Summary:

- Wall Street has gone downgrade happy on Pfizer in January, loudly complaining the end of the pandemic has arrived.

- What brokerage analysts are failing to appreciate is Pfizer now has the strongest balance sheet and free cash flow setup in Big Pharma.

- If you like cash holdings, cash generation, and a bright free cash flow future during a recession, Pfizer is now a Strong Buy.

Moussa81

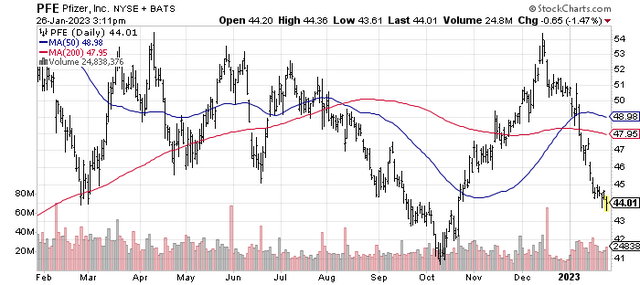

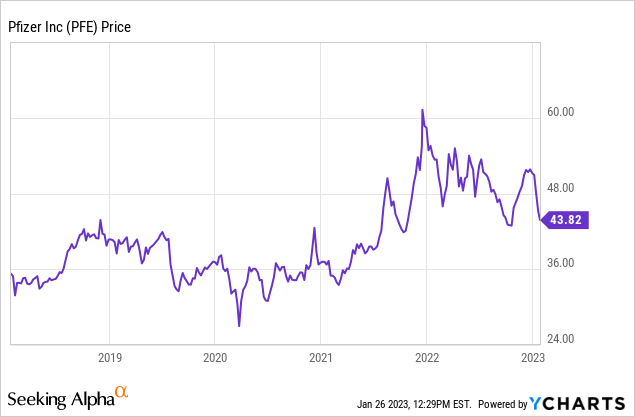

I suggested Pfizer (NYSE:PFE) as a solid buy on weakness idea in the middle of December here, when price was $51 per share. I also mentioned the stock as a top pick for the upcoming year. My feelings have not changed with the recent downgrade-happy Wall Street analyst selloff to $44. In fact, this is the area I considered Strong Buy territory just a month ago. Why?

StockCharts.com – Pfizer, 1 Year of Daily Price & Volume Changes, Dividend Adjusted

For me, it’s all about cash holdings and free cash flow generation vs. peers and competitors in the patented-drug discovery, manufacturing, and marketing space. The Wall Street cyclical-sentiment gotcha crowd is selling the obvious end of the COVID-19 pandemic. In all likelihood we are moving to a yearly COVID vaccination in the fall, just like the regular flu shot recommended by doctors and the CDC for better than 20 years (while administered with terrific results for public health). Pfizer’s COVID shot in partnership with BioNTech SE (BNTX), and the company’s hugely successful Paxlovid antiviral pill will see declining sales in 2023 vs. 2021-22. I and others have been factoring in a major decline in total company results in the future for over a year now.

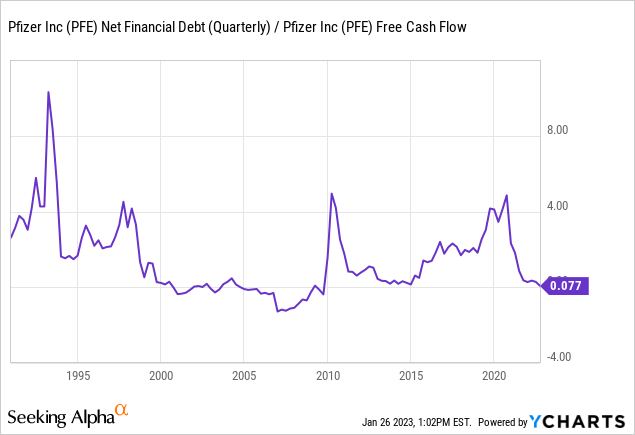

Saying Pfizer is a sell or hold sitting at a forward P/E of 10x with its most conservative balance sheet position since 2009 is a bit of overkill (laughably so if you really want my opinion). But that’s only part of the bullish story. Below is a graph comparing net financial debt (all debt minus cash held) to free cash flow generation since 1992. Today’s low number means debt is a miniscule fraction of yearly dollars coming the door (in fact, 1-month of free cash flow could pay of the net debt sum).

