Bank of America: Why Fearmongering From Latest Earnings Is Likely Exaggerated

Summary:

- Fears of net interest income peaking and delinquencies rising appear to be less of an issue for long-term holders.

- Investors tend to fight the last war when it comes to recessions and this often has bad consequences on returns.

- Bank of America appears to be in a very good position to improve its return on equity, without taking too much risk.

VIEW press/Corbis News via Getty Images

Bank of America Corporation (NYSE:BAC) and the banking sector more broadly have been getting more cautionary ratings as the risk of a recession in the coming months is getting priced in.

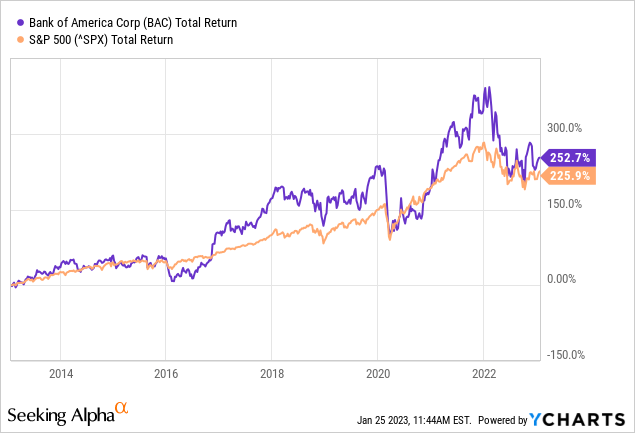

Although banks tend to perform poorly during recessions as delinquency rates spike and interest rates are reduced, Bank of America appears in a far better position to outperform the market going forward than many market commentators realize.

I will go into further detail on why I believe this to be the case later on in the article, but what is worth considering is that BAC has been performing exceptionally well over the past decade even as its traditional business has been disrupted by the near zero interest rate environment.

Before taking a look at the bigger picture and the long-term potential of the business, I will briefly go through the latest quarterly results that the company released a few weeks ago.

BAC’s Latest Quarterly Results

Bank of America reported yet another strong quarterly result earlier this month, with both earnings and revenue coming in higher than the consensus estimate.

Seeking Alpha

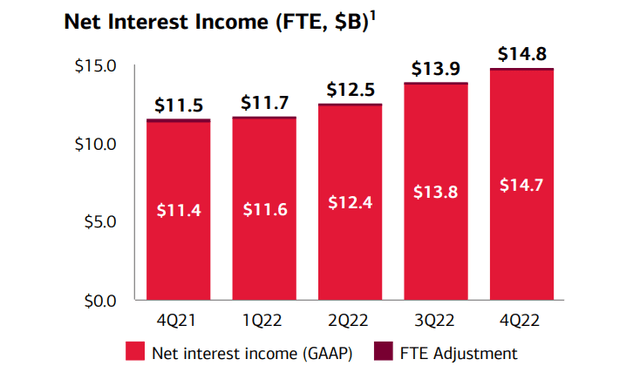

Nevertheless, the stock quickly fell back in the days following the release on fears that the current record high in net interest income is close to reaching its peak levels.

Bank of America Investor Presentation

Indeed, on a long-term basis, Bank of America currently generates a record high net interest income and contrary to the previous highs of 2009-10 period, it also record low provisions for credit losses.

prepared by the author, using data from SEC Filings

The fear that this dynamic could change rapidly in a base case scenario of a recession in the coming months, has resulted in the latest quarter being viewed rather negatively by the consensus on Wall Street.

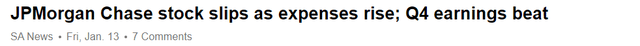

The situation was similar across other major banks with record high earnings, but increased fears of deteriorating net interest income outlook and expectations of macro weakness and rising costs.

Seeking Alpha

Seeking Alpha

Seeking Alpha

Although Bank of America management still operates on the assumption of a ‘mild recession’ (see below), investors are growing wary of all the risks associated with the recent sharp increase in bond yields and Federal Funds Rate and the potential of a major economic slowdown.

