Summary:

- Amazon has been taking digital advertising market share for years, but Google’s revenue keeps climbing, nonetheless.

- Headlines sometimes underestimate the growth of the digital ad market and overestimate the severity of threats.

- Google will adjust as new systems like ChatGPT become monetized and take digital advertising market share.

brightstars

Introduction

New systems like ChatGPT will eventually be monetized effectively. In some ways, this will limit Google’s (NASDAQ:GOOG, NASDAQ:GOOGL) market share in digital advertising, but I am optimistic that Google’s revenue will continue to grow nicely as the entire digital ad market continues to expand rapidly. My thesis is that Google will continue to increase revenue despite competitive threats in the coming years. It is easy to reconcile a loss of market share with an increase of revenue by recognizing that the digital ad market continues to grow rapidly, such that this is not a zero-sum game between competitors.

Amazon Threats

Amazon has been a threat to Google with product searches for a long time now:

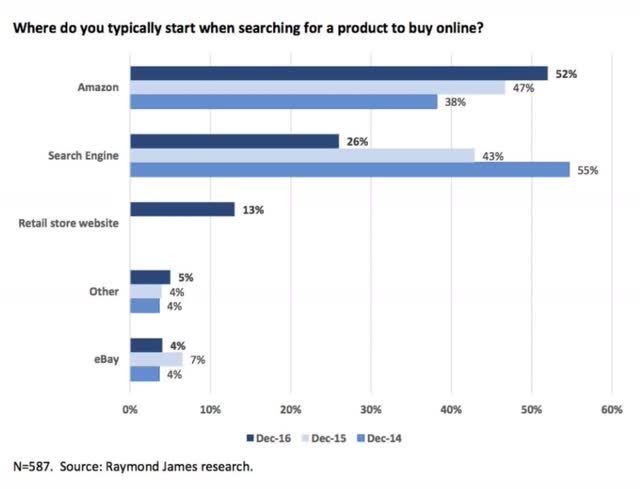

Years ago, a BriteWire article showed survey results about the starting point for online product searches. 38% reported using Amazon as of December 2014. This went up to 47% for December 2015, and it went up again to 52% for December 2016. Meanwhile, the percentages for search engines like Google declined:

Amazon product searches (BriteWire)

Despite Google losing some market share during this time from 2014 to 2016, their revenue kept going up. A CNBC article from October 2018 made it seem like Google was in trouble because of Amazon. At the time, this part of the October 2018 CNBC article was stressful for Google shareholders:

One exec from a large agency said some brands find Google search ads “quaint” and want their budgets moved to Amazon because it directly correlates to sales. About 49 percent of product searches begin on Amazon, according to Survata.

Another part of the 2018 CNBC article said some clients were moving 50 to 60% of Google search ad dollars to Amazon:

While some of the dollars are being siphoned from print, TV and programmatic display advertising, one executive at a large agency said some clients who sell products on Amazon are moving between 50 and 60 percent of their allocated Google search ad dollars specifically to Amazon. The shift amounts to hundreds of millions of dollars a year, he noted.

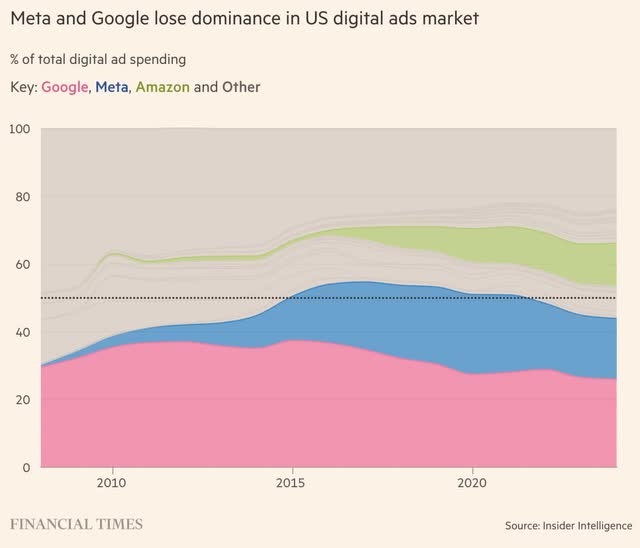

Indeed, Amazon has done well with product searches over the years and this has propelled Amazon’s digital advertising efforts. A December 22nd article in the Financial Times shows that Google has lost market share over the years with respect to digital advertising just as Amazon has gained share:

Amazon market share (Financial Times)

