Summary:

- Google (Alphabet) stock is now priced at ~13x FW pretax earnings when adjusted for its cash position.

- It is essentially viewed by the market as a terminally stagnating business, according to Buffett’s 10x EBT rule.

- Yet, the reality is the exact opposite in the way I see things.

- Plenty of strong growth catalysts are afoot to support outsized long-term return potential for Google stock.

Justin Sullivan

The investment thesis

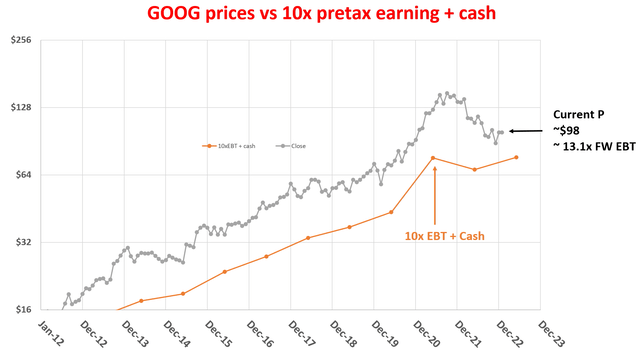

The argument in this article is quite simple: Alphabet Inc. (NASDAQ:GOOG) (“Google”) is undervalued based on the Buffett 10x EBT (earnings before taxes) rule. It is selling at a valuation of around 13x FW EBT only after its cash position is adjusted. At such a valuation, the market essentially views Google as a terminally stagnating business. A 13x FW EBT already provides close to 8% of pretax earnings earning yield, making it equivalent to owning an equity bond with a similar yield (bond yields are all quoted on a pretax basis). Any growth will be a bonus at this valuation.

Yet the reality is the exact opposite in the way I see things. GOOG is anything but a terminally stagnating business. As to be detailed in the rest of the article, GOOG not only enjoys a tremendous moat in its current segments (search engine and digital ad), but it is also well-positioned to capitalize on a range of high-growth areas. And all these new initiatives are supported by its fortress balance sheet and highly profitable existing products.

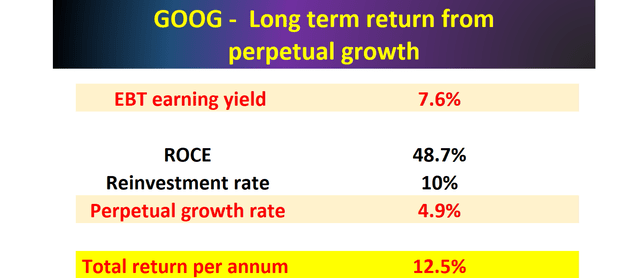

All told, I see GOOG stock easily offers a double-digit pretax annual return potential (around 13%) under current conditions, consisting of about 8% of pretax earnings earning yield as just mentioned and about 5% of perpetual growth rates.

Google stock and Buffett’s 10x EBT rule

As seen from the next plot, Google has been trading at valuations well above 10x EBT historically. However, under current conditions, it is trading very close to 10x EBT. Note that the vertical axis in the plot is in logarithm scale. So the current valuation is closer to 10x EBT than it appears visually in the plot.

To be more specific, as of this writing, Google’s stock price is about $98 per share. And my estimate for its 2023 EPS is about $5.8 per share and its tax rate is about 14%. And finally, do not forget that it has about $9 of net cash position sitting on its balance sheet (more on this later). Putting all these numbers together, its current valuations turn out to be ~13x FW EBT after the cash position is subtracted from its stock price.

Author based on Seeking Alpha data

At such a valuation, Google is essentially viewed by the market as a terminally stagnating business, according to Buffett’s 10x EBT rule. In Buffett’s 10x EBT rule is new to you, I have a blog article detailing it with Q&As I’ve received. A quick summary:

- Buffett paid ~10x pretax earnings for many of his largest and best deals (ranging from Coca-Cola, American Express, Walmart, Burlington Northern, and also the more recent Apple purchase). It is hardly a coincidence because buying a business that stagnates forever at 10x EBT would already provide a 10% pretax earnings yield, directly comparable to a 10% yield bond. Any growth is a bonus.

- The 10x EBT rule, of course, does NOT mean you should buy every/any stock trading below 10x EBT. Investors face two primary risks: A) quality risk and B) valuation risk. The 10x EBT rule is to avoid the type B risk AFTER the type A risk has been eliminated already.

- Then how do we eliminate type A risks? I look for three things primarily. First and second, the business should have no existential issue in short term and the long term. And third, the business should have a decent chance to grow (at the so-call perpetual growth rate). This will be a plus.

Under this framework, next, I will argue that Google meets all the above requirements. It has no existential threats at all and is well-positioned to grow.

Does GOOG have existential issues?

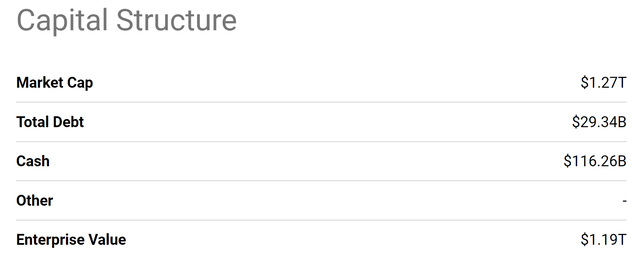

I do not see any short-term or long-term survivability issues at all in Google’s case. In the near term, the survivability issue can always be reliably evaluated by dividends (if the company pays regular dividends) and/or its balance sheet and capital structure. In Google’s case, it does not pay dividends. Thus, let’s examine its balance sheet more closely.

