Summary:

- GameStop experienced an upward surge in the share price lately, fueled by speculation about another short squeeze.

- GameStop’s shares remain highly shorted. However, the real problem is the company’s weak underlying business performance.

- The retailer’s revenue and net income are declining.

- GameStop’s valuation is indefensible at 3.0X revenues. FOMO-driven buying exposes investors to significant correction risks.

wildpixel

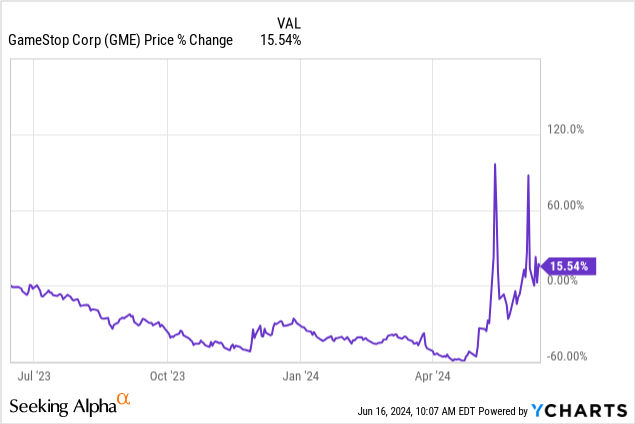

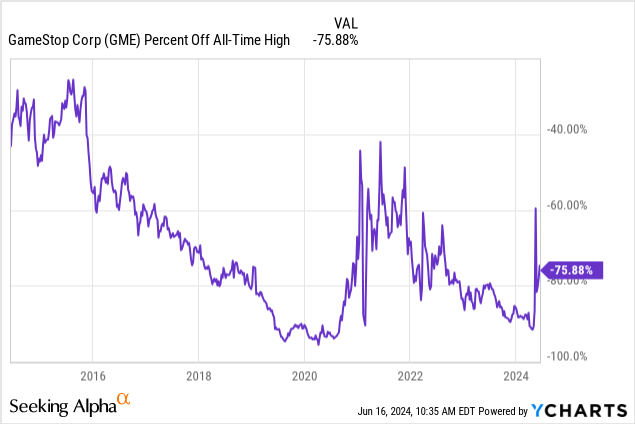

GameStop (NYSE:GME) has taken investors on a wild ride since May, as new speculation about a new short squeeze (and FOMO) caused shares to soar to a new 1-year high of $64.83. Hopes for a short squeeze were driven by Keith Gill, also known as Roaring Kitty, who disclosed last week that he was now holding approximately 9M shares of the video game retailer. Roaring Kitty’s recent disclosures have caused new interest in the flailing video game retailer, but the company’s performance is far from great… and continues to disintegrate. GameStop continued to see an eroding revenue base in the first quarter and lost a ton of money in its operations as well, and recently the company issued new shares to take advantage of the share price increase, creating dilution headwinds for shareholders. The valuation is also decoupled from the firm’s underlying business reality, in my opinion, and the risk profile remains heavily skewed to the downside!

Previous rating

I wrote about GameStop more than two years ago when the market was getting giddy about another short squeeze at the time: Short Squeeze Delusion. GameStop’s shares have lost approximately 7% of their value since then. With GameStop continuing to lose a lot of money and revenues tanking amid strong competition from online video game platforms, I believe the value proposition for GME is not an attractive one and FOMO-driven buying activity is not sustainable.

Fundamentals do matter

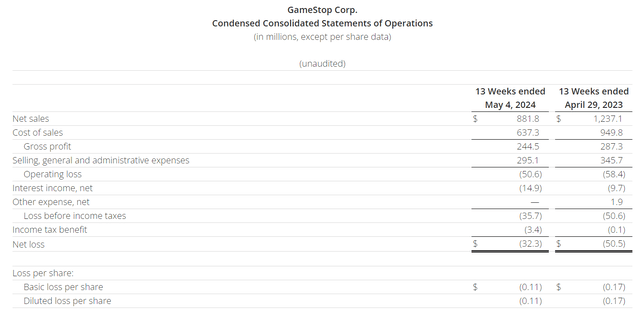

Fundamentally speaking, GameStop’s position has not improved very much at all in the last two years. The video game retailer posted deeply disappointing first fiscal quarter results in May that showed a 29% decrease in the top line to $881.8M, in large part due to fierce competition from other e-Commerce and online video game platforms. At the end of the day, GameStop generated a loss of $32.3M, or $0.11 per-share, on its retail operations in the first-quarter.

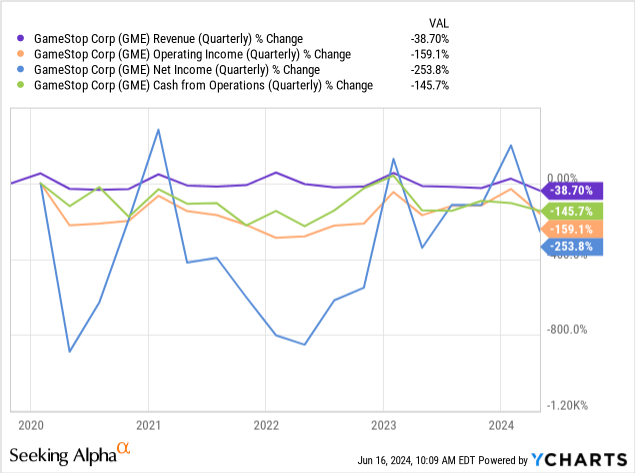

If we look at the longer-term revenue and net income trends, we can see that GameStop continues to face significant risks. The revenue growth rate has fallen significantly in the last five years, largely because competition in the video game market is fierce. Almost every large video game developer offers a direct-sales channel on their website, making video game purchases simple and straightforward for consumers. All key metrics for GameStop are pointing south, including the company’s operating income as well as cash flow from operations…