And then, obviously, we built reserves against the portfolios across the board that are strong and reflect, as I said earlier, basically a mild recession in the base case and the worst recession in the adverse case that we weight 40%.

Source: Bank Of America Q4 2022 Earnings Transcript

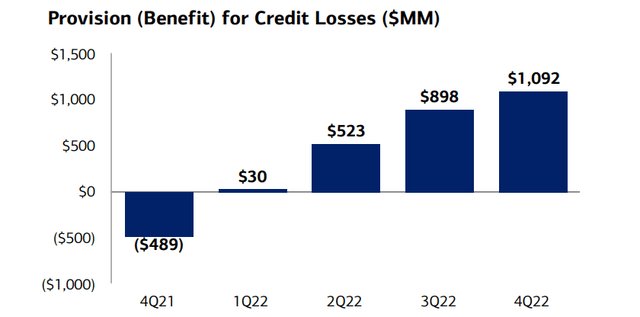

The quarterly increase in provisions not only at Bank of America (see below) but most of its major peers, did not help on the deteriorating outlook for the rest of the year.

Bank of America Investor Presentation

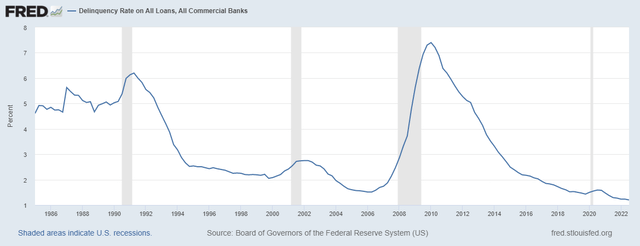

As the unprecedented monetary and fiscal stimulus helped bring down delinquency rates to record lows, it is now the expectation that the Federal Reserve will remain committed in its efforts to tame up the raging inflation by pivoting away from the previously supportive policy.