It is a bit of an understatement to say that Google has a strong balance sheet. It has one of the strongest balance sheets in my view. As of its most recent financial statements, it has a significant amount of cash (and cash equivalents) and a net cash position totaling about $116B. translating into about $9 per share. Additionally, Google has a low level of debt (only $29B as seen). It is currently facing some immediate uncertainties ahead (like the layoffs) together with the rest of the economy. But its fortress balance sheet provides a thick cushion for the company to weather any potential downturns in the economy.

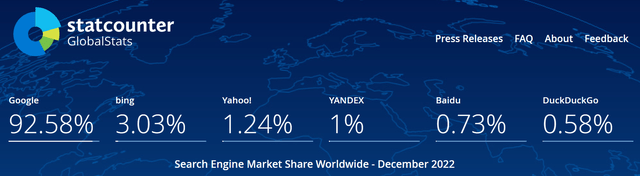

Long-term survivability hinges on the fundamental moat. And here again, I see Google enjoys one of the widest and most dominant moats. Google has a dominating market share in the search engine space. According to statistics from Statcounter below, as of December 2022, Google had a market share of over 92.5% of the global search engine market share. The next largest player, Microsoft Bing, is a remote second, with a ~3% market share only.

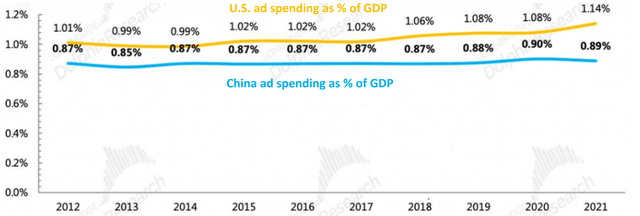

Many of us worry about an economic recession and further worry that a recession might hit the ad space more harshly. However, in reality, advertising expenditures are quite stable as you can see from the following data. After all, ad is what draws customers in the first place.

To wit, the chart shows ad spending is quite stable over time, with only small fluctuations in both the U.S. and China, the two largest economies. In the U.S., ad spending has fluctuated within a relatively narrow range of 1.01% to 1.80% over the past decade. The only exception was 2021. The COVID-19 pandemic unexpectedly spurred ad spending drastically. The picture for China is very similar.

Also note that developed countries like the U.S., where consumption is a larger part of the economy, have been demonstrating higher ad spending as a percentage of GDP. Ad spending as a percentage of GDP has been in a range of 0.85% to 0.90% over the past 10 years in China. And this observation leads me to the next topic: the profitability and growth potential of Google.

GOOG: Profitability and growth prospects

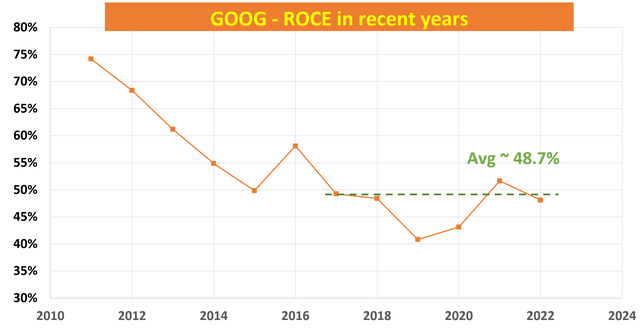

Thanks to its moat and technological lead, Google has a robust revenue stream and has been consistently profitable. Furthermore, its diversified business model across various segments and geographies has also helped in providing a stable revenue stream and growth opportunities (especially in developing countries as mentioned above). All told, the plot next shows GOOG’s profitability in terms of ROCE (return on capital employed). As seen, its ROCE is on average 48.7% in recent years, a very competitive level even in the overachieving FAAMG group.

Supported by its existing moat and strong ROCE, I see strong potential for Google ahead. Leading growth catalysts include growth in the advertising space as mentioned above, cloud computing, its multitude of digital services, and also its fast expansion of hardware lineup (such as Pixel smartphones and smart home devices).

For the long-term, as also detailed in my blog article, the growth rate of any business is ultimately governed by the products of ROCE and Reinvestment Rate (“RR”). Google has been maintaining a 10%+ RR in recent years, and I see such a RR as sustainable in the long term given its strong cash flow. And the combination of an average 48.7% ROCE and 10% RR could lead to ~5% of perpetual growth rates (48.7% ROCE * 10% RR = ~4.87% of perpetual growth rates) as summarized in the table below.

Risks and final thoughts

To recap, Google certainly faces uncertainties. In the near term, Google faces competition from other social media platforms such as Facebook, Twitter, and TikTok. The company also faces regulatory risks almost constantly. Its core business relies on collecting and using data from users, which has always attracted privacy concerns and regulatory scrutiny. In recent years, Google has faced fines and penalties from various governments for alleged violations of privacy laws. These risks have (and could) impact Google’s stock prices substantially.

However, to me, the current valuation suggests that these above issues are overblown. At ~13x FW EBT after adjusting for its cash position, the market essentially views it as a terminally stagnating business according to Buffett’s 10x EBT rule. Yet, I see it as anything but. I see the stock as an almost-perfect fit to the Buffett 10x EBT rule (except the valuation is a bit above 10x EBT). And as such, I see very favorable prospects for double-digit annual returns in the long term. My projections show ~13% of annual long-term return potential, with about 8% coming from pretax earnings yield and about 5% coming from organic growth.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.