YCharts – Pfizer, Net Debt to Free Cash Flow, Since 1992

I have taken the latest selloff in price as a gift I cannot refuse in my brokerage account. Pfizer is today my largest single company holding. I will take the 3.7% cash distribution yield (and 5% net payout yield including share buybacks), on top of at least 9% in long-term annual free cash flow yield for myself (all the result of today’s disregarded and ignored COVID product windfall in profits and cash flow). The good news is management has the flexibility (cash) to reinvest in Pfizer’s business through accretive acquisitions and share buybacks that other Big Pharma names do not.

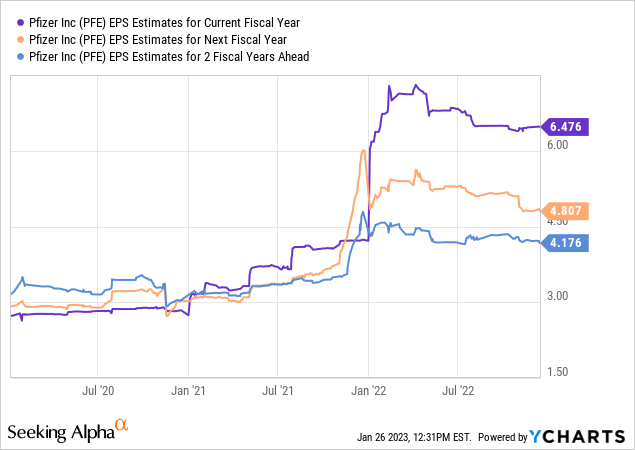

The bump in sustainable earnings from the new COVID cash is pictured below. Moving from EPS estimates around $2.70 in early 2020, $6.48 was projected for 2022 by analysts in late December, vs. $4.80 for 2023 and $4.17 for 2024.

YCharts – Pfizer, Analyst EPS Forecasts 2022-24, Running since Jan 2020, Snapshot on Dec 31st, 2022

Cash Valuation Story Upgraded

Versus just a month ago, the 15% decline in Pfizer’s price has opened up a very compelling valuation setup for new share accumulation.

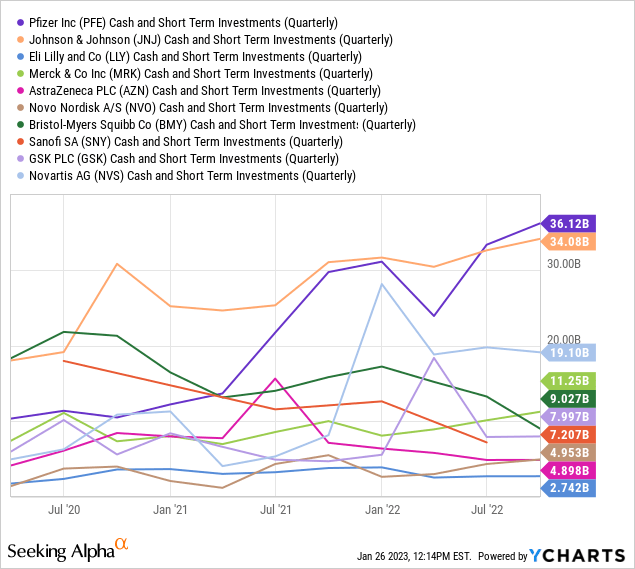

For starters, I want to focus on the large and fast-growing cash position. Pfizer’s cash and short-term investment stash is drawn below vs. the largest pharmaceutical businesses in the world. It has quickly grown into a significant cash stake at $36 billion in Q3 ended in September. The sort group includes Johnson & Johnson (JNJ), Eli Lilly (LLY), Merck (MRK), AstraZeneca (AZN), Novo Nordisk (NVO), Bristol-Myers Squibb (BMY), Sanofi (SNY), Glaxo Smith Klein (GSK), and Novartis (NVS).

