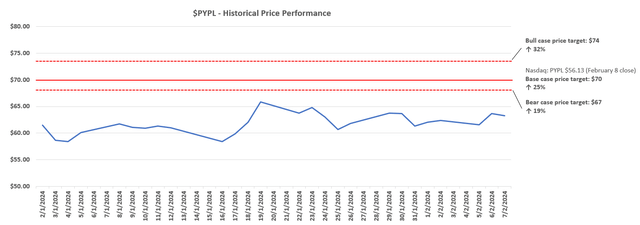

Despite our optimism for PayPal’s forward outlook, we are decreasing our base case price target for the stock from the previous $80 to $70. The reduction primarily considers the delayed prospects of margin expansion due to company-specific restructuring efforts, as well as evolving macroeconomic dynamics in the near term.

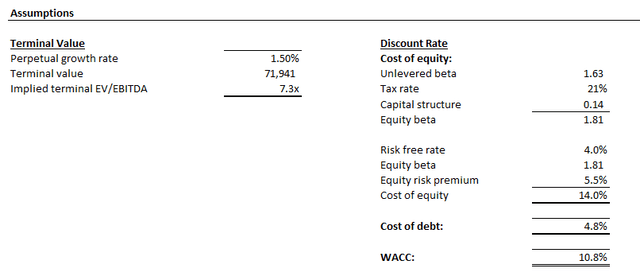

The price target is derived under the discounted cash flow, or DCF, approach. The analysis considers cash flow projections taken in conjunction with the fundamental forecast discussed in the earlier section. We have applied a 10.8% WACC, which is consistent with PayPal’s capital structure and risk profile. The analysis also considers an implied perpetual growth rate of 1.5% on estimated terminal cash flows. The assumption is in line with the anticipated pace of long-term economic expansion across PayPal’s core operating regions. The conservative implied perpetual growth rate applied on estimated terminal cash flows also sufficiently accounts for PayPal’s near-term exposure to elevated execution risks, in our opinion.

The Bottom Line

We believe 2024 is a year of execution for PayPal, as it navigates the game of managing lapping dynamics stemming from near-term macroeconomic and company-specific implications. This includes reallocating the impending cost-savings realized through rolling job cuts and divestments back into core payments and checkout business innovations critical to sustaining long-term profitable growth. The emerging general availability of newly announced PayPal/Venmo functions will also be accretive to TPV and take rates later in the year. This will be critical to offsetting peak headwinds facing the value-added services revenue stream stemming from impending interest rate cuts.

Although management’s guidance for 2024 has largely carried over disappointment from the modest First Look presentation earlier this year, the anticipated lapping dynamics show the emerging efficiency gains from recently implemented strategies are in the works. Management’s expectations for $5 billion in free cash flows in the current year, alongside PayPal’s robust net cash position, also reinforces its capital returns program for investors. Specifically, expectations for at least $5 billion of share buybacks through 2024, with a 70% to 80% FCF-to-capital returns conversion rate in the long run will provide support for the stock.

Taken together with PayPal’s longer-term profitable growth trajectory, sustained by a restored focus on capturing core transaction volumes and other efficiency gains, PayPal Holdings, Inc. stock remains well positioned for upside potential from current levels.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly, exclusive research content and ideas, and tools designed for growth investing, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to research coverage, exclusive ideas and complementary financial models

- Monitored and regularly updated price alerts for our coverage

- A compilation of complementary tools such as growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!