Summary:

- Institutional investors purchased nearly 147 million of Google’s Class A shares in the last 13F reporting cycle.

- There’s good reason behind this shift in market sentiment, and it’s driven by fundamental developments.

- Readers and investors can view this as an encouraging sign and remain invested or increase exposure in the stock.

Alexander Koerner/Getty Images News

It seems like the Street is turning bullish on Google (NASDAQ:GOOGL) (NASDAQ:GOOG) in a big way. Latest data reveals that a broad swath of institutional investors collectively bought nearly 147 million of Google’s Class A shares in the last 13F reporting cycle alone. This significant buying should come as an encouraging sign for the company’s investors and dissuade bearish narratives floating around in investing forums. Let’s take a closer look to gain a better understanding of it all.

The Massive Buying

Let me start by saying that institutions such as hedge funds, mutual funds, pension funds, and other similar entities are mandated by the SEC to disclose their holdings every quarter. We can follow their trading patterns to understand how bullish or bearish they are towards any given stock and also to confirm our trade direction. So, this is a handy tool to gauge the Street’s sentiment for any US-listed stock.

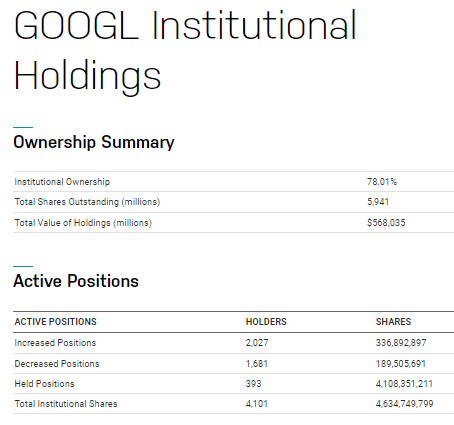

As far as Google is concerned, a group of 2,027 institutional investors accumulated a little over 336 million of Google’s Class A shares in the last 13F cycle, which dwarfed the selloff of 189 million shares by 1,681 other such entities. This created a net accumulation of roughly 147 million of Google’s Class A shares in the last 13F cycle. The figure may not mean much in isolation but it translates into a net purchase of nearly 2.5% of Google’s total shares outstanding, which is a noteworthy development considering that this accumulation happened within one quarter.

Nasdaq

What’s even more interesting here is that institutions already owned roughly 75.5% of Google’s total Class A shares, and they have now decisively increased their ownership to around 78%. I believe this means they’re even more bullish on Google, at a time when investors are growing cautious about recessionary pressures weighing down on the company’s growth trajectory. For the record, the data being referenced here is from January through March, and it was fully released into the public domain only last week. This makes it fresh and relevant to our discussion here. Also, we’re referencing data for Google’s Class A shares trading with the symbol “GOOGL” throughout this article, instead of Class C shares trading with the symbol “GOOG”, as the former comes with voting rights and I had to pick one out of the two.

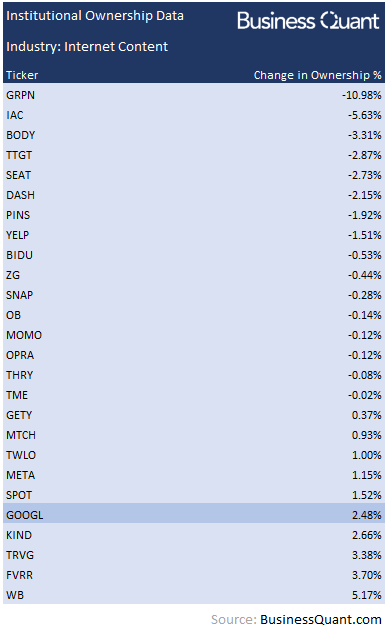

But returning to our discussion, I wanted to see if institutional investors were bullish specifically on Google or if they grew bullish on other internet companies as well. After all, if these investors were bullish on the entire sector in general, then Google wouldn’t stand out and our discussion would end right here. So, to gain clarity on the matter, I pulled the institutional ownership data for 25 other stocks that are also classified in the internet content industry and are listed on US indices.

BusinessQuant.com

The results were rather interesting. The majority of stocks in our study group experienced in institutional selloff of varying magnitudes. In fact, only 10 out of the 26 stocks saw an increase in institutional ownership. But what stands out here is the fact that Google saw one of the highest increases in institutional holdings during the last 13F cycle nonetheless.

This brings us to an important question – why are institutional investors growing bullish on Google in the first place?