YCharts – Big Pharma, Total Cash Held, 3 Years

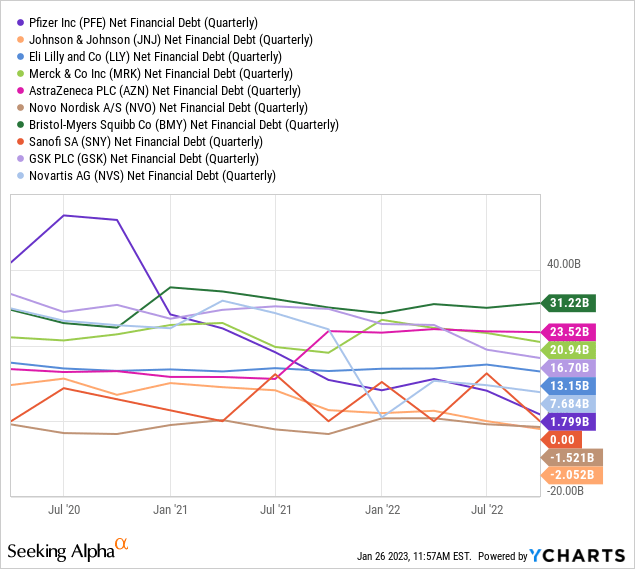

Net financial debt has plummeted to nearly zero and may decline under zero when December Q4 results are published next week (meaning more cash than debt exists). Total debt minus cash has fallen from the highest reading in the Big Pharma group when the COVID-19 pandemic appeared to perhaps the lowest in early 2023 (another solid quarter for profits is expected at the end of last year).

YCharts – Big Pharma, Net Financial Debt, 3 Years

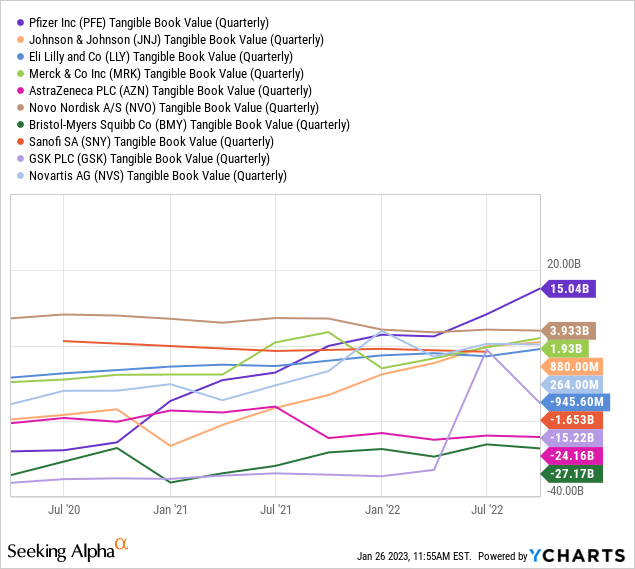

And, for the first time since 2009, Pfizer has a “tangible” book value again in early 2023, which is clearly not the case for others in the pharmaceutical industry. What this means is the company has more hard assets like inventory, cash, and plant & equipment easily liquidated worth MORE than total liabilities and IOUs on its books. Usually, Big Pharma businesses are run with patent intangibles and takeover/merger values beyond net hard assets (creating goodwill accounting) to create tangible book values in negative territory. So, Pfizer is uniquely able to withstand a major recession and take advantage of it with asset purchases on the cheap (using existing cash at the bank).

YCharts – Big Pharma, Tangible Book Values, 3 Years

The strongest buy arguments for Pfizer focus on enterprise valuations, which properly account for its monster cash holdings and little net debt. Most peer Big Pharma plays slide in comparison under the EV microscope, holding extra debt burdens and interest expense.

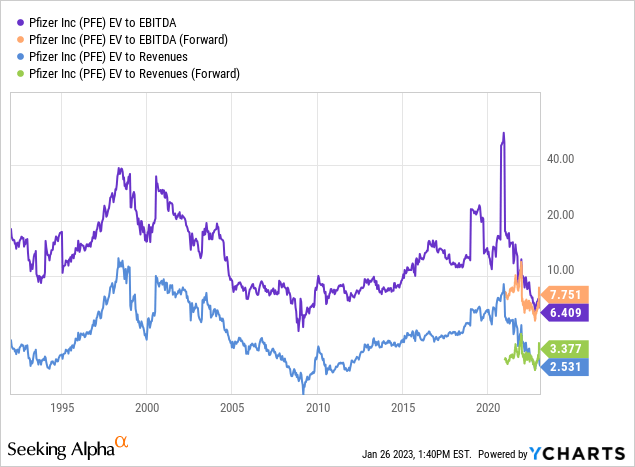

All told, Pfizer’s EV to EBITDA and revenue calculations at $44 per share are hovering near 30-year lows. If your investment goal is to purchase a high-margin business, also a brand-name leader, at a discounted price/valuation, Pfizer may be one of the easiest buy choices on Wall Street in January 2023 (using either trailing results or forward estimates).