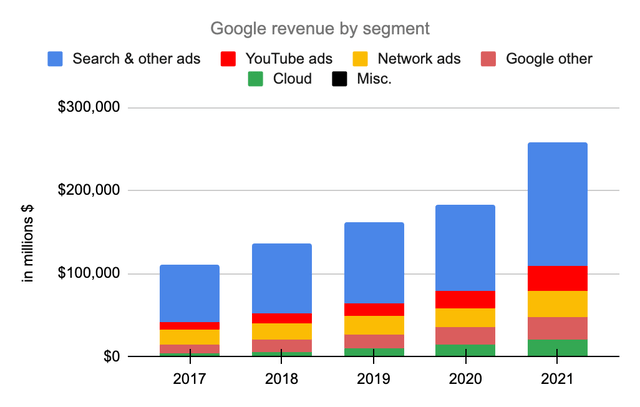

Google’s revenue numbers show that this has not been a zero-sum game. Despite Amazon doing well with digital ad revenue, Google has also done tremendously well. The digital ad market has been growing very quickly, such that Google’s revenue numbers are extremely impressive despite the fact that they have lost share. In other words, 2 slices from a small pizza can be less food than 1 slice from a much larger pizza. We see that the search ads, YouTube ads and network ads have grown nicely for Google since they started being broken out separately:

Google revenue (Author’s spreadsheet from company filings)

It’s not just search ads in Amazon’s marketplace that have been disturbing for Google shareholders. Some of the headlines about Google got even worse when Amazon’s Alexa voice assistant became popular. Writers conjectured that people would just have Alexa buy products for them online, such that Google would be squeezed out altogether. In other words, people wouldn’t even see Google’s search engine result pages (“SERPs”) that contain their digital ads. A February 2018 Business Insider article said Amazon’s Alexa voice assistant was a big threat to Google’s search business:

Alexa’s rise poses a big challenge to Google, because it doesn’t rely on the search giant’s stockpiles of data. Instead, to answer users’ questions about traffic, restaurant hours, or trivia, it taps into a mix of other sources, including Yahoo and Microsoft’s Bing search engine. The danger for Google is that as people use Alexa more, they’ll potentially use Google’s search engine less. But Alexa’s threat to Google goes beyond search to advertising, its core business. Amazon has been quietly building its own advertising business. This year, it will reportedly start selling product placement and other ads that will be spoken by Alexa. Should Alexa’s user base continue to grow as Amazon thinks it will, Alexa could start to steal advertising dollars and market share from Google.

We now know that Alexa’s impact on Google’s revenue didn’t materialize to the extent that many headlines suggested it would. Recently, it has been revealed that Amazon is dialing back their efforts with respect to Alexa; the perceived threat to Google from Alexa is now less severe.

It now appears that some of the past headlines about Amazon’s threat to Google were overblown. Per a November 25th Seeking Alpha article, Morgan Stanley (MS) says Google is still strong relative to Amazon (AMZN) with respect to online shopping:

We see GOOGL’s retail search innovation the past few years bringing more merchants and inventory across improved GOOGL e-commerce experiences (Search, Maps, YouTube etc.) and our AlphaWise survey data continue to show how e-commerce consumer behavior (including Prime member behavior) remains strong on GOOGL.

The Seeking Alpha article goes on to cite Morgan Stanley’s findings that the combination of Google search and YouTube for product research is stronger than the combination of Amazon and Walmart:

Among its key takeaways, the firm says “More Americans visit Google (including YouTube) first when researching products online than Amazon and Walmart (WMT) combined (58% vs. 27%).”

Additionally, Amazon’s loyal Prime users have surprisingly strong percentages for starting product research on Google and comparing prices on Google:

About 57% of Amazon Prime members start on Google to research products, up from about 50% in 2020, and 32% of Prime members hit Google first when comparing prices, Morgan Stanley said.

Amazon is a classic example as to why Google’s revenue numbers are more important than headlines and market share percentages.

ChatGPT Threat

Google employee #23 and Gmail creator, @paultoo, tweeted the following about ChatGPT on December 1st:

Google may be only a year or two away from total disruption. AI will eliminate the Search Engine Result Page, which is where they make most of their money.

Even if they catch up on AI, they can’t fully deploy it without destroying the most valuable part of their business!

Systems like ChatGPT are a serious threat to Google, and some disruption with respect to Google’s market share is inevitable. @alexisohanian tweeted about a ChatGPT example where he asked who is the most similar modern NFL running back to John Riggins. It is only a matter of time before ChatGPT and others implement monetization and take share in the digital ad market. In the case of the John Riggins example, ads for NFL paraphernalia might be a good fit. Having said that, I am optimistic that the disruptions we’ll see to Google will be more on the market share side than the overall revenue side as the digital ad market continues to expand. In addition, the PaLM Seeking Alpha article points out that Google can make innovations of their own with respect to systems like ChatGPT:

While acknowledging ChatGPT’s threat to Google Search is welcome, we believe the tech giant’s robust balance sheet, unwavering commitment to innovation, and sprawling market share remain key factors anchoring the sustainability of its longer-term growth trajectory.

