Summary:

- General Motors has outperformed the market in 2024, unlike most automakers, due to strong earnings and effective cost-reduction strategies.

- GM’s Q3 earnings and FY2025 prospects look promising, driven by a $2B reduction in fixed costs and growing market share, especially in EVs.

- GM’s Q3 earnings are also particularly delicate because they will have to prove whether the company can keep moving counter to the industry trend.

JHVEPhoto

General Motors Goes Countertrend

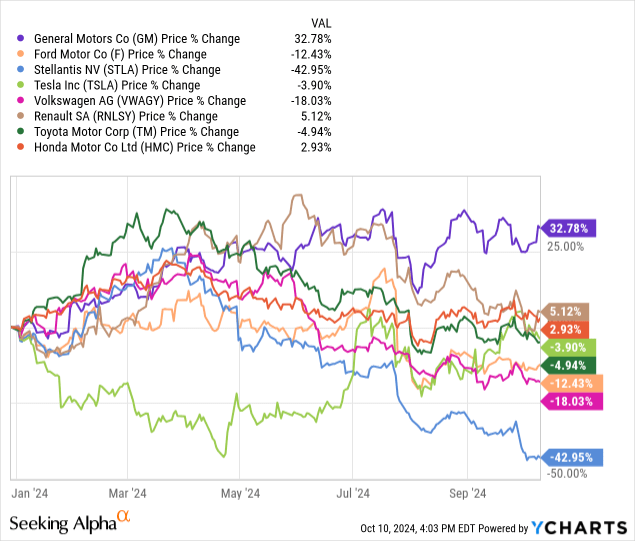

Who says automakers were not the right place to invest in 2024? Well, while most of the major automakers have deeply underperformed the market, General Motors Company (NYSE:GM) has not only been able to gain positive returns, but it has also outperformed the market, not counting dividends. As for me, my readers know that I picked Stellantis N.V. (STLA) two years ago, and while up to Q1 of this year, it turned out to be a market-trouncing investment, returning over 2x, since then, it has been nothing but woes and it is now the worst performing stock in the industry.

As General Motors’ Q3 earnings approach, it is time to understand why it performed so well this year and its prospects as we get close to year-end and FY 2025. After all, GM had been an underperformer until this year. As concerns over the automotive industry mount, we should be cautious in assessing whether GM can still stand out as a market-beating pick or if the good times are already behind us.

In particular, General Motors was able to beat the market thanks to higher-than-expected profits ($10.1B in FY2023 and $11.2B as the top-end of the FY2024 guidance) and a well-managed cost-reduction program with an important $2B reduction in its fixed costs net of D&A. Free cash flow generated in FY2023 was $11.7B. The company was thus able to return $12B to its shareholders via dividends and generous buybacks.

We see that General Motors invested and focused on reducing the overall part count, with an 80% reduction in buildable combinations, a 60% reduction in selectable options, and 35% fewer trims. This created a total reduction of over 1,000 parts.

GM 2024 Investor Day Presentation

An encouraging piece of data for GM is its market share in the U.S., which has been constantly growing in the past few quarters. Moreover, GM’s share in the EV market is rapidly increasing. This is helping GM’s EV business achieve long-sought profitability, which should be reached by Q4. Good news recently came from an unexpected report showing that sales in China rose 14.3% QoQ with EV and PHEV sales surpassing ICE vehicles (52.7% of total sales).

GM 2024 Investor Day Presentation

With these fundamentals – leaner operations and growing market share – it is understandable that a profitable company expects a growing EBIT and FCF even in a tough industry year like this one.

GM 2024 Investor Day Presentation

It also seems GM is feasting on Stellantis’ market share decline in the U.S. Just a few years ago, Stellantis reported a double-digit market share in the U.S., thanks to the strength of American brands such as Jeep, Ram, and Chrysler. But since 2022, Stellantis has lost market share and is now fighting for 8%. At the same time, GM reported a market share of 15% in Q1 2024 and 15.9% in Q2 2024. The recent Q3 sales news release told us that worldwide, GM increased its deliveries by 2%, but in the U.S. volume was down 2%. However, GM reported record EV sales (up 60% YoY), saying it will reach the breakeven point by the end of the year. This makes GM the second-largest EV player in the U.S., beating Stellantis. Surely, GM’s EV portfolio has gained appeal among U.S. consumers, with over 50% of EV buyers being new to GM. This is positive, but we will have to watch what the impact of the 2% decline in U.S. sales will bring. Has GM lost market share? Recent estimates believe the car market in the U.S. grew by 0.2% in the third quarter. This would mean GM lost a bit of market share. But we will have to see what it did versus its main competitors such as Stellantis, Ford, Toyota, and Volkswagen. Surely, GM has been able to follow a correct pricing strategy, that has not aimed at double-digit margins in the way Stellantis did but has still been able to generate profits for the company, while offering models whose value was perceived by the customers. This is why GM didn’t need to heavily discount its models, at least so far. Stellantis, on the other hand, has truly and rapidly turned into the Cinderella of today’s market with a 20% YoY decline in shipments. However, thanks to heavy discounts, Stellantis’ market share in the U.S. climbed from 7.2% in July, to 7.9% in August, to 8% in September while inventory was down 11.6%. While this may be positive in terms of market share, we should not be fooled: Stellantis’ bottom line at the end of Q3 won’t look pretty because North America was Stellantis’ most profitable market. Heavy discounts to clear inventory will generate a bleeding income statement.

