Summary:

- Plenty of time has passed since the January 2021 irrational GME stock rally.

- But the stock is still trading over and above what it used to trade for before 2021.

- GameStop’s fundamentals have not improved.

- GME stock remains a horrible investment.

jetcityimage/iStock Editorial via Getty Images

GameStop (NYSE:GME) stock has lost almost 66% of its value as of the time of writing since my rather cautious article published in June 2021. At the same time, it is still trading over and above what it used to trade for before the January 2021 meme stock rally. In this article, I would like to analyze the company’s fundamental changes.

GME stock

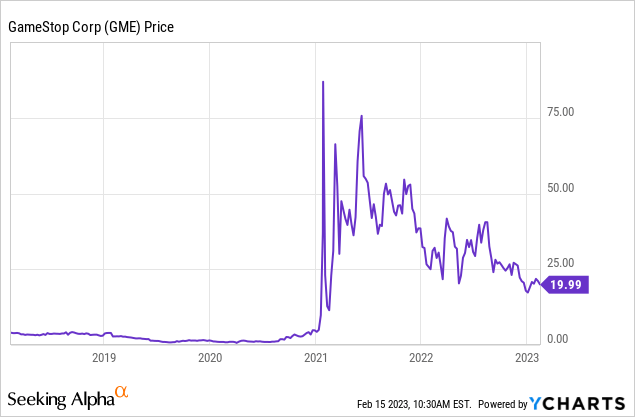

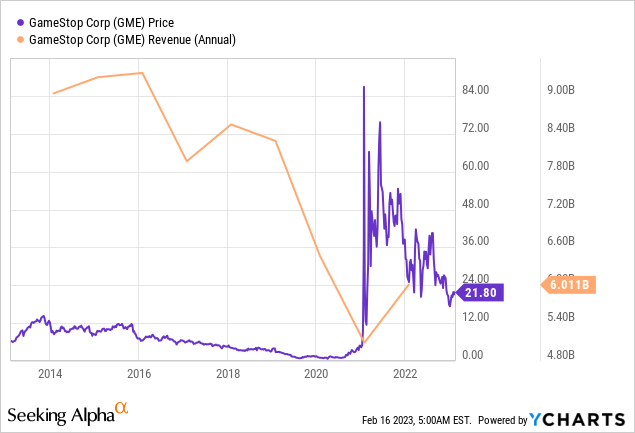

As can be seen from the diagram below, GME stock has substantially plunged since the stock buying frenzy at the beginning of 2021. At the same time, it is still sufficiently above the levels seen before the meme stock rally.

This can be even better seen on the 3-year graph below borrowed from MarketWatch. In 2020 before the monstrous rally in early 2021 the stock price was less than $3. However, it quickly soared to more than $75. The stock price has fallen significantly since then. It has even depreciated from the levels mentioned in my previous article. But strangely enough, the shares have not returned to their previous levels reached before the meme stock mania.

I would like to discuss the recent changes and also explain how rational or irrational the current valuations may be.

GameStop’s fundamental changes

Last year was tough for video game stocks. Consumer spending plunged somewhat in 2022. This can also be said about GameStop which suffered from decreasing sales and rising net losses.

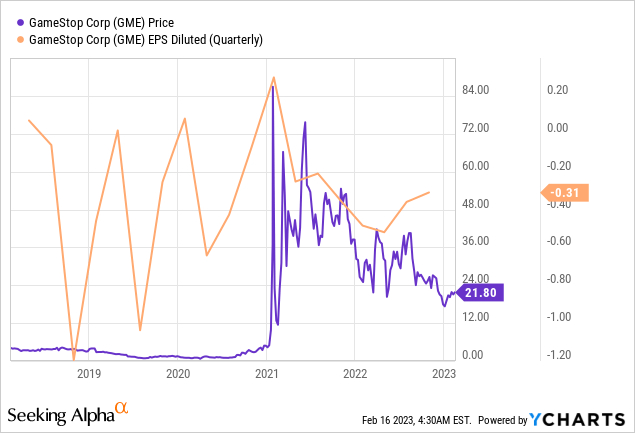

In fact, GameStop has been recording negative EPS since 2018. I prepared several graphs presenting GameStop’s earnings and revenues.

The first diagram shows the company’s quarterly EPS history. As you can see, only at the beginning of 2021 did the company manage to record positive EPS of just over 20 cents per share. The other quarters were all loss-making. Some GME stock optimists may point out that the stock price reflected the company’s improving performance at the time. But no.