Valuation

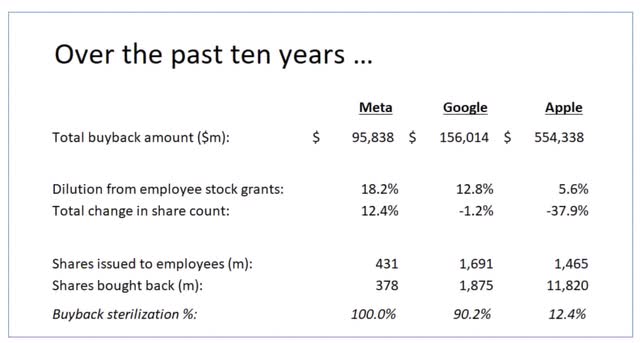

Google needs to do more than just increase top line revenue in order to meet our valuation expectations. They also need to return large amounts of cash to shareholders. Ostensibly, buybacks are a return of capital to shareholders, but in the case of companies like Google that have high amounts of stock based compensation (“SBC”), many of the buybacks are merely an offset to dilution. A November 2022 Epsilon Theory stock buyback article by Ben Hunt shows that Google has spent massive amounts of money over the last 10 years in order to offset or “sterilize” SBC. The numbers for Google in this regard do not look good when compared to Apple (AAPL):

Google buybacks (November 2022 Epsilon Theory stock buyback article)

We see that 1,691 million or 90.2% of the 1,875 million shares Google bought back over the last 10 years were to cancel share issuances to employees. Said another way, the 90.2% is the sterilization percentage. The article shows that things are even worse for Google shareholders when we consider taxes:

In the case of Google, for example, $48 billion of shareholder money has been spent over the past ten years paying for its employees’ taxes on RSU awards.

90.2% of $156,014 million comes to nearly $141 billion and Google paid taxes of about $48 billion on this, such that the total consideration including taxes to offset dilution was closer to $189 billion.

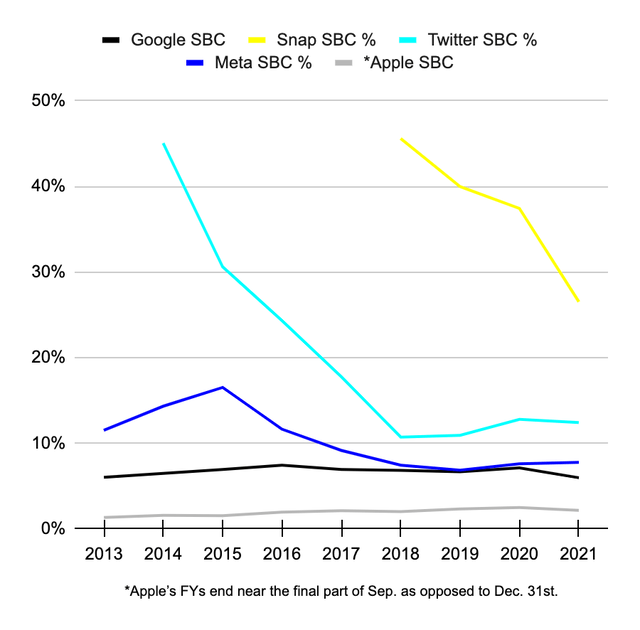

Here is SBC as a percentage of revenue for Google, Meta (META) and Apple. I threw in Snap (SNAP) and Twitter because their SBC is an even higher percentage of revenue than what we see for Google and Meta:

Google SBC (Author’s spreadsheet)

These troubling numbers above are not good from a valuation perspective unless Google can be more like Apple in terms of lowering SBC as a percentage of revenue in the years ahead. In other words, I’d like to see Google get closer to Apple’s level where SBC is about 2% of revenue as opposed to the current level where it is 6 or 7% of revenue. I am optimistic that Google will make changes in the decade ahead such that more of their buybacks go towards returning capital to shareholders as opposed to offsetting SBC.

The above SBC numbers are sobering and the ChatGPT threat is real, but my overall sum of the parts valuation thoughts haven’t changed dramatically since my October 30th article:

$1,650 to $1,830 billion Google Services

$75 to $110 billion Google Cloud

$0 Other Bets

—————————–

$1,725 to $1,940 billion Total

On December 29th, GOOGL closed at $88.45 while GOOG was at $88.95. These are multiplied by the A/B and C share counts which were 6,857 million and 6,086 million, respectively, as of October 18th per the 3Q22 10-Q. The market cap is $1,148 billion or $606.5 billion + $541.3 billion. The enterprise value is well under the market cap due to the $94.3 billion in marketable securities. I think the stock will do well for long term investors, seeing as both the market cap and the enterprise value are beneath my valuation range.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Disclosure: I/we have a beneficial long position in the shares of GOOG, GOOGL, AAPL, AMZN, META, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.