Summary:

- Google plans to introduce a premium pricing model called Duet AI for its Workspace clients, similar to Microsoft’s M365 CoPilot.

- The estimated price for Duet AI is $9.47 per month per user, a 68% reduction compared to Microsoft’s offering.

- Duet AI’s advanced generative AI features can enhance user engagement, boost productivity, provide a competitive advantage, and create monetization opportunities for Google.

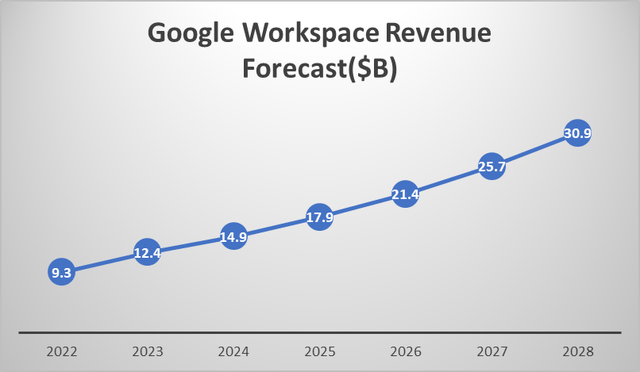

- Google Workspace segment has a potential to generate ~$30B by 2027.

da-kuk

Investment Thesis:

Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) aka Google is expected to introduce a premium product called Duet AI for its Workspace clients similar to Microsoft 365 CoPilot. This possibly will be around or before the GCP Next Conference scheduled for August 29th, 2023. This move follows Microsoft’s (MSFT) surprising decision to set a high monthly user fee of $30 for its M365 CoPilot. I consider this to be a strategic domain in which Google possesses a strong offensive position in the realm of advanced AI.

Evidence for this strategy and why it makes sense for Google:

Google has initiated a pre-order option for Duet AI aimed at Google Workspace Enterprise clientele. However, specific details regarding pricing and the timeline for its general availability remain uncertain. UBS research suggests Google could price Duet AI at a rate of $9.47 per month per user, presenting a substantial 68% reduction compared to Microsoft 365 CoPilot’s price point of $30 per month per user. This estimate is approximately three times higher than the $6 per month per user cost associated with Google Workspace’s most affordable paid package. My assumption is based on the following considerations:

- Google’s pricing spectrum, ranging from $6 to $18 per month per user, is designed to compete with Microsoft’s lower-priced plan range of $12.50 to $22 per month per user.

- Google’s user base is predominantly composed of smaller businesses that are more inclined to require a budget-friendly price point to encourage adoption.

- Google’s user demographic is likely to be more sensitive to pricing, as evidenced by the fact that a significant majority of its over 3 billion total users opted for the free version of Workspace in 2022.

Since March 2023, Google has been actively testing a fresh array of generative AI features tailored for Google Workspace Enterprise, collectively named Duet AI. These innovative features include:

- The capacity to instantly compose draft content on a topic provided by the user within Gmail and Google Docs.

- A suggestion panel for proofreading that offers concise writing recommendations in Google Docs.

- The capability to expound on a subject or condense a message with a few simple clicks in Gmail and Google Docs.

- The option to modify the tone of content, making it more playful or professional, through a few intuitive clicks in Gmail and Google Docs.

- The ability to automatically formulate customized plans for tasks, projects, or any designated activity within Sheets, guided by a textual description of the user’s plan.

- Generating personalized backgrounds for Google Meet sessions with minimal effort.

- The creation of original images derived from text within Google Slides.

Considering Google’s pre-existing search chatbot technologies through Bard and the Search Generative Experience, it is plausible that a generative AI chatbot search feature could be integrated into Duet AI. The recent unveiling of Bing Chat Enterprise as part of M365 CoPilot by Microsoft, announced on July 18, further reinforces the case for the introduction of an enterprise-focused search chatbot feature.

While alternatives like free ChatGPT and Bard exist, the premium versions should hold considerable appeal for organizations, primarily due to the assurance of data security. Microsoft’s approach underscores this, as they have declared that:

- Bing Chat Enterprise will not retain user data

- User interactions with Bing Chat Enterprise will not be utilized for training models

- No personnel at Microsoft will have access to interactions with Bing Chat Enterprise.

Let’s dive deeper into this business case for how Google’s Duet Generative AI could drive growth and create long-term incremental revenue:

- Enhanced User Engagement: Duet AI’s capabilities, such as generating instant drafts, proofreading suggestions, and custom background creation, can significantly enhance user experience and engagement within Google Workspace. As users find these features valuable and time-saving, they are more likely to remain loyal to Google’s ecosystem, leading to increased user retention rates.