GM Q3 Earnings Preview

We have seen how GM represents a true exception in the automotive world. Yet, we should not be overconfident as the industry certainly has a tough road ahead. Limited growth, margin compression, credit deterioration, and lower ASPs expected to go on through 2025 are all factors looming on the horizon and partly already present. GM will be affected by this environment, but it enters this challenging period in good shape. In particular, it seems to have implemented a correct pricing strategy where it accepted lower margins vs. its peers in 2022 and 2023 to focus on leaner and nimbler production to cope better once the “value-over-volume” strategy would have turned unsustainable for most OEMs.

Let’s now make some educated guesses on what GM’s Q3 earnings may look like.

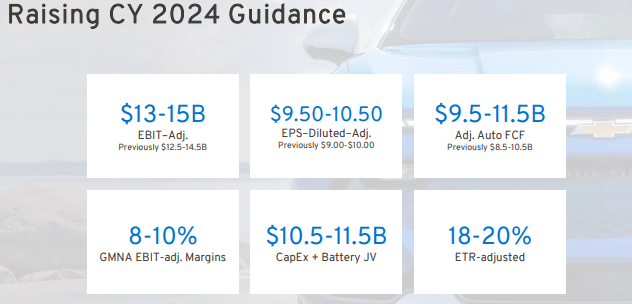

Firstly, GM was bold and confident enough to raise its FY guidance twice in the past two quarters. If the company can maintain it, then we should see a solid report. We are talking about an industrial FCF that should be above $10B and EBIT margins in the high single digits. If GM achieves these results, it will probably surpass Stellantis in profitability. What matters is that GM should report an industrial FCF of around $20B by the end of the year, while Stellantis will probably report an outflow of $10B. The gap stands out as a sentence.

GM Q2 2024 Earnings Presentation

Current consensus expects GM’s EPS to grow 7.4% to $2.45 while GM’s revenues should come in rather flat (consensus: -0.5%). Besides a focus on cost management, GM’s EPS will benefit from the massive buyback program the company is carrying out. In June, the company’s board authorized a repurchase of up to $6B that summed up with a $10B accelerated share repurchase program approved in November 2023. Of this program, $1.4B was remaining as of June and GM exhausted this authorization by the end of Q2, reducing its share count by 18% in just one year. Yes, you read that right, 18%. This is the yield received through the buyback, which can then be added to the dividend. So, we should also look at GM’s share repurchases in Q3 to see how much of the newly authorized program is still being carried out. After all, the stock has surely benefited from these share repurchases as it has gathered popularity among investors and has soared to its 52-week high of just below $50. The target for GM is to have a share count below 1B. At the end of Q2, it reported 1.1B shares, so there were still at least 100M shares to be bought back by GM. Considering an average share price of around $45 in Q3, GM should have spent around $4.5B to reach its goal, leaving at least another $1.5B under the remaining authorization. My guess is that it probably didn’t spend this much and that we should see at least $3B left under the current authorization.

The outlook for FY2024 is $178B in revenue (+3.8% YoY) and EPS of $9.97 (almost 30% YoY growth). I believe that we should not be superficial as we read GM’s Q3 report. As much as the company has been able to perform quite well, the environment is so difficult that we should be weary and watchful for any possible sign of excessive weakness or lower profits. In fact, GM currently trades at a fwd PE of 4.8. It may seem cheap, but it is a rather fair multiple for a large OEM. But if GM’s earnings don’t grow as fast as expected, we would immediately have a multiple above 5 and even close to 6. In this market, it would almost certainly trigger a sell-off to reposition the stock between a 4 and 5 fwd PE. This is exactly what happened to Stellantis, which currently trades at a fwd PE of 4.9. The stock is falling accordingly to the downward earnings revisions.

Now, on this ground, I consider GM stock a hold currently. I see a financially strong company that will probably end this fiscal year with nice profits. However, its current valuation, as cheap as it may seem, positions the company in the high range of its usual multiple. A little bit of softness may thus cause GM’s stock to tumble as well since investors are, for the most part, nervous about the industry. I have a small stake in GM which I never increased to a full position due to the deteriorating environment. I am neither increasing before earnings nor am I selling. I believe the company has enough strength to support its stock and keep performing well in its key markets, but I am a bit in doubt regarding the possibility of reporting very strong results in a deteriorating environment where consumers are pulling back or postponing their next car purchase. Truly, we are before a make-or-break moment. We will either see GM remark on its regained strength or we could see it aligning with the overall industry. Depending on the outcome, the stock could take two very different paths.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.