FRED

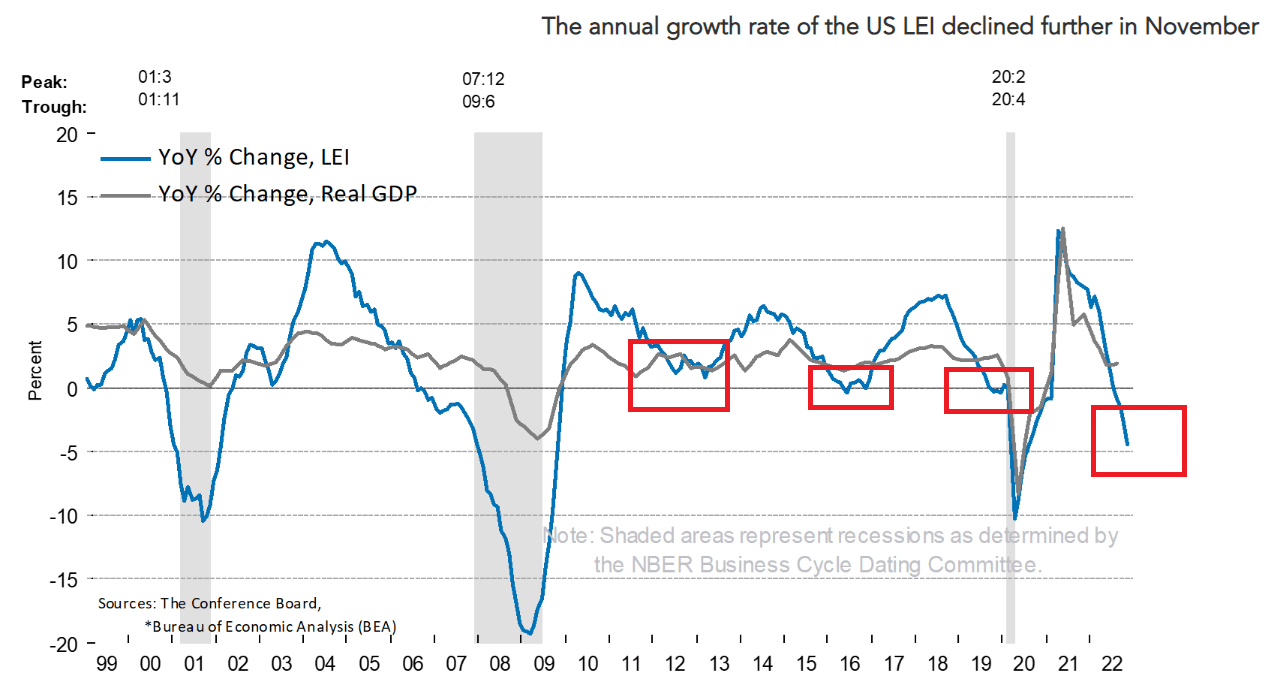

That is why the outlook for the economy as measured by the Leading Economic Index is deteriorating so fast.

conference-board.org

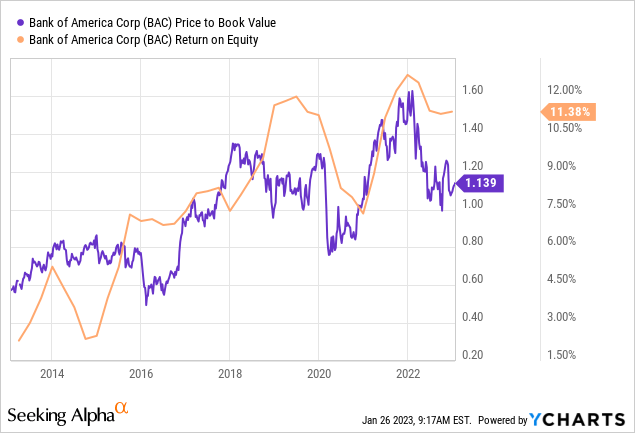

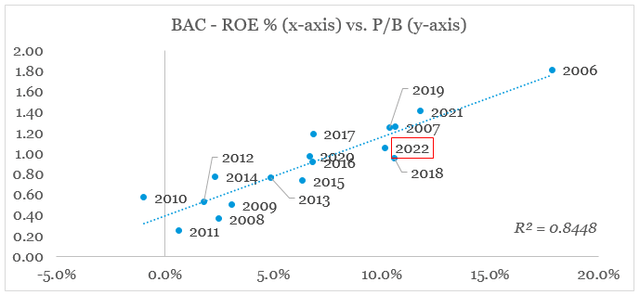

And as a result, Bank of America’s Price-to-Book multiple now sits at significantly lower levels than what its record high Return on Equity suggests (see below).

Thus, similarly to 2019 when there was a wide gap between the two variables, the premium over book value of equity acts as a leading indicator of where return on equity is headed.

What To Expect After Earnings?

As we saw above, Bank of America’s share price has already begun pricing in a recession in the coming months. Whether it’s a mild or a very deep and prolonged one, remains highly speculative.

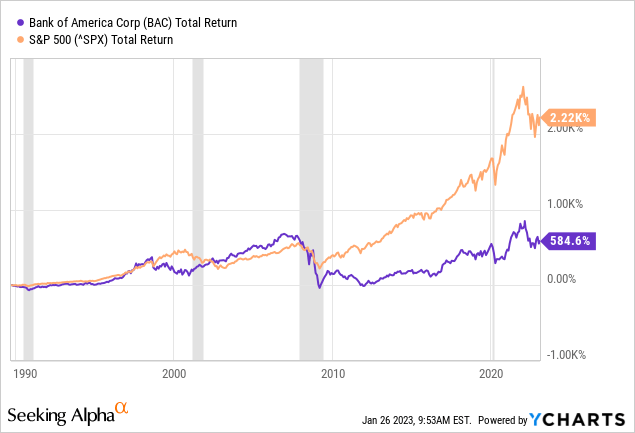

More importantly, however, when most investors hear the word ‘recession’ their first thought is of the Global Financial Crisis of 2007-08 period, when the banking sector was in freefall. However, not all recessions are the same. For comparison, during the early 2000s recession, the banking sector and Bank of America more specifically outperformed the broader equity market (see below).

