Summary:

- GameStop beat expectations for Q4 results on both top and bottom lines.

- The cash booty expanded as well and the bulls came charging back in the after hours.

- We look at what the company got right and where this is headed.

Anski/iStock Editorial via Getty Images

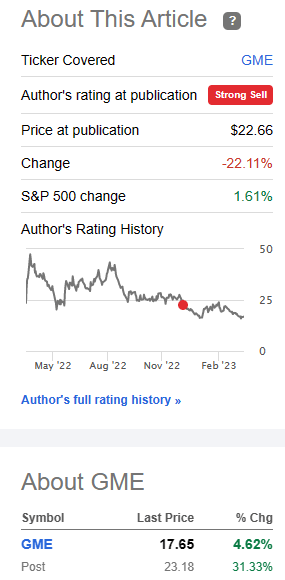

On our last coverage of GameStop Corp. (NYSE:GME) we identified the stock as the last meme play that still was standing. Amongst the carnage elsewhere GME still held a respectable market capitalization and also had suffered lower losses from its peak than many of other meme brethren. We felt that the time was nigh for the end and slapped another “Strong Sell” rating on the stock. Specifically we said,

So reality is coming for GameStop too. It may be the last meme stock hanging on to a substantial portion of its gains, but that will change. Every trail has its end, and every calamity brings its lesson.

Source: The Last Of The Memeicans

That call worked right until the results came out. Prior to that release, GME lagged the broader indices quite markedly.

Seeking Alpha

Post that, the stock caught back up and is now exceeding the minute gain S&P 500 ETF (SPY) has shown since early December. We look at the results to see if this comeback kid can deliver the high hopes and promises that the crowd is expecting.

Q4-2022

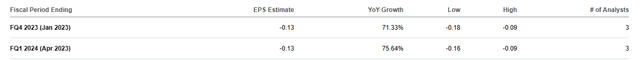

There were a couple of positive headlines around the release. Notable was that GME beat revenue estimates by a smidge. Net sales were $2.226 billion, compared to $2.254 billion. Well if you call that a “beat,” then color us excited. The bigger number for the bulls was the Non-GAAP earnings of 16 cents a share. Consensus was expecting a 13 cents a share loss. We have alluded to this before and it bears mentioning again. There are almost no analysts left covering the stock. Back before COVID-19 when there was no such thing as a “meme stock,” there was a healthy coverage consisting of more than a dozen analysts. The ranks have now dwindled to only three that are still following this saga.

Seeking Alpha

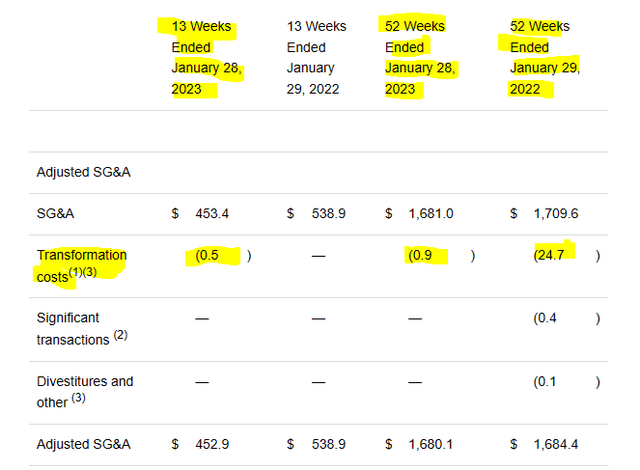

You are likely to get big beats and misses when the rank and file have been whittled. You also have to keep in mind that these non-GAAP numbers can get a lot of massaging in ways that analysts don’t necessarily forecast. So were the adjustments the driver? Not in this case. This was a rare case where GAAP to Non-GAAP has extremely minute adjustments.