YCharts – Pfizer, EV to EBITDA & Revenues, Since 1992

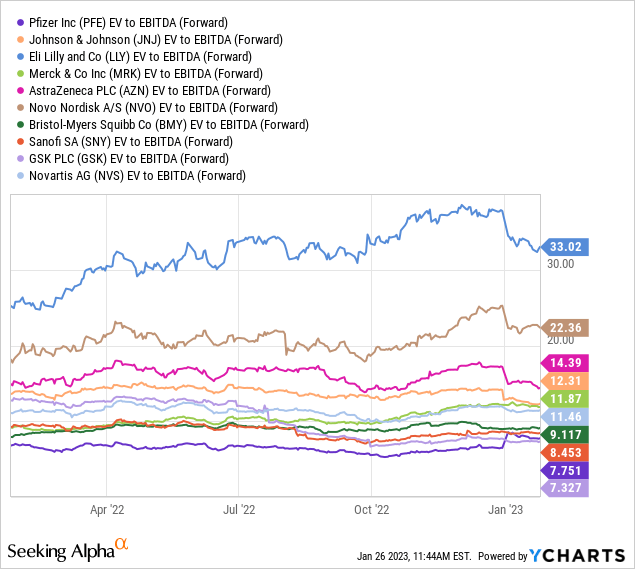

EV to “forward” EBITDA and revenue estimates (which include a drop-off in COVID sales) are also roughly the cheapest in the Big Pharma group.

