Summary:

- Alphabet Inc., also known as Google, is bouncing off its bottom and trying to reach its previous high.

- Bottom fishers began buying at the start of the year, followed by other buyers triggering multiple Buy Signals.

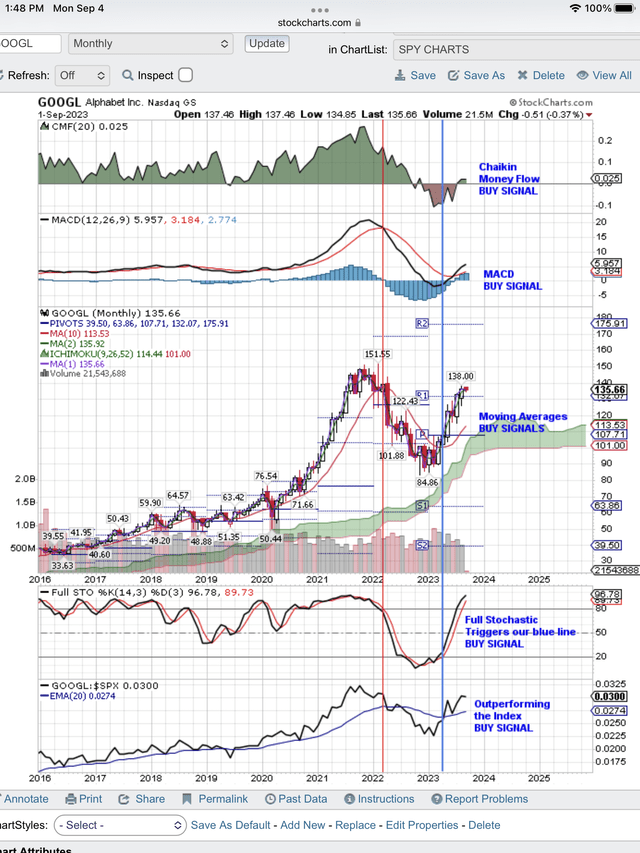

- The monthly chart displays the ongoing Buy Signals and the continued buying in Google stock.

cagkansayin

Alphabet Inc. (NASDAQ:GOOG), (NASDAQ:GOOGL), aka Google, Buy Signals are still in place as it continues to bounce off its bottom and reaches for its old high. On the monthly chart below, you can see where the bottom fishers started buying at the beginning of the year. Then other buyers joined in to trigger all the Buy Signals we show on this chart.

The bounce and buy signals on the chart come as no surprise to anyone as these signals became obvious early in the year. The real question is how high will GOOGL go, and how long will it take? As you can see on the chart, all the positive signals show that GOOGL is still marching from the bottom to reach its old high, and it is more than halfway there.

This monthly chart expects months of buying ahead before this buying cycle is over. Of course, there could be a negative surprise in the stock, or a market selloff could take it down. In fact, we expect the market to take it down in September and October. We expect that pullback will trigger our timing “buy on weakness” signals, and we will post those signals to this article as an update.

On the monthly chart, you can see that the Full Stochastic signal triggers the blue, vertical, blue line Buy Signal. This is in place about four months. This signal is now in overbought territory, but you can see in the past how long it can stay overbought. It can do this for months.