GME Q4-2022 Results

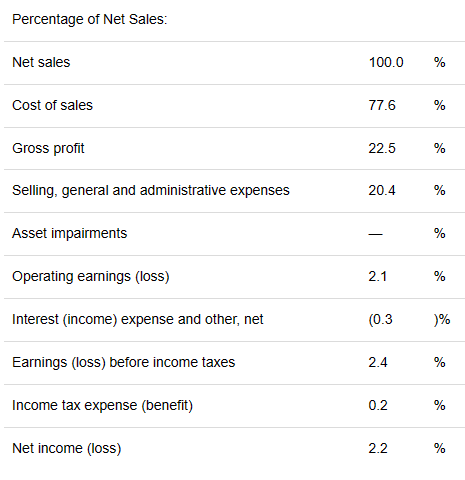

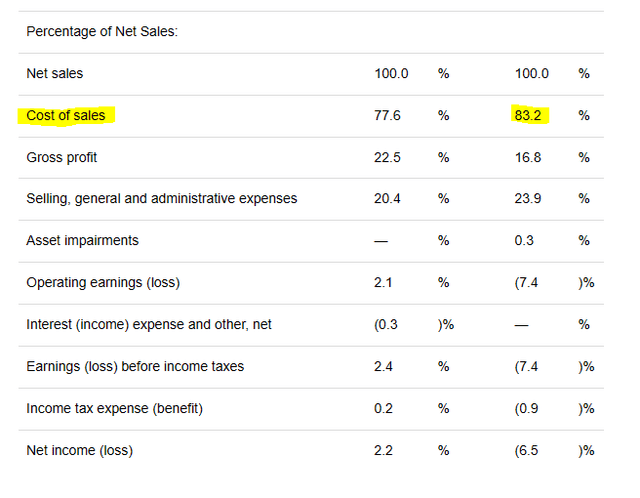

So the beat was real as they come. So what drove this beat and how does it impact the future outlook? For GME, the biggest improvement here was in the cost of sales which came in at 77.6% of the net sales’ cost.

GME Q4-2022 Results

Last year, this same number for this quarter was 83.2%.

GME Q4-2022 Results

We also saw a solid improvement in Selling, General and Administrative expenses as layoffs kicked in from the restructuring. This number was 3.5 percentage points lower. While that all looks great on paper, there are some big caveats here before you take this to mean that the turnaround is here.

The first one is that for all the improvement you do see, sales are still falling and were down year over year. In a period of 7%-8% total inflation, if your nominal sales drop, you are in trouble. So far the turnaround has focused on improving the cost of sales even though revenues continue to decline.

The second major one is that this is winding down of a major hardware cycle for GME for a few years and it was supposed to be one which they could milk for a lot of profits. With the cycle coming to an end, GME has little to show for it. The entire fiscal year still showed a loss for the company.

The third one here is that we believe a lot of the lower cost of sales was driven by liquidating older inventory.

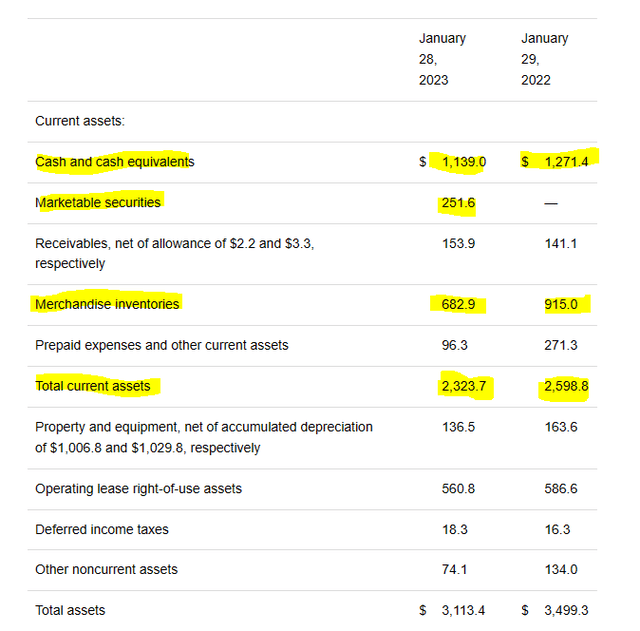

Inventory was $682.9 million at the close of the period, compared to $915.0 million at the close of the prior year’s fourth quarter, reflecting the Company’s ongoing focus on maintaining a healthy inventory position.

Source: GME Q4-2022 Results

We don’t this can be replicated in the quarters ahead and the company’s margins may once again come under pressure.

Outlook and Verdict

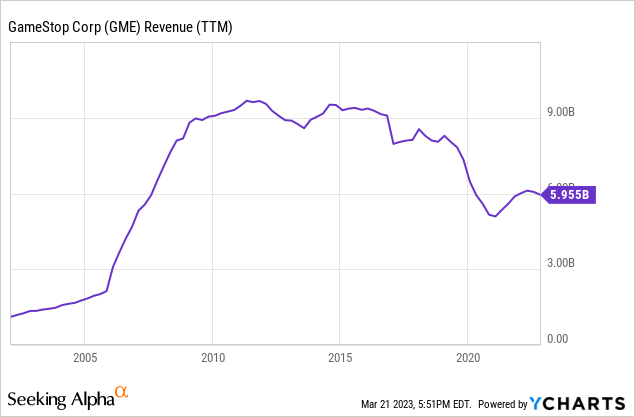

GME’s sales peaked a decade back and have moved lower in fits and starts.