YCharts – Big Pharma, EV to Forward Estimated EBITDA, 1 Year

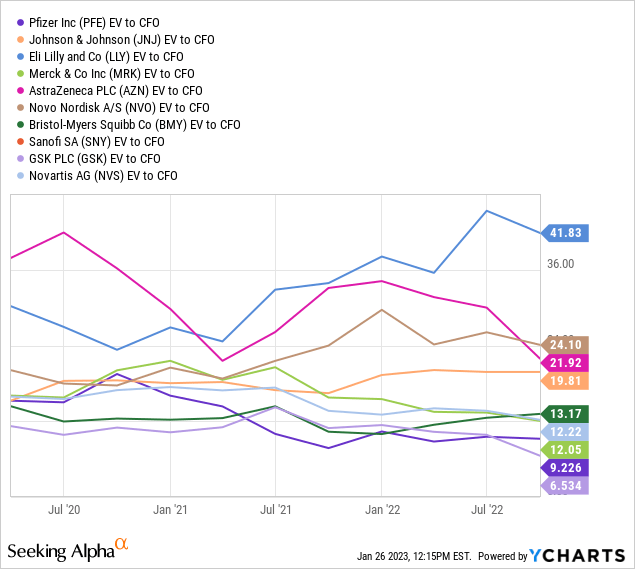

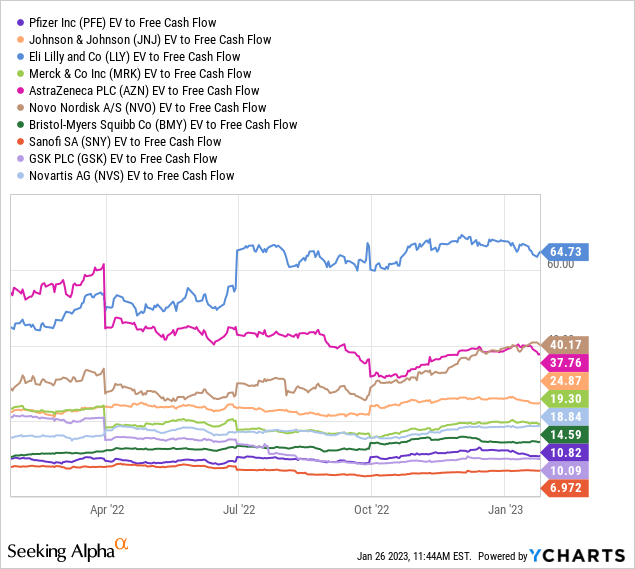

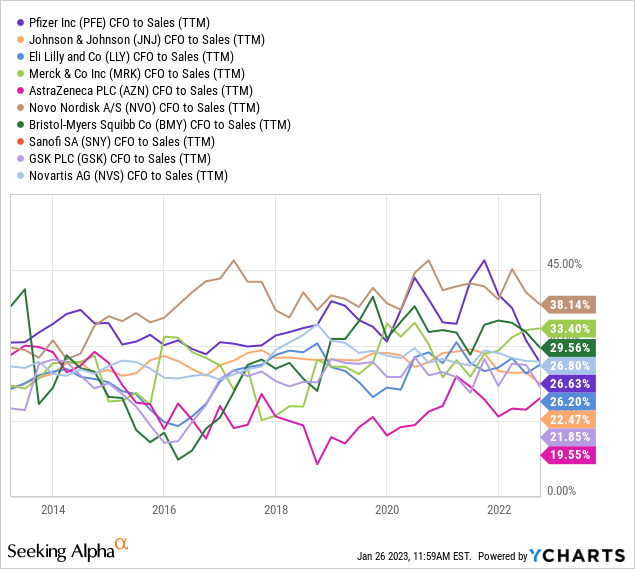

EV to “trailing” cash flow and free cash flow are also leading the alternatives today. If you are searching for extremely positive levels of cash generation vs. an inexpensive price to own it, Pfizer is knocking the ball out of the park. In addition, cash flow rates on sales have fallen a little in 2022, which could rebound starting in 2023.

YCharts – Big Pharma, EV to Basic Cash Flow, 3 Years YCharts – Big Pharma, EV to Free Cash Flow, 1 Year YCharts – Big Pharma, Cash Flow to Sales, 10 Years

Earnings Yield vs. Inflation Rate

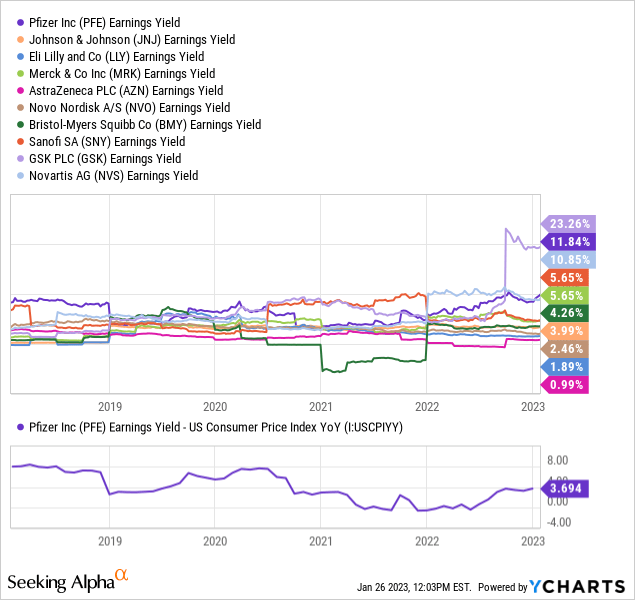

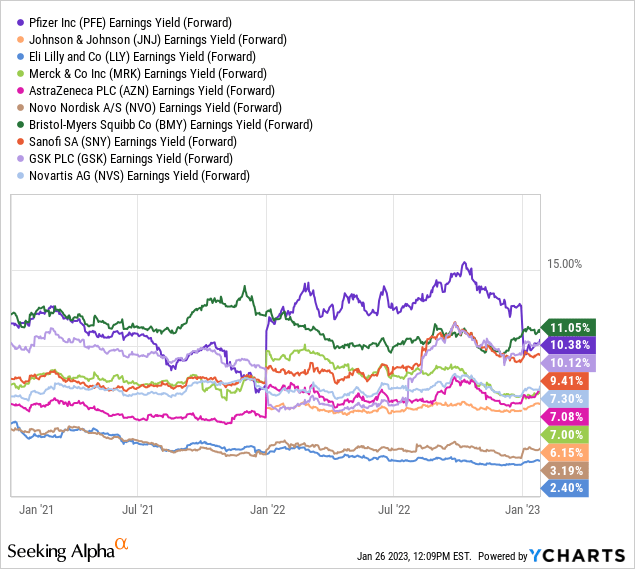

The last point I want to make revolves around Pfizer’s high level of earnings yield available to investors in 2022 and projected in 2023 vs. the existing sharp rise in cost-of-living adjustments. I have harped on this issue since the middle of 2021 – rising CPI rates of inflation are often considered the “minimum” threshold for successful investment returns. Owning a company with a 2% earnings (or free cash flow) yield during periods of high inflation is borderline suicide as a rule. This is the main reason high-flying Big Tech stocks have crashed over the last 18 months. (And, a recession in corporate earnings could drive U.S. stocks even lower this year). Today’s inflation rate of 6.5% requires me to only consider buying equities delivering cash returns above this level. I do not want to lose wealth upfront guaranteed through a subpar earnings yield.