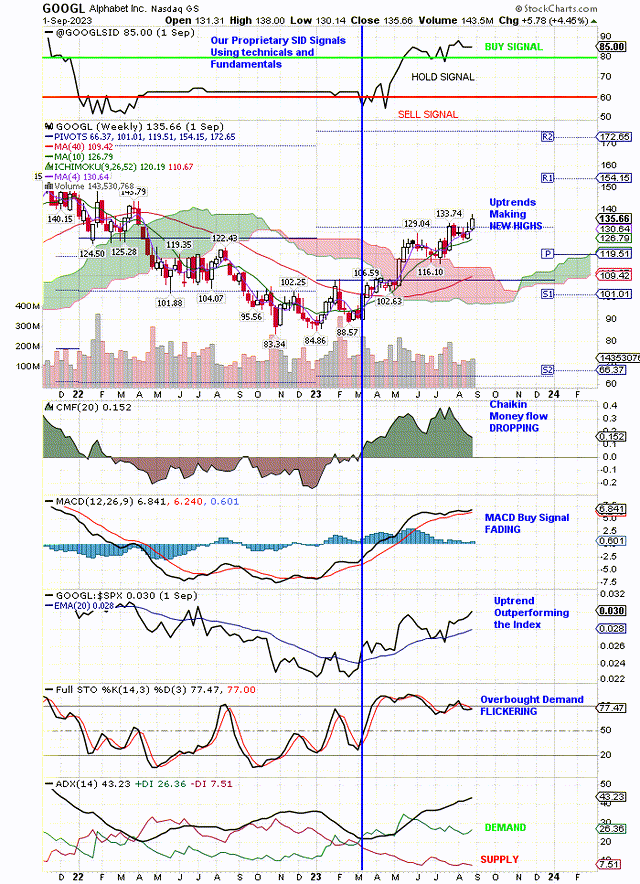

The monthly chart signals are lagging but are more reliable. The weekly chart signals are leading. For this reason we prefer to use the weekly chart. Here is the weekly chart:

GOOGL Weekly Chart Buy Signal Lead the Monthly Signals (StockCharts.com)

We like to do our due diligence by reading SA articles and checking with the SA Quantitative grades. They give GOOGL good grades for Profitability, Growth, Momentum, and Revisions. The only poor grade is Valuation. We know that aggressive growth stocks are usually overvalued by the market until the market drops or there is a negative surprise that takes price down closer to fair value.

Index selling takes the good stocks down with the bad, and we expect that any market weakness in the next couple of months will take GOOGL down too. We expect GOOGL to hold on to our proprietary SID Buy Signal on any pullback and that will trigger buying on weakness.

On the weekly chart, shown above, you can see all the strong, shorter-term buy signals. Chaikin Money Flow is still in the green but dropping. A change in direction in this signal is a negative. Instead of moving up, it has turned down, to give us an early warning to watch for any weakness in the other signals. We are also seeing some weakness in the MACD and Full Stochastic signals. You can see our blue vertical line Buy Signal is still in place on the weekly chart despite the weakness in the signals. This will change to a red line Sell Signal if we have the market pullback we think will happen in September or October.

At the top of the weekly chart, you will find our proprietary SID Buy Signal for GOOGL. This signal uses both fundamental and technical factors. The rest of the signals on this chart are purely technical. As long as we have buy signals on this chart, we use any pullback in the market or in the stock, to buy on weakness.

Here is our monthly chart overview, showing the Buy Signals:

GOOGL Buy Signals, Monthly Chart (StockCharts.com)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in GOOGL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: We are not investment advisers and we never recommend stocks or securities. Nothing on this website, in our reports and emails or in our meetings is a recommendation to buy or sell any security. Options are especially risky and most options expire worthless. You need to do your own due diligence and consult with a professional financial advisor before acting on any information provided on this website or at our meetings. Our meetings and website are for educational purposes only. Any content sent to you is sent out as any newspaper or newsletter, is for educational purposes and never should be taken as a recommendation to buy or sell any security. The use of the terms buy, sell or hold are not recommendations to buy sell or hold any security. They are used here strictly for educational purposes. Analysts price targets are educated guesses and can be wrong. Computer systems like ours, using analyst targets therefore can be wrong. Chart buy and sell signals can be wrong and are used by our system which can then be wrong. Therefore, you must always do your own due diligence before buying or selling any stock discussed here. Past results may never be repeated again and are no indication of how well our SID score Buy signal will do in the future. We assume no liability for erroneous data or opinions you hear at our meetings and see on this website or its emails and reports. You use this website and our meetings at your own risk

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Use our free, 30-day training program to become a successful trader or investor. See all the stocks that have our proprietary Buy/Hold/Sell Signal every day. Use our Model Portfolio or see the Buy Signal stocks by style of investing like Growth, Value, Dividends, Sector Rotation etc.