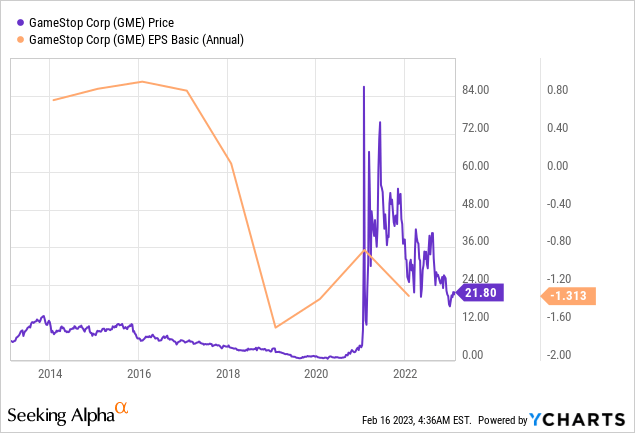

In order to see the bigger picture, I decided to also compare the 10-year annual EPS to the stock price over the same period. It looks staggering just how little value the stock provides. Strangely enough, when the company was doing relatively well, managing to record positive earnings per share, its stock was worth well below $12 per share. Right now GameStop’s net profit is negative, its earnings have got worse even compared to the 2021 levels. At the same time, the effect of the meme stock rally, in my view, did not totally fade. Only this can explain the levels the stock is trading at now.

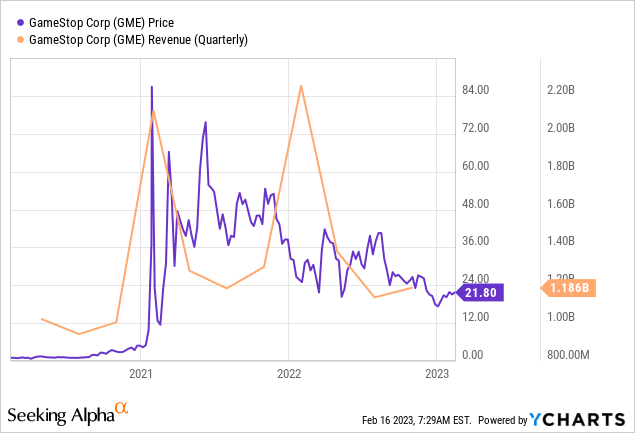

One might think that the company is trading at these levels because of its rising revenues. Not at all.

GameStop’s quarterly revenues have decreased compared to the beginning of 2022 and the early 2021 levels.

The sales fall is even more striking if we see the 10-year annual sales history. Compared to 2016 the revenues have fallen by more than 50%.

Although the company is not running out of cash, its financial position is not brilliant either. GameStop’s bonds are rated as “B” by S&P Global. This means that the company currently has the capacity to meet its financial obligations. However, complicated business and financial conditions as well as external factors will likely affect the company’s ability to meet its financial commitments.

This can clearly be illustrated with a few excerpts from GuruFocus. They all reflect GameStop’s financial position.

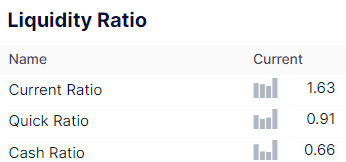

To start with, GameStop’s liquidity ratios imply the company is not headed for bankruptcy in the near term, though.

GuruFocus

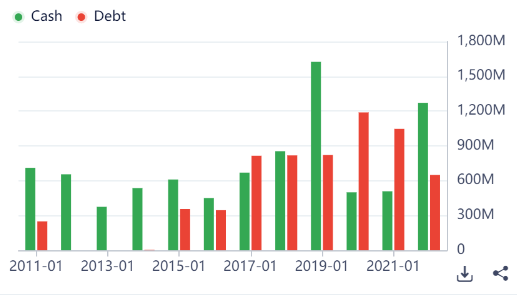

At the same time, it would be rather hard for GameStop to pay all its current liabilities straight away, even though the cash raised last year made the game company’s liquidity position substantially better.

GuruFocus

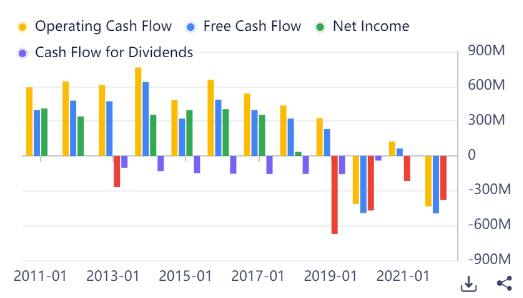

I would also like to have a look at GameStop’s cash flow history. Unfortunately, since 2020 the company has been recording negative cash flows. This is mostly due to the net profits that have been struggling since 2018.

GuruFocus

So, fundamentally, the stock does not appear to be sound enough.

Risks

You might be wondering if it is a good stock to short-sell now. I would personally stay away from both buying and short-selling it. The reason why I am advising my readers to stay away from betting against this stock is that GME stock is a popular speculative instrument. Indeed, when there is a short squeeze, GME is one of the few stocks that market participants use to speculate on. So, there is a risk for GME shares to unexpectedly surge.