Well, Pfizer passes my inflation rate minimum with a trailing (11%) and forward (10%) earnings yield well above 6.5% currently. Below are graphs of this analysis vs. peers, which are struggling in general to keep up with basic inflation for repeatable cash returns on your investment dollar. Pfizer’s +3.7% adjusted return above the trailing inflation rate is at least in the middle of its 5-year range (roughly 80% of U.S. equities fail to deliver returns above the inflation rate today, another argument our stock market remains overvalued!).

YCharts – Big Pharma, Earnings Yield, 5 Years, with Pfizer vs. CPI Inflation

YCharts – Big Pharma, Forward Projected Earnings Yield, 2 Years

Final Thoughts

Pfizer in the low-$40s is exactly the type of setup free cash flow investors like Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) love to purchase. A large, brand-name blue chip with super high margins and customer goodwill built up over decades, selling at a ridiculously low price/valuation, after Wall Street sentiment turns sour on the business for a short period of time. I suspect in a few months we will hear a number of hedge funds, billionaires, and conglomerates like Berkshire have purchased major positions during January. Why not get into the stock at a great price possibly with them?

Wall Street analysts have been factoring in a slowdown in COVID related product sales for over a year. Now, bearish sentiment is moving into emotional overdrive. Believe it or not $44 for a share price is basically the same as late 2018’s high trade, BEFORE an estimated $40 to $50 billion pandemic windfall in cash arrived for the company (measured against the current $250 billion equity market capitalization). Does this make sense, with Pfizer now sitting on its best balance sheet since 2009, flush with cash, ready for years of reinvestment and accretive acquisitions? No.

YCharts – Pfizer, Weekly Price Changes, 5 Years

Depending on the 2023 future of COVID related sales, I am still modeling a year end price of $55 to $60 per share. From $44 now, including projected dividends, that works out to a solid +28% to +40% total return target from one of the top defensive names historically, going into a potentially serious recession.

Even if COVID variants don’t make news headlines in 2023-24, high rates of illness may still require new annual shots and robust sales demand for Paxlovid. Another important bullish argument in favor of owning Pfizer’s leading COVID assets is the company is working hard on new mRNA technologies to treat all kinds of viruses from influenza and shingles to even deadlier diseases like cancer. It is entirely possible, operating results past 2024 will continue at better than presently forecasted rates, because of Pfizer’s successful 2020-21 treatment inventions and offspring ideas from them.

What’s the downside risk of owning the strongest balance sheet and smartest bargain valuation on cash flow generation in Big Pharma? My answer is very limited risk from $44 is the reality of today’s situation. Perhaps a stock market crash could pull Pfizer under $40 to as low as $35, but I doubt a serious recession would do the same by itself. The stock has a history of outperformance during bear markets on Wall Street and recessions on main street. Management could simply intervene and buy back extra stock with its cash to prevent an oversized share price decline from the low-$40s.

I am modeling worst-case downside potential to $35 (-17% TR) vs. best-case upside to $60 (+40% TR) over the next 12 months. Stronger operating results than today’s low-balled, fear-induced analyst forecast, combined with falling inflation rates and flight-to-safety buying by investors (on top of likely share buyback increases) means substantially higher quotes may play out by 2024.

I can envision $4.75 in EPS for 2024 and an acceptable P/E of 18x (similar to current S&P 500 estimates) delivering an $85 share price in 18-24 months. Such would be good for a total return of +100% (+40% or greater compounded annually) on your investment today. Where else can you find similar upside from a conservatively-positioned and managed asset? I cannot find another.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations, and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks or estimates herein are forward looking statements and are based upon certain assumptions and should not be construed to be indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author’s opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author’s best judgment at the time of publication, and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.