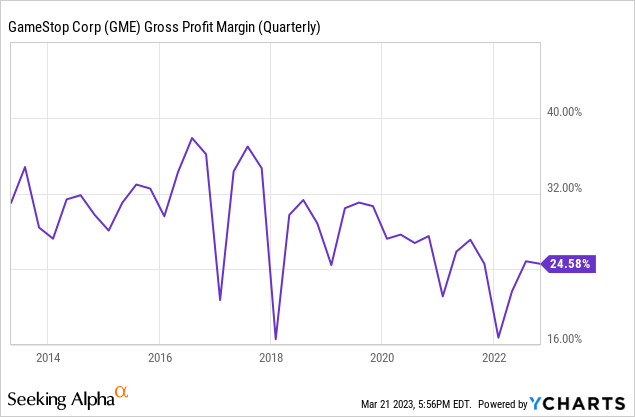

As this hardware cycle winds down, we believe the next move lower in sales will be even more brutal. Games are moving to online model and console sales are becoming increasingly competitive, driving lower margins. The big question will be whether GME can manage through this next phase with a modicum of profitability. In a bricks and mortar store model with high employee costs we think this will prove to be difficult. Wage inflation will likely run at 4-6% and hardware gross margins are likely to move lower over time. Even at present levels, they are about eight percentage points too low to allow healthy profits over the entire cycle.

We’re reaching diminishing returns from cost cutting as well. So, the next $1.0 billion of loss in sales will cause a lot more losses than the last $1.0 billion did. The offset here is that GME has no net debt and a healthy cash load. Total current assets are $2.323 billion.

GME Q4-2022 Results

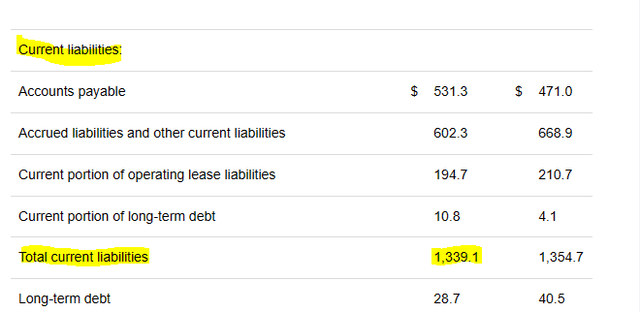

Before bulls start counting all of this as a starting valuation for the stock, you do need to remove the current liabilities from the equation.

GME Q4-2022 Results

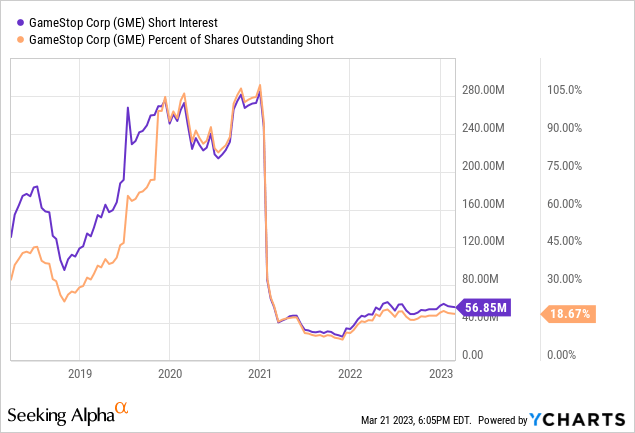

The net result is about $1.0 billion and that gives the company some liquidity to weather the upcoming challenges. The big problem is that the market capitalization is now well above $7.0 billion (adjusting for after-hours action). Do you want to pay $6.0 billion net for a dying retailer that is still making annual losses? Of course logical valuations are few and far between these days. What is pointed out is the short interest. That short interest could ignite some fire, but remains incredibly low relative to history.

Bulls should use the excitement to exit GME stock. For bears, we would look to only short this using options, preferably costless ratio-put-spreads. We also would wait until the euphoria of posting only $1.03 in annual loss per share fades before engaging. We rate the shares a Strong Sell.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Cash Secured Put and Covered Call Portfolios are designed to reduce volatility while generating 7-9% yields. We focus on being the house and take the opposite side of the gambler.

Learn more about our method & why it might be right for your portfolio.