I would not buy GameStop’s stock either for the following reasons:

- The fundamentals are poor, whilst the stock price does not quite take this into account. The market would eventually realize this.

- The market environment might change. The Fed is quite hawkish, and the rising interest rates might provoke a recession, which will obviously affect the not-so-high-quality stocks.

- The company’s financial position might get worse due to rising net losses. The cash levels might fall further. In order to stay afloat, the company will have to issue more shares, thus diluting its existing stockholders.

Valuations

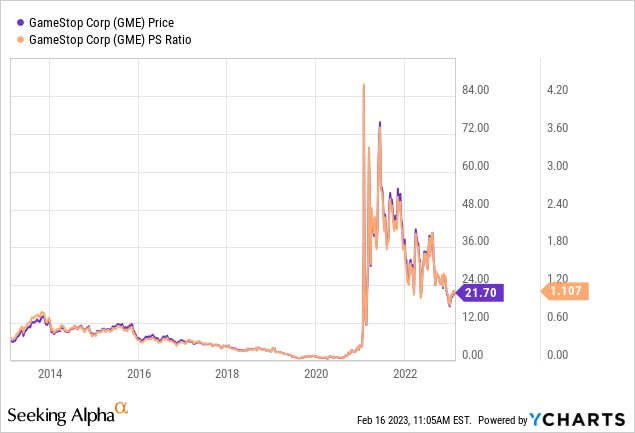

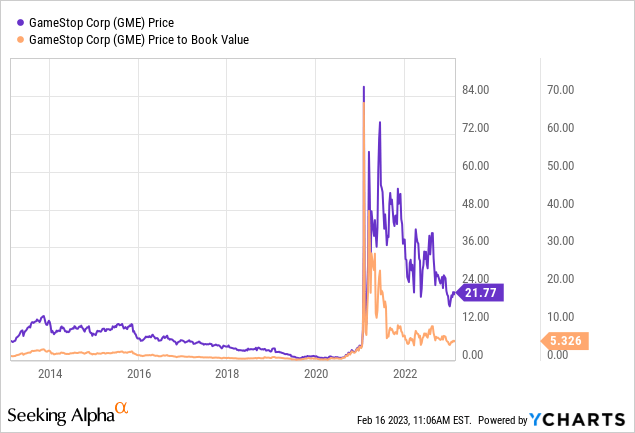

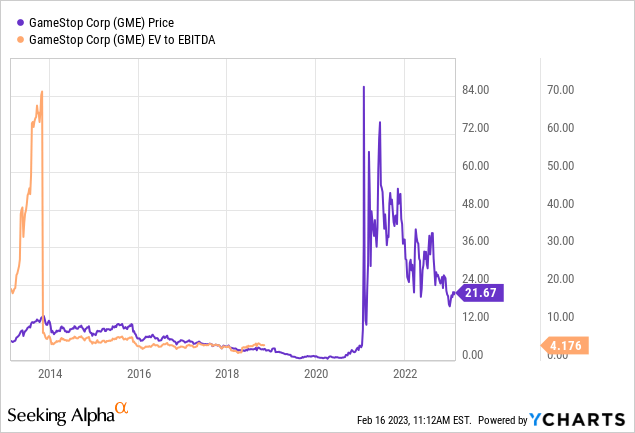

Let us also have a look at GameStop’s classical valuation ratios.

As I have mentioned before, the company is loss-making. So, I am not taking the price-to-earnings (P/E) ratio. Instead, I will use the EV-to-EBITDA, the price-to-sales (P/S), and the price-to-book (P/B) ratios.

To start with, GameStop’s P/S ratio suggests good value for money, especially if we compare it to the levels reached in 2021. However, given the deteriorating financial indicators, such a P/S is rather a sign of a value trap.

The current P/B paints a picture of an overvalued company. It is currently above 5, which is sufficiently above the ideal 1 to 3 range.

Even GameStop’s EV-to-EBITDA has been staying negative since 2019 because the company has been reporting negative EBITDA (earnings before interest, taxes, depreciation, and amortization) for a while.

So, we cannot say GME stock is a value play. In fact, just the opposite is true.

Conclusion

GME stock is not worth your investment. Its results have not improved since then. Even the raised cash was due to share dilution. I understand this is a common way for loss-making companies to raise cash. This allows businesses like GameStop to avoid bankruptcy. Yet, the fundamentals do not show many other signs of improvement. At the same time, the existing shareholders might benefit if there is another rally for meme stocks. I would be glad for GameStop’s stockholders if that happens. In my view, it does not make any sense to buy GME stock, though. Yet, I would not short-sell GME. So, my rating is “Neutral” and therefore unchanged.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.