- Productivity Boost: The ability to automate tasks like drafting content, generating custom plans, and simplifying communication tones can greatly boost productivity for businesses using Google Workspace. This increased efficiency translates to time saved and improved workflows, making Google Workspace an attractive choice for enterprises seeking to optimize their operations.

- Competitive Advantage: By offering advanced generative AI features, Google can differentiate its Workspace offering from competitors. In a rapidly evolving technological landscape, having cutting-edge tools can give Google a competitive edge, enticing more organizations to choose their platform over alternatives.

- Monetization Opportunities: Google can introduce tiered pricing models for Duet AI, providing basic features for free and offering a premium subscription for access to more advanced capabilities. This monetization strategy can diversify Google’s revenue streams and contribute to incremental earnings over time.

- Cross-Selling and Upselling: As organizations adopt Duet AI, it opens avenues for cross-selling and upselling other Google services. For instance, organizations that find value in Duet AI might be more inclined to explore and invest in other Google Workspace features or cloud services, leading to increased adoption rates and revenue generation.

- Data Security and Compliance: One of the critical factors in today’s digital landscape is data security and compliance. By emphasizing the security measures and privacy protocols surrounding Duet AI, Google can address concerns and encourage more organizations to opt for the paid versions, generating additional revenue.

- Evolving Use Cases: Generative AI’s capabilities are not static; they can evolve and expand over time. Google can continually innovate and introduce new features, making Duet AI increasingly indispensable to businesses. This ongoing evolution can lead to sustained growth and a consistent revenue stream.

- Long-Term Partnership Opportunities: Successful implementation of Duet AI can foster long-term partnerships with businesses. By consistently providing value and adapting to changing needs, Google can establish itself as a trusted partner in an organization’s growth journey, leading to stable revenue streams over the years.

Sizing the Duet AI impact on Google Financials:

Even if we go with a baseline scenario that involves a projected adoption rate of 25% for Duet AI, it could lead to an additional $3.1 billion in revenue for Google in the fiscal year 2024.

| Google Workspace Q1 2023 | |

| Q1 2023 Google Workspace Revenue($MM) | $2,325 |

| Q1 2023 Paying Customers (MM) | 9 |

| Q1 2023 Revenue Per Paying Customers($MM) | $258 |

| Generative AI Business Plan | |

| Business Base Plan Price | $6 |

| % Paying Customers using this plan | 70% |

| Business Standard Plan Price | $12 |

| % Paying Customers using this plan | 20% |

| Business Plus Plan Price | $18 |

| % Paying Customers using this plan | 10% |

| Monthly Plan Price | $8.40 |

| Discount | 30% |

| Realized Monthly ARPU | $5.88 |

| Q1 2023 Revenue Per Paying Customers($MM) | $258 |

| Realized Monthly ARPU | $17.64 |

| Q1 2023 Seats per Paying Customers | 15 |

| Duel AI FY 2024 Revenue Impact | |

| Q1 2023 Paying Customers (MM) | 9 |

| Q1 2023 Seats per Paying Customers | 15 |

| Total Seats (MM) | 135 |

| Duel AI adoption rate | 25% |

| Duel AI Seats (MM) | 34 |

| Implied Google Duel AI – Monthly Pricing | $9.47 |

| Discount 20% | $7.58 |

| Google Duel AI – Monthly Revenue ($MM) | $256 |

| Google Duel AI Annualized Revenue ($MM) | $3,068 |

|

Microsoft | ||

| FY 2024 Seats (MM) | 135 | 385 | |

| Attach rate for Gen AI Suite % | 25% | 20% | |

| Monthly List Price | $9.47 | $30 | |

| Most Expensive Plan List Price | $18 | $57 | |

| Monthly List Price as % of Most expensive plan | 53% | 53% | |

| Monthly ARPU($) | $8 | $18-$21 | |

| FY 2024 Revenue Uplift ($B) | $3.1B | $7B-$9B |

Assuming an operating margin of 10%, this might translate to an incremental operating income of $310 million. In terms of FY24 operating income, this would signify a 0.34% positive deviation from the projected $90.4 billion.

In a more optimistic scenario, a true Bull Case, with an attachment rate of 33% and a premium pricing increase of 100% before any discounts, the potential gains become more pronounced. This could result in incremental revenue of $9.1B and an operating income of ~$910 million.

If we overlay the projected growth of Duet AI on the Google Workspace segment it has the potential to generate ~$30B by 2027 from this segment only. If Google can actually make this stride I can see the stock trading min $155 per share. (Providing investors ~20% upside from current trading price.)

Data compiled using forecast model

Conclusion:

In summary, the integration of Duet Generative AI into Google Workspace has the potential to bring about significant advantages in terms of user engagement, productivity, competitive positioning, monetization, and long-term partnerships. By strategically capitalizing on these opportunities and continuously innovating, Google can drive growth and generate incremental revenue in the years to come.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.