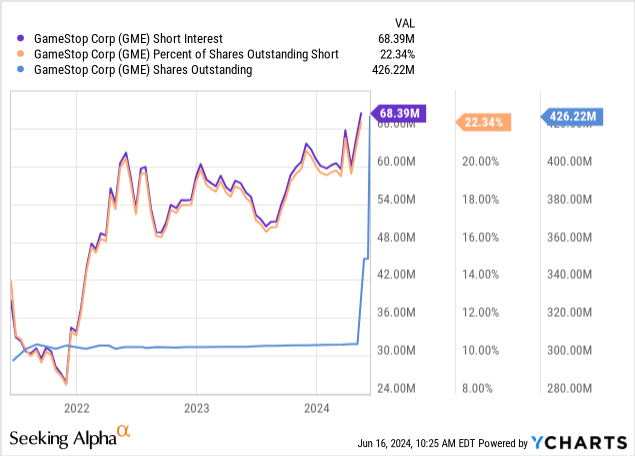

Short interest ratio and equity raise

GameStop is still a very heavily shorted retail company. As of the last count, the video game company had a short interest ratio of approximately 22.3%, meaning more than every fifth share has been sold short. GameStop used the opportunity of sudden, renewed interest in the retail company to sell more shares to shareholders and raise $2.1B. For investors, this means they are going to see additional dilution headwinds going forward.

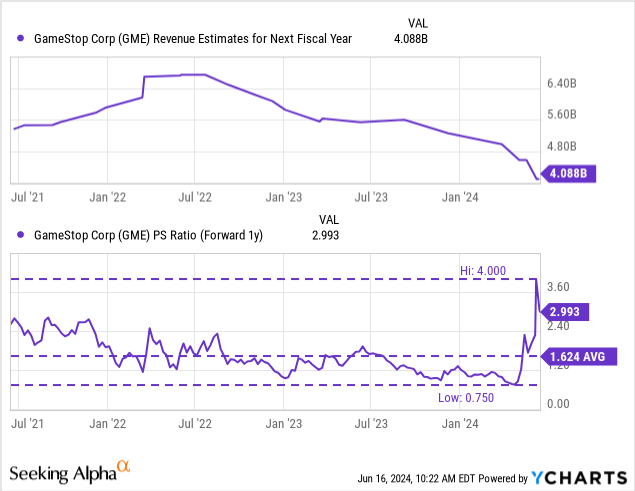

GameStop’s valuation

GameStop is currently valued at 3.0X revenues, which investors pay for a company that does not have a moat or a clear competitive advantage over its rivals in the industry. In the year before the latest short squeeze hype, GameStop’s shares sold for less than 1.0X revenues… and this was a rich multiplier as well, considering that the retailer is continuing to lose revenues.

The average price-to-revenue ratio in the last three years was 1.6X, which means the current valuation is significantly (+84%) above the historical average, all the while the company’s financial situation did not improve. In my opinion, given the fundamentals of the business, GameStop’s valuation is not justifiable or sustainable, and I continue to see a highly unfavorable risk profile for investors buying into the FOMO hype here.

If GameStop were to be valued at its pre-hype valuation ratio of 1.0X, then shares of the video game retailer could have a fair value of up to $10. According to consensus estimates, GameStop is expected to lose about one-fifth of its revenue volume this year (compared to last year) and another 4% next year. This means that investors are facing a shrinking top line, persistent losses and now a much larger share count which will dilute their stake in the company. Given the fundamental weakness of GameStop’s business, I believe GameStop’s shares will soon return to their longer-term valuation average of ~1.0X P/S.

Risks with GameStop

Just because GameStop valuation doesn’t make any sense to me when put into relation to the company’s financials doesn’t mean that the share price can’t rise further… at least in the short term. There is, at least theoretically, a possibility that GameStop’s share price will surge (as it did at the beginning of the meme stock mania in 2020) despite weak fundamentals, purely because short sellers are forced to close their positions. However, as GameStop’s history has also taught the market in 2021, companies that are highly shorted are typically shorted for a good reason. Companies with unsustainable business models and continual losses will ultimately find their performance reflected in their share prices.

Closing thoughts

A FOMO rally has led to some significant short-term price gains for shares of GameStop lately, but this optimism is not justified from a financial and valuation point of view. GameStop is fundamentally a business in decline and one that continues to lose a lot of money for shareholders. The retailer continues to see a shrinking top line and now issued $2.1B worth of new shares, which are diluting shareholders as well. The valuation also is not justifiable based on the company’s historical valuation average, in my opinion, and investors buying into GameStop at this point have a high chance of losing a significant portion of their capital. I see a very unfavorable risk profile here and given the collapse of GameStop’s shares after the last short squeeze hype, I believe investors that care about their money better avoid this FOMO play at all costs!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.