Reasons to Cheer

There are broadly three reasons, in my opinion, that triggered the institutional buying spree in Google. It’s important to note that the sentiment had turned extremely bearish towards the company a few months ago. Recessionary pressures were weighing down on its ad revenue, Microsoft (MSFT) announced its $10 billion investment in ChatGPT and swiftly integrated it in its search engine Bing, and meanwhile, Google had a failed launch of its Bard AI platform. It seemed like Google was in dire straits and Microsoft was going to quickly nab away its search engine market share.

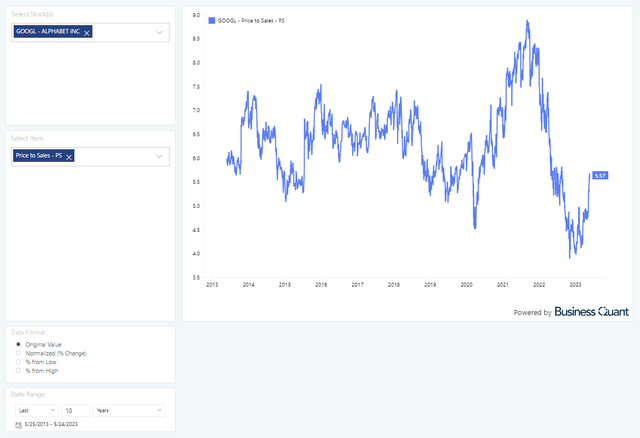

This caused investors to hit the “panic sell” button, and Google’s stock plummeted shortly after. Its shares started to trade at just under 4 times the company’s trailing twelve-month sales, dropping from over 8 times in 2021, down to its decade-low levels. So, institutional investors, with a long-term time horizon and a greater tolerance for portfolio drawdowns, scooped up Google’s shares while they were still deeply discounted. This was the first factor.

Secondly, much of the bear thesis surrounding Google has been proven wrong or at least diluted down. Its Bard AI has now been successfully launched and is competing nicely with ChatGPT. The chances of Microsoft Bing overtaking Google Search overnight are now less likely, and any such displacement would now take several years, if it’s even going to happen. I believe the reduced risk to its business longevity is another reason why a broad swath of institutional investors was now comfortable in increasing their holdings in Google.

Lastly, Google’s business was expected to deteriorate quickly during the currently-prevalent recessionary times. Yours truly, admittedly, showed in a previous article how some of Google’s competitors were growing their advertising revenue at a much faster pace. This presented the possibility that Google’s ad business could come under pressure, and the company might be revenue challenged. But the internet giant proved the naysayers wrong by beating the Street’s estimates in its Q1 FY23 earnings report.

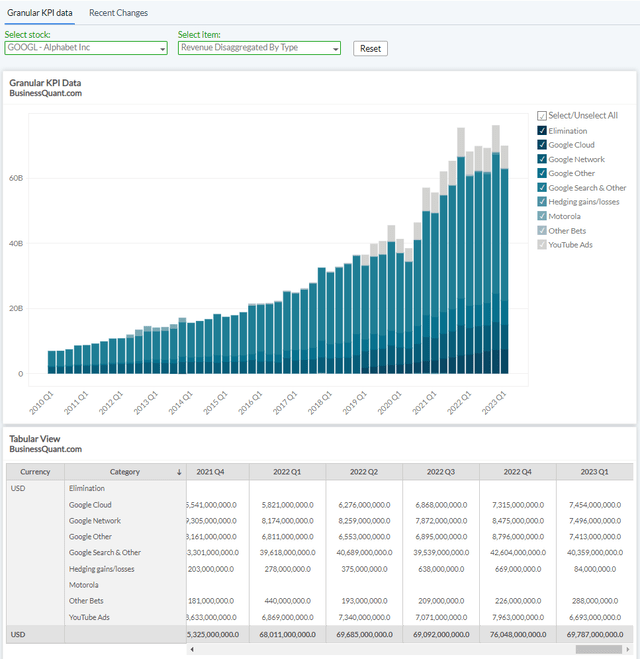

Google’s revenue is hovering close to its all-time highs, and nearly all of its business segments are flourishing. This prospect of diversified and continued growth is another reason, in my opinion, that drove institutional investors to actively increase their long positions in the company.

Final Thoughts

The chart above highlights that Google’s current price-to-sales multiple is right between the high and low ranges that it has created over the past decade, indicating that the stock is fairly valued at current levels. Also, we know now that it’s well poised to compete in the AI race and that much of the bear thesis surrounding the name has now faded. This is a good reason for institutions to accumulate Google’s shares and investors may want to as well. Therefore, I’m turning bullish on Google and believe it offers substantial upside for investors with a multi-year time horizon. Good Luck!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.