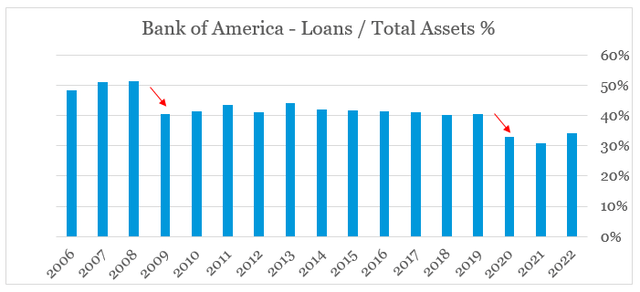

Overstating the impact that a recession would have on Bank of America’s balance sheet is also reminiscent of fighting the last war. The reason being that Bank of America is now better capitalized than it was during the years prior to the Global Financial Crisis.

prepared by the author, using data from SEC Filings

At the same time, the company’s balance sheet has changed dramatically over the past decade or so. For example, interest-bearing deposits with the Federal Reserve now make nearly 7% of BAC’s total assets, while the share of debt securities held to maturity has also increased. Therefore, as the short-term interest rates and the federal funds rate increase, Bank of America is in a position to increase its interest income.

The main asset of any traditional bank – loans and leases, however, has reached a new bottom as a share of Total Assets.

prepared by the author, using data from SEC Filings

This clearly illustrates the structural change that has been going on, not only at Bank of America, but the banking sector more broadly. As interest rates declined over the decade leading up to the pandemic, financial institutions had to adapt by keeping more debt securities on their balance sheets and depositing more funds at the Federal Reserve.

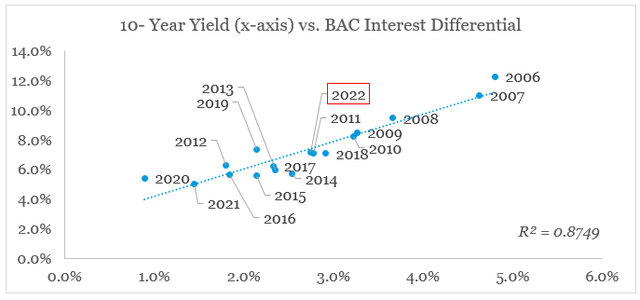

With that, the ability for banks to generate high returns on capital has been significantly diminished since the Global Financial Crisis. As yields begun to normalize in 2022, however, Bank of America’s interest rate differential (the difference between interest rates on assets and liabilities) has improved.

prepared by the author, using data from SEC Filings and FRED

As the interest rate differential increases and the share of loans to total assets bottoms, Bank of America is in a very good position to improve its return on equity over the coming years which will ultimately have a positive impact on its premium to book value i.e. its Price-to-Book multiple.

prepared by the author, using data from SEC Filings and Seeking Alpha

Investor Takeaway

In a nutshell, investors are rightfully concerned about all the risks related to a potential recession within the next 12-18 month period. The issue with that when it comes to Bank of America is twofold:

- firstly, the recession is likely to have an impact on short-term results and it is already getting priced into the company’s share price;

- secondly, investors are prone to assuming that the next recession will resemble the events of the GFC of 2007-08 period.

As we saw above, Bank of America is better capitalized than it was 15 years ago and is well-positioned to capitalize on normalizing interest rates. The major risk scenarios for the company are related to either the Federal Reserve coming back to near zero interest rates for longer which at the moment appears unlikely or the potential of a devastating recession to the United States and the global economy. Needless to say that if the latter scenario is largely speculative and if realized, investors would be better-off staying away from equities entirely.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author’s opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies’ SEC filings. Any opinions or estimates constitute the author’s best judgment as of the date of publication, and are subject to change without notice.

All the research in this article is based on The Roundabout Investor strategy. An investment philosophy which finds high quality and reasonably priced investment opportunities. It capitalizes on inefficiencies in the market by avoiding short-termism, momentum chasing and narrative driven expectations.

In addition to exclusive roundabout investment opportunities, the service offers a concentrated portfolio based on the highest conviction ideas. A more holistic overview to the equity market is also utilized through the lens of factor investing techniques.

To find similar investment opportunities and learn more about how the roundabout investment philosophy could protect portfolio returns during market